Market news

-

23:20

Commodities. Daily history for Mar 15’02’2017:

(raw materials / closing price /% change)

Oil 49.08 +0.45%

Gold 1,218.80 +1.51%

-

23:19

Stocks. Daily history for Mar 15’2017:

(index / closing price / change items /% change)

Nikkei -32.12 19577.38 -0.16%

TOPIX -3.59 1571.31 -0.23%

Hang Seng -35.10 23792.85 -0.15%

CSI 300 +6.95 3463.64 +0.20%

Euro Stoxx 50 +9.89 3409.32 +0.29%

FTSE 100 +10.79 7368.64 +0.15%

DAX +21.08 12009.87 +0.18%

CAC 40 +11.22 4985.48 +0.23%

DJIA +112.73 20950.10 +0.54%

S&P 500 +19.81 2385.26 +0.84%

NASDAQ +43.23 5900.05 +0.74%

S&P/TSX +141.30 15520.91 +0.92%

-

23:18

Currencies. Daily history for Mar 15’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0736 +1,19%

GBP/USD $1,2286 +1,07%

USD/CHF Chf1,0004 -0,93%

USD/JPY Y113,45 -1,14%

EUR/JPY Y121,81 +0,08%

GBP/JPY Y139,42 -0,03%

AUD/USD $0,7704 +1,90%

NZD/USD $0,7009 +1,27%

USD/CAD C$1,3299 -1,38%

-

23:03

Schedule for today,Thursday, Mar 16’2017 (GMT0)

00:00 Australia Consumer Inflation Expectation March 4.1%

00:30 Australia RBA Bulletin

00:30 Australia Unemployment rate February 5.7% 5.7%

00:30 Australia Changing the number of employed February 13.5 16

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

08:30 Switzerland SNB Interest Rate Decision -0.75% -0.75%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) February 0.9% 0.9%

10:00 Eurozone Harmonized CPI February -0.8% 0.4%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) February 1.8% 2%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

12:00 United Kingdom Asset Purchase Facility 435 435

12:30 Canada Foreign Securities Purchases January 10.23 9.45

12:30 U.S. Continuing Jobless Claims 2058 2050

12:30 U.S. Philadelphia Fed Manufacturing Survey March 43.3 30

12:30 U.S. Initial Jobless Claims 243 240

12:30 U.S. Building Permits February 1293 1260

12:30 U.S. Housing Starts February 1246 1260

14:00 U.S. JOLTs Job Openings January 5.501 5.450

21:30 New Zealand Business NZ PMI February 51.6

-

21:46

New Zealand: GDP y/y, Quarter IV 2.7% (forecast 3.1%)

-

21:46

New Zealand: GDP q/q, Quarter IV 0.4% (forecast 0.7%)

-

21:46

New Zealand: GDP y/y, Quarter IV 2.7% (forecast 3.1%)

-

20:08

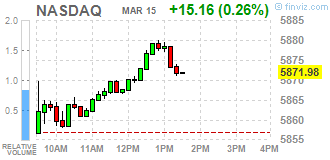

The main US stock indexes completed the session in the "green zone"

Major US stock indexes finished trading with a moderate increase, receiving support from the outcome of the meeting of the Federal Reserve System, as well as statistics on the United States.

The leadership of the Fed decided to raise the key interest rate by 0.25%, to 0.75% -1%. The regulator said it expects a gradual rate hike if the economy develops in line with their forecasts. The so-called "point" diagram of the Fed, through which the Central Bank reflects its assessment of the interest rate trajectory, shows that officials expect two more increases this year. Meanwhile, the average forecasts indicated that by the end of 2018 the rate will be in the range 2.0% -2.25%, which implies three more rate increases of 0.25% in 2018. As for 2019, expectations have slightly increased, and now forecasts indicate that the rate will be 3% by the end of 2019. At the same time, the economic forecasts of the Fed have not changed much relative to December. According to the median forecast, GDP growth in 2017 and in 2018 will be 2.1%. Expectations for long-term unemployment fell to 4.7% from 4.8% in December.

As for the statistical data, the Ministry of Labor reported that consumer prices continued to rise in February. The consumer price index in February rose by 0.1% compared to the previous month. The cost of energy and food, so-called basic prices, increased by 0.2%. These figures corresponded to the expectations of economists and reinforced the opinion of the Fed on the underlying strength in the economy. Consumer prices rose by 2.7% compared to last year, which is the largest annual increase from 12 months to March 2012.

