Market news

-

23:29

Stocks. Daily history for Dec 15’2016:

(index / closing price / change items /% change)

Nikkei 225 19,273.79 +20.18 +0.10%

Shanghai Composite 3,118.32 -22.21 -0.71%

S&P/ASX 200 5,538.58 0.00 0.00%

FTSE 100 6,999.01 +49.82 +0.72%

CAC 40 4,819.23 +49.99 +1.05%

Xetra DAX 11,366.40 +121.56 +1.08%

S&P 500 2,262.03 +8.75 +0.39%

Dow Jones Industrial Average 19,852.24 +59.71 +0.30%

S&P/TSX Composite 15,218.31 +21.13 +0.14%

-

20:02

DJIA 19868.80 76.27 0.39%, NASDAQ 5457.18 20.51 0.38%, S&P 500 2263.01 9.73 0.43%

-

17:02

European stocks closed: FTSE 6999.01 49.82 0.72%, DAX 11366.40 121.56 1.08%, CAC 4819.23 49.99 1.05%

-

16:33

WSE: Session Results

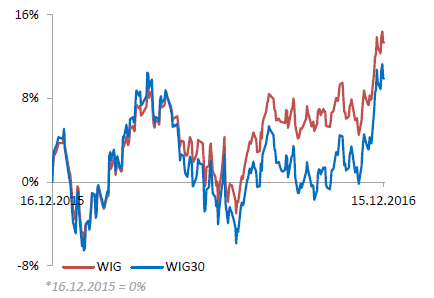

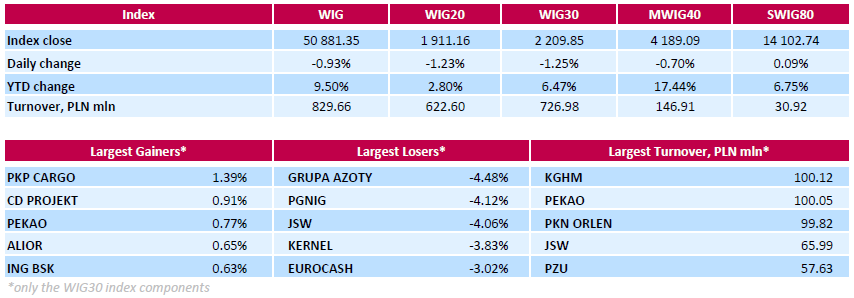

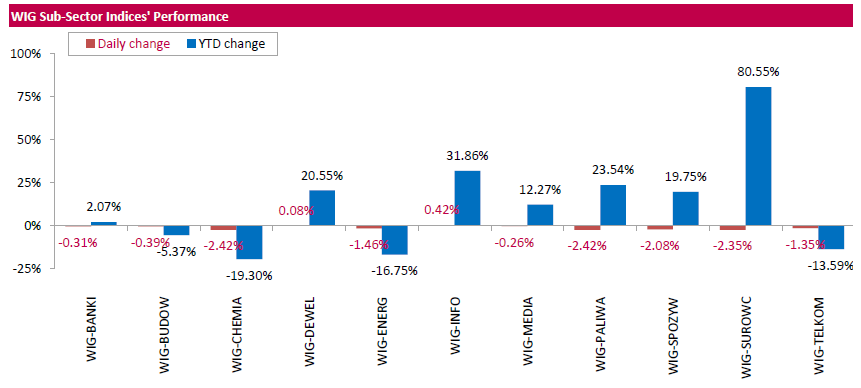

Polish equity market closed lower on Thursday. The broad market measure, the WIG index, fell by 0.93%. Most sectors dropped, with chemicals (-2.42%) and oil and gas (-2.42%) underperforming.

The large-cap stocks' gauge, the WIG30 Index, sank by 1.25%. A majority of the index components recorded declines. Chemical company GRUPA AZOTY (WSE: ATT) suffered the biggest daily drop, tumbling by 4.48%. Other largest losers were oil and gas producer PGNIG (WSE: PGN), coking coal miner JSW (WSE: JSW) and agricultural producer KERNEL (WSE: KER), plunging by 4.12%, 4.06% and 3.83% respectively. At the same time, railway freight transport operator PKP CARGO (WSE: PKP) and videogame developer CD PROJEKT (WSE: CDR) led a handful of gainers, adding 1.39% and 0.91% respectively.

