Market news

-

23:30

Commodities. Daily history for Jan 03’2017:

(raw materials / closing price /% change)

Oil 52.47 +0.27%

Gold 1,159.40 -0.22%

-

23:29

Stocks. Daily history for Jan 03’2017:

(index / closing price / change items /% change)

Hang Seng +149.84 22150.40 +0.68%

CSI 300 +32.15 3342.23 +0.97%

Euro Stoxx 50 +6.35 3315.02 +0.19%

FTSE 100 +35.06 7177.89 +0.49%

DAX -14.09 11584.24 -0.12%

CAC 40 +16.95 4899.33 +0.35%

DJIA +119.16 19881.76 +0.60%

S&P 500 +19.00 2257.83 +0.85%

NASDAQ +45.97 5429.09 +0.85%

S&P/TSX +115.44 15403.03 +0.76%

-

23:28

Currencies. Daily history for Jan 03’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0405 -0,47%

GBP/USD $1,2237 -0,33%

USD/CHF Chf1,0272 +0,34%

USD/JPY Y117,74 +0,17%

EUR/JPY Y122,51 -0,29%

GBP/JPY Y144,07 -0,16%

AUD/USD $0,7217 +0,46%

NZD/USD $0,6915 -0,13%

USD/CAD C$1,3426 -0,10%

-

23:00

Schedule for today,Wednesday , Jan 04’2017 (GMT0)

00:30 Japan Manufacturing PMI (Finally) December 51.3 51.9

08:50 France Services PMI (Finally) 51.6 52.6

08:55 Germany Services PMI (Finally) December 55.1 53.8

09:00 Eurozone Services PMI (Finally) December 53.8 53.1

09:30 United Kingdom Mortgage Approvals November 67.52 69

09:30 United Kingdom Consumer credit, mln November 1618

09:30 United Kingdom Net Lending to Individuals, bln November 4.9 4.9

09:30 United Kingdom PMI Construction December 52.8 53

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.6% 1%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.8% 0.8%

19:00 U.S. FOMC meeting minutes

20:00 U.S. Total Vehicle Sales, mln December 17.87 17.7

22:30 Australia AIG Services Index December 51.1

-

21:05

Major US stock indexes finished trading in the "green zone"

Major US stock indexes Wall Street closed with moderate plus, down from the morning marks on the background of falling oil prices.

Data for December signaled the strong end of the year for the US manufacturing sector, and the overall business environment improved at the fastest pace since March 2015. Strong rise in new orders and production volume led to the fastest pace of job creation and a half years. At the same time, the increased costs of customers and optimistic business confidence have led to the largest accumulation of inventories in August, 2014. Seasonally adjusted, the US manufacturing purchasing managers index (PMI) released by the Markit slightly rose to 54.3 in December from 54.1 in November, and signaled a strong improvement in the business environment a little less than two years. Last index growth was largely driven by stronger employment growth and stocks in December, which more than offset slightly weaker increase in output and new orders.

Furthermore, a report published by the Institute for Supply Management (ISM), showed that in December, activity in the US manufacturing sector grew moderately, while exceeding the average forecast. The PMI for the manufacturing was 54.7 points versus 53.2 points in November. Analysts had expected that this figure will rise to only 53.5 points.

At the same time, construction spending in the US rose more than expected in November, reaching its highest level of 10.5 years, which may provide a revision of the economic growth for the fourth quarter estimates. The Commerce Department reported that construction spending increased by 0.9%, to $ 1.18 trillion. This is the highest level since April 2006. The main reason for this change was to increase the expenditure in the private and public sectors.

Oil prices reached 18-month highs, lost all earned position. The increase contributed to hopes that a deal between OPEC and other major oil exporters to cut production reduce the global surplus of supply. Meanwhile, the pressure on the quotation provided the growth of the US dollar and partial profit-taking.

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares rose NIKE, Inc. (NKE, + 2.29%). Outsider were shares of McDonald's Corporation (MCD, -1.75%).

