Market news

-

23:36

Australia: Westpac Consumer Confidence, March 99.7

-

23:28

Currencies. Daily history for Mar 14’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0608 -0,41%

GBP/USD $1,2155 -0,53%

USD/CHF Chf1,0097 +0,26%

USD/JPY Y114,74 -0,08%

EUR/JPY Y121,71 -0,50%

GBP/JPY Y139,46 -0,60%

AUD/USD $0,7558 -0,15%

NZD/USD $0,6920 -0,01%

USD/CAD C$1,3482 +0,27%

-

23:03

Schedule for today,Wednesday, Mar 15’2017 (GMT0)

00:30 Australia New Motor Vehicle Sales (YoY) February -0.9%

00:30 Australia New Motor Vehicle Sales (MoM) February 0.6%

04:30 Japan Industrial Production (MoM) (Finally) January 0.7% -0.8%

04:30 Japan Industrial Production (YoY) (Finally) January 3.2% 3.2%

07:45 France CPI, m/m (Finally) February -0.2% 0.1%

07:45 France CPI, y/y (Finally) February 1.3% 1.2%

08:15 Switzerland Producer & Import Prices, y/y February 0.8% 1.8%

08:15 Switzerland Producer & Import Prices, m/m February 0.4% 0.4%

09:00 U.S. IEA Monthly Report

09:30 United Kingdom Average Earnings, 3m/y January 2.6% 2.4%

09:30 United Kingdom ILO Unemployment Rate January 4.8% 4.8%

10:00 Eurozone Employment Change Quarter IV 0.2% 0.2%

12:30 U.S. Retail sales excluding auto February 0.8% 0.2%

12:30 U.S. NY Fed Empire State manufacturing index March 18.7 15

12:30 U.S. Retail Sales YoY February 5.6%

12:30 U.S. Retail sales February 0.4% 0.1%

12:30 U.S. CPI excluding food and energy, Y/Y February 2.3% 2.2%

12:30 U.S. CPI, Y/Y February 2.5% 2.7%

12:30 U.S. CPI, m/m February 0.6% 0.1%

12:30 U.S. CPI excluding food and energy, m/m February 0.3% 0.2%

14:00 U.S. Business inventories January 0.4% 0.3%

14:00 U.S. NAHB Housing Market Index March 65 65

14:30 U.S. Crude Oil Inventories March 8.209

18:00 U.S. Fed Interest Rate Decision 0.75% 1%

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

20:00 U.S. Total Net TIC Flows January -42.8

20:00 U.S. Net Long-term TIC Flows January -12.9

21:45 New Zealand GDP y/y Quarter IV 3.5% 3.1%

21:45 New Zealand GDP q/q Quarter IV 1.1% 0.7%

-

21:45

New Zealand: Current Account , Quarter IV -2.34 (forecast -2.543)

