Market news

-

23:30

Commodities. Daily history for Dec 15’2016:

(raw materials / closing price /% change)

Oil 51.07 +0.33%

Gold 1,130.30 +0.04%

-

23:29

Stocks. Daily history for Dec 15’2016:

(index / closing price / change items /% change)

Nikkei 225 19,273.79 +20.18 +0.10%

Shanghai Composite 3,118.32 -22.21 -0.71%

S&P/ASX 200 5,538.58 0.00 0.00%

FTSE 100 6,999.01 +49.82 +0.72%

CAC 40 4,819.23 +49.99 +1.05%

Xetra DAX 11,366.40 +121.56 +1.08%

S&P 500 2,262.03 +8.75 +0.39%

Dow Jones Industrial Average 19,852.24 +59.71 +0.30%

S&P/TSX Composite 15,218.31 +21.13 +0.14%

-

23:28

Currencies. Daily history for Dec 15’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0413 -1,17%

GBP/USD $1,2417 -1,17%

USD/CHF Chf1,0299 +0,96%

USD/JPY Y118,16 +0,96%

EUR/JPY Y123,06 -0,18%

GBP/JPY Y146,71 -0,20%

AUD/USD $0,7356 -0,65%

NZD/USD $0,7036 -1,14%

USD/CAD C$1,3334 +0,39%

-

23:00

Schedule for today,Friday, Dec 16’2016 (GMT0)

10:00 Eurozone Trade balance unadjusted October 26.5 29

10:00 Eurozone Harmonized CPI November 0.2% -0.1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) November 0.5% 0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) November 0.8%

11:00 United Kingdom CBI industrial order books balance December -3 -6

12:00 United Kingdom BOE Quarterly Bulletin

13:30 Canada Foreign Securities Purchases October 11.77 12.35

13:30 U.S. Housing Starts November 1323 1225

13:30 U.S. Building Permits November 1260 1243

-

21:02

U.S.: Net Long-term TIC Flows , October 9.4

-

21:01

U.S.: Total Net TIC Flows, October 18.8

-

20:02

DJIA 19868.80 76.27 0.39%, NASDAQ 5457.18 20.51 0.38%, S&P 500 2263.01 9.73 0.43%

-

17:02

European stocks closed: FTSE 6999.01 49.82 0.72%, DAX 11366.40 121.56 1.08%, CAC 4819.23 49.99 1.05%

-

16:33

WSE: Session Results

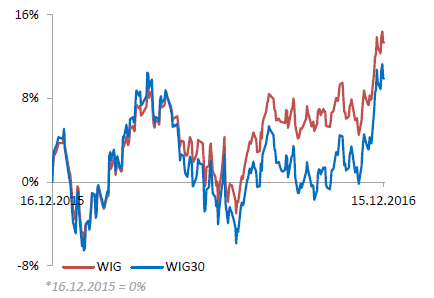

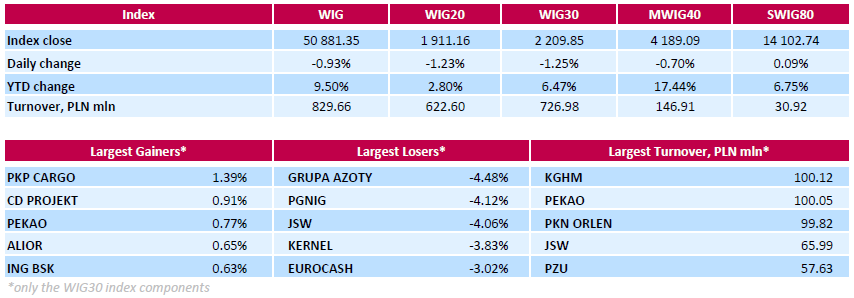

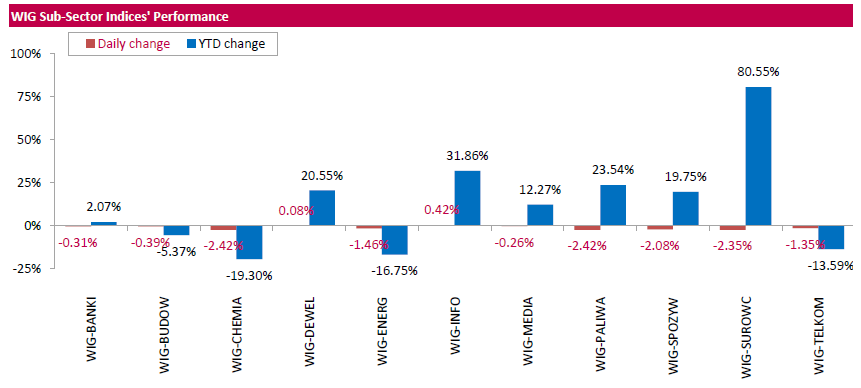

Polish equity market closed lower on Thursday. The broad market measure, the WIG index, fell by 0.93%. Most sectors dropped, with chemicals (-2.42%) and oil and gas (-2.42%) underperforming.