Almost all sectors of the S & P ended the session in positive territory. The leader turned conglomerates sector (+ 1.8%). Reducing only showed utilities sector (-0.3%).

At the close:

Dow + 0.60% 19,880.77 +118.17

Nasdaq + 0.85% 5,429.08 +45.96

S & P + 0.84% 2,257.70 +18.87

-

20:00

DJIA +0.24% 19,809.05 +46.45 Nasdaq +0.41% 5,405.07 +21.95 S&P +0.48% 2,249.56 +10.73

-

17:51

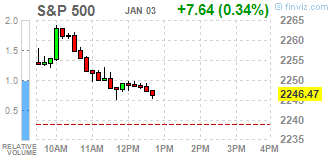

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes slightly higher on Tuesday as a post-election rally extended into the new year, but stocks pared some of their early gains after oil prices eased from an 18-month high. Oil prices fell 2,44% after touching a high levels as investors keep a close watch on whether major producers keep their promise of limiting output.

Most of Dow stocks in positive area (21 of 30). Top gainer - Verizon Communications Inc. (VZ, +2.20%). Top loser - McDonald's Corporation (MCD, -2.04%).

Most of S&P sectors also in positive area. Top gainer - Conglomerates (+1.2%). Top loser - Utilities (-0.2%).

At the moment:

Dow 19727.00 +7.00 +0.04%

S&P 500 2243.00 +6.75 +0.30%

Nasdaq 100 4889.50 +25.50 +0.52%

Oil 52.41 -1.31 -2.44%

Gold 1162.00 +10.30 +0.89%

U.S. 10yr 2.46 +0.02

-

17:41

WSE: Session Results

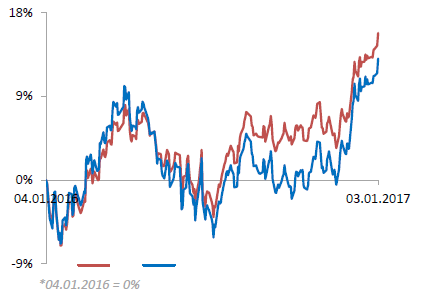

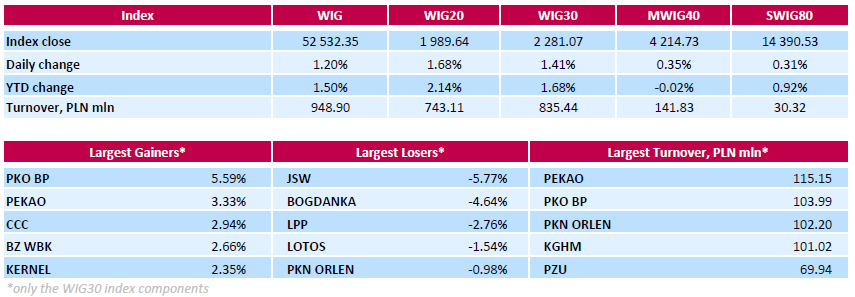

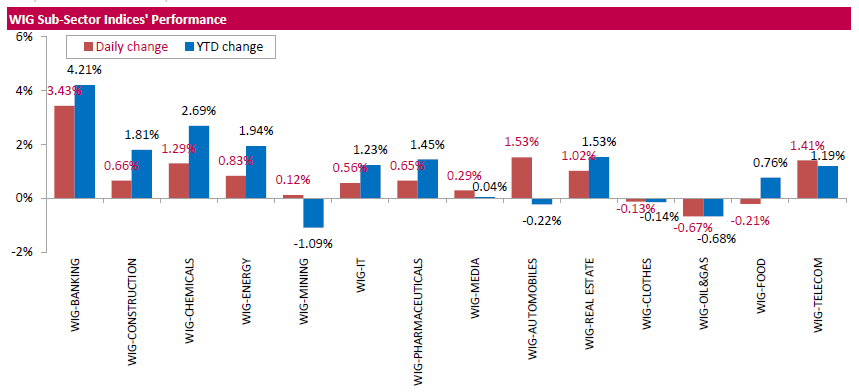

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 1.2%. The WIG sub-sector indices were mainly higher with banking stocks (+3.43%) outperforming.

