Market news

-

20:00

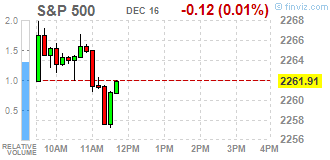

DJIA 19850.50 -1.74 -0.01%, NASDAQ 5441.37 -15.49 -0.28%, S&P 500 2258.35 -3.68 -0.16%

-

17:00

European stocks closed: FTSE 7011.64 12.63 0.18%, DAX 11404.01 37.61 0.33%, CAC 4833.27 14.04 0.29%

-

16:51

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday. The Fed sees three rate hikes next year instead of the two foreseen in September, partly as a result of the expected economic benefits under President-elect Donald Trump.

Most of Dow stocks in negative area (17 of 30). Top gainer - General Electric Company (GE, +1.17%). Top loser - Intel Corporation (INTC, -1.36%).

All S&P sectors in positive area. Top gainer - Conglomerates (+1.5%). Top loser - Technology (-0.5%).

At the moment:

Dow 19811.00 +8.00 +0.04%

S&P 500 2255.75 -2.75 -0.12%

Nasdaq 100 4921.75 -13.00 -0.26%

Oil 53.00 +1.03 +1.98%

Gold 1140.50 +10.70 +0.95%

U.S. 10yr 2.58 +0.00

-

16:25

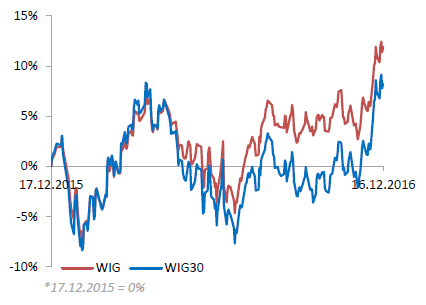

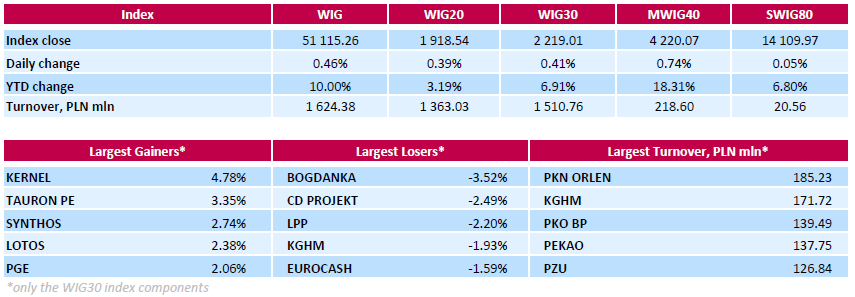

WSE: Session Results

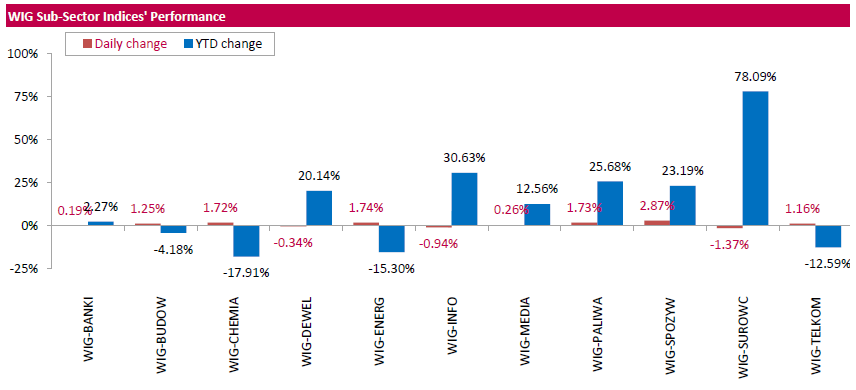

Polish equity market closed higher on Friday. The broad market measure, the WIG Index, surged by 0.46%. The WIG sub-sector indices were mainly higher with food stocks (+2.87%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 0.41%. Nearly 2/3 of all index components returned gains, with the way up led by agricultural producer KERNEL (WSE: KER), genco TAURON PE (WSE: TPE), chemical producer SYNTHOS (WSE: SNS) and oil refiner LOTOS (WSE: LTS), which added between 2.38% and 4.78%. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB), videogame developer CD PROJEKT (WSE: CDR) and clothing retailer LPP (WSE: LPP) topped decliners' list, falling by 3.52%, 2.49% and 2.2% respectively.