-

15:34

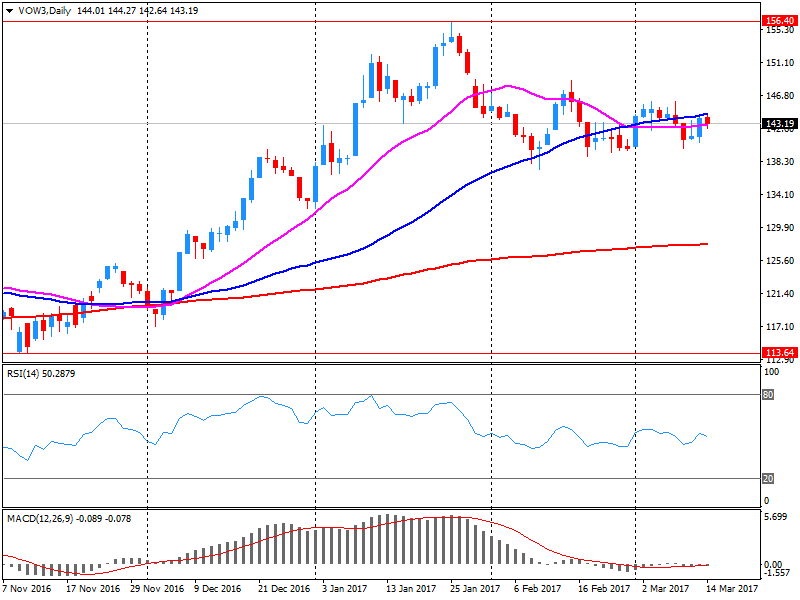

Volkswagen (VOW3) plans to get strong results in 2017

Volkswagen's investors gathered in Wolfsburg, Germany, for an annual meeting with the automaker.

During the meeting, Matthias Mueller, the general director of the auto concern, said he sees a good chance of maintaining the positive dynamics recorded last year, when the company managed to get a record base profit, which was promoted by sales of prestigious cars Audi and Porsche.

The company expects that the group's revenue in 2017 will exceed last year's figure of 217 billion euros by as much as 4%, and sales will amount to more than 10.3 million cars.

Vow3 shares are trading at 143.25 euros (-0.62%).

-

14:55

Moody's: Fed rate rise would confirm policy makers set for monetary tightening course

-

14:38

France's Fillon has been placed under formal investigation for diversion of public funds - Le Canard Enchaine

-

13:58

UK CB leading index rose 0.4% in January

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously;

The Conference Board Leading Economic Index(LEI) for the U.K. increased 0.4 percent in January 2017 to 113.5 (2010=100).

The Conference Board Coincident Economic Index(CEI) for the U.K. was unchanged in January 2017 at 108.7 (2010=100).

-

13:41

Option expiries for today's 10:00 ET NY cut

EURUSD:1.050 (EUR 1.66bln) 1.0550 (430m) 1.0580-90 (1.3bln) 1.0600 (235m) 1.0630 (433m) 1.0650 (456m) 1.0700-10 (735m)

USDJPY: 114.00 (USD 901m) 114.30 (730m) 114.50 (646m) 114.75 (330m) 115.00 (1.1bln) 115.50 (700m)

AUDUSD: 0.7400 (AUD 354m) 0.7500 (389m) 0.7545 (1.3bln)

USDCAD 1.3430 (USD 25 2m) 1.3500 (200m)

NZDUSD 0.6935 (NZD 200m)

-

13:03

Brexit legislation giving PM May right to launch EU exit talks will proceed to royal assent in coming days - May in parliament

-

Will return to parliament before end of month to notify that I have triggered article 50 to launch Brexit talks

-

Told ministers leaving EU is big project but govt must not lose sight of its plans for economic and social reform

-

-

12:34

US producer price index rose more than expected in February

The Producer Price Index for final demand increased 0.3 percent in February, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.6 percent in January and 0.2 percent in December. On an unadjusted basis, the final demand index climbed 2.2 percent for the 12 months ended February 2017, the largest advance since a 2.4-percent increase in the 12 months ended March 2012.

In February, over 80 percent of the advance in the final demand index is attributable to a 0.4-percent increase in prices for final demand services. The index for final demand goods moved up 0.3 percent.

Prices for final demand less foods, energy, and trade services rose 0.3 percent in February, the largest increase since a 0.3-percent advance in April 2016. For the 12 months ended in February, the index for final demand less foods, energy, and trade services climbed 1.8 percent. -

12:30

U.S.: PPI, m/m, February 0.3% (forecast 0.1%)

-

12:30

U.S.: PPI, y/y, February 2.2% (forecast 2%)

-

12:30

U.S.: PPI excluding food and energy, Y/Y, February 1.5% (forecast 1.5%)

-

12:30

U.S.: PPI excluding food and energy, m/m, February 0.3% (forecast 0.2%)

-

11:33

Bank of England says its court has commissioned review to learn lessons from Hogg case

