Market news

-

23:19

Stocks. Daily history for Mar 15’2017:

(index / closing price / change items /% change)

Nikkei -32.12 19577.38 -0.16%

TOPIX -3.59 1571.31 -0.23%

Hang Seng -35.10 23792.85 -0.15%

CSI 300 +6.95 3463.64 +0.20%

Euro Stoxx 50 +9.89 3409.32 +0.29%

FTSE 100 +10.79 7368.64 +0.15%

DAX +21.08 12009.87 +0.18%

CAC 40 +11.22 4985.48 +0.23%

DJIA +112.73 20950.10 +0.54%

S&P 500 +19.81 2385.26 +0.84%

NASDAQ +43.23 5900.05 +0.74%

S&P/TSX +141.30 15520.91 +0.92%

-

20:08

The main US stock indexes completed the session in the "green zone"

Major US stock indexes finished trading with a moderate increase, receiving support from the outcome of the meeting of the Federal Reserve System, as well as statistics on the United States.

The leadership of the Fed decided to raise the key interest rate by 0.25%, to 0.75% -1%. The regulator said it expects a gradual rate hike if the economy develops in line with their forecasts. The so-called "point" diagram of the Fed, through which the Central Bank reflects its assessment of the interest rate trajectory, shows that officials expect two more increases this year. Meanwhile, the average forecasts indicated that by the end of 2018 the rate will be in the range 2.0% -2.25%, which implies three more rate increases of 0.25% in 2018. As for 2019, expectations have slightly increased, and now forecasts indicate that the rate will be 3% by the end of 2019. At the same time, the economic forecasts of the Fed have not changed much relative to December. According to the median forecast, GDP growth in 2017 and in 2018 will be 2.1%. Expectations for long-term unemployment fell to 4.7% from 4.8% in December.

As for the statistical data, the Ministry of Labor reported that consumer prices continued to rise in February. The consumer price index in February rose by 0.1% compared to the previous month. The cost of energy and food, so-called basic prices, increased by 0.2%. These figures corresponded to the expectations of economists and reinforced the opinion of the Fed on the underlying strength in the economy. Consumer prices rose by 2.7% compared to last year, which is the largest annual increase from 12 months to March 2012.

Meanwhile, the Ministry of Commerce said that retail sales in the US were practically not moving forward in February, which is a warning to consumers, which may be due to a brief delay in some tax refunds. Sales in retail stores and restaurants in the US rose 0.1% compared with the previous month and seasonally adjusted $ 473.99 billion. This was the weakest increase since August. Excluding cars and auto parts, sales rose 0.2% from January.

The components of the DOW index have mostly grown (24 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 1.68%). More shares fell American Express Company (AXP, -0.53%).

All sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 2.6%).

At closing:

Dow + 0.54% 20,949.75 +112.38

Nasdaq + 0.74% 5,900.05 +43.23

S & P + 0.83% 2,385.11 +19.66

-

19:00

DJIA +0.54% 20,949.03 +111.66 Nasdaq +0.70% 5,897.76 +40.94 S&P +0.81% 2,384.57 +19.12

-

17:31

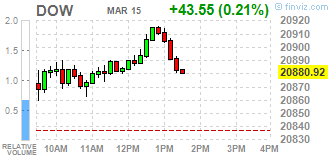

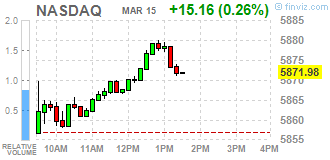

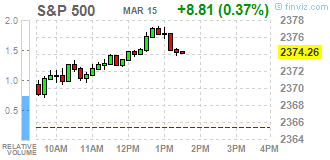

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes were mostly higher on Wednesday, with investors counting down to the conclusion of the Federal Reserve's two-day meeting, where the central bank is widely expected to raise rates for the first time this year.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -1.73%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.22%).

All S&P sectors in positive area. Top loser - Conglomerates (+1.5%).

At the moment:

Dow 20850.00 +47.00 +0.23%

S&P 500 2371.75 +8.75 +0.37%

Nasdaq 100 5396.00 +10.50 +0.19%

Oil 48.42 +0.70 +1.47%

Gold 1199.70 -2.90 -0.24%

U.S. 10yr 2.58 -0.01

-

13:35

U.S. Stocks open: Dow +0.14%, Nasdaq +0.15%, S&P +0.19%

-

13:29

Before the bell: S&P futures +0.20%, NASDAQ futures +0.16%

U.S. stock-index futures rose slightly as investors focused on a Federal Reserve meeting, where the regulator is widely expected to hike interest rates for the second time in three months.

