Market news

-

23:29

Stocks. Daily history for Mar 16’2017:

(index / closing price / change items /% change)

Nikkei +12.76 19590.14 +0.07%

TOPIX +1.38 1572.69 +0.09%

Hang Seng +495.43 24288.28 +2.08%

CSI 300 +17.87 3481.51 +0.52%

Euro Stoxx 50 +30.64 3439.96 +0.90%

FTSE 100 +47.31 7415.95 +0.64%

DAX +73.31 12083.18 +0.61%

CAC 40 +27.90 5013.38 +0.56%

DJIA -15.55 20934.55 -0.07%

S&P 500 -3.88 2381.38 -0.16%

NASDAQ +0.72 5900.76 +0.01%

S&P/TSX +41.50 15562.41 +0.27%

-

20:11

Major US stock markets closed the session without a single dynamic

The main US stock indexes finished trading in different directions, as the decline in utilities prices was countered by the growth of the technology sector.

Influence on the course of trading also provided data on the United States. As it became known, the number of Americans who applied for unemployment benefits fell last week and continues to be held at a low level, corresponding to the healthy US labor market. Initial applications for unemployment benefits fell by 2000 to 241,000, seasonally adjusted during the week to March 11. Economists were expecting 240,000 hits. The assessment for the week to March 4 remained at the level of 243,000.

In addition, the Ministry of Trade reported that bookings of new houses jumped by 3.0 percent to an annual level of 1.288 melees. In February after falling by 1.9 percent to a revised 1.251 million in January. It was expected that the bookmarking of new homes will grow to 1.260 million from 1.246 million originally reported for the previous month.

At the same time, the JOLTS survey published by the US Bureau of Labor Statistics showed that in January the number of vacancies increased to 5.626 million. The indicator for December was revised to 5.539 million from 5.501 million. Analysts had expected that the number of vacancies Will be reduced to 5.450 million. The vacancy rate was 3.7 percent, unchanged from December. The number of vacancies has changed little in the private sector and in the government segment. The number of vacancies increased in the sphere of professional and business services (+136,000) and the real estate sector, rental and leasing (+67,000), but fell in the federal government (-37,000).

The components of the DOW index mostly decreased (21 out of 30). More shares fell E.I du Pont de Nemours and Company (DD, -1.14%). The leader of growth was the shares of International Business Machines Corporation (IBM, + 0.88%).

Most sectors of the S & P index recorded an increase. The leader of growth was the technological sector (+ 0.5%). The utilities sector fell most of all (-0.8%).

At closing:

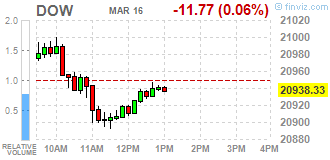

Dow -0.08% 20,934.14 -15.96

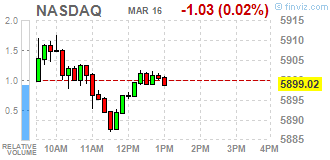

Nasdaq + 0.01% 5,900.76 +0.71

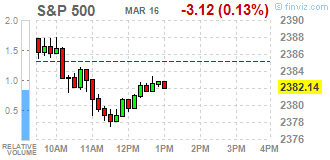

S & P -0.16% 2,381.38 -3.88

-

19:00

DJIA -0.16% 20,916.58 -33.52 Nasdaq -0.13% 5,892.37 -7.68 S&P -0.25% 2,379.33 -5.93

-

17:12

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stocks slipped on Thursday as declines in the healthcare sector outweighed gains in financial stocks. The Fed raised rates by a quarter point to 0,75-1,00 percent on Wednesday, responding to continued strength in the labor market and a pick up in inflation. However, the central bank stuck to its outlook for two more rate hikes this year and three in 2018.

Most of Dow stocks in negative area (20 of 30). Top loser - E. I. du Pont de Nemours and Company (DD, -0.98%). Top gainer - International Business Machines Corporation (IBM, +0.98%).

Most of S&P sectors in positive area. Top loser - Healthcare (-0.7%). Top gainer - Technology (+0.5%).

At the moment:

Dow 20891.00 -7.00 -0.03%

S&P 500 2379.50 -1.00 -0.04%

Nasdaq 100 5414.50 -4.75 -0.09%

Oil 48.74 -0.12 -0.25%

Gold 1229.30 +28.60 +2.38%

U.S. 10yr 2.52 +0.02

-

17:00

European stocks closed: FTSE 100 +47.31 7415.95 +0.64% DAX +73.31 12083.18 +0.61% CAC 40 +27.90 5013.38 +0.56%

-

13:34

U.S. Stocks open: Dow +0.17%, Nasdaq +0.16%, S&P +0.07%

-

13:27

Before the bell: S&P futures +0.15%, NASDAQ futures +0.18%

U.S. stock-index futures rose, building on a day-earlier rally after the Fed increased interest rates for the first time this year and signaled it was in no hurry to accelerate the pace of tightening.