The large-cap stocks' measure, the WIG30 Index, surged by 1.41%. A majority of the index components returned gains, with the way up led by banking sector names BKO BP (WSE: PKO) and PEKAO (WSE: PEO), which soared by 5.59% and 3.33% respectively. Other major advancers were footwear retailer CCC (WSE: CCC), agricultural producer KERNEL (WSE: KER) and chemical producer SYNTHOS (WSE: SNS), which added between 2.35% and 2.94%. Among few decliners, coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB) were the weakest performers, tumbling by 5.77% and 4.64% respectively. They were followed by clothing retailer LPP (WSE: LPP), dropping by 2.76%. The company reported yesterday its consolidated revenues totaled about PLN 737 mln in December 216, up 13% y/y. At the same time, the company announced that the results for December 2016 were influenced by a one-off operation involving the wholesale of old collections on stock both in Poland and at twelve foreign units. The value of these inventories was PLN 120 mln. As a result, its gross margin on the December sales decreased to approx. 36% from 51% before that operation.

-

17:00

European stocks closed: FTSE 100 +35.06 7177.89 +0.49% DAX -14.09 11584.24 -0.12% CAC 40 +16.95 4899.33 +0.35%

-

15:53

Gold prices started 2017 on a weak note

Gold prices started 2017 on a weak note Tuesday, as a stronger dollar and expectations of future rate increases pushed the precious metal lower on the first trading day of the year, says Dow Jones.

Spot gold prices fell 0.18% to $1,148.25 a troy ounce in midmorning trading in London, its lowest price since Dec. 28. The metal spent the holidays in a narrow trading range, and ended the year up about 8% despite a sharp sell off in the final three months of 2016.

Looking forward to the year ahead, "the price performance of precious metals and gold first and foremost will probably be largely determined by interest rate developments and resulting bond yields, and by the U.S. dollar," Commerzbank said in a note.

-

15:26

EUR/USD falls to lowest since 2003 at $1.0341. Demand noted

-

15:25

US construction spending rose during November 2016

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2016 was estimated at a seasonally adjusted annual rate of $1,182.1 billion, 0.9 percent (±1.5%)* above the revised October estimate of $1,171.4 billion. The November figure is 4.1 percent (±2.0%) above the November 2015 estimate of $1,135.5 billion. During the first 11 months of this year, construction spending amounted to $1,070.9 billion, 4.4 percent (±1.0%) above the $1,025.5 billion for the same period in 2015.

-

15:23

US manufacturing sector business activity index rose in December

Data for December signaled the strong end of the year for the US manufacturing sector, and the overall business environment improved at the fastest pace since March 2015. Strong rise in new orders and production volume led to the fastest pace of job creation and a half years. At the same time, the increased costs of customers and optimistic business confidence have led to the largest accumulation of inventories in August, 2014.

Seasonally adjusted, the US manufacturing purchasing managers index (PMI) released by Markit rose to 54.3 in December from 54.1 in November, and signaled a strong improvement in the business environment.

-

15:00

U.S.: ISM Manufacturing, December 54.7 (forecast 53.5)

-

15:00

U.S.: Construction Spending, m/m, November 0.9% (forecast 0.5%)

-

14:52

WSE: After start on Wall Street

The Americans started the new year with considerable optimism and their yesterday's absence means that Wall Street has to work off arrears to the markets in Europe. In Warsaw Stock Exchange consistently grow large companies, indicating the influx of foreign purchase orders. The leader of growth is PKO BP (WSE: PKO), stands out also Tauron (WSE: TPE), Orange (WSE: OPL) and Pekao (WSE: PEO).