-

Charlotte Hogg says has recognised that "being sorry is not enough" in letter to BoE Governor Carney

-

-

11:12

Hungarian lawmakers propose economist Bianka Parragh as new member of Central Bank Monetary Council - Committee chairman

-

10:25

Euro Zone industrial production rose less than expected in January

In January 2017 compared with December 2016, seasonally adjusted industrial production rose by 0.9% in the euro area (EA19) and by 0.5% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In December 2016 industrial production fell by 1.2% in the euro area and by 0.7% in the EU28. In January 2017 compared with January 2016, industrial production increased by 0.6% in the euro area and by 1.3% in the EU28.

The increase of 0.9% in industrial production in the euro area in January 2017, compared with December 2016, is due to production of capital goods rising by 2.8% and energy by 1.9%, while production of non-durable consumer goods fell by 0.7% and both intermediate goods and durable consumer goods by 0.4%. In the EU28, the increase of 0.5% is due to production of capital goods rising by 2.4% and energy by 1.5%, while production of non-durable consumer goods fell by 1.5%, durable consumer goods by 0.9% and intermediate goods by 0.4%.

-

10:23

The ZEW Indicator of Economic Sentiment for Germany improved slightly in March

The ZEW Indicator of Economic Sentiment for Germany improved slightly by 2.4 points in March 2017, with the indicator now standing at 12.8 points. The long-term average, which has been calculated since the survey was begun, is 23.9 points.

"The fact that the ZEW Indicator of Economic Sentiment only shows a slight upward movement is a reflection of the current uncertainty surrounding future economic development. With regard to the economic situation in Germany, no clear conclusions can be drawn from the most recent economic signals for January 2017. While industrial production and exports witnessed a positive development, the figures for incoming orders and retail sales were less favourable. The political risks resulting from upcoming elections in a number of EU countries are keeping uncertainty surrounding the German economy at a relatively high level," comments ZEW President Professor Achim Wambach.

-

10:01

Eurozone: ZEW Economic Sentiment, March 25.6 (forecast 19.3)

-

10:00

Eurozone: Industrial Production (YoY), January 0.6% (forecast 0.9%)

-

10:00

Eurozone: Industrial production, (MoM), January 0.9% (forecast 1.3%)

-

10:00

Germany: ZEW Survey - Economic Sentiment, March 12.8 (forecast 13.1)

-

09:52

Band of England's Hogg resigns as Deputy Governor

-

09:22

UK parliament's treasury committee concerned that Bank of England deputy governor Hogg misled committee, albeit inadvertently

-

09:04

More downside for EUR/USD before 1.15 says Nomura

EUR/USD has been in demand as of late mainly following its positive reaction to last week' President Draghi's press conference.

In that regard, Nomura Research notes that President Draghi communicated that the Bank had removed the reference to using all instruments to signal that the sense of urgency is gone, and as the ECB's risk assessment has likely become more balanced, these communications supported EUR for now.

Nonetheless, over the next few months, Nomura argues that French elections and the Fed policy stance will likely be more important drivers of EUR/USD, as they pose near-term downside risks.

Beyond that, Nomura expects the EUR to benefit from the reflation in the medium term and target 1.15 for EUR/USD by year-end.

EUR/USD is trading at 1.0652 as of writing.

Source: Nomura Securities Research, efxnews.