-

16:31

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Thursday, helped by a rise in bank stocks, a day after the Federal Reserve increased interest rates for the first time this year and signaled a faster pace of hikes in 2017. The Fed sees three rate hikes next year instead of the two foreseen as of September, partly as a result of the changes anticipated under President-elect Donald Trump. Fed Chair Janet Yellen also cited an improving labor market and evidence of faster inflation for its 2017 rate outlook.

Most of Dow stocks in positive area (27 of 30). Top gainer - American Express Company (AXP, +2.09%). Top loser - NIKE, Inc. (NKE, -0.42%).

All S&P sectors in positive area. Top gainer - Financials (+1.1%).

At the moment:

Dow 19887.00 +122.00 +0.62%

S&P 500 2267.00 +15.00 +0.67%

Nasdaq 100 4958.25 +25.75 +0.52%

Oil 50.57 -0.47 -0.92%

Gold 1128.20 -35.50 -3.05%

U.S. 10yr 2.61 +0.08

-

14:58

WSE: After start on Wall Street

Americans began trading in the area of the reference level, but they had already time yesterday to respond to reports from the US monetary authorities and importantly had a chance to sleep with it, and now they find also the relative calm market shares in the European part of the session. Today's response should already be somewhat more subdued, and above all, something more to say about the actual sentiment on Wall Street.

On the Warsaw parquet the day is marked by a declines and one an hour before the end of trading the WIG20 index was at the level of 1,912 points (-1,15%).

-

14:33

U.S. Stocks open: Dow +0.24%, Nasdaq +0.14%, S&P +0.10%

-

14:26

Before the bell: S&P futures -0.02%, NASDAQ futures -0.09%

U.S. stock-index futures were little changed after some post-Fed volatility yesterday. Investors also assessed a raft of macroeconomic data.

Global Stocks:

Nikkei 19,273.79 +20.18 +0.10%

Hang Seng 22,059.40 -397.22 -1.77%

Shanghai 3,118.32 -22.21 -0.71%

FTSE 6,947.00 -2.19 -0.03%

CAC 4,796.57 +27.33 +0.57%

DAX 11,281.02 +36.18 +0.32%

Crude $50.55 (-0.96%)

Gold $1,130.40 (-2.86%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.08

-0.37(-1.2151%)

4527

Amazon.com Inc., NASDAQ

AMZN

769.3

0.48(0.0624%)

25071

AMERICAN INTERNATIONAL GROUP

AIG

66.1

0.09(0.1363%)

100

Apple Inc.

AAPL

115.05

-0.14(-0.1215%)

108385

AT&T Inc

T

40.95

-0.15(-0.365%)

23926

Barrick Gold Corporation, NYSE

ABX

14.35

-0.38(-2.5798%)

371450

Caterpillar Inc

CAT

93.53

-0.21(-0.224%)

2856

Chevron Corp

CVX

115.6

-0.36(-0.3105%)

2937

Cisco Systems Inc

CSCO

30.58

0.12(0.394%)

820

Citigroup Inc., NYSE

C

59.9

0.45(0.7569%)

21939

E. I. du Pont de Nemours and Co

DD

73.7

-0.01(-0.0136%)

110

Exxon Mobil Corp

XOM

90.27

-0.31(-0.3422%)

4266

Facebook, Inc.

FB

119.95

-0.26(-0.2163%)

68939

Ford Motor Co.

F

12.51

-0.02(-0.1596%)

19054

General Motors Company, NYSE

GM

35.9

-0.05(-0.1391%)

1410

Goldman Sachs

GS

241.32

1.39(0.5793%)

14163

Google Inc.

GOOG

797

-0.07(-0.0088%)

1169

Intel Corp

INTC

36.7

0.15(0.4104%)

401

International Business Machines Co...

IBM

167.89

-0.62(-0.3679%)

5811

Johnson & Johnson

JNJ

115.46

0.47(0.4087%)

685

JPMorgan Chase and Co

JPM

85.5

0.77(0.9088%)

25007

Merck & Co Inc

MRK

61.98

0.18(0.2913%)

621

Microsoft Corp

MSFT

62.81

0.13(0.2074%)

14188

Nike

NKE

52.09

0.30(0.5793%)

3130

Pfizer Inc

PFE

32.89

0.07(0.2133%)

6202

Procter & Gamble Co

PG

84.07

-0.30(-0.3556%)

775

Starbucks Corporation, NASDAQ

SBUX

58.4

-0.35(-0.5957%)

5209

Tesla Motors, Inc., NASDAQ

TSLA

198.5

-0.19(-0.0956%)

8312

The Coca-Cola Co

KO

41.1

-0.11(-0.2669%)

