Market news

-

23:29

Commodities. Daily history for Mar 16’02’2017:

(raw materials / closing price /% change)

Oil 48.74 -0.02%

Gold 1,226.50 -0.05%

-

23:29

Stocks. Daily history for Mar 16’2017:

(index / closing price / change items /% change)

Nikkei +12.76 19590.14 +0.07%

TOPIX +1.38 1572.69 +0.09%

Hang Seng +495.43 24288.28 +2.08%

CSI 300 +17.87 3481.51 +0.52%

Euro Stoxx 50 +30.64 3439.96 +0.90%

FTSE 100 +47.31 7415.95 +0.64%

DAX +73.31 12083.18 +0.61%

CAC 40 +27.90 5013.38 +0.56%

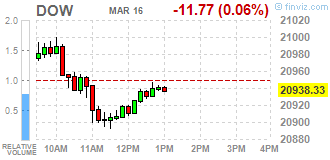

DJIA -15.55 20934.55 -0.07%

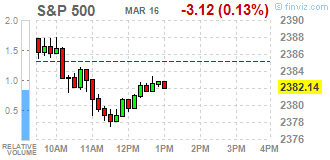

S&P 500 -3.88 2381.38 -0.16%

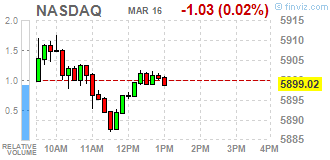

NASDAQ +0.72 5900.76 +0.01%

S&P/TSX +41.50 15562.41 +0.27%

-

23:27

Currencies. Daily history for Mar 16’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0771 +0,32%

GBP/USD $1,2258 -0,23%

USD/CHF Chf0,9959 -0,45%

USD/JPY Y113,29 -0,14%

EUR/JPY Y122,03 +0,18%

GBP/JPY Y140,01 +0,42%

AUD/USD $0,7679 -0,33%

NZD/USD $0,6984 -0,36%

USD/CAD C$1,3313 +0,11%

-

22:59

Schedule for today,Friday, Mar 17’2017 (GMT0)

08:00 G20 G20 Meetings

10:00 Eurozone Trade balance unadjusted January 28.1

12:00 United Kingdom BOE Quarterly Bulletin

12:30 Canada Manufacturing Shipments (MoM) January 2.3% -0.4%

13:15 U.S. Capacity Utilization February 75.3% 75.5%

13:15 U.S. Industrial Production (MoM) February -0.3% 0.2%

13:15 U.S. Industrial Production YoY February 0.0%

14:00 U.S. Leading Indicators February 0.6% 0.4%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) March 96.3 97

-

21:30

New Zealand: Business NZ PMI, February 55.2

-

20:11

Major US stock markets closed the session without a single dynamic

The main US stock indexes finished trading in different directions, as the decline in utilities prices was countered by the growth of the technology sector.

Influence on the course of trading also provided data on the United States. As it became known, the number of Americans who applied for unemployment benefits fell last week and continues to be held at a low level, corresponding to the healthy US labor market. Initial applications for unemployment benefits fell by 2000 to 241,000, seasonally adjusted during the week to March 11. Economists were expecting 240,000 hits. The assessment for the week to March 4 remained at the level of 243,000.

In addition, the Ministry of Trade reported that bookings of new houses jumped by 3.0 percent to an annual level of 1.288 melees. In February after falling by 1.9 percent to a revised 1.251 million in January. It was expected that the bookmarking of new homes will grow to 1.260 million from 1.246 million originally reported for the previous month.

At the same time, the JOLTS survey published by the US Bureau of Labor Statistics showed that in January the number of vacancies increased to 5.626 million. The indicator for December was revised to 5.539 million from 5.501 million. Analysts had expected that the number of vacancies Will be reduced to 5.450 million. The vacancy rate was 3.7 percent, unchanged from December. The number of vacancies has changed little in the private sector and in the government segment. The number of vacancies increased in the sphere of professional and business services (+136,000) and the real estate sector, rental and leasing (+67,000), but fell in the federal government (-37,000).