Meanwhile, the Ministry of Commerce said that retail sales in the US were practically not moving forward in February, which is a warning to consumers, which may be due to a brief delay in some tax refunds. Sales in retail stores and restaurants in the US rose 0.1% compared with the previous month and seasonally adjusted $ 473.99 billion. This was the weakest increase since August. Excluding cars and auto parts, sales rose 0.2% from January.

The components of the DOW index have mostly grown (24 out of 30). Caterpillar Inc. was the growth leader. (CAT, + 1.68%). More shares fell American Express Company (AXP, -0.53%).

All sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 2.6%).

At closing:

Dow + 0.54% 20,949.75 +112.38

Nasdaq + 0.74% 5,900.05 +43.23

S & P + 0.83% 2,385.11 +19.66

-

20:01

U.S.: Net Long-term TIC Flows , January 6.3

-

20:00

U.S.: Total Net TIC Flows, January 110.4

-

19:00

DJIA +0.54% 20,949.03 +111.66 Nasdaq +0.70% 5,897.76 +40.94 S&P +0.81% 2,384.57 +19.12

-

18:00

U.S.: Fed Interest Rate Decision , 1% (forecast 1%)

-

17:31

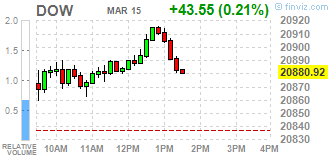

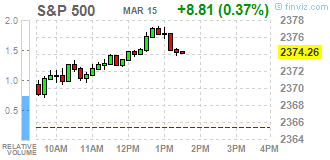

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes were mostly higher on Wednesday, with investors counting down to the conclusion of the Federal Reserve's two-day meeting, where the central bank is widely expected to raise rates for the first time this year.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -1.73%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.22%).

All S&P sectors in positive area. Top loser - Conglomerates (+1.5%).

At the moment:

Dow 20850.00 +47.00 +0.23%

S&P 500 2371.75 +8.75 +0.37%

Nasdaq 100 5396.00 +10.50 +0.19%

Oil 48.42 +0.70 +1.47%

Gold 1199.70 -2.90 -0.24%

U.S. 10yr 2.58 -0.01

-

15:29

Senior Ukraine Central Bank official says to implement sanctions against Ukrainian subsidiaries of Kremlin-owned banks

-

15:15

White House says Trump and prince Mohammed affirmed their desire to continue bilateral consultations on energy in a way that enhances growth of global economy, limits supply disruption and market volatility

-

14:54

U.S. commercial crude oil inventories decreased by 0.2 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.2 million barrels from the previous week. At 528.2 million barrels, U.S. crude oil inventories are above the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 3.1 million barrels last week, but are in the upper half of the average range. Both finished gasoline inventories and blending components inventories decreased last week. Distillate fuel inventories decreased by 4.2 million barrels last week but are near the upper limit of the average range for this time of year. Propane/propylene inventories fell 0.8 million barrels last week but are in the middle of the average range. Total commercial petroleum inventories decreased by 7.8 million barrels last week.

-

14:30

U.S.: Crude Oil Inventories, March -0.237 (forecast 3.713)

-

14:07

US builder confidence in the market jumped six points - NAHB

Builder confidence in the market for newly-built single-family homes jumped six points to a level of 71 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since June 2005.

"Builders are buoyed by President Trump's actions on regulatory reform, particularly his recent executive order to rescind or revise the waters of the U.S. rule that impacts permitting," said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas.

"While builders are clearly confident, we expect some moderation in the index moving forward," said NAHB Chief Economist Robert Dietz. "Builders continue to face a number of challenges, including rising material prices, higher mortgage rates, and shortages of lots and labor."

-

14:05

US business inventories rose 0.3% in January, as expected

Manufacturers' and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,841.4 billion, up 0.3 percent (±0.1 percent) from December 2016 and were up 2.3 percent (±0.3 percent) from January 2016.

The combined value of distributive trade sales and manufacturers' shipments for January, adjusted for seasonal and trading-day differences but not for price changes, was estimated at $1,359.3 billion, up 0.2 percent (±0.2 percent)* from December 2016 and was up 6.4 percent (±0.4 percent) from January 2016.

