Market news

-

23:28

Stocks. Daily history for Mar 14’2017:

(index / closing price / change items /% change)

Nikkei -24.25 19609.50 -0.12%

TOPIX -2.50 1574.90 -0.16%

Hang Seng -1.72 23827.95 -0.01%

CSI 300 -1.41 3456.69 -0.04%

Euro Stoxx 50 -16.06 3399.43 -0.47%

FTSE 100 -9.23 7357.85 -0.13%

DAX -1.24 11988.79 -0.01%

CAC 40 -25.34 4974.26 -0.51%

DJIA -44.11 20837.37 -0.21%

S&P 500 -8.02 2365.45 -0.34%

NASDAQ -18.97 5856.82 -0.32%

S&P/TSX -165.21 15379.61 -1.06%

-

20:05

Major US stock indexes finished trading in negative territory

Major US stock indexes declined on Tuesday amid falling oil prices and expectations of the Fed meeting.

Investors focused on the Fed meeting, which is expected to raise interest rates. At the moment, the chances of a decision to raise rates at this meeting according to the dynamics of futures on federal funds are estimated at 93%. The head of the Federal Reserve, Janet Yellen, said earlier that the regulator is likely to raise the rate in March. However, investors are most interested in the Fed's signals about how quickly it is planned to raise rates this year. Now the probability of raising rates three or more times this year, they estimate in 64%.

The volume of trading was low, as the northeastern US state caught a snowstorm, leaving people at home.

The focus of investors' attention was also data on changes in producer prices last month. As it became known, in February, producer prices rose by 0.3% m / m, which is above the average forecast of analysts at + 0.1%. The base producer prices also rose by 0.3%, while analysts had expected growth of 0.2%.

The components of the DOW index mostly decreased (20 out of 30). The shares of Chevron Corporation fell more than others (CVX, -1.55%). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 1.34%).

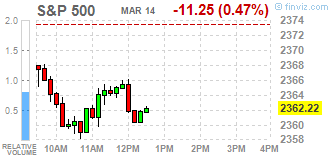

All sectors of the S & P index ended the session in negative territory. Most of all, the main materials sector fell (-1.4%).

At closing:

Dow -0.21% 20,837.54 -43.94

Nasdaq -0.32% 5,856.82 -18.96

S & P-0.34% 2,365.38 -8.09

-

19:00

DJIA -0.24% 20,832.20 -49.28 Nasdaq -0.45% 5,849.33 -26.45 S&P -0.42% 2,363.41 -10.06

-

17:00

European stocks closed: FTSE 100 -9.23 7357.85 -0.13% DAX -1.24 11988.79 -0.01% CAC 40 -25.34 4974.26 -0.51%

-

16:37

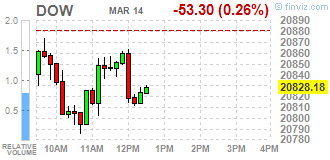

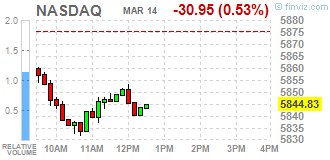

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes lower on Tuesday as oil prices fell and investors focused on the Federal Reserve's policy meeting, where it is widely expected to raise interest rates. Trading volumes were light as a blizzard in the northeastern United States grounded flights and kept people indoors.

Most of Dow stocks in negative area (21 of 30). Top loser - Chevron Corporation (CVX, -1.49%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.58%).

All S&P sectors in negative area. Top loser - Basic Materials (-1.4%).

At the moment:

Dow 20783.00 -60.00 -0.29%

S&P 500 2358.25 -13.50 -0.57%

Nasdaq 100 5373.75 -25.50 -0.47%

Oil 47.35 -1.05 -2.17%

Gold 1204.20 +1.10 +0.09%

U.S. 10yr 2.59 -0.01

-

13:33

U.S. Stocks open: Dow -0.25%, Nasdaq -0.32%, S&P -0.35%

-

13:29

Before the bell: S&P futures -0.35%, NASDAQ futures -0.27%

U.S. stock-index futures fell ahead of the Federal Reserve's closely watched two-day meeting, where it is widely expected to raise interest rates.

Global Stocks:

Nikkei 19,609.50 -24.25 -0.12%

Hang Seng 23,827.95 -1.72 -0.01%

Shanghai 3,238.62 +1.60 +0.05%

FTSE 7,355.68 -11.40 -0.15%

CAC 4,971.34 -28.26 -0.57%

DAX 11,952.13 -37.90 -0.32%

Crude $47.83 (-1.18%)

Gold $1,204.80 (+0.14%)

-

12:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

191.1

-0.42(-0.22%)

500

Amazon.com Inc., NASDAQ

AMZN

852.04

-2.55(-0.30%)

1942

Apple Inc.

AAPL

138.9

-0.30(-0.22%)

25795

Caterpillar Inc

CAT

92.01

-0.63(-0.68%)

2312

Chevron Corp

CVX

108.53

-0.82(-0.75%)

4330

Citigroup Inc., NYSE

C

61.15

-0.38(-0.62%)

36839

Exxon Mobil Corp

XOM

81.15

-0.27(-0.33%)

22462

Facebook, Inc.

FB

139.25

-0.35(-0.25%)

27554

Ford Motor Co.

F

12.51

-0.03(-0.24%)

32778

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.45

-0.11(-0.88%)

102636

General Electric Co

GE

29.79

-0.07(-0.23%)

16499

Goldman Sachs

GS

247

-1.16(-0.47%)

2906

Intel Corp

INTC

35.1

-0.06(-0.17%)

25593

International Business Machines Co...

IBM

176.07

-0.39(-0.22%)

2233

JPMorgan Chase and Co

JPM

90.9

-0.46(-0.50%)

6112

Merck & Co Inc

MRK

64.17

0.02(0.03%)

1350

Microsoft Corp

MSFT

64.58

-0.13(-0.20%)

6569

Nike

NKE

56.7

0.03(0.05%)

3202

Tesla Motors, Inc., NASDAQ

TSLA

246.35

0.18(0.07%)

7933

Twitter, Inc., NYSE

TWTR

15.15

-0.06(-0.39%)

13301

Verizon Communications Inc

VZ

49.42

-0.05(-0.10%)

13148

Visa

V

89.91

-0.20(-0.22%)

3819

Wal-Mart Stores Inc

WMT

70.55

0.60(0.86%)

13607

Walt Disney Co

DIS

111.7

0.18(0.16%)

7996

Yandex N.V., NASDAQ

YNDX

23

-0.24(-1.03%)

2020

-

12:44

Upgrades and downgrades before the market open

Upgrades:

Walt Disney (DIS) upgraded to Buy from Neutral at Guggenheim

Downgrades:

Other:

FedEx (FDX) initiated with a Outperform at Wells Fargo

Wal-Mart (WMT) added to US 1 List at BofA/Merrill

-

06:35

Global Stocks

European stocks climbed in volatile trade Monday, but with investors trading cautiously ahead of potentially market-moving events this week, including the Dutch election, the U.K.'s Brexit bill vote and a U.S. interest-rate decision.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

Stocks closed marginally higher after switching between small gains and losses on Monday as investors refrained from making sizable bets ahead of a Federal Reserve meeting that is widely expected to deliver an interest-rate increase.

-