The components of the DOW index mostly decreased (21 out of 30). More shares fell E.I du Pont de Nemours and Company (DD, -1.14%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 0.88%).

Most sectors of the S & P index recorded an increase. The leader of growth was the technological sector (+ 0.5%). The utilities sector fell most of all (-0.8%).

At closing:

Dow -0.08% 20,934.14 -15.96

Nasdaq + 0.01% 5,900.76 +0.71

S & P -0.16% 2,381.38 -3.88

-

19:00

DJIA -0.16% 20,916.58 -33.52 Nasdaq -0.13% 5,892.37 -7.68 S&P -0.25% 2,379.33 -5.93

-

17:12

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stocks slipped on Thursday as declines in the healthcare sector outweighed gains in financial stocks. The Fed raised rates by a quarter point to 0,75-1,00 percent on Wednesday, responding to continued strength in the labor market and a pick up in inflation. However, the central bank stuck to its outlook for two more rate hikes this year and three in 2018.

Most of Dow stocks in negative area (20 of 30). Top loser - E. I. du Pont de Nemours and Company (DD, -0.98%). Top gainer - International Business Machines Corporation (IBM, +0.98%).

Most of S&P sectors in positive area. Top loser - Healthcare (-0.7%). Top gainer - Technology (+0.5%).

At the moment:

Dow 20891.00 -7.00 -0.03%

S&P 500 2379.50 -1.00 -0.04%

Nasdaq 100 5414.50 -4.75 -0.09%

Oil 48.74 -0.12 -0.25%

Gold 1229.30 +28.60 +2.38%

U.S. 10yr 2.52 +0.02

-

17:00

European stocks closed: FTSE 100 +47.31 7415.95 +0.64% DAX +73.31 12083.18 +0.61% CAC 40 +27.90 5013.38 +0.56%

-

15:31

Trump administration to nominate David Joel Trachtenberg to become U.S Defense Secretary's top policy adviser

-

David Norquist to become under secretary of defense, comptroller

-

Boeing executive Patrick M. Shanahan to become deputy defense secretary

-

-

15:04

Fitch says post-election political dynamics are consistent with its expectations when it affirmed Netherlands' 'AAA' sovereign rating in november 2016

-

14:36

U.S treasury yields extend rise; 30, 10-year yields hit session highs of 3.151 pct, 2.538 pct. UK 10-year gilt yield hits 1-month high of 1.291 pct after split BoE decision on rates

-

14:15

US job openings little changed at 5.6 million on the last business day of January

The number of job openings was little changed at 5.6 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were also little changed at 5.4 million and 5.3 million, respectively. Within separations, the quits rate was little changed

at 2.2 percent and the layoffs and discharges rate was unchanged at 1.1 percent.This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions. The release also includes 2016 annual estimates for hires and separations. The annual number of hires at 62.7 million in 2016 was essentially the same as in 2015. The annual number of quits at 36.1 million increased in 2016 while the annual number of layoffs and discharges at 19.9 million declined.

-

14:00

U.S.: JOLTs Job Openings, January 5.626 (forecast 5.450)

-

13:34

U.S. Stocks open: Dow +0.17%, Nasdaq +0.16%, S&P +0.07%

-

13:27

Before the bell: S&P futures +0.15%, NASDAQ futures +0.18%

U.S. stock-index futures rose, building on a day-earlier rally after the Fed increased interest rates for the first time this year and signaled it was in no hurry to accelerate the pace of tightening.