-

14:00

U.S.: Business inventories , January 0.3% (forecast 0.3%)

-

14:00

U.S.: NAHB Housing Market Index, March 71 (forecast 65)

-

13:45

Option expiries for today's 10:00 ET NY cut

EURUSD:1.0400 (EUR 1.75bln) 1.0420-25 (1.7bln) 1.0450 (756m) 1.0500 (996m) 1.0550 (433m) 1.0560-70 (1.35bln) 1.0575 (1.1bln) 1.0600 (529m) 1.0650-55 (931m) 1.0690-700 (810m)

USDJPY: 113.50-60 (USD 1.8bln) 114.00 (600m) 114.20-30 (835m) 114.50 (1.9bln) 114.65-75 (816m) 115.00 (1.42bln) 115.25 (400m) 115.50 (455m) 116.00 ( 955m)

USDCHF 1.0000 (USD 274m)

EURGBP 0.8825 (EUR 295m)

EURJPY 122.00-05 (EUR 401m)

AUDUSD: 0.7650-55 (AUD 369m) 0.7700 (206m)

USDCAD 1.3400 (USD 695m) 1.3485 (225m) 1.3550 (265m)

NZDUSD 0.6875 (NZD 278m) 0.7000 (281m) 0.7100 (321m)

-

13:35

U.S. Stocks open: Dow +0.14%, Nasdaq +0.15%, S&P +0.19%

-

13:34

Fitch: US Congress is likely to vote in a "timely fashion" to suspend or raise Federal debt limit

-

13:29

Before the bell: S&P futures +0.20%, NASDAQ futures +0.16%

U.S. stock-index futures rose slightly as investors focused on a Federal Reserve meeting, where the regulator is widely expected to hike interest rates for the second time in three months.

Global Stocks:

Nikkei 19,577.38 -32.12 -0.16%

Hang Seng 23,792.85 -35.10 -0.15%

Shanghai 3,241.94 +2.61 +0.08%

FTSE 7,373.92 +16.07 +0.22%

CAC 4,978.42 +4.16 +0.08%

DAX 11,987.79 -1.00 -0.01%

Crude $48.71 (+2.07%)

Gold $1,198.20 (-0.37%)

-

12:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

34.57

0.38(1.11%)

3115

Amazon.com Inc., NASDAQ

AMZN

854

1.47(0.17%)

2659

Apple Inc.

AAPL

139.26

0.27(0.19%)

39204

AT&T Inc

T

42.17

0.08(0.19%)

217

Barrick Gold Corporation, NYSE

ABX

17.87

0.07(0.39%)

27886

Caterpillar Inc

CAT

92.25

0.39(0.42%)

1375

Chevron Corp

CVX

108.15

0.79(0.74%)

4658

Cisco Systems Inc

CSCO

34.14

0.02(0.06%)

557

Citigroup Inc., NYSE

C

61.63

0.19(0.31%)

7942

Exxon Mobil Corp

XOM

81.46

0.47(0.58%)

11251

Facebook, Inc.

FB

139.5

0.18(0.13%)

17464

Ford Motor Co.

F

12.56

0.01(0.08%)

28636

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.48

0.21(1.71%)

25454

General Electric Co

GE

29.6

0.06(0.20%)

2275

General Motors Company, NYSE

GM

37.04

0.08(0.22%)

3465

Goldman Sachs

GS

248.82

1.10(0.44%)

3606

Intel Corp

INTC

34.9

-0.28(-0.80%)

59426

International Business Machines Co...

IBM

175.99

0.27(0.15%)

1181

JPMorgan Chase and Co

JPM

91.65

0.14(0.15%)

2180

Microsoft Corp

MSFT

64.54

0.13(0.20%)

2460

Nike

NKE

57.55

0.27(0.47%)

6278

Starbucks Corporation, NASDAQ

SBUX

54.52

0.25(0.46%)

1781

Tesla Motors, Inc., NASDAQ

TSLA

256.81

-1.19(-0.46%)

58558

Twitter, Inc., NYSE

TWTR

15.2

-0.12(-0.78%)

71415

Visa

V

90.05

0.50(0.56%)

1027

Wal-Mart Stores Inc

WMT

70.75

0.03(0.04%)

1265

Walt Disney Co

DIS

112.76

0.45(0.40%)

1767

Yandex N.V., NASDAQ

YNDX

23

0.20(0.88%)

1850

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Intel (INTC) downgraded to Neutral from Outperform at Credit Suisse

Other:

Apple (AAPL) target raised to $155 from $140 at RBC Capital Mkts

-

12:36

US retail sales little changed in February

Advance estimates of U.S. retail and food services sales for February 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $474.0 billion, an increase of 0.1 percent from the previous month, and 5.7 percent above February 2016. Total sales for the December 2016 through February 2017 period were up 5.4 percent from the same period a year ago.