An hour before the close of trading the WIG20 index was at the level of 1,978 points (+1.07%) and turnover in the segment of the largest companies was amounted to PLN 535 million.

-

14:45

U.S.: Manufacturing PMI, December 54.3 (forecast 54.2)

-

14:35

U.S. Stocks open: Dow +0.83%, Nasdaq +0.80%, S&P +0.79%

-

14:25

Before the bell: S&P futures +0.83%, NASDAQ futures +0.83%

U.S. stock-index futures rose amid strength in major foreign equity bourses and in commodities markets, supported by upbeat Chinese economic data. The Caixin Purchasing Managers' Index (PMI), which tracks manufacturing activity in China, recorded the fastest rate of improvement since January, 2013.

Global Stocks:

Nikkei Closed

Hang Seng 22,150.40 +149.84 +0.68%

Shanghai 3,136.28 +32.65 +1.05%

FTSE 7,180.16 +37.33 +0.52%

CAC 4,903.51 +21.13 +0.43%

DAX 11,594.13 -4.20 -0.04%

Crude $54.89 (+1.86%)

Gold $1,151.10 (-0.08%)

-

14:15

Change in GDT Price Index from previous event -3.9%, Average price (USD/MT, FAS) $3,463. NZD/USD a little lower

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

757.2

7.33(0.9775%)

50760

AMERICAN INTERNATIONAL GROUP

AIG

65.7

0.39(0.5971%)

1358

Apple Inc.

AAPL

116.1

0.28(0.2418%)

114981

Barrick Gold Corporation, NYSE

ABX

16.15

0.17(1.0638%)

72563

Chevron Corp

CVX

118.69

0.99(0.8411%)

7390

Citigroup Inc., NYSE

C

60.25

0.82(1.3798%)

32308

E. I. du Pont de Nemours and Co

DD

73.5

0.10(0.1362%)

680

Exxon Mobil Corp

XOM

91.18

0.92(1.0193%)

5671

Facebook, Inc.

FB

116.01

0.96(0.8344%)

107183

FedEx Corporation, NYSE

FDX

187.17

0.97(0.5209%)

861

Ford Motor Co.

F

12.18

0.05(0.4122%)

87443

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.44

0.25(1.8954%)

81026

General Electric Co

GE

31.69

0.09(0.2848%)

21594

General Motors Company, NYSE

GM

34.71

-0.13(-0.3731%)

110979

Goldman Sachs

GS

242.11

2.66(1.1109%)

12095

Hewlett-Packard Co.

HPQ

15.1

0.26(1.752%)

107258

Home Depot Inc

HD

134.91

0.83(0.619%)

8261

Intel Corp

INTC

36.48

0.21(0.579%)

633351

International Business Machines Co...

IBM

166.8

0.81(0.488%)

5155

Johnson & Johnson

JNJ

115.65

0.44(0.3819%)

5714

JPMorgan Chase and Co

JPM

87.22

0.93(1.0778%)

17985

Microsoft Corp

MSFT

62.52

0.38(0.6115%)

37222

Nike

NKE

51.65

0.82(1.6132%)

51850

Pfizer Inc

PFE

32.69

0.21(0.6465%)

20570

Procter & Gamble Co

PG

84.48

0.40(0.4757%)

7221

Starbucks Corporation, NASDAQ

SBUX

55.98

0.46(0.8285%)

6583

Tesla Motors, Inc., NASDAQ

TSLA

216.3

2.61(1.2214%)

34397

The Coca-Cola Co

KO

41.65

0.19(0.4583%)

6006

Twitter, Inc., NYSE

TWTR

16.28

-0.02(-0.1227%)

118616

UnitedHealth Group Inc

UNH

161.06

1.02(0.6373%)

852

Verizon Communications Inc

VZ

53.81

0.43(0.8055%)

19933

Wal-Mart Stores Inc

WMT

69.3

0.18(0.2604%)