-

08:58

ECB says 620 mln euros borrowed using overnight loan facility, 495.394 bln euros deposited

-

07:34

Options levels on tuesday, March 14, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0828 (989)

$1.0801 (117)

$1.0762 (43)

Price at time of writing this review: $1.0638

Support levels (open interest**, contracts):

$1.0558 (482)

$1.0507 (654)

$1.0447 (1365)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 38457 contracts, with the maximum number of contracts with strike price $1,1450 (4227);

- Overall open interest on the PUT options with the expiration date June, 9 is 39576 contracts, with the maximum number of contracts with strike price $1,0350 (3901);

- The ratio of PUT/CALL was 1.03 versus 1.00 from the previous trading day according to data from March, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.2417 (297)

$1.2322 (407)

$1.2227 (218)

Price at time of writing this review: $1.2133

Support levels (open interest**, contracts):

$1.2083 (561)

$1.1986 (741)

$1.1889 (788)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 12975 contracts, with the maximum number of contracts with strike price $1,3000 (1227);

- Overall open interest on the PUT options with the expiration date June, 9 is 15389 contracts, with the maximum number of contracts with strike price $1,1500 (3130);

- The ratio of PUT/CALL was 1.19 versus 1.17 from the previous trading day according to data from March, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:13

Consumer prices in Germany were 2.2% higher in February 2017 y/y, as expected

Consumer prices in Germany were 2.2% higher in February 2017 than in February 2016. The inflation rate as measured by the consumer price index continued to increase (January 2017: +1.9%; December 2016: +1.7%). An inflation rate of more than two percent was last recorded in August 2012 (also +2.2%). Compared with January 2017, the consumer price index rose by 0.6% in February 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 1 March 2017.

Energy prices as a whole were markedly up in February 2017 compared with a year earlier (+7.2%) and again had a strong upward effect on the overall inflation rate. The price increases for energy in recent months (January 2017: +5.9%; December 2016: +2.5%) were mainly due to the low level of energy prices a year ago. In 2016, the lowest level was reached in February 2016. As a result of this base effect, the prices of especially heating oil (+43.8%) and motor fuels (+15.6%) were markedly up in February 2017 compared with a year earlier. The year-on-year price changes for other energy products were much smaller (e.g. electricity: +1.6%; gas: −3.2%; charges for central and district heating: −4.7%). Excluding energy prices, the inflation rate in February 2017 would have been +1.7%; excluding the prices of mineral oil products, it would have been only +1.5%.

-

07:00

Germany: CPI, m/m, February 0.6% (forecast 0.6%)

-

07:00

Germany: CPI, y/y , February 2.2% (forecast 2.2%)

-

06:44

Russia's Economy Minister says rouble is still stronger than fundamentally justified levels - Interfax

-

06:43

Fed speakers have already send a strong signal that the Fed intends to hike this week - Bank of America Merrill Lynch

"With the rate decision likely to be a nonevent, attention turns to the Summary of Economic Projections and the press conference at this week's FOMC meeting," BofAML adds.

In this regard, BofAML believes that the combination of a shift higher in the dots and language changes in the statement will send a hawkish signal, but suspects that Chair Yellen will sound more balanced in her press conference.

As such, BofA argues that depending on how hawkish the Fed sounds this week, 'there is room for repricing in rates and further strengthening in the USD.'

USD is tarding at 1.0654 vs EUR and at 114.81 vs JPY as of writing.

Source: Bank of America Merrill Lynch Rates and Currencies Research. efxnews.

-

06:40

China's industrial production and fixed asset investment growth accelerated

China's industrial production and fixed asset investment growth accelerated more-than-expected at the start of the year, while retail sales grew at a slower pace from a year ago, according to rttnews.

Data from the National Bureau of Statistics showed that industrial production climbed 6.3 percent in January to February from the same period of last year, faster than the 6.0 percent increase seen in December and the 6.2 percent rise economists had forecast.

A similar faster growth was last seen in August 2016. Data for the first two months of the year are combined to even out the impact of the Lunar New Year holiday.

-

06:33

UK Parliament gives Theresa May permission to start Brexit @zerohedge

-

02:00

China: Fixed Asset Investment, January 8.9% (forecast 8.2%)

-

02:00

China: Retail Sales y/y, January 9.5% (forecast 10.5%)

-

02:00

China: Industrial Production y/y, January 6.3% (forecast 6.2%)

-

00:30

Australia: National Australia Bank's Business Confidence, February 7

-