The December 2016 to January 2017 percent change was revised from up 0.4 percent (±0.5 percent)* to up 0.6 percent (±0.3 percent). Retail trade sales were up 0.1 percent (±0.5 percent)* from January 2017, and up 5.9 percent (±0.7 percent) from last year. Gasoline Stations sales were up 19.6 percent (±1.4 percent) from February 2016, while Nonstore Retailers were up 13.0 percent (±1.8 percent) from last year.

-

12:33

The February increase of the US CPI was the smallest 1-month rise in the seasonally adjusted all items index since July 2016

The Consumer Price Index increased 0.1 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.7 percent before seasonal adjustment.

The February increase was the smallest 1-month rise in the seasonally adjusted all items index since July 2016. The gasoline index declined, partially offsetting increases in several indexes, including food, shelter, and

recreation. The energy index fell 1.0 percent, with the decline in gasoline outweighing increases in the other energy component indexes. The food index increased 0.2 percent over the month, its largest rise since September 2015.

-

12:30

U.S.: NY Fed Empire State manufacturing index , March 16.4 (forecast 15)

-

12:30

U.S.: Retail sales, February 0.1% (forecast 0.1%)

-

12:30

U.S.: CPI, Y/Y, February 2.7% (forecast 2.7%)

-

12:30

U.S.: CPI excluding food and energy, Y/Y, February 2.2% (forecast 2.2%)

-

12:30

U.S.: CPI, m/m , February 0.1% (forecast 0.1%)

-

12:30

U.S.: CPI excluding food and energy, m/m, February 0.2% (forecast 0.2%)

-

12:30

U.S.: Retail sales excluding auto, February 0.2% (forecast 0.2%)

-

12:30

U.S.: Retail Sales YoY, February 5.7%

-

11:31

Macron seen beating Le Pen in run-off vote by 61 pct - Opinionway poll

-

Fillon would beat Le Pen in run-off vote by 56 pct to 44 pct if Fillon made it through to second round

-

Far-right's Le Pen to get 27 pct (unchanged) in 1st round of french election, Macron 25 pct (+1) , Fillon 19 pct (-1)

-

-

10:56

Greece sells 1.3 bln euros of 13-week t-bills, yield 2.70 pct (pvs 2.70 pct), bid-cover ratio 1.30 (pvs 1.30)

-

10:36

OPEC remains in full compliance with the agreed production deal in February

Target as per OPEC deal

(million barrel per day)

February production

(million barrel per day)

January production

(million barrel per day)

Algeria

1.039

1.053

1.053

Angola

1.673

1.641

1.659

Ecuador

0.522

0.526

0.531

Gabon

0.193

0.194

0.201

Iran

3.797

3.814

3.778

Iraq

4.351

4.414

4.476

Kuwait

2.707

2.709

2.718

Qatar

0.618

0.622

0.623

Saudi Arabia

10.058

9.797

9.865

UAE

2.874

2.925

2.962

Venezuela

1.972

1.987

2.003

Total

29.804

29.682

29.869

-

10:21

ECB's Praet says steady hand evolution that we announced is to mitigate overshooting

-

We don't want mkt to overshoot

-

Not yet at regime change

-

Still conditional on very easy financial conditions

-

Says is cautiously optimisitc

-

-

10:12

The number of persons employed increased by 0.3% in the euro area

The number of persons employed increased by 0.3% in the euro area (EA19) and by 0.2% in the EU28 in the fourth quarter of 2016 compared with the previous quarter, according to national accounts estimates published by Eurostat, the statistical office of the European Union. In the third quarter of 2016, employment increased by 0.2% in both areas. These figures are seasonally adjusted.

Compared with the same quarter of the previous year, employment increased by 1.1% in the euro area and by 1.0% in the EU28 in the fourth quarter of 2016 (after +1.2% and +1.1% respectively in the third quarter of 2016). Eurostat estimates that, in the fourth quarter of 2016, 232.9 million men and women were employed in the EU28 (highest level ever recorded); of which 153.9 million were in the euro area (highest level since the third quarter of 2008). These figures are seasonally adjusted. Over the whole year 2016, employment rose by 1.3% in the euro area and by 1.2% in the EU28, compared with +1.0% and +1.1% respectively in 2015.

