Market news

-

23:28

Currencies. Daily history for Jan 03’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0405 -0,47%

GBP/USD $1,2237 -0,33%

USD/CHF Chf1,0272 +0,34%

USD/JPY Y117,74 +0,17%

EUR/JPY Y122,51 -0,29%

GBP/JPY Y144,07 -0,16%

AUD/USD $0,7217 +0,46%

NZD/USD $0,6915 -0,13%

USD/CAD C$1,3426 -0,10%

-

23:00

Schedule for today,Wednesday , Jan 04’2017 (GMT0)

00:30 Japan Manufacturing PMI (Finally) December 51.3 51.9

08:50 France Services PMI (Finally) 51.6 52.6

08:55 Germany Services PMI (Finally) December 55.1 53.8

09:00 Eurozone Services PMI (Finally) December 53.8 53.1

09:30 United Kingdom Mortgage Approvals November 67.52 69

09:30 United Kingdom Consumer credit, mln November 1618

09:30 United Kingdom Net Lending to Individuals, bln November 4.9 4.9

09:30 United Kingdom PMI Construction December 52.8 53

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) December 0.6% 1%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) December 0.8% 0.8%

19:00 U.S. FOMC meeting minutes

20:00 U.S. Total Vehicle Sales, mln December 17.87 17.7

22:30 Australia AIG Services Index December 51.1

-

15:26

EUR/USD falls to lowest since 2003 at $1.0341. Demand noted

-

15:25

US construction spending rose during November 2016

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2016 was estimated at a seasonally adjusted annual rate of $1,182.1 billion, 0.9 percent (±1.5%)* above the revised October estimate of $1,171.4 billion. The November figure is 4.1 percent (±2.0%) above the November 2015 estimate of $1,135.5 billion. During the first 11 months of this year, construction spending amounted to $1,070.9 billion, 4.4 percent (±1.0%) above the $1,025.5 billion for the same period in 2015.

-

15:23

US manufacturing sector business activity index rose in December

Data for December signaled the strong end of the year for the US manufacturing sector, and the overall business environment improved at the fastest pace since March 2015. Strong rise in new orders and production volume led to the fastest pace of job creation and a half years. At the same time, the increased costs of customers and optimistic business confidence have led to the largest accumulation of inventories in August, 2014.

Seasonally adjusted, the US manufacturing purchasing managers index (PMI) released by Markit rose to 54.3 in December from 54.1 in November, and signaled a strong improvement in the business environment.

-

15:00

U.S.: ISM Manufacturing, December 54.7 (forecast 53.5)

-

15:00

U.S.: Construction Spending, m/m, November 0.9% (forecast 0.5%)

-

14:45

U.S.: Manufacturing PMI, December 54.3 (forecast 54.2)

-

14:15

Change in GDT Price Index from previous event -3.9%, Average price (USD/MT, FAS) $3,463. NZD/USD a little lower

-

13:40

Option expiries for today's 10:00 ET NY cut

USDJPY 114.0/09 (670m), 115.00, 115.50/55/60, 115.75, 116.00, 116.25, 116.50, 117.45/50/52 (865m)

EURUSD 1.0320, 1.0350, 1.0375, 1.0475, 1.0575, 1.0600, 1.0650 (939m)

AUDUSD 0.7000, 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200, 1.3444/45

EURJPY 120.45/50, 120.60, 123.00

-

13:05

The inflation rate in Germany as measured by the consumer price index is expected to be 1.7% in December 2016 - Destatis

The inflation rate in Germany as measured by the consumer price index is expected to be 1.7% in December 2016. Compared with November 2016, consumer prices are expected to increase by 0.7%. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that, on an annual average, the inflation rate is expected to stand at 0.5% in 2016.

In December 2016, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 1.7% year on year and 1.0% on November 2016. On an annual average the harmonised index of consumer prices is expected to be up 0.4% in 2016 as compared with a year earlier.

The final results for December 2016 will be released on 18 January 2017.

