Market news

-

23:29

Stocks. Daily history for Jan 04’2017:

(index / closing price / change items /% change)

Nikkei +479.79 19594.16 +2.51%

TOPIX +35.87 1554.48 +2.36%

Hang Seng -15.93 22134.47 -0.07%

CSI 300 +26.08 3368.31 +0.78%

Euro Stoxx 50 +2.50 3317.52 +0.08%

FTSE 100 +11.85 7189.74 +0.17%

DAX +0.07 11584.31 +0.00%

CAC 40 +0.07 4899.40 +0.00%

DJIA +60.40 19942.16 +0.30%

S&P 500 +12.92 2270.75 +0.57%

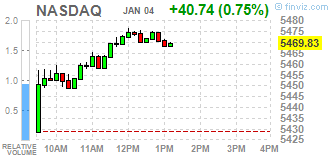

NASDAQ +47.92 5477.00 +0.88%

S&P/TSX +113.72 15516.75 +0.74%

-

21:05

Major US stock indexes finished trading in the "green zone"

Major stock Wall Street indices showed an increase during the second trading day of the year, supported by stocks of consumer goods companies in the sector, as well as the expectations of the investors of the December Fed meeting minutes.

According to the minutes, Fed officials noted "considerable uncertainty" regarding Trump policy impact on the economy. Almost all the leaders of the Central Bank believe that fiscal stimulus could accelerate the growth of the national economy in the next few years. However, the Fed emphasized the uncertainty with regards to the timing, scale and composition of future policies. In addition, Fed officials agreed that it is too early to say what changes will happen and how they will affect the economic outlook. Many participants of the meeting also talked about his concern at the fact that the increased uncertainty "hampered the process of communication about the likely course of interest rates." Recall that in December, Fed officials voted unanimously to increase the key rate to a range of 0.50% -0.75%.

In addition, as it became known today, the index of business activity in New York significantly improved the results of December, exceeding the estimates of experts, and showing the second consecutive monthly expansion. This is evidenced by a report published by the Institute for Supply Management (ISM) in New York. According to the data, the index assesses the economic conditions in the sectors of production and services for the companies listed in New York, jumped in December to 63.8 points compared to 52.5 points in November. Economists had forecast that the index was 53.5 points.

Oil futures rose about 1.5 percent, which was due to expectations of reductions in US oil inventories and signs that oil producers will adhere to the agreed conditions to reduce oil production, which came into force this week. The American Petroleum Institute (API) will publish its data on oil reserves in the United States today, and tomorrow will come the official statistics from the US Department of Energy. Analysts expect the US Energy Department reported a decline in crude oil inventories of 2.3 million barrels. Recall the previous week crude oil inventories rose by 0.614 million barrels.

DOW index components closed mostly in positive territory (16 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 2.28%). Outsider were shares of Cisco Systems, Inc. (CSCO, -1.39%).

All business sectors S & P index ended the session in positive territory. The leader turned conglomerates sector (+ 2.4%).

At the close:

Dow + 0.30% 19,941.61 +59.85

Nasdaq + 0.88% 5,477.01 +47.93

S & P + 0.57% 2,270.72 +12.89

-

20:00

DJIA +0.28% 19,936.66 +54.90 Nasdaq +0.86% 5,475.87 +46.79 S&P +0.53% 2,269.88 +12.05

-

18:20

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose in the second trading day of the new year, supported by consumer discretionary stocks, as investors awaited minutes of the Federal Reserve's December meeting where it raised interest rates. The central bank had cited strength in the labor market and a slight uptick in inflation among reasons for its move.

Most of Dow stocks in positive area (17 of 30). Top gainer - NIKE, Inc. (NKE, +1.77%). Top loser - Cisco Systems, Inc. (CSCO, -1.02%).

All S&P sectors also in positive area. Top gainer - Conglomerates (+2.7%).

At the moment:

Dow 19856.00 +58.00 +0.29%

S&P 500 2263.00 +10.50 +0.47%

Nasdaq 100 4930.75 +24.50 +0.50%

Oil 53.29 +0.96 +1.83%

Gold 1165.40 +3.40 +0.29%

U.S. 10yr 2.46 +0.01

Информационно-аналитический отдел TeleTrade

-

17:00

European stocks closed: FTSE 100 +11.85 7189.74 +0.17% DAX +0.07 11584.31 +0.00% CAC 40 +0.07 4899.40 +0.00%