-

14:52

WSE: After start on Wall Street

Wall Street began from a slight increase, although the scale of change suggests that we will see a replication scenario for the last days. The whole week of trading in America shows consolidation but the bulls have the chance of a successful closing of the next week, which is important due to adverse for market shares statement of Fed.

On 15:50 (Warsaw time) on the Warsaw market has started the last 60 minutes of continuous trading, which will be decisive to determine the settlement price of the December series.

Into this last hour of trading the WIG20 enter on the level of 1,917 points (+ 0.32%).

-

14:32

U.S. Stocks open: Dow +0.23%, Nasdaq +0.21%, S&P +0.21%

-

14:27

Before the bell: S&P futures +0.15%, NASDAQ futures +0.19%

U.S. stock-index futures rose slightly, approaching to the pre-Fed levels.

Global Stocks:

Nikkei 19,401.15 +127.36 +0.66%

Hang Seng 22,020.75 -38.65 -0.18%

Shanghai 3,124.03 +6.35 +0.20%

FTSE 7,008.03 +9.02 +0.13%

CAC 4,832.98 +13.75 +0.29%

DAX 11,400.89 +34.49 +0.30%

Crude $51.28 (+0.75%)

Gold $1,135.40 (+0.50%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

763.5

2.50(0.3285%)

9115

American Express Co

AXP

75.12

0.18(0.2402%)

500

Apple Inc.

AAPL

116.4

0.58(0.5008%)

125217

Barrick Gold Corporation, NYSE

ABX

14.2

0.20(1.4286%)

68595

Boeing Co

BA

153.59

-0.18(-0.1171%)

225

Caterpillar Inc

CAT

94.86

0.33(0.3491%)

1079

Citigroup Inc., NYSE

C

60.6

0.37(0.6143%)

5989

Exxon Mobil Corp

XOM

91.26

0.37(0.4071%)

4070

Facebook, Inc.

FB

120.87

0.30(0.2488%)

23274

Ford Motor Co.

F

12.67

0.09(0.7154%)

14806

General Electric Co

GE

31.61

0.35(1.1196%)

71927

Goldman Sachs

GS

244.09

1.09(0.4486%)

5570

Google Inc.

GOOG

801

3.15(0.3948%)

1004

Home Depot Inc

HD

136.13

0.29(0.2135%)

2395

HONEYWELL INTERNATIONAL INC.

HON

113.56

-2.78(-2.3895%)

12568

Intel Corp

INTC

36.68

-0.11(-0.299%)

2254

International Business Machines Co...

IBM

169.1

1.08(0.6428%)

1718

JPMorgan Chase and Co

JPM

86.39

0.39(0.4535%)

10923

Merck & Co Inc

MRK

62.75

0.38(0.6093%)

3286

Microsoft Corp

MSFT

62.72

0.14(0.2237%)

990

Nike

NKE

51.63

0.34(0.6629%)

14782

Pfizer Inc

PFE

33

0.25(0.7634%)

4408

Procter & Gamble Co

PG

84.8

0.12(0.1417%)

1419

Tesla Motors, Inc., NASDAQ

TSLA

199.45

1.87(0.9465%)

5488

The Coca-Cola Co

KO

41.4

-0.15(-0.361%)

32825

Twitter, Inc., NYSE

TWTR

18.87

0.08(0.4258%)

44674

UnitedHealth Group Inc

UNH

160.73

0.11(0.0685%)

685

Walt Disney Co

DIS

104.67

0.28(0.2682%)

3460

Yahoo! Inc., NASDAQ

YHOO

38.79

0.38(0.9893%)

7310

Yandex N.V., NASDAQ

YNDX

20.82

0.24(1.1662%)

17541

-

13:40

Upgrades and downgrades before the market open

Upgrades:

General Electric (GE) upgraded to Outperform from Mkt Perform at Bernstein

Downgrades:

Coca-Cola (KO) downgraded to Equal-Weight from Overweight at Morgan Stanley

Other:

Apple (AAPL) resumed with a Overweight at Piper Jaffray; target $155

FedEx (FDX) target raised to $240 at Cowen

-

12:02

WSE: Mid session comment

The morning part of today's trading on the Warsaw market ended for the WIG20 index with minor changes and with a modest level of turnover. The course of today's trading indicates more waiting for the final hour than a consolidation after the last increases.