-

13:00

Germany: CPI, y/y , December 1.7% (forecast 1.5%)

-

13:00

Germany: CPI, m/m, December 0.7% (forecast 0.6%)

-

13:00

Orders

EUR/USD

Offers: 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids: 1.0420-25 1.0400 1.0380-85 1.0365 1.0350 1.0300

GBP/USD

Offers: 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids: 1.2250 1.2220-25 1.2200 1.2185 1.2150 1.2100

EUR/GBP

Offers: 0.8530 0.8550 0.8575-80 0.8600

Bids: 0.8480-85 0.8450 0.8435 0.8400

EUR/JPY

Offers: 123.00 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids: 122.80 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers: 118.00-05 118.20-25118.45-50118.80 119.00

Bids: 117.75 117.50 117.20-25 117.00 116.70 116.50-55 116.30 116.00

AUD/USD

Offers: 0.7250 0.7280 0.7300 0.73200.73500.7365 0.73800.7400

Bids: 0.7200 0.7175-80 0.7145-50 0.7100-10

-

12:57

General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border. Make in U.S.A. or pay big border tax! @realDonaldTrump

-

12:37

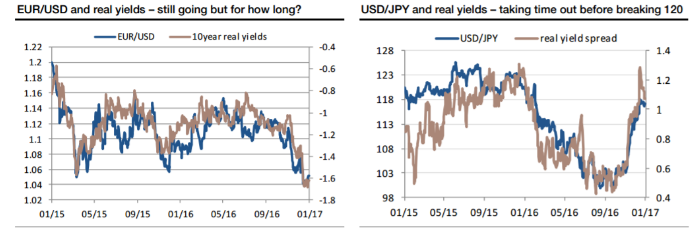

EUR - Cheap but unbuyable yet, JPY too fast to sell - Societe Generale

"A look forwards. The yen's nearly fallen too far/too fast to sell, the dollar's getting closer to its peak and the Euro is cheap but unbuyable before the French elections.

My favourite currencies are Scandinavian, and after an unstellar 2016, long SEK/KRW is a trade we've been pushing for a week or two. A more mundane G10 version is short EUR/SEK. A second trade is to be short NZD/NOK. Long current account surplus, short deficit. Finally, with all this positive growth, oil isn't done yet. Short GBP/CAD for a final flurry..

There is no Eurodollar recommendation on the list, though we do expect to see parity before the French presidential elections. In nominal terms, the Treasury/Bund yields spread, at around 225bp, is wider than any any point since April 1989, the time of the Hillsborough disaster and just over 6 months before the Berlin wall came down. More recently, we've seen a 100bp widening in the real yield differential between Germany and the US since the start of 2015, which has taken EUR/USD down by 15 figures. Another 30bp real yield widening isn't impossible but this morning's release of the strongest Eurozone manufacturing PMI since 2011 is surely a reminder that a softer currency and stronger US data aren't really compatible with never-ending doom pessimism about the European economic outlook. Getting EUR/USD down is like pushing Sisyphus' rock uphill.

USD/JPY doesn't look like an exciting buy on real yield differentials now, but they should be supportive again going forwards. Tread carefully, yen bears!"

-

11:56

President-elect Trump announces that Robert Lighthizer is his pick to be US Trade Representative @CNBC

-

10:02

Option expiries for today's 10:00 ET NY cut

USDJPY 114.0/09 (670m), 115.00, 115.50/55/60, 115.75, 116.00, 116.25, 116.50, 117.45/50/52 (865m)

EURUSD 1.0320, 1.0350, 1.0375, 1.0475, 1.0575, 1.0600, 1.0650 (939m)

AUDUSD 0.7000, 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200, 1.3444/45

EURJPY 120.45/50, 120.60, 123.00

Информационно-аналитический отдел TeleTrade

-

09:33

UK Markit/CIPS Purchasing Managers’ Index (PMI®) rose to a 30-month high of 56.1 in December

The UK manufacturing sector ended 2016 on a positive note. Rates of growth for production and new orders in December were among the best seen over the past two-and-a-half years. Companies benefited from stronger inflows of new work from both domestic and overseas clients, the latter aided by the boost to competitiveness from the weak sterling exchange rate.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI®) rose to a 30-month high of 56.1 in December, up from 53.6 in November and well above its long-run average (51.5). The headline PMI has signalled expansion in each of the past five months. December saw output expanded to meet the needs of stronger new work inflows. Growth of production and new business was broad-based by sector, with strong gains registered across the consumer, intermediate and investment goods industries. However, the increases seen at consumer goods producers were relatively mild in comparison to those seen in the other sectors.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , December 56.1 (forecast 53.3)

-

09:06

Germany's unemployment rate remained stable in November

Germany's unemployment rate remained stable in November, provisional data from Destatis showed Tuesday, cited by rttnews.