Global Stocks:

Nikkei 19,590.14 +12.76 +0.07%

Hang Seng 24,288.28 +495.43 +2.08%

Shanghai 3,269.54 +27.78 +0.86%

FTSE 7,403.80 +35.16 +0.48%

CAC 5,009.55 +24.07 +0.48%

DAX 12,092.27 +82.40 +0.69%

Crude $49.23 (+0.76%)

Gold $1,231.80 (+2.59%)

-

12:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

75.79

0.12(0.16%)

1723

Amazon.com Inc., NASDAQ

AMZN

854.6

1.63(0.19%)

6047

AMERICAN INTERNATIONAL GROUP

AIG

63

-0.23(-0.36%)

711

Apple Inc.

AAPL

140.7

0.24(0.17%)

93110

AT&T Inc

T

42.65

0.06(0.14%)

4477

Barrick Gold Corporation, NYSE

ABX

19.27

0.25(1.31%)

184669

Caterpillar Inc

CAT

93.58

0.22(0.24%)

826

Chevron Corp

CVX

109.35

0.47(0.43%)

2932

Cisco Systems Inc

CSCO

34.35

0.11(0.32%)

1627

Citigroup Inc., NYSE

C

61.1

0.26(0.43%)

9614

Deere & Company, NYSE

DE

112.11

1.32(1.19%)

1005

Exxon Mobil Corp

XOM

82.3

0.30(0.37%)

3885

Facebook, Inc.

FB

140.27

0.55(0.39%)

48920

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.05

0.16(1.24%)

145446

General Electric Co

GE

29.82

0.06(0.20%)

10243

Goldman Sachs

GS

248.44

1.66(0.67%)

2669

Google Inc.

GOOG

852

4.80(0.57%)

1295

International Business Machines Co...

IBM

177.4

1.59(0.90%)

19281

Johnson & Johnson

JNJ

129

0.04(0.03%)

624

JPMorgan Chase and Co

JPM

92.15

0.42(0.46%)

10048

Merck & Co Inc

MRK

64.95

0.25(0.39%)

1433

Microsoft Corp

MSFT

64.9

0.15(0.23%)

5078

Nike

NKE

57.7

0.04(0.07%)

1826

Pfizer Inc

PFE

34.69

0.06(0.17%)

1757

Procter & Gamble Co

PG

91.48

0.08(0.09%)

443

Tesla Motors, Inc., NASDAQ

TSLA

263.69

7.96(3.11%)

85992

The Coca-Cola Co

KO

42.22

0.10(0.24%)

2998

Twitter, Inc., NYSE

TWTR

15.12

0.09(0.60%)

52281

UnitedHealth Group Inc

UNH

172

0.22(0.13%)

409

Verizon Communications Inc

VZ

50.2

0.06(0.12%)

465

Walt Disney Co

DIS

112

0.13(0.12%)

236

Yahoo! Inc., NASDAQ

YHOO

46.58

0.29(0.63%)

3307

Yandex N.V., NASDAQ

YNDX

22.93

-0.01(-0.04%)

1600

-

12:44

Upgrades and downgrades before the market open

Upgrades:

Barrick Gold (ABX) upgraded to Outperform at RBC Capital Mkts; target raised to $23 from $19

Downgrades:

Other:

-

12:35

US housing starts and building permits mixed

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,213,000. This is 6.2 percent (±1.8 percent) below the revised January rate of 1,293,000, but is 4.4 percent (±1.3 percent) above the February 2016 rate of 1,162,000. Single-family authorizations in February were at a rate of 832,000; this is 3.1 percent (±1.5 percent) above the revised January figure of 807,000. Authorizations of units in buildings with five units or more were at a rate of 334,000 in February.

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,288,000. This is 3.0 percent (±13.0 percent)* above the revised January estimate of 1,251,000 and is 6.2 percent (±10.4 percent)* above the February 2016 rate of 1,213,000. Single-family housing starts in February were at a rate of 872,000; this is 6.5 percent (±10.9 percent)* above the revised January figure of 819,000. The February rate for units in buildings with five units or more was 396,000.

