Market news

-

15:41

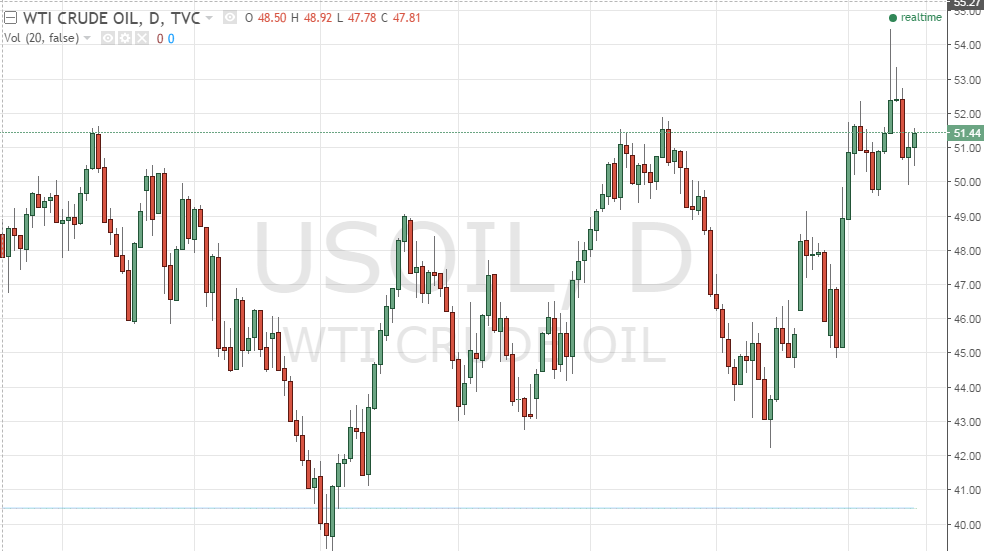

Oil prices traded higher today

Oil prices edged up on Friday despite pressure from potential production increases in Libya, where operations have restarted at two key oil fields.

Even after OPEC cobbled together a deal to cut almost 2% from global oil production to tackle a supply glut and rally prices, returning production from major oil producers such as Libya is threatening to boost supply. says Dow Jones.

Libya's oil production has dropped steeply in the past five years, since dictator Moammar Gadhafi's 2011 ouster, but in recent months it has been ramping back up. Earlier this week Libyan officials said revived production could bring back more than 200,000 barrels a day of oil within days

Brent crude, the global oil benchmark, rose 0.54% to $54.32 a barrel on London's ICE Futures exchange. On the New York Mercantile Exchange, West Texas Intermediate futures were trading up 0.14% at $50.96 a barrel.

-

15:32

Caixin: Bank of China encourages commercial banks to increase lending

China's central bank has made a move to encourage commercial banks to lend to large non-bank financial institutions, after many of them have suspended interbank operations in a tough situation with liquidity. This was announced by the Chinese financial magazine Caixin.

Caixin said that traders indicate worsening sentiment among banks about market conditions and growing caution with respect to inter-bank lending, especially after the US Federal Reserve provoked a sell-off in the bond market, futures signaled a greater number of rate hikes in 2017.

Liquidity has become a major factor in the market after the central bank increased the cost of open market operations last month.

-

14:32

-

13:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0300 (EUR 929m) 1.0350 ( 2.19bln) 1.0400 (1.56bln) 1.0500 (3.02bln) 1.0600 (2.29bln) 1.0700 (1.96bln) 1.0800 (3.95bln)

USDJPY 113.00 (USD 885m) 116.00 (USD 1.22bln)

GBPUSD 1.2700 (GBP 777m)

AUDUSD 0.7435-40 (AUD 537m)

USDCAD 1.3350 (USD 857m) 1.3500 (927m)

-

13:39

US building permits and housing starts below estimates in November

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 1,201,000. This is 4.7 percent below the revised October rate of 1,260,000 and is 6.6 percent below the November 2015 estimate of 1,286,000.

Single-family authorizations in November were at a rate of 778,000; this is 0.5 percent above the revised October figure of 774,000. Authorizations of units in buildings with five units or more were at a rate of 384,000 in November.

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 1,090,000. This is 18.7 percent below the revised October estimate of 1,340,000 and is 6.9 percent below the November 2015 rate of 1,171,000.

Single-family housing starts in November were at a rate of 828,000; this is 4.1 percent * below the revised October figure of 863,000. The November rate for units in buildings with five units or more was 259,000.

-

13:37

Foreign acquisitions of Canadian securities reached $15.8 billion in October

Foreign acquisitions of Canadian securities reached $15.8 billion in October, above the monthly average investment of $13.7 billion from January to September. The activity was mainly concentrated in Canadian debt securities issued by private corporations, both short- and long-term instruments.

Non-resident investors resumed their acquisitions in the Canadian money market by adding $7.7 billion worth to their holdings in October, following a $5.4 billion divestment in September. Foreign acquisitions of private corporate paper accounted for the bulk of the investment, reaching a record $6.8 billion, mainly paper denominated in foreign currencies. Canadian short-term interest rates were down slightly and the Canadian dollar depreciated against its US counterpart by 1.7 US cents in the month.