2629

Walt Disney Co

DIS

105.5

1.28(1.2282%)

22462

Yahoo! Inc., NASDAQ

YHOO

39.06

0.39(1.0085%)

3288

Yandex N.V., NASDAQ

YNDX

20.77

0.64(3.1793%)

13784

-

13:47

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Buy at Evercore ISI

Verizon (VZ) upgraded to Buy from Neutral at Citigroup

Downgrades:

Other:

Facebook (FB) initiated with a Buy at Aegis

Twitter (TWTR) initiated with a Sell at Aegis; target $14

Amazon (AMZN) resumed with a Overweight at Piper Jaffray; target $900

-

13:40

Option expiries for today's 10:00 ET NY cut

USDJPY 114.0/09 (670m), 115.00, 115.50/55/60, 115.75, 116.00, 116.25, 116.50, 117.45/50/52 (865m)

EURUSD 1.0320, 1.0350, 1.0375, 1.0475, 1.0575, 1.0600, 1.0650 (939m)

AUDUSD 0.7000, 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200, 1.3444/45

EURJPY 120.45/50, 120.60, 123.00

-

13:05

The inflation rate in Germany as measured by the consumer price index is expected to be 1.7% in December 2016 - Destatis

The inflation rate in Germany as measured by the consumer price index is expected to be 1.7% in December 2016. Compared with November 2016, consumer prices are expected to increase by 0.7%. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that, on an annual average, the inflation rate is expected to stand at 0.5% in 2016.

In December 2016, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 1.7% year on year and 1.0% on November 2016. On an annual average the harmonised index of consumer prices is expected to be up 0.4% in 2016 as compared with a year earlier.

The final results for December 2016 will be released on 18 January 2017.

-

13:00

Orders

EUR/USD

Offers: 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0420-25 1.0400 1.0380-85 1.0365 1.0350 1.0300

GBP/USD

Offers: 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids: 1.2250 1.2220-25 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8530 0.8550 0.8575-80 0.8600

Bids: 0.8480-85 0.8450 0.8435 0.8400

EUR/JPY

Offers: 123.00 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids: 122.80 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers: 118.00-05 118.20-25118.45-50118.80 119.00

Bids: 117.75 117.50 117.20-25 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers: 0.7250 0.7280 0.7300 0.73200.73500.7365 0.73800.7400

Bids: 0.7200 0.7175-80 0.7145-50 0.7100-10

-

13:00

Germany: CPI, y/y , December 1.7% (forecast 1.5%)

-

13:00

Germany: CPI, m/m, December 0.7% (forecast 0.6%)

-

12:57

General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border. Make in U.S.A. or pay big border tax! @realDonaldTrump

-

12:37

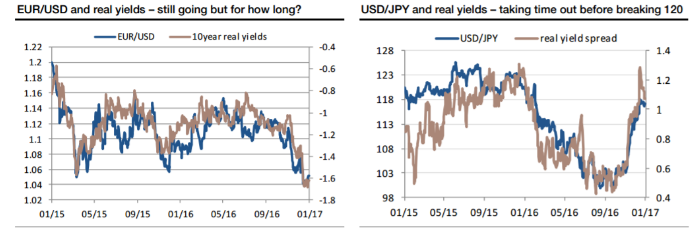

EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

"A look forwards. The yen's nearly fallen too far/too fast to sell, the dollar's getting closer to its peak and the Euro is cheap but unbuyable before the French elections.

My favourite currencies are Scandinavian, and after an unstellar 2016, long SEK/KRW is a trade we've been pushing for a week or two. A more mundane G10 version is short EUR/SEK. A second trade is to be short NZD/NOK. Long current account surplus, short deficit. Finally, with all this positive growth, oil isn't done yet. Short GBP/CAD for a final flurry..