At the halfway point of the session, the WIG20 index was on the level of 1,913 points (+0,12%). The turnover in the segment of blue-chips was amounted to PLN 267 million.

-

11:42

Major stock indices in Europe show a positive trend

European stocks traded higher, near the highest level since January, helped by growth in the health sector and telecommunications. At the same time, lower banks shares inhibits the rally.

Certain influence on the dynamics of trade had statistical data for the euro area. The final report, submitted by Statistics agency Eurostat showed that in November, consumer prices in the euro area fell by 0.1% after rising 0.2% in October. However, the decline in prices has confirmed the expectations of experts. Meanwhile, the growth rate of annual inflation accelerated to 0.6% from 0.5% in the previous month. Core CPI, which excludes energy and food prices, rose 0.8% year on year, confirming the forecasts and coincided with the previous estimate. Recall that in October the index also increased by 0.8%. Among EU countries, annual inflation rose in November by 0.6% after rising 0.5% in October. A year earlier the rate was at 0.1%. The report also stated that the bigest increase in prices in the euro area (in annual terms) was seen in restaurants and cafes (+ 0.07%). Expenses for the rent increased by 0.04%. The cost of tobacco products also increased by 0.04%.

The composite index of the largest companies in the region Stoxx Europe 600 is trading with an increase of 0.29 percent. Over the past two weeks, the index rose nearly 6 percent .

Shares of Banca Monte dei Paschi di Siena increased by 0.7 per cent after receiving regulatory approval to extend the bond exchange program. However, experts note that the concerns about the need for government intervention remain.

At the moment:

FTSE 100 +13.36 7012.30 + 0.19%

DAX +52.38 11418.78 + 0.46%

CAC 40 +26.77 4846.00 + 0.56%

-

08:34

Major stock markets little changed after opening: FTSE flat, DAX, flat, FTMIB + 0.4%, IBEX -0.2%

-

08:20

WSE: After opening

WIG20 index opened at 1913.05 points (+0.10%)*

WIG 50982.38 0.20%

WIG30 2215.75 0.27%

mWIG40 4200.84 0.28%

*/ - change to previous close

Investors in Europe started the day from virtually neutral level. In the Warsaw market, we have to deal with the optimism and after the first transactions the WIG20 index rose by 0.5 percent. For the bulls helps the stronger zloty, but the turnover does not look impressive. After fifteen minutes of trading WIG20 index reached 1,919 points (+ 0.44%).

-

07:28

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.2%, FTSE -0.1%

-

07:23

WSE: Before opening

Indices on the New York stock markets rose slightly on Thursday after the release of good macroeconomic data from the US economy. Oil remained largely unchanged. Heavily fell quotations of gold. Rising yields of the US bonds. The dollar is the strongest since 2003. The Dow Jones Industrial at closing increased by 0.3 percent, the S&P500 by 0.39 percent while the Nasdaq Comp. went up by 0.37 per cent.

From the perspective of European markets, the most important element is light withdrawal on Wall Street in the second half of the day which may result in a similar withdrawal in Europe.

It must be remembered that today the world is facing a session with the settlement of derivatives, so part of the trade will be disturbed by players from futures markets.

There is no important elements in the macro calendar today.

Third Friday in December is also the day of settlement of derivative in Warsaw. Usually the market may be muted in anticipation of the final hour of the session and the festival of basket orders, which not only disturb the image of activity during the day, but also discourage entry into the game before the time of miracles. Thus, for reliable technical trade we have to wait until the next week.

-

06:18

Global Stocks

European stocks on Thursday closed just shy of a 2016 high as bank shares rallied and the euro sank after the U.S. Federal Reserve signaled a faster pace of interest-rate hikes than previously mapped out. But shares in mining companies fell as the U.S. dollar continued its post-Fed surge. The dollar's jump came partly at the expense of the shared currency, which traded at 14-year lows against the greenback.

U.S. stocks closed higher Thursday, but off their intraday highs, as investors adjusted to the Federal Reserve's plan for a faster path of interest-rate increases in 2017. After a pullback following the Fed decision Wednesday, stock-market indexes resumed their post-election march higher.

Asian shares steadied on Friday, tracking U.S. gains, with financials leading Japan's stock market to a fresh high for the year. Japan financials are benefiting from rising yields for global government bonds, in which they invest heavily.

-