-

16:47

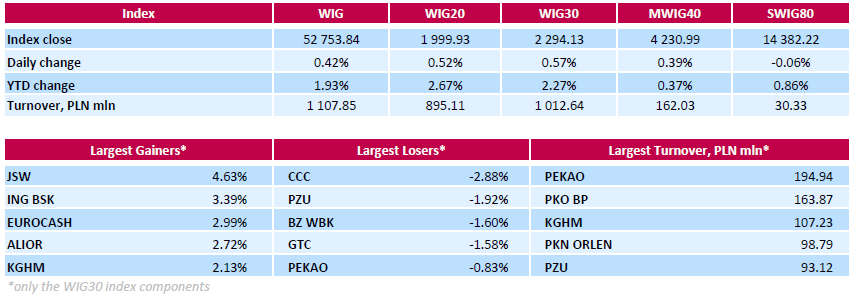

WSE: Session Results

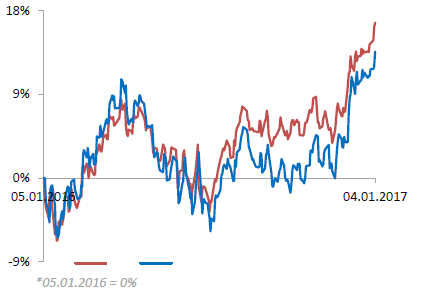

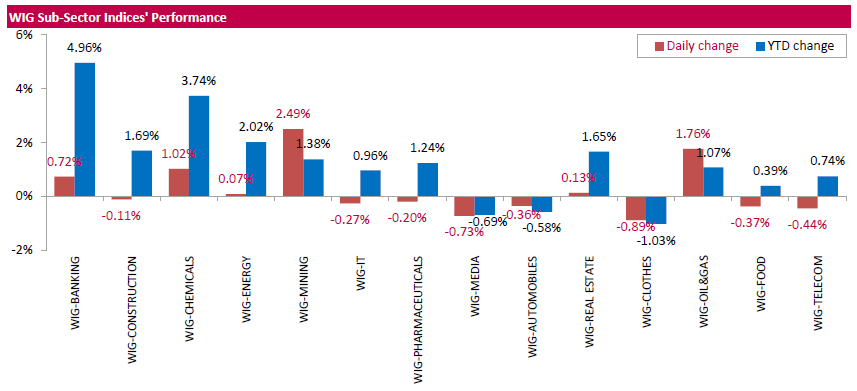

Polish equity market closed higher on Wednesday. The broad market benchmark, the WIG Index, surged by 0.42%. Sector performance within the WIG Index was mixed. Mining (+2.49%) outperformed, while clothes (-0.89%) lagged behind.

The large-cap stocks added 0.57%, as measured by the WIG30 Index. Within the index components, coking coal miner JSW (WSE: JSW) led the gainers pack with a 4.63% advance, recovering somewhat after two weeks of declines, which pushed the stock's quotation down nearly 20%. It was followed by FMCG-wholesaler EUROCASH (WSE: EUR) and two banking names ING BSK (WSE: ING) and ALIOR (WSE; ALR), climbing by 2.72%-3.39%. On the other side of the ledger, footwear retailer CCC (WSE: CCC) recorded the biggest drop of 2.88%, breaking a six-session streak of gains. Other major decliners were insurer PZU (WSE: PZU), bank BZ WBK (WSE: BZW) and property developer GTC (WSE: GTC), plunging by 1.92%, 1.6% and 1.58% respectively.

-

14:57

WSE: After start on Wall Street

The market in the US started wit rise, which increased slightly after the first transactions. In addition, there is a noticeable revival of copper, which price rises to surrounding of yesterday's highs, what gives us a good afternoon mood. The Warsaw WIG20 went on the green side and still has a chance to end the day above the level of 2,000 points.

An hour before the close of trading, the WIG20 index was at the level of 1,992 points (+ 0.16%).

-

14:33

U.S. Stocks open: Dow +0.23%, Nasdaq +0.33%, S&P +0.33%

-

14:28

Before the bell: S&P futures +0.21%, NASDAQ futures +0.17%

U.S. stock-index futures advanced. Investors await the publication of the minutes of the December Federal Open Market Committee meeting.

Global Stocks:

Nikkei 19,594.16 +479.79 +2.51%

Hang Seng 22,134.47 -15.93 -0.07%

Shanghai 3,159.82 +23.90 +0.76%

FTSE 7,178.50 +0.61 +0.01%

CAC 4,901.16 +1.83 +0.04%

DAX 11,574.55 -9.69 -0.08%

Crude $52.67 (+0.65%)

Gold $1,165.60 (+0.31%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

28.79

-0.04(-0.1387%)

600

ALTRIA GROUP INC.

MO

68.15

0.52(0.7689%)

14249

Amazon.com Inc., NASDAQ

AMZN

755.97

2.30(0.3052%)

6156

American Express Co

AXP

75.35

0.32(0.4265%)

522

Apple Inc.