-

12:34

Manufacturing activity in the Philadelphia region continued to expand

Results from the March Manufacturing Business Outlook Survey suggest that regional manufacturing activity continued to expand. The diffusion index for general activity fell from its high reading in February, but the survey's other broad indicators for new orders, shipments, and employment all improved or were steady this month. Price pressures also picked up, according to reporting firms. The survey's future indicators continued to improve and reflect a broadening base of optimism about future growth in manufacturing.

The index for current manufacturing activity in the region decreased from a reading of 43.3 in February to 32.8 this month.

-

12:32

French media reports police sources say several people have been injured in a shooting at a college in the southern town of Grasse @SkyNewsBreak

-

12:30

U.S.: Initial Jobless Claims, 241 (forecast 240)

-

12:30

U.S.: Building Permits, February 1213 (forecast 1260)

-

12:30

U.S.: Continuing Jobless Claims, 2030 (forecast 2050)

-

12:30

U.S.: Housing Starts, February 1288 (forecast 1260)

-

12:30

U.S.: Philadelphia Fed Manufacturing Survey, March 32.8 (forecast 30)

-

12:30

Canada: Foreign Securities Purchases, January 6.2 (forecast 9.45)

-

12:16

Romania records current account surplus of 416 mln euros in january vs surplus of 211 mln euros in january 2016

-

12:08

Bank of England: CPI expected to rise to around 2 pct over the next month or two, to exceed target materially by summer

-

Most mpc members saw signs that squeeze on households was feeding through into spending

-

Potential for uncertainty over future trade deals pose downside risk for growth

-

Staff forecast for gdp growth in q1 raised to +0.6 pct vs +0.5 pct forecast in february

-

Expectation that growth will slow in line with feb forecasts was held with differing degrees of confidence across mpc

-

Some mpc members who voted to keep rates on hold would consider reducing stimulus after relatively little further upside news on growth or inflation

-

Wage growth had been notably softer than expected at feb meeting, despite fall in unemplomyent rate

-

Since february meeting, inflation only a touch weaker than expected, price pressures clearly evident

-

-

12:05

BoE says Kristin Forbes voted in favour of raising bank rate by 25 basis points

-

Forbes felt measures of domestically generated inflation had increased notably

-

-

12:03

Bank of England holds rates at 0.25% but one MPC member voted for a rate hike. GBP/USD up 50 pips so far

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target,and in a way that helps to sustain growth and employment. At its meeting ending on 15 March 2017, the Committee voted by a majority of 8-1 to maintain Bank Rate at 0.25%. The Committee voted unanimously to continue with the programme of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, totalling up to £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

11:08

Bank of England expected to vote 9-0 for holding the interest rate unchanged at 0.25%. Decision up next

-

10:40

Norway Central Bank says capacity utilisation is on the increase and economic growth will likely be higher in 2017 than projected in the december 2016 monetary policy

-

10:03

Euro area annual inflation was 2.0%, in line with expectations

Euro area annual inflation was 2.0% in February 2017, up from 1.8% in January. In February 2016 the rate was -0.2%. European Union annual inflation was 1.9% in February 2017, up from 1.7% in January. A year earlier the rate was -0.1%. These figures come from Eurostat, the statistical office of the European Union. In February 2017, the lowest annual rates were registered in Ireland (0.3%), Romania (0.5%), Bulgaria and Denmark (both 0.9%).

The highest annual rates were recorded in Estonia (3.4%), Belgium (3.3%), Latvia and Lithuania (both 3.2%). Compared with January 2017, annual inflation fell in three Member States and rose in twenty-four.

The largest upward impacts to euro area annual inflation came from fuels for transport (+0.60 percentage points), vegetables (+0.25 pp) and heating oil (+0.16 pp), while telecommunication (-0.10 pp), garments (-0.07 pp) and gas (-0.06 pp) had the biggest downward impacts.

