Market news

-

20:08

Major US stock indexes finished trading mostly in the red

The main US stock indexes mostly fell, as the continuing effects of the Fed's less aggressive position vis-à-vis the rates had a negative impact on the financial sector. As it became known today, manufacturing production in the US increased for the sixth consecutive month in February, which indicates that the recovery of production is gaining momentum, as rising commodity prices increase the demand for engineering products and other equipment. The Federal Reserve said manufacturing production in the manufacturing sector rose 0.5% last month.

In addition, preliminary research results submitted by Thomson-Reuters and the Michigan Institute showed that the mood sensor among US consumers increased in March, exceeding the average forecasts. According to the data, in March the consumer sentiment index rose to 97.6 points compared to the final reading for February at the level of 96.3 points. According to average estimates, the index had to grow to the level of 97 points.

At the same time, the index of leading economic indicators from the Conference Board (LEI) for the US increased by 0.6% in February, to 126.2 (2010 = 100) after a 0.6% increase in January, as well as an increase of 0, 6% in December. Analysts had expected the index to grow by 0.4%.

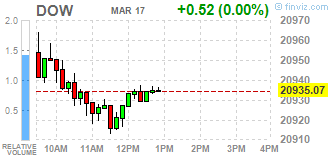

The components of the DOW index have mostly grown (17 out of 30). More shares fell The Goldman Sachs Group, Inc. (GS, -1.58%). The leader of growth was shares United Technologies Corporation (UTX, + 1.12%).

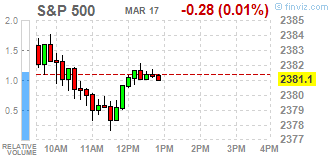

Most sectors of the S & P index recorded an increase. The leader of growth was the utilities sector (+ 0.9%). The financial sector fell most of all (-0.5%).

At closing:

Dow -0.10% 20,914.49 -20.06

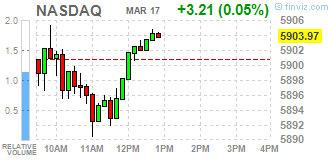

Nasdaq + 0.00% 5,901.00 +0.24

S & P -0.14% 2,378.08 -3.30

-

19:00

DJIA +0.11% 20,957.19 +22.64 Nasdaq +0.14% 5,908.85 +8.09 S&P +0.08% 2,383.28 +1.90

-

17:01

European stocks closed: FTSE 100 +9.01 7424.96 +0.12% DAX +12.06 12095.24 +0.10% CAC 40 +15.86 5029.24 +0.32%

-

16:53

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as the lingering effects of the Federal Reserve's less aggressive stance on the rates outlook hurt the financial sector.

Most of Dow stocks in positive area (17 of 30). Top loser - The Goldman Sachs Group, Inc. (GS, -1.41%). Top gainer - McDonald's Corporation (MCD, +1.12%).

Most of S&P sectors also in positive area. Top loser - Financials (-0.5%). Top gainer - Utilities (+0.5%).

At the moment:

Dow 20882.00 0.00 0.00%

S&P 500 2377.75 -1.25 -0.05%

Nasdaq 100 5418.00 +3.00 +0.06%

Oil 49.27 +0.03 +0.06%

Gold 1228.20 +1.10 +0.09%

U.S. 10yr 2.50 -0.02

-

13:34

U.S. Stocks open: Dow +0.14%, Nasdaq -0.04%, S&P +0.09%

-

13:25

Before the bell: S&P futures +0.03%, NASDAQ futures +0.14%

U.S. stock-index futures were flat, as investors looked for new catalyst for further movement.

Global Stocks:

Nikkei 19,521.59 -68.55 -0.35%

Hang Seng 24,309.93 +21.65 +0.09%

Shanghai 3,237.31 -31.62 -0.97%

FTSE 7,434.22 +18.27 +0.25%

CAC 5,029.75 +16.37 +0.33%

DAX 12,096.10 +12.92 +0.11%

Crude $48.98 (+0.47%)

Gold $1,228.90 (+0.15%)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

190.62

0.31(0.16%)

500

Amazon.com Inc., NASDAQ

AMZN

850.49

-2.93(-0.34%)

13182

Apple Inc.

AAPL

140.89

0.20(0.14%)

51686

Barrick Gold Corporation, NYSE

ABX

19.05

0.14(0.74%)

32548

Boeing Co

BA

178.75

0.56(0.31%)

675

Caterpillar Inc

CAT

93

0.15(0.16%)

1160

Chevron Corp

CVX

107.8

-0.06(-0.06%)

661

Exxon Mobil Corp

XOM

82.3

0.23(0.28%)

5318

Facebook, Inc.

FB

140.08

0.09(0.06%)

30121

FedEx Corporation, NYSE

FDX

193.55

0.44(0.23%)

1720

Ford Motor Co.

F

12.68

-0.02(-0.16%)

19071

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.87

0.05(0.39%)

16531

General Electric Co

GE

29.74

-0.01(-0.03%)

9466

General Motors Company, NYSE

GM

36.99

-0.09(-0.24%)

3916

Intel Corp

INTC

35.27

0.13(0.37%)

12579

International Business Machines Co...

IBM

177.21

-0.03(-0.02%)

386

Johnson & Johnson

JNJ

128.44

-0.02(-0.02%)

492

McDonald's Corp

MCD

129

1.02(0.80%)

4608

Procter & Gamble Co

PG

91.64

0.20(0.22%)

2564

Starbucks Corporation, NASDAQ

SBUX

54.75

-0.05(-0.09%)

241

Tesla Motors, Inc., NASDAQ

TSLA

263.11

1.06(0.40%)

105871

Twitter, Inc., NYSE

TWTR

15.18

-0.01(-0.07%)

4771

Yandex N.V., NASDAQ

YNDX

23.99

0.25(1.05%)

300

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Tesla (TSLA) target raised to $187 from $185 at Goldman; maintain Sell

-

09:34

Major stock markets in Europe trading mixed: DAX 12035.78 -47.40-0.39%, FTSE 7419.14 + 3.19 + 0.04%, CAC 5008.21 -5.17-0.10%

-

07:22

Negative start of trading expected in major European stock markets: DAX -0.3%, CAC -0.1%, FTSE -0.1%

-

06:32

Global Stocks

European stocks leapt to their strongest levels in more than a year Thursday, buoyed by a rally in mining shares, and after Dutch voters rebuffed Geert Wilders's far-right party in a general election.

U.S. stocks retreated Thursday to close lower, giving back some of the previous day's Federal Reserve-inspired gains as a fall for health-care and utilities stocks pushed the market into negative territory.

Investors in Asia turned cautious Friday ahead of a meeting of finance chiefs from the Group of 20 industrialized and emerging economies, where U.S. Treasury Secretary Steven Mnuchin is widely expected to pressure countries to boost the value of their currencies.

-