There is no Eurodollar recommendation on the list, though we do expect to see parity before the French presidential elections. In nominal terms, the Treasury/Bund yields spread, at around 225bp, is wider than any any point since April 1989, the time of the Hillsborough disaster and just over 6 months before the Berlin wall came down. More recently, we've seen a 100bp widening in the real yield differential between Germany and the US since the start of 2015, which has taken EUR/USD down by 15 figures. Another 30bp real yield widening isn't impossible but this morning's release of the strongest Eurozone manufacturing PMI since 2011 is surely a reminder that a softer currency and stronger US data aren't really compatible with never-ending doom pessimism about the European economic outlook. Getting EUR/USD down is like pushing Sisyphus' rock uphill.

USD/JPY doesn't look like an exciting buy on real yield differentials now, but they should be supportive again going forwards. Tread carefully, yen bears!"

-

12:01

WSE: Mid session comment

The first half of today's trading was under the sign of robust growth of the Warsaw WIG20 index. Thus, the return of foreign investors nothing broke but actually helps, because yesterday's positive trend was captured, even with a slightly disappointing attitude of the environment, especially at the level of the DAX. However, Europe's mood is positive and the Warsaw market entered into this trend.

At the halfway point of quotations the WIG20 index was at the level of 1,978 points (+ 1.13%); the turnover in the segment of the largest companies was amounted to PLN 285 million.

-

11:56

President-elect Trump announces that Robert Lighthizer is his pick to be US Trade Representative @CNBC

-

11:55

Major stock indices in Europe trading in the green zone

European stocks rose for a third day continuing the bull market, as data showed that the Purchasing Managers' Index in the manufacturing sector and services in China were relatively strong in 2016.

The activity index of the manufacturing sector of China's economy by Caixin, also published by Markit Economics, in December was 51.9, higher than the previous value of 50.9 and economists' forecast of 50.7. As can be seen from the data, the index increased by 0.1 points and reached the highest level since January 2013. Chief Economist at Caixin Shenchzhun Zheng said that in December there was the development of positive trends in the Chinese economy, the majority of sub-indices show positive trends. However, he noted that despite the improvement of the situation, the Government of China need to remain vigilant to ensure the stability of the economy.

UK manufacturing sector expanded at the fastest pace in 30 months in December, showed on Tuesday the results of the survey by IHS Markit. PMI rose to 56.1 in December from 53.6 in November. The score was significantly higher than its long-term average of 51.5 and the expected level of 53.3.

PMI indicates expansion in each of the past five months. The study showed that in December, growth in production and new orders were among the best that have seen over the past two and a half years. Manufacturers benefited from a strong influx of new orders from domestic and overseas customers. Employment increased for the fifth consecutive month in December, while the job creation has accelerated the most in 14 months. On the price front, selling prices remained among the fastest throughout the survey history.

"Based on its historical connection with official data on industrial production, the survey indicates that the quarterly growth rate of close to 1.5 per cent, showing a surprisingly robust pace, given the weak start of the year and the uncertainty surrounding the referendum on EU membership," said Rob Dobson, senior economist at IHS Markit.

Banking stocks were the best performers, having jumped more than 1.3 percent. Shares of the new merged bank BPM in Italy have been at the top of the European index of the second day in a row, rising by more than 6 per cent in mid-morning trading. Italian banking index moves up, despite news that the sale of three small banks could be in jeopardy after the European Commission asked to postpone the process, at least for a week.

At the moment:

FTSE 7173.75 30.92 0.43%

DAX 11596.41 -1.92 -0.02%

CAC 4905.36 22.98 0.47%

-

11:15

Oil rose in early trading

This morning, the New York futures for Brent rose 1.18% to $ 57.49 WTI up 1.02% to $ 54.27. Thus, the black gold prices rise in anticipation of oil producing cuts worldwide.

Last year, WTI crude oil showed an increase of 45%, the biggest gain in the last seven years. In December, the black gold has increased by more than 8% after the OPEC agreement to lower production volumes.