-

10:00

Eurozone: Employment Change, Quarter IV 0.3% (forecast 0.2%)

-

09:35

UK unemployment rate down to 4.7% but average earnings rose less than expected

Estimates from the Labour Force Survey show that, between August to October 2016 and the 3 months to January 2017, the number of people in work increased, the number of unemployed people fell, and the number of people aged from 16 to 64 not working and not seeking or available to work (economically inactive) also fell.

There were 31.85 million people in work, 92,000 more than for August to October 2016 and 315,000 more than for a year earlier.

The unemployment rate was 4.7%, down from 5.1% for a year earlier. It has not been lower since June to August 1975. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Latest estimates show that average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.2% including bonuses, and by 2.3% excluding bonuses, compared with a year earlier.

-

09:30

United Kingdom: ILO Unemployment Rate, January 4.7% (forecast 4.8%)

-

09:30

United Kingdom: Average Earnings, 3m/y , January 2.2% (forecast 2.4%)

-

09:05

Major European stock exchanges trading in the green zone: FTSE 7373.50 +15.65 + 0.21%, DAX 11998.93 +10.14 + 0.08%, CAC 4972.94 -1.32 -0.03%

-

09:04

ECB's Weidmann: G20 Shouldn’t Backtrack On Resistance To Protectionism, Commitment To Bank Regulation - Reuters

-

08:15

Switzerland: Producer & Import Prices, m/m, February -0.2% (forecast 0.4%)

-

08:15

Switzerland: Producer & Import Prices, y/y, February 1.3% (forecast 1.8%)

-

08:00

French CPI little changed in February

In February 2017, the Consumer Prices Index (CPI) recovered a little, at +0.1% over a month after a decrease by 0.2% in January. Seasonally adjusted, it edged down by 0.2%, after having risen by 0.7% in January. Year on year, consumer prices slowed down slightly (+1.2% after +1.3%).

Over a month, the slight increase resulted from a rebound in services prices and a rise in tobacco price. Food prices decelerated slightly due to fresh food prices. Winter sales having continued in February, manufactured products prices fell again, thus limiting the overall rebound. At last, energy prices were stable after five months of sharp increase.

-

07:59

UK's Scotland Minister Mundell: No Option For Scotland To Remain In EU As UK Leaves, Or For Scotland To Inherit UK's Place - Herald

-

07:59

France: CPI, m/m, February 0.2% (forecast 0.1%)

-

07:36

A negative start of trading on the main European stock markets is expected: DAX -0.2%, CAC -0.1%, FTSE -0.1%

-

07:31

Options levels on wednesday, March 15, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0794 (994)

$1.0764 (117)

$1.0721 (43)

Price at time of writing this review: $1.0627

Support levels (open interest**, contracts):

$1.0571 (294)

$1.0533 (482)

$1.0486 (642)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 38639 contracts, with the maximum number of contracts with strike price $1,1450 (4227);

- Overall open interest on the PUT options with the expiration date June, 9 is 39685 contracts, with the maximum number of contracts with strike price $1,0350 (3907);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from March, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (762)

$1.2414 (297)

$1.2318 (405)

Price at time of writing this review: $1.2218

Support levels (open interest**, contracts):

$1.2176 (370)

$1.2080 (564)

$1.1984 (787)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 12963 contracts, with the maximum number of contracts with strike price $1,3000 (1219);

- Overall open interest on the PUT options with the expiration date June, 9 is 15637 contracts, with the maximum number of contracts with strike price $1,1500 (3140);

- The ratio of PUT/CALL was 1.21 versus 1.19 from the previous trading day according to data from March, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:14

With a rate hike already priced in by the markets, the focus will turn to the Fed’s forward guidance - Nordea

Noreda Markets shares the widely held expectation of a 25bp increase in the fed funds rate on Wednesday, to a range of 0.75-1.00%.

"With a rate hike already priced in by the markets, the focus will turn to the Fed's forward guidance...We expect the Fed again to emphasise that the pace of rate hikes will be "only gradual"." Nordea projects.