The large-cap stocks' gauge, the WIG30 Index, sank by 1.25%. A majority of the index components recorded declines. Chemical company GRUPA AZOTY (WSE: ATT) suffered the biggest daily drop, tumbling by 4.48%. Other largest losers were oil and gas producer PGNIG (WSE: PGN), coking coal miner JSW (WSE: JSW) and agricultural producer KERNEL (WSE: KER), plunging by 4.12%, 4.06% and 3.83% respectively. At the same time, railway freight transport operator PKP CARGO (WSE: PKP) and videogame developer CD PROJEKT (WSE: CDR) led a handful of gainers, adding 1.39% and 0.91% respectively.

-

16:31

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Thursday, helped by a rise in bank stocks, a day after the Federal Reserve increased interest rates for the first time this year and signaled a faster pace of hikes in 2017. The Fed sees three rate hikes next year instead of the two foreseen as of September, partly as a result of the changes anticipated under President-elect Donald Trump. Fed Chair Janet Yellen also cited an improving labor market and evidence of faster inflation for its 2017 rate outlook.

Most of Dow stocks in positive area (27 of 30). Top gainer - American Express Company (AXP, +2.09%). Top loser - NIKE, Inc. (NKE, -0.42%).

All S&P sectors in positive area. Top gainer - Financials (+1.1%).

At the moment:

Dow 19887.00 +122.00 +0.62%

S&P 500 2267.00 +15.00 +0.67%

Nasdaq 100 4958.25 +25.75 +0.52%

Oil 50.57 -0.47 -0.92%

Gold 1128.20 -35.50 -3.05%

U.S. 10yr 2.61 +0.08

-

16:02

BofA Merrill post FOMC views on the dollar

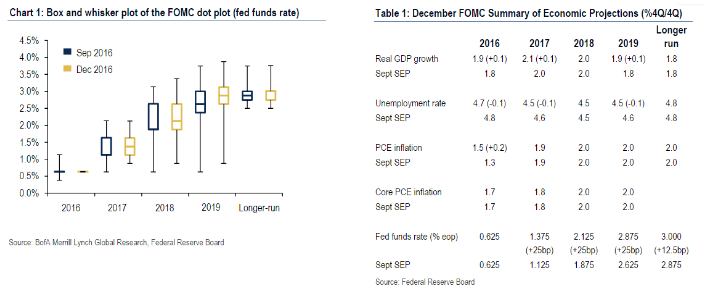

"From 2 to 3 hikes in 2017

The FOMC hiked 25bp to a range of 50 - 75bp, as largely expected. The spotlight was on the dots, which shifted higher -the median forecast for 2017 fed funds increased to 1.375%, which implies three hikes for 2017. The trajectory stayed the same thereafter, assuming three hikes in 2018 and 2019, leaving the median forecast for the FF rate at 2.125% and 2.875%, respectively, for 2018 and 2019 ) The Fed also increased the long-run expectation for the fed funds rate to 3.0%. Outside of the dots, the economic forecasts were little changed with slightly stronger growth and a slightly lower unemployment rate, which was largely a mark-to-market. The statement maintained a cautious tone, noting that the Fed will continue to monitor risks. We are holding with our forecast that the Fed will hike once in 2017 and three times in 2018, but the risks to our forecast are skewed to the upside.

FX: Fed supports our bullish USD views

The FOMC statement confirms our view that the risks of a faster pace of Fed hikes on the back of fiscal easing will be a significant USD support in 2017. The increase in the Fed's dot plots to imply 3 hikes in 2017, while not directly attributable to fiscal easing, belies the upside growth risks from such policies. Indeed, as discussed above, oureconomics team now sees 2 hikes in 2017 (1 before) consistent with these risks.

Additionally, as we anticipated, the Statement and Chair Yellen did not evince any specific concerns about the recent USD rally. When asked in the press conference about the USD strength, Chair Yellen discussed broad asset price movements in terms of expectations for fiscal policy expansion. With trade-weighted USD gains since the election still relatively modest, and the Y/Y changes in the dollar flat, the USD is not the clear and present danger it was in the past 1.5 years. Also, the factors driving the Fed (namely Fed hikes and best US growth expectations) are what's driving the USD, not ECB/BOJ easing, so they are more able to withstand the tightening of financial conditions as a result. This leaves further room for the dollar to rise in the absence of a negative hit to growth & equity prices and/or a more permanent shift by the new administration away from the Treasury's long-held 'strong dollar' policy.

Bottom line, the trajectory of Fed policy will remain a positive USD support heading into 2017. We do see some risk that stretched fast money positioning (and other idiosyncratic factors) could lead to some periodic USD pullbacks, but the trend remains firmly higher following today's meeting".

Copyright © 2016 BofAML, eFXnews™

-

15:37

BOC Financial System Review - Economic growth has been modest

Economic growth has been modest: after a disappointing first half of the year, global economic growth has regained some momentum, led by solid fundamentals in the United States and a modest pickup in emerging markets. The adjustment of the Canadian economy to low commodity prices is well under way. Growth in Canada is supported by fiscal measures, as well as accommodative monetary and financial conditions. New housing finance rules will mitigate household vulnerabilities over time and are expected to slow the housing market.