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, February 0.9% (forecast 0.9%)

-

10:00

Eurozone: Harmonized CPI, February 0.4% (forecast 0.4%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, February 2% (forecast 2%)

-

09:12

Major European stock exchanges trading in the green zone: FTSE 7406.93 +38.29 + 0.52%, DAX 12144.66 +134.79 + 1.12%, CAC 5026.84 +41.36 + 0.83%

-

08:50

Interest on sight deposits at the SNB to remain at -0.75%

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at -0.75% and the target range for the three-month Libor is unchanged at between -1.25% and -0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

The SNB's expansionary monetary policy is aimed at stabilising price developments and supporting economic activity. The Swiss franc is still significantly overvalued. The negative interest rate and the SNB's willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency.

-

08:32

Switzerland: SNB Interest Rate Decision, -0.75% (forecast -0.75%)

-

08:15

BoJ Gov Kuroda: don't think rising rates overseas would make it hard for BoJ to control yield curve

-

Will not automatically raise interest rates even if core CPI approaches 1 pct later this year

-

No direct impact on BoJ policy from Fed hike

-

Downside risks to economy still larger than upside risks

-

Not considering now deepening negative rates

-

-

07:39

Options levels on thursday, March 16, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0855 (989)

$1.0831 (116)

$1.0797 (47)

Price at time of writing this review: $1.0736

Support levels (open interest**, contracts):

$1.0630 (299)

$1.0585 (492)

$1.0530 (654)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 38852 contracts, with the maximum number of contracts with strike price $1,1450 (4227);

- Overall open interest on the PUT options with the expiration date June, 9 is 39736 contracts, with the maximum number of contracts with strike price $1,0350 (3885);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from March, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2514 (664)

$1.2418 (247)

$1.2323 (409)

Price at time of writing this review: $1.2274

Support levels (open interest**, contracts):

$1.2183 (352)

$1.2087 (558)

$1.1989 (785)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 13683 contracts, with the maximum number of contracts with strike price $1,3000 (1220);

- Overall open interest on the PUT options with the expiration date June, 9 is 16489 contracts, with the maximum number of contracts with strike price $1,1500 (3142);

- The ratio of PUT/CALL was 1.21 versus 1.21 from the previous trading day according to data from March, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:32

Positive start of trading on the main European stock markets expected: DAX + 0.3%, CAC + 0.1%, FTSE + 0.1%

-

07:29

Momentum indicators turning bullish on EUR/USD says Danske Bank

The overall message from the meeting was that the Fed is on track and delivered one of the three hikes it projected back in December 2016 -the Fed has not become more hawkish, notes Danske Markets Research.

"We expect the Fed to hike twice more this year (July and December) and three-four times next year. We expect the Fed to begin the reduction of its balance sheet in Q1 18," Danske projects.

On the FX front, as EUR/USD bounced on the Fed announcement, Danske notes that technically short-term momentum indicators for EUR/USD are turning bullish and we could see a near-term move to the upper end of the recent 1.0350-1.0850 range.

"Hence, EUR/USD is in our view currently forming a base and we expect a gradual move higher later in the year forecasting the cross at 1.12 in 12 months," Danske projects.

Source: Danske Bank Research, efxnews.

-

07:26

EUR/USD rally after Fed hike and announces 2 more hikes this year. Markets starting to price in euro zone recovery and ECB taper?

-

07:24

New Zeeland GDP rose less than expected in Q4

Gross domestic product (GDP) rose 0.4 percent in the December 2016 quarter, following an increase of 0.8 percent (revised) in the September 2016 quarter, Stats NZ said today.

"Growth in service industries was partly offset by weaker activity in primary industries also flowing through into manufacturing," national accounts senior manager Gary Dunnet said.

"At an industry level, growth was a mixed bag, with only half of our 16 industries rising."

Service industries continued to grow, increasing 0.7 percent in the December 2016 quarter. The main drivers were business services; arts, recreation, and other services; and health care and residential care.

-

07:21

Australia's inflationary expectations fell by 0.1 - Melbourne Institute Survey

The expected inflation rate (30‐per‐cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, fell by 0.1 percentage points to 4.0 per cent in March from 4.1 per cent in February.