Foreign investment in Canadian bonds slowed to $6.3 billion in October. Foreign acquisitions of Canadian private corporate bonds amounted to $5.0 billion, mainly new issues denominated in foreign currencies. This followed an investment of $11.1 billion in these instruments in September.

-

13:30

U.S.: Housing Starts, November 1090 (forecast 1225)

-

13:30

Canada: Foreign Securities Purchases, October 15.75 (forecast 12.35)

-

13:30

U.S.: Building Permits, November 1201 (forecast 1243)

-

13:09

EUR/USD Back Above $1.04, But Gains Seen Temporary

-

13:07

UK expectations for production growth in the first quarter of 2017 remain solid - CBI

The survey of 482 firms found that total order books were at a 20-month high, while export order books softened for a second successive month but remained above historical norms.

Growth in output was the highest since mid-2014 and was broad-based. Just 4 of the 18 sectors reported a fall in production, with mechanical engineering and the aerospace sectors the main drivers of the improvement. Expectations for production growth in the first quarter of 2017 remain solid.

-

13:01

Orders

EUR/USD

Offers 1.0465 1.0485 1.0500 1.0525 1.0550-55 1.05851.0600 1.0625-30 1.0650

Bids 1.0420 1.0400 1.0380 1.0350 1.030-35 1.0300

GBP/USD

Offers 1.2460 1.2480 1.2500 1.2530 1.2550 1.2565 1.2580 1.2600 1.2630-35 1.2650

Bids 1.2400 1.2380-85 1.2350 1.2330-35 1.2300 1.2275 1.2250

EUR/GBP

Offers 0.8420-25 0.8450 0.8460-65 0.8480 0.8500

Bids 0.8380 0.8350-55 0.8330-35 0.8300 0.8285 0.8250

EUR/JPY

Offers 123.60 123.85 124.00-10 124.30 124.50 124.80 125.00

Bids 123.00 122.80 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers 118.25-30 118.60 118.80 119.00 119.20 119.50 120.00

Bids 117.80 117.50 117.20 117.00 116.80 116.50 116.30 116.00 115.85 115.50 115.00

AUD/USD

Offers 0.7380 0.7400 0.7430 0.7450 0.7485 0.7500 0.7520-25 0.7550

Bids 0.7350 0.7330 0.7300 0.7285 0.7250 0.7200

-

10:50

Bank of Russia to Consider Key Rate Cut in 1H 2017 If Inflation Slowdown Strengthens

-

Inflation Slowed to 5.6% As of Dec 12

-

Sees Inflation at 4% by End-2017

-

Decrease in Inflation Expectations Remains Unstable

-

Slowing Consumer Price Inflation Partly Caused by Temporary Factors

-

Inflation in Line with Forecast, Inflation Risks Eased a Little

-

-

10:17

The euro area recorded a €20.1 bn surplus in trade in October, lower than expected

The first estimate for euro area (EA19) exports of goods to the rest of the world in October 2016 was €172.5 billion, a decrease of 5% compared with October 2015 (€180.8 bn). Imports from the rest of the world stood at €152.4 bn, a fall of 3% compared with October 2015 (€157.5 bn). As a result, the euro area recorded a €20.1 bn surplus in trade in goods with the rest of the world in October 2016, compared with +€23.2 bn in October 2015. Intra-euro area trade fell to €144.7 bn in October 2016, down by 3% compared with October 2015.

-

10:16

Euro area annual inflation was 0.6% in November

Euro area annual inflation was 0.6% in November 2016, up from 0.5% in October. In November 2015 the rate was 0.1%. European Union annual inflation was 0.6% in November 2016, up from 0.5% in October. A year earlier the rate was 0.1%. These figures come from Eurostat, the statistical office of the European Union.

In November 2016, negative annual rates were observed in six Member States. The lowest annual rates were registered in Bulgaria and Cyprus (both -0.8%). The highest annual rates were recorded in Belgium (1.7%), the Czech Republic (1.6%) and Austria (1.5%). Compared with October 2016, annual inflation fell in five Member States, remained stable in six and rose in seventeen.

The largest upward impacts to euro area annual inflation came from restaurants & cafés (+0.07 percentage points), rents and tobacco (both +0.04 pp), while gas (-0.11 pp), heating oil (-0.05 pp) and package holidays (-0.04 pp) had the biggest downward impacts.