-

10:02

Option expiries for today's 10:00 ET NY cut

USDJPY 114.0/09 (670m), 115.00, 115.50/55/60, 115.75, 116.00, 116.25, 116.50, 117.45/50/52 (865m)

EURUSD 1.0320, 1.0350, 1.0375, 1.0475, 1.0575, 1.0600, 1.0650 (939m)

AUDUSD 0.7000, 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200, 1.3444/45

EURJPY 120.45/50, 120.60, 123.00

Информационно-аналитический отдел TeleTrade

-

09:33

UK Markit/CIPS Purchasing Managers’ Index (PMI®) rose to a 30-month high of 56.1 in December

The UK manufacturing sector ended 2016 on a positive note. Rates of growth for production and new orders in December were among the best seen over the past two-and-a-half years. Companies benefited from stronger inflows of new work from both domestic and overseas clients, the latter aided by the boost to competitiveness from the weak sterling exchange rate.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI®) rose to a 30-month high of 56.1 in December, up from 53.6 in November and well above its long-run average (51.5). The headline PMI has signalled expansion in each of the past five months. December saw output expanded to meet the needs of stronger new work inflows. Growth of production and new business was broad-based by sector, with strong gains registered across the consumer, intermediate and investment goods industries. However, the increases seen at consumer goods producers were relatively mild in comparison to those seen in the other sectors.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , December 56.1 (forecast 53.3)

-

09:06

Germany's unemployment rate remained stable in November

Germany's unemployment rate remained stable in November, provisional data from Destatis showed Tuesday, cited by rttnews.

The jobless rate came in at adjusted 4.1 percent in November, the same as in October. The number of unemployed totaled 1.76 million, down by around 12,000 from October.

On an unadjusted basis, the unemployment rate dropped to 3.9 percent from 4 percent in the prior month.

Employment increased by adjusted 34,000, or 0.1 percent in November from October.

-

08:55

Germany: Unemployment Rate s.a. , December 6% (forecast 6%)

-

08:55

Germany: Unemployment Change, December -17 (forecast -5)

-

08:44

Major European stock markets trading in the green zone: FTSE + 0.3%, DAX + 0.3%, CAC40 + 0.5%, FTMIB + 0.5%, IBEX + 0.3%

-

08:30

Switzerland: Manufacturing PMI, December 56 (forecast 56.1)

-

08:21

Germany's Saxony Dec CPI +0.9% m/m, +1.8% On Year. Data point to jump in German inflation in Dec

-

08:18

WSE: After opening

WIG20 index opened at 1961.73 points (+0.26%)*

WIG 52040.34 0.26%

WIG30 2256.64 0.32%

mWIG40 4197.83 -0.06%

*/ - change to previous close

The futures market (FW20H1720) began trading with an increase of eight points over yesterday's closing and subsequent transactions brought further upward movement.

The cash market just started in positive territory. After the message about the possible loss of a contract with Biedronka retail chain negatively stands out Wawel (WSE:WWL). After the first transactions the WIG20 index clearly went over the level of 1,950 points, what causes a slow directing of attention to the important psychological barrier of 2,000 points.

After fifteen minutes of trading the index of the largest companies was at 1,969 points (+ 0.63%)

-

07:48

French CPI is likely to edge up by 0.3% in December 2016 - Insee

Year on year, the Consumer Price Index (CPI) should increase by 0.6% in December 2016, a little faster than in the two previous months (+0.5% in November and +0.4% in October), according to the provisional estimate made at the end of December. This slight rise in inflation should be due to a more pronounced increase in energy and food prices. By contrast, services prices are expected to slow down a little and those of manufactured products should decline more strongly than in the previous month.

Over one month, the CPI is likely to edge up by 0.3% in December 2016, after a stability in the two previous months. Indeed, services prices should rebound seasonally, essentially because of airfares. Energy prices should increase as much as in the previous month. Food prices should go up at the same pace as in November. Moreover, manufactured product prices should be stable after a slight decrease in November.