AAPL

116.04

-0.11(-0.0947%)

65999

AT&T Inc

T

43

-0.02(-0.0465%)

7577

Barrick Gold Corporation, NYSE

ABX

16.47

0.08(0.4881%)

69328

Caterpillar Inc

CAT

93.75

-0.24(-0.2553%)

160

Chevron Corp

CVX

118.5

0.65(0.5515%)

3838

Cisco Systems Inc

CSCO

30.35

0.07(0.2312%)

4669

Citigroup Inc., NYSE

C

60.71

0.12(0.1981%)

46640

Deere & Company, NYSE

DE

103.69

-0.36(-0.346%)

618

Facebook, Inc.

FB

117.2

0.34(0.2909%)

34022

Ford Motor Co.

F

12.7

0.11(0.8737%)

67815

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.95

0.17(1.2337%)

87013

General Electric Co

GE

31.63

-0.06(-0.1893%)

1121

General Motors Company, NYSE

GM

35.11

-0.04(-0.1138%)

1291

Goldman Sachs

GS

241.66

0.09(0.0373%)

980

Google Inc.

GOOG

788

1.86(0.2366%)

1561

Intel Corp

INTC

36.74

0.14(0.3825%)

6319

International Business Machines Co...

IBM

167.2

0.01(0.006%)

330

Johnson & Johnson

JNJ

116

0.16(0.1381%)

575

JPMorgan Chase and Co

JPM

87.16

0.41(0.4726%)

13038

McDonald's Corp

MCD

87.16

0.41(0.4726%)

13038

Microsoft Corp

MSFT

62.6

0.02(0.032%)

3271

Nike

NKE

52.26

0.28(0.5387%)

8535

Pfizer Inc

PFE

33.01

0.01(0.0303%)

2208

Starbucks Corporation, NASDAQ

SBUX

55.46

0.11(0.1987%)

260

Tesla Motors, Inc., NASDAQ

TSLA

214.16

-2.83(-1.3042%)

55230

The Coca-Cola Co

KO

41.9

0.10(0.2392%)

338

Twitter, Inc., NYSE

TWTR

16.51

0.07(0.4258%)

17111

Verizon Communications Inc

VZ

54.7

0.12(0.2199%)

1250

Visa

V

79.39

-0.11(-0.1384%)

4315

Walt Disney Co

DIS

106.01

-0.07(-0.066%)

6021

Yahoo! Inc., NASDAQ

YHOO

38.92

0.02(0.0514%)

1001

-

13:50

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Buy from Neutral at BofA/Merrill

Altria (MO) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

UnitedHealth (UNH) initiated with an Overweight at Piper Jaffray

McDonald's (MCD) target lowered to $137 from $139 at Instinet

-

12:01

WSE: Mid session comment

The morning phase of today's trading brought considerable higher activity on the Warsaw Stock Exchange which adds credibility to concluded transactions. The index of the largest companies is still located near the psychological level of 2,000 points, which was defeated in the first fifteen minutes of trading, but it was only a test, after which the graph of the WIG20 index returned even slightly below yesterday's close. European markets show similar behavior and even slightly better publications of PMI's for services did not change this state.

At the halfway point of quotations the WIG20 index was at the level of 1,984 points (-0,26%) and the turnover in the segment of blue chips was amounted to PLN 429 million.

-

08:31

Major European stock markets trading in the green zone: FTSE 100 7,179.22 1.33 0.02%, DAX 11,613.94 29.70 0.26%, CAC 40 4,911.27 11.94 0.24%

-

08:16

WSE: After opening

WIG20 index opened at 1991.97 points (+0.12%)*

WIG 52670.78 0.26%

WIG30 2287.43 0.28%

mWIG40 4221.28 0.16%

*/ - change to previous close

The cash market opens with growth of 0.12% at a moderate turnover focused on JSW and Pekao. The German DAX gained 0.2%, which means a slight upward correction in relation to yesterday's weaker close. On the Warsaw Stock Exchange first bars are seen as clear growth and the level of 2,000 points was quickly tested.

After fifteen minutes of trading WIG20 index was at the level of 1,998 points (+0,44%).

-

07:06

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.4%, CAC40 + 0.3%, FTSE + 0.4%

-

06:35

Global Stocks

European stock markets charged higher again on Tuesday, closing at a fresh one-year high after upbeat Chinese and U.S. manufacturing data fueled optimism over economic growth in the world's two largest economies.

U.S. stocks closed up Tuesday below their highs for the first trading session of 2017 as oil prices dropped. The Dow Jones Industrial Average DJIA, +0.60% rose 119.16 points, or 0.6%, to finish at 19,881.76, led higher by shares of Nike Inc. NKE, +2.26% and Verizon Communications Inc. VZ, +2.25% The S&P 500 index SPX, +0.85% closed up 19.00 points, or 0.9%, at 2,257.83, with the telecom and health care sectors the strongest performers.

Japanese equities kicked off the new year sharply higher on Wednesday, leading the region's gains amid a robust outlook for the U.S. economy, coupled with expectations of continued yen weakness.

-