-

10:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, November 0.8%

-

10:00

Eurozone: Trade balance unadjusted, October 20.1 (forecast 29)

-

10:00

Eurozone: Harmonized CPI, Y/Y, November 0.6% (forecast 0.6%)

-

10:00

Eurozone: Harmonized CPI, November -0.1% (forecast -0.1%)

-

09:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0300 (EUR 929m) 1.0350 ( 2.19bln) 1.0400 (1.56bln) 1.0500 (3.02bln) 1.0600 (2.29bln) 1.0700 (1.96bln) 1.0800 (3.95bln)

USD/JPY 113.00 (USD 885m) 116.00 (USD 1.22bln)

GBP/USD 1.2700 (GBP 777m)

AUD/USD 0.7435-40 (AUD 537m)

USD/CAD 1.3350 (USD 857m) 1.3500 (927m)

Информационно-аналитический отдел TeleTrade

-

09:11

Ifo Chief Fuest: Italy To Leave EUR If Gov’t Fails To Boost Growth

-

08:31

Australia risks losing the "AAA" rating

On Monday, the Australian Government will make "The economic and budgetary projections." Economists point out that if projections prove weak, the global rating agencies will deprive Australia of the highest credit rating of "AAA". According to the forecasts, the cumulative reduction of the budget could reach about 15 billion Australian dollars over the next four fiscal years.

Some analysts believe that the probability of this scenario is 50%. Reducing the sovereign rating of the country will also reduce the ratings of major banks. The downgrade will lead to the fact that Australia will harder attract investment.

-

08:02

Today’s events

-

At 10:30 GMT the Bank of Russia will announce interest rate decision

-

At 12:15 GMT the ECB Vice-President Vitor Constancio will give a speech

-

At 17:30 GMT FOMC member Jeffrey Lacker will give a speech

-

Also today, the European Council hold a meeting

-

-

07:35

What's next for USD? - Nomura

"The FOMC delivered the market a hawkish surprise this week, with the 2017 dots signalling three hikes next year, up from the two signalled in September. USD strength followed, and we think USD/JPY has the furthest to run.

With the BOJ remaining committed to its yield control policy, the widening rates differential is likely to be highly supportive for USD/JPY. Risk sentiment reaction remains important for the cross, but so far seems contained.We are not expecting any surprises from the BOJ next week, and with low easing expectations market reactions should be muted.

We expect USD to outperform over 2017, but unlike 2016 it is likely to be driven more by the fiscal purse rather than monetary policy easing. Stronger global growth momentum than a year ago should also reduce the likelihood of a risk-off environment that caused the position unwind earlier this year.

The "Trumpflation trade" is still in full swing, and as we write this USD crosses are breaking above key levels at an impressive pace.

We expect this to continue into the new year and more so if President-elect Trump passes legislation at a faster pace than the market is expecting. Politics will likely continue to dominate the headlines next year, and we expect EUR to move below parity and GBP to reach new lows.

CAD is likely to outperform AUD and NZD, while SEK and NOK are likely to outperform CHF as their central banks turn more hawkish. Finally, we believe foreign bond flows could have a greater impact on EUR going forward, as the higher FX hedge costs for euro area investors could mean a stronger FX impact from those outflows".

Copyright © 2016 Nomura, eFXnews™

-

07:27

Consumer confidence in New Zealand fell in December

Consumer confidence in New Zealand fron ANZ was down 2.1% in December, well below the previous value of +3.5%.

ANZ said consumer sentiment fell in December, but economic signals remain healthy. Strong levels of trust - a sign of continued sustainable growth in all sectors of the economy. Earthquakes in the last month, did not seem to have any significant effect

Data on consumer confidence include inflation expectations, which, according to the report ncreased to 3.4% in December from the previous value of 3.3% - this is in line with the average value, which occurred in the previous 12 months

-

07:25

RBA Chief Economist, Lucy Ellis: The main objective of the RBA is to avoid recessions

Ms. Ellis recalled that the events of recent years have clearly demonstrated that the economic downturn may have long-term negative consequences for the labor market. At the same time, the economist refused to comment on the possibility that the Australian economy in the second quarter may decline again. Reserve Bank of Australia is trying not to talk about a recession in the country. Lucy Ellis also referred to the slow recovery in the United States, stressing that the world economic recessions have become increasingly protracted and complex in terms of the restoration of the number of jobs.

-

07:23

Options levels on friday, December 16, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0719 (449)

$1.0671 (316)

$1.0612 (212)

Price at time of writing this review: $1.0438

Support levels (open interest**, contracts):

$1.0364 (1080)

$1.0325 (1856)

$1.0278 (2744)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 41807 contracts, with the maximum number of contracts with strike price $1,1500 (3226);

- Overall open interest on the PUT options with the expiration date March, 13 is 51196 contracts, with the maximum number of contracts with strike price $1,0000 (5591);

- The ratio of PUT/CALL was 1.22 versus 1.02 from the previous trading day according to data from December, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2713 (484)

$1.2617 (991)

$1.2521 (331)

Price at time of writing this review: $1.2428

Support levels (open interest**, contracts):

$1.2380 (273)

$1.2283 (357)

$1.2187 (533)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9896 contracts, with the maximum number of contracts with strike price $1,2600 (991);

- Overall open interest on the PUT options with the expiration date March, 13 is 12831 contracts, with the maximum number of contracts with strike price $1,1500 (2954);

- The ratio of PUT/CALL was 1.30 versus 1.31 from the previous trading day according to data from December, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:20

Draghi discussed Trump stimulus prospects with EU leaders: Merkel

-