In March, the weighted proportion of respondents (excluding the 'don't know' category) expecting the inflation rate to fall within the 0‐5 per cent range fell by 2.0 percentage points to 68.1 per cent. The weighted mean of responses within this range was unchanged relative to last month at 2.5 per cent.

-

07:17

Australian unemployment rate up 0.2% in February

Trend estimates (monthly change):

-

Employment increased 11,600 to 12,005,000.

-

Unemployment increased 5,200 to 738,900.

-

Unemployment rate remained steady at 5.8% following a revised January 2017 estimate.

-

Participation rate remained steady at 64.6%.

-

Monthly hours worked in all jobs increased 1.2 million hours to 1,671.5 million hours.

Seasonally adjusted estimates (monthly change):

-

Employment decreased 6,400 to 11,998,800. Full-time employment increased 27,100 to 8,158,900 and part-time employment decreased 33,500 to 3,840,000.

-

Unemployment increased 26,000 to 748,100. The number of unemployed persons looking for full-time work increased 10,800 to 523,800 and the number of unemployed persons only looking for part-time work increased 15,100 to 224,300.

-

Unemployment rate increased 0.2 pts to 5.9%.

-

Participation rate remained steady at 64.6%.

-

Monthly hours worked in all jobs decreased 20.5 million hours to 1,661.9 million hours.

-

-

07:12

The Bank of Japan left monetary policy unchanged

The Bank of Japan, as expected, retained the main parameters of the monetary policy following the meeting on March 15-16.

The Central Bank kept the interest rate on deposits of commercial banks at the level of 0.1% and the target yield of 10-year government bonds at around zero.

The decision to control the yield curve was taken by a vote of 7 to 2. Sato and Kiuchi voted against the decision to control the yield curve. The bank also maintains economic valuation unchanged, saying that the economy continues to recover at a moderate pace.

The planned rate of asset purchases will also remain unchanged at 80 trillion yen per year.

-

07:10

BOJ's Kuroda: We'll continue with QQE and YCC as long as necessary until we reach 2% inflation @LiveSquawk

-

07:08

The Federal Reserve raised its benchmark interest to 1% and indicate 1.5% this year

As expected, the Federal Reserve on Wednesday raised its benchmark interest rate in response to the improving economy, says rttnews. The Fed has lifted its target rate by a quarter point to a range of 0.75% to 1%.

Earlier this month, Fed Chair Janet Yellen telegraphed today's action by saying the Fed would raise rates barring any unpleasant economic surprises.

Since then, data has shown the unemployment rate fell to 4.7% in February, while core consumer prices (stripping out volatile food and energy) were up by 2.2% compared to a year ago, in line with the Fed's inflation target.

The Fed said "the labor market has continued to strengthen and that economic activity has continued to expand at a moderate pace."

It was the second interest rate in three months, and the first since President Donald Trump's inauguration in January.

-

06:29

Global Stocks

European stocks logged modest gains Wednesday, helped by advances for energy shares as oil prices were in recovery mode. The results of the Dutch election and the Federal Reserve's policy meeting also weighed on investors' minds.

U.S. stocks clambered higher on Wednesday, as the Federal Reserve raised interest rates for the third time since December 2015. The Fed increased its benchmark interest rate by 25 basis points, noting that headline inflation is "moving close" to its 2% target. The dot plot, a table of policy makers' projections for short-term rates, showed more unity among the central bankers about their interest-rate forecast and indicated two more hikes this year.

Investors in Asia sent equities higher following indications of a measured response from the Federal Reserve in countering inflation.

-

02:56

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

00:31

Australia: Changing the number of employed, February -6.4 (forecast 16)

-

00:30

Australia: Unemployment rate, February 5.9% (forecast 5.7%)

-

00:00

Australia: Consumer Inflation Expectation, March 4.0%

-