Regarding the dot plot, Nordea believes the FOMC's median projections of the fed funds rate at the end of 2017 and 2018 are unlikely to change, consistent with three rate hikes both this year and in 2018, in line with the recent projection from December.

Finally, Nordea expects The FOMC's neutral rate estimate to remain unchanged at 3.0%.

Source: Nordea Research. efxnews.

-

07:05

White House says in response to MSNBC that Trump paid $38 million in taxes on income of $150 million

-

White House says Trump had a responsibility "to pay no more tax than legally required"

-

-

06:59

10-year U.S treasury yield at 2.598 percent vs U.S close of 2.595 percent on Tuesday

-

06:58

Japanese industrial production declined less than expected in January

Japan's industrial production declined less than initially estimated in January, latest figures from the Ministry of Economy, Trade and Industry, cited by rttnews.

Industrial production fell 0.4 percent month-over-month in January instead of a 0.8 percent drop estimated earlier. It was the first decline in six months.

In December, production had risen 0.7 percent.

Inventories dropped 0.1 percent over the month, while it showed no variations in the preliminary data.

On an annual basis, industrial production climbed at a faster pace of 3.7 percent in January, following a 3.2 percent gain in the prior month.

Data also revealed that capacity utilization edged up 0.1 percent monthly in January, after 0.6 percent increase in December.

-

06:54

Australian new motor vehicle sales down 2.7% in Feb

The February 2017 trend estimate (95,932) decreased by 0.5% when compared with January 2017.

When comparing national trend estimates for February 2017 with January 2017, sales for Passenger vehicles, Sports utility vehicles and Other vehicles decreased by 0.6%, 0.5% and 0.3% respectively.

The largest downward movement across all states and territories, on a trend basis, was in Tasmania (-2.6%), continuing a downward trend that began in November 2016.

The largest upward movement across all states and territories, on a trend basis, was in the Northern Territory (0.1%).

-

06:51

The government of the United Kingdom is now fully legally ready to trigger Article 50 and it is now a matter of days before the Article is triggered. Sell the rumors, buy the facts?. GBP/USD up 100 pips for the day

-

06:49

Lowest New Zeeland current account deficit since March 2014

New Zealand earned more income from our overseas investments in the December 2016 quarter, Stats NZ said today. This resulted in the lowest current account deficit since March 2014. The seasonally adjusted current account deficit decreased to $1.6 billion for the December 2016 quarter, $420 million smaller the September 2016 quarter's deficit.

"New Zealand earned $2.0 billion from investment overseas, $129 million more than in the September quarter," international statistics senior manager Daria Kwon said. "A large portion of this extra income was reinvested back into the overseas subsidiaries, instead of being paid out as dividends."

New Zealand's primary income deficit decreased to $2.0 billion in the December 2016 quarter, $140 million lower than in the September 2016 quarter deficit. Primary income comes mostly from investments. Typically, dividends are returned to New Zealand investors from overseas investments twice a year, not in every quarter.

At 31 December 2016, New Zealand had $240.6 billion of investment abroad (financial assets). On the flip side, foreign investments in New Zealand (financial liabilities) were valued at $397.1 billion.

-

06:28

Global Stocks

European stocks closed with their first loss in four sessions Tuesday, with a selloff in the oil prices knocking down oil shares, while investors stepped back before this week's Dutch election and the Federal Reserve's policy meeting.

U.S. stocks finished lower Tuesday as a persistent slump in oil prices put pressure on energy shares, while investors were also making guarded moves as the Federal Reserve's two-day Federal Open Market Committee meeting got underway. Meanwhile, a winter storm bearing down on New York City cut into trading volumes, with thousands of flights canceled across parts of the East Coast and a state of emergency declared for the city itself.

Asian shares were broadly lower Wednesday, tracking losses in the U.S., as the market cautiously awaited a decision on interest rates by the Federal Reserve. In keeping with the theme of quiet anticipation that has dominated markets for much of the week, selling was modest ahead of the conclusion of the two-day Federal Open Market Committee meeting later in the global trading day.

-

04:46

Japan: Industrial Production (YoY), January 3.7% (forecast 3.2%)

-

04:32

Japan: Industrial Production (MoM) , January -0.4% (forecast -0.8%)

-

00:31

Australia: New Motor Vehicle Sales (YoY) , February -4.1%

-

00:30

Australia: New Motor Vehicle Sales (MoM) , February -2.7%

-