12920

Twitter, Inc., NYSE

TWTR

18.99

0.06(0.317%)

38355

UnitedHealth Group Inc

UNH

160.65

0.79(0.4942%)

300

Verizon Communications Inc

VZ

51.4

-0.23(-0.4455%)

9852

Visa

V

79.79

0.66(0.8341%)

8828

Wal-Mart Stores Inc

WMT

71.39

0.05(0.0701%)

1348

Walt Disney Co

DIS

103.5

-0.55(-0.5286%)

3613

Yahoo! Inc., NASDAQ

YHOO

39.85

-1.06(-2.5911%)

81291

Yandex N.V., NASDAQ

YNDX

20.91

0.13(0.6256%)

1350

-

13:54

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Outperform from Neutral at Macquarie

Visa (V) upgraded to Buy from Neutral at BofA/Merrill

MasterCard (MA) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

-

12:15

WSE: Mid session comment

On the Warsaw market today we have to deal with the predominance of demand-side and foreign capital apparently refrain from further purchases. At the halfway point of today's session the WIG20 index was at the level of 1,914 points (-1.03%) and the turnover in the segment of the largest companies was amounted to PLN 224 million. The main European parquets are doing well and increases dominate there. Particularly well doing banking sector.

-

08:37

Major stock exchanges trading mixed: the FTSE 100 6,944.19 -5.00 -0.07%, DAX 11,293.47 48.63 0.43%, CAC 40 4,794.03 24.79 0.52%, IBEX 35 9,248.70 30.30 0.33%

-

08:20

WSE: After opening

WIG20 index opened at 1931.36 points (-0.18%)*

WIG 51257.75 -0.19%

WIG30 2232.76 -0.23%

mWIG40 4208.70 -0.24%

*/ - Change to Previous Close

The futures market started the day from a discount of 0.52% to 1,922 points. Contract for the DAX gain of 0.3% after yesterday's slight decline.. Thus, a negative reaction to the Fed for now is focused on emerging markets, including the WSE.

The cash market opened with cosmetics decline. A large turnover seen in the ABC Data (WSE: ABC) after yesterday's statement to discontinue the proceedings against the company by the Tax Office. Among large companies well-presented Eurocash (WSE: EUR), which informs about qualified approval take over the PDA company. Slightly lose fuel companies in response to falling oil prices.

After fifteen minutes of trading the WIG20 index was at the level of 1,930 points (-0.24%).

-

07:26

WSE: Before opening

Open Market Committee of the US Federal Reserve decided that increases key interest rate by 25 basis points to 0.5-0.75 percent, as expected. At the same time Fed signaled faster than previously announced a series of rate hikes in 2017. The bank said that policymakers now expect three rate hikes of 25 basis points in 2017, while in September two only was expected.

All this affected the sell-off of stocks (the S&P500 fell by 0.8%, the Nasdaq lost 0.5%), strengthening of the dollar and rise of the US bond yields. At the same time dropped the price of oil and gold.

From the point of view of the Warsaw Stock Exchange we may expect initial negative reaction. Proposed by Fed policy change global risk aversion, and this will adversely affect the perception of emerging markets.

In the macro calendar will be announced today a lot of data; the weekly data from the US labor market (14.30 Warsaw time) reading of PMI for the services sector and industry, among others from France (9.00), Germany (9.30), Euroland (10.00) and the USA (15.45; only for the industry).

-

07:18

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.9%, CAC40 -0.8%, FTSE -0.5%

-

06:15

Global Stocks

European stocks finished lower Wednesday, stepping away from their best level in 11 months, as investors prepared for a likely interest-rate increase by the U.S. Federal Reserve.

U.S. stocks ended a volatile session lower on Wednesday, as investors grappled with the prospect of a faster pace of rate increases in 2017 than had been previously forecast. The Federal Reserve raised its key short-term rate on Wednesday, as had been universally expected, but it also forecast three rate increases in 2017, compared with the two that had been anticipated at its previous meeting in September. While the revised outlook could be taken as a positive sign-the Fed has said it would only raise rates when it deems the economy strong enough to withstand such a move-it added an element of uncertainty to the market.

Asian markets were down across the board Thursday after the U.S. Federal Reserve overnight indicated it would raise interest rates faster than expected in 2017. Overnight, the Federal Reserve raised the federal-funds rate by a quarter of a percentage point to between 0.50% and 0.75%, and said it expected to raise short-term rates next year by another 0.75 percentage points, spread over three rate increases.

-