Global Stocks:

Nikkei 19,590.14 +12.76 +0.07%

Hang Seng 24,288.28 +495.43 +2.08%

Shanghai 3,269.54 +27.78 +0.86%

FTSE 7,403.80 +35.16 +0.48%

CAC 5,009.55 +24.07 +0.48%

DAX 12,092.27 +82.40 +0.69%

Crude $49.23 (+0.76%)

Gold $1,231.80 (+2.59%)

-

12:49

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

75.79

0.12(0.16%)

1723

Amazon.com Inc., NASDAQ

AMZN

854.6

1.63(0.19%)

6047

AMERICAN INTERNATIONAL GROUP

AIG

63

-0.23(-0.36%)

711

Apple Inc.

AAPL

140.7

0.24(0.17%)

93110

AT&T Inc

T

42.65

0.06(0.14%)

4477

Barrick Gold Corporation, NYSE

ABX

19.27

0.25(1.31%)

184669

Caterpillar Inc

CAT

93.58

0.22(0.24%)

826

Chevron Corp

CVX

109.35

0.47(0.43%)

2932

Cisco Systems Inc

CSCO

34.35

0.11(0.32%)

1627

Citigroup Inc., NYSE

C

61.1

0.26(0.43%)

9614

Deere & Company, NYSE

DE

112.11

1.32(1.19%)

1005

Exxon Mobil Corp

XOM

82.3

0.30(0.37%)

3885

Facebook, Inc.

FB

140.27

0.55(0.39%)

48920

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.05

0.16(1.24%)

145446

General Electric Co

GE

29.82

0.06(0.20%)

10243

Goldman Sachs

GS

248.44

1.66(0.67%)

2669

Google Inc.

GOOG

852

4.80(0.57%)

1295

International Business Machines Co...

IBM

177.4

1.59(0.90%)

19281

Johnson & Johnson

JNJ

129

0.04(0.03%)

624

JPMorgan Chase and Co

JPM

92.15

0.42(0.46%)

10048

Merck & Co Inc

MRK

64.95

0.25(0.39%)

1433

Microsoft Corp

MSFT

64.9

0.15(0.23%)

5078

Nike

NKE

57.7

0.04(0.07%)

1826

Pfizer Inc

PFE

34.69

0.06(0.17%)

1757

Procter & Gamble Co

PG

91.48

0.08(0.09%)

443

Tesla Motors, Inc., NASDAQ

TSLA

263.69

7.96(3.11%)

85992

The Coca-Cola Co

KO

42.22

0.10(0.24%)

2998

Twitter, Inc., NYSE

TWTR

15.12

0.09(0.60%)

52281

UnitedHealth Group Inc

UNH

172

0.22(0.13%)

409

Verizon Communications Inc

VZ

50.2

0.06(0.12%)

465

Walt Disney Co

DIS

112

0.13(0.12%)

236

Yahoo! Inc., NASDAQ

YHOO

46.58

0.29(0.63%)

3307

Yandex N.V., NASDAQ

YNDX

22.93

-0.01(-0.04%)

1600

-

12:44

Upgrades and downgrades before the market open

Upgrades:

Barrick Gold (ABX) upgraded to Outperform at RBC Capital Mkts; target raised to $23 from $19

Downgrades:

Other:

-

09:12

Major European stock exchanges trading in the green zone: FTSE 7406.93 +38.29 + 0.52%, DAX 12144.66 +134.79 + 1.12%, CAC 5026.84 +41.36 + 0.83%

-

07:32

Positive start of trading on the main European stock markets expected: DAX + 0.3%, CAC + 0.1%, FTSE + 0.1%

-

06:29

Global Stocks

European stocks logged modest gains Wednesday, helped by advances for energy shares as oil prices were in recovery mode. The results of the Dutch election and the Federal Reserve's policy meeting also weighed on investors' minds.

U.S. stocks clambered higher on Wednesday, as the Federal Reserve raised interest rates for the third time since December 2015. The Fed increased its benchmark interest rate by 25 basis points, noting that headline inflation is "moving close" to its 2% target. The dot plot, a table of policy makers' projections for short-term rates, showed more unity among the central bankers about their interest-rate forecast and indicated two more hikes this year.

Investors in Asia sent equities higher following indications of a measured response from the Federal Reserve in countering inflation.

-