Global Stocks:

Nikkei 19,577.38 -32.12 -0.16%

Hang Seng 23,792.85 -35.10 -0.15%

Shanghai 3,241.94 +2.61 +0.08%

FTSE 7,373.92 +16.07 +0.22%

CAC 4,978.42 +4.16 +0.08%

DAX 11,987.79 -1.00 -0.01%

Crude $48.71 (+2.07%)

Gold $1,198.20 (-0.37%)

-

12:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

34.57

0.38(1.11%)

3115

Amazon.com Inc., NASDAQ

AMZN

854

1.47(0.17%)

2659

Apple Inc.

AAPL

139.26

0.27(0.19%)

39204

AT&T Inc

T

42.17

0.08(0.19%)

217

Barrick Gold Corporation, NYSE

ABX

17.87

0.07(0.39%)

27886

Caterpillar Inc

CAT

92.25

0.39(0.42%)

1375

Chevron Corp

CVX

108.15

0.79(0.74%)

4658

Cisco Systems Inc

CSCO

34.14

0.02(0.06%)

557

Citigroup Inc., NYSE

C

61.63

0.19(0.31%)

7942

Exxon Mobil Corp

XOM

81.46

0.47(0.58%)

11251

Facebook, Inc.

FB

139.5

0.18(0.13%)

17464

Ford Motor Co.

F

12.56

0.01(0.08%)

28636

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.48

0.21(1.71%)

25454

General Electric Co

GE

29.6

0.06(0.20%)

2275

General Motors Company, NYSE

GM

37.04

0.08(0.22%)

3465

Goldman Sachs

GS

248.82

1.10(0.44%)

3606

Intel Corp

INTC

34.9

-0.28(-0.80%)

59426

International Business Machines Co...

IBM

175.99

0.27(0.15%)

1181

JPMorgan Chase and Co

JPM

91.65

0.14(0.15%)

2180

Microsoft Corp

MSFT

64.54

0.13(0.20%)

2460

Nike

NKE

57.55

0.27(0.47%)

6278

Starbucks Corporation, NASDAQ

SBUX

54.52

0.25(0.46%)

1781

Tesla Motors, Inc., NASDAQ

TSLA

256.81

-1.19(-0.46%)

58558

Twitter, Inc., NYSE

TWTR

15.2

-0.12(-0.78%)

71415

Visa

V

90.05

0.50(0.56%)

1027

Wal-Mart Stores Inc

WMT

70.75

0.03(0.04%)

1265

Walt Disney Co

DIS

112.76

0.45(0.40%)

1767

Yandex N.V., NASDAQ

YNDX

23

0.20(0.88%)

1850

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded to Neutral from Outperform at Credit Suisse

Other:

Apple (AAPL) target raised to $155 from $140 at RBC Capital Mkts

-

09:05

Major European stock exchanges trading in the green zone: FTSE 7373.50 +15.65 + 0.21%, DAX 11998.93 +10.14 + 0.08%, CAC 4972.94 -1.32 -0.03%

-

07:36

A negative start of trading on the main European stock markets is expected: DAX -0.2%, CAC -0.1%, FTSE -0.1%

-

06:28

Global Stocks

European stocks closed with their first loss in four sessions Tuesday, with a selloff in the oil prices knocking down oil shares, while investors stepped back before this week's Dutch election and the Federal Reserve's policy meeting.

U.S. stocks finished lower Tuesday as a persistent slump in oil prices put pressure on energy shares, while investors were also making guarded moves as the Federal Reserve's two-day Federal Open Market Committee meeting got underway. Meanwhile, a winter storm bearing down on New York City cut into trading volumes, with thousands of flights canceled across parts of the East Coast and a state of emergency declared for the city itself.

Asian shares were broadly lower Wednesday, tracking losses in the U.S., as the market cautiously awaited a decision on interest rates by the Federal Reserve. In keeping with the theme of quiet anticipation that has dominated markets for much of the week, selling was modest ahead of the conclusion of the two-day Federal Open Market Committee meeting later in the global trading day.

-