-

07:46

The Chinese authorities have imposed new restrictions on the purchase of foreign currency

Today the National Bank of China introduced new restrictions on the purchase of foreign currency in the country. Now, in order to buy dollars or euros you must fill out an application. Authorities released 11 possible options, such as travel and medical assistance. The list does not include items such as buying a house abroad, insurance and investments.

-

07:21

WSE: Before opening

Today are back to the game the main financial markets. Not working yet Japan and New Zealand, but on other continents we will have already full set of investors. From the point of view of the Warsaw Stock Exchange the most important is that back comes London and New York, which means a return to normality and orders from abroad. Tested will also be yesterday's New Year optimism, which is sustained so far. In Asia dominate the rise, contracts in the US are also gaining in value, quite a lot, as 0.6%. Thus, the mood in the morning is good, what forecasts positive opening of European markets.

Today's macro calendar is marked by the publication of PMI's. Tonight we met this kind of publication from China, a score of 51.9 points vs. the forecast of 50.7 points. At 10:30 (Warsaw time) we will know the PMI for the UK industry, while in the US the rate will be released at 15:45 and it is assumed its delicate growth from 54.1 points to 54.2 points. At 16:00 we will know different, but similar reading, namely the ISM index for the industry sector.

-

07:06

Chinese manufacturing PMI increased in December

The activity index of the manufacturing sector of China's economy by Caixin, also published by Markit Economics, was 51.9 in December, higher than the previous value of 50.9 and economists' forecast of 50.7. As can be seen from the data, the index increased by 0.1 points and reached the highest level since January 2013. Values above 50 indicates growth, while below this level indicates contraction. As China's economy is one of the largest in the world, this indicator can have a strong impact on the Forex market.

-

07:03

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.1%

-

06:59

RBA commodity index increased by 8.1 per cent on a monthly basis

Preliminary estimates for December indicate that the index increased by 8.1 per cent (on a monthly average basis) in SDR terms, after increasing by 11.8 per cent in November (revised). The increase was led by the prices of iron ore and coking coal. The base metals subindex increased in the month, while the rural subindex declined. In Australian dollar terms, the index rose by 9.3 per cent in December.

Over the past year, the index has increased by 45.5 per cent in SDR terms, led by higher coking coal and iron ore prices. The index has increased by 39.7 per cent in Australian dollar terms.

-

06:54

China has been taking out massive amounts of money & wealth from the U.S. in totally one-sided trade, but won't help with North Korea. Nice! from @realDonaldTrump

-

06:05

Options levels on tuesday, January 3, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0768 (2030)

$1.0702 (594)

$1.0655 (236)

Price at time of writing this review: $1.0481

Support levels (open interest**, contracts):

$1.0450 (1075)

$1.0406 (2221)

$1.0352 (2915)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44488 contracts, with the maximum number of contracts with strike price $1,1500 (3205);

- Overall open interest on the PUT options with the expiration date March, 13 is 54760 contracts, with the maximum number of contracts with strike price $1,0000 (5017);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.2611 (1159)

$1.2515 (526)

$1.2419 (243)

Price at time of writing this review: $1.2294

Support levels (open interest**, contracts):

$1.2185 (768)

$1.2088 (457)

$1.1991 (1405)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14324 contracts, with the maximum number of contracts with strike price $1,2800 (3000);

- Overall open interest on the PUT options with the expiration date March, 13 is 17187 contracts, with the maximum number of contracts with strike price $1,1500 (2977);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from December, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:00

Open of the Market

Positive start for European stocks. After the first exchanges on the Frankfurt Dax of 0.28% to 11,630 points, + 0.46% for the CAC 40 and + 0.38% for the Eurostoxx 50. Somewhat sparse European economic agenda with the data on the German employment market and the British manufacturing PMI.

Today, to be reported the re-opening of Wall Street after being closed for the New Year festivities. -