The jobless rate came in at adjusted 4.1 percent in November, the same as in October. The number of unemployed totaled 1.76 million, down by around 12,000 from October.

On an unadjusted basis, the unemployment rate dropped to 3.9 percent from 4 percent in the prior month.

Employment increased by adjusted 34,000, or 0.1 percent in November from October.

-

08:55

Germany: Unemployment Rate s.a. , December 6% (forecast 6%)

-

08:55

Germany: Unemployment Change, December -17 (forecast -5)

-

08:30

Switzerland: Manufacturing PMI, December 56 (forecast 56.1)

-

08:21

Germany's Saxony Dec CPI +0.9% m/m, +1.8% On Year. Data point to jump in German inflation in Dec

-

07:48

French CPI is likely to edge up by 0.3% in December 2016 - Insee

Year on year, the Consumer Price Index (CPI) should increase by 0.6% in December 2016, a little faster than in the two previous months (+0.5% in November and +0.4% in October), according to the provisional estimate made at the end of December. This slight rise in inflation should be due to a more pronounced increase in energy and food prices. By contrast, services prices are expected to slow down a little and those of manufactured products should decline more strongly than in the previous month.

Over one month, the CPI is likely to edge up by 0.3% in December 2016, after a stability in the two previous months. Indeed, services prices should rebound seasonally, essentially because of airfares. Energy prices should increase as much as in the previous month. Food prices should go up at the same pace as in November. Moreover, manufactured product prices should be stable after a slight decrease in November.

-

07:46

The Chinese authorities have imposed new restrictions on the purchase of foreign currency

Today the National Bank of China introduced new restrictions on the purchase of foreign currency in the country. Now, in order to buy dollars or euros you must fill out an application. Authorities released 11 possible options, such as travel and medical assistance. The list does not include items such as buying a house abroad, insurance and investments.

-

07:06

Chinese manufacturing PMI increased in December

The activity index of the manufacturing sector of China's economy by Caixin, also published by Markit Economics, was 51.9 in December, higher than the previous value of 50.9 and economists' forecast of 50.7. As can be seen from the data, the index increased by 0.1 points and reached the highest level since January 2013. Values above 50 indicates growth, while below this level indicates contraction. As China's economy is one of the largest in the world, this indicator can have a strong impact on the Forex market.

-

06:59

RBA commodity index increased by 8.1 per cent on a monthly basis

Preliminary estimates for December indicate that the index increased by 8.1 per cent (on a monthly average basis) in SDR terms, after increasing by 11.8 per cent in November (revised). The increase was led by the prices of iron ore and coking coal. The base metals subindex increased in the month, while the rural subindex declined. In Australian dollar terms, the index rose by 9.3 per cent in December.

Over the past year, the index has increased by 45.5 per cent in SDR terms, led by higher coking coal and iron ore prices. The index has increased by 39.7 per cent in Australian dollar terms.

-

06:54

China has been taking out massive amounts of money & wealth from the U.S. in totally one-sided trade, but won't help with North Korea. Nice! from @realDonaldTrump

-

06:05

Options levels on tuesday, January 3, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0768 (2030)

$1.0702 (594)

$1.0655 (236)

Price at time of writing this review: $1.0481

Support levels (open interest**, contracts):

$1.0450 (1075)

$1.0406 (2221)

$1.0352 (2915)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44488 contracts, with the maximum number of contracts with strike price $1,1500 (3205);

- Overall open interest on the PUT options with the expiration date March, 13 is 54760 contracts, with the maximum number of contracts with strike price $1,0000 (5017);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.2611 (1159)

$1.2515 (526)

$1.2419 (243)

Price at time of writing this review: $1.2294

Support levels (open interest**, contracts):

$1.2185 (768)

$1.2088 (457)

$1.1991 (1405)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14324 contracts, with the maximum number of contracts with strike price $1,2800 (3000);

- Overall open interest on the PUT options with the expiration date March, 13 is 17187 contracts, with the maximum number of contracts with strike price $1,1500 (2977);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from December, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-