-

15:15

Notable rise in US builder sentiment - NAHB

Builder confidence in the market for newly-built single-family homes jumped seven points to a level of 70 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This is the highest reading since July 2005.

"This notable rise in builder sentiment is largely attributable to a post-election bounce, as builders are hopeful that President-elect Trump will follow through on his pledge to cut burdensome regulations that are harming small businesses and housing affordability," said NAHB Chairman Ed Brady, a home builder and developer from Bloomington, Ill. "This is particularly important, given that a recent NAHB study shows that regulatory costs for home building have increased 29 percent in the past five years."

-

15:00

U.S.: NAHB Housing Market Index, December 70 (forecast 63)

-

14:58

WSE: After start on Wall Street

Americans began trading in the area of the reference level, but they had already time yesterday to respond to reports from the US monetary authorities and importantly had a chance to sleep with it, and now they find also the relative calm market shares in the European part of the session. Today's response should already be somewhat more subdued, and above all, something more to say about the actual sentiment on Wall Street.

On the Warsaw parquet the day is marked by a declines and one an hour before the end of trading the WIG20 index was at the level of 1,912 points (-1,15%).

-

14:47

U.S. manufacturers reported a strong end to 2016 - Markit

U.S. manufacturers reported a strong end to 2016, with business conditions improving at the fastest pace since March 2015. At 54.2 in December, up fractionally from 54.1 in November, the seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers' Index™ (PMI™ ) 1 continued its recovery from the post-crisis low seen in May (50.7).

-

14:46

U.S.: Manufacturing PMI, December 54.2 (forecast 54.2)

-

14:38

-

14:33

U.S. Stocks open: Dow +0.24%, Nasdaq +0.14%, S&P +0.10%

-

14:26

Before the bell: S&P futures -0.02%, NASDAQ futures -0.09%

U.S. stock-index futures were little changed after some post-Fed volatility yesterday. Investors also assessed a raft of macroeconomic data.

Global Stocks:

Nikkei 19,273.79 +20.18 +0.10%

Hang Seng 22,059.40 -397.22 -1.77%

Shanghai 3,118.32 -22.21 -0.71%

FTSE 6,947.00 -2.19 -0.03%

CAC 4,796.57 +27.33 +0.57%

DAX 11,281.02 +36.18 +0.32%

Crude $50.55 (-0.96%)

Gold $1,130.40 (-2.86%)

-

13:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.08

-0.37(-1.2151%)

4527

Amazon.com Inc., NASDAQ

AMZN

769.3

0.48(0.0624%)

25071

AMERICAN INTERNATIONAL GROUP

AIG

66.1

0.09(0.1363%)

100

Apple Inc.

AAPL

115.05

-0.14(-0.1215%)

108385

AT&T Inc

T

40.95

-0.15(-0.365%)

23926

Barrick Gold Corporation, NYSE

ABX

14.35

-0.38(-2.5798%)

371450

Caterpillar Inc

CAT

93.53

-0.21(-0.224%)

2856

Chevron Corp

CVX

115.6

-0.36(-0.3105%)

2937

Cisco Systems Inc

CSCO

30.58

0.12(0.394%)

820

Citigroup Inc., NYSE

C

59.9

0.45(0.7569%)

21939

E. I. du Pont de Nemours and Co

DD

73.7

-0.01(-0.0136%)

110

Exxon Mobil Corp

XOM

90.27

-0.31(-0.3422%)

4266

Facebook, Inc.

FB

119.95

-0.26(-0.2163%)

68939

Ford Motor Co.

F

12.51

-0.02(-0.1596%)

19054

General Motors Company, NYSE

GM

35.9

-0.05(-0.1391%)

1410

Goldman Sachs

GS

241.32

1.39(0.5793%)

14163

Google Inc.

GOOG

797

-0.07(-0.0088%)

1169

Intel Corp

INTC

36.7

0.15(0.4104%)

401

International Business Machines Co...

IBM

167.89

-0.62(-0.3679%)

5811

Johnson & Johnson

JNJ

115.46

0.47(0.4087%)

685

JPMorgan Chase and Co

JPM

85.5

0.77(0.9088%)

25007

Merck & Co Inc

MRK

61.98

0.18(0.2913%)

621

Microsoft Corp

MSFT

62.81

0.13(0.2074%)

14188

Nike

NKE

52.09

0.30(0.5793%)

3130

Pfizer Inc

PFE

32.89

0.07(0.2133%)

6202

Procter & Gamble Co

PG

84.07

-0.30(-0.3556%)

775

Starbucks Corporation, NASDAQ

SBUX

58.4

-0.35(-0.5957%)

5209

Tesla Motors, Inc., NASDAQ

TSLA

198.5

-0.19(-0.0956%)

8312

The Coca-Cola Co

KO

41.1

-0.11(-0.2669%)

12920

Twitter, Inc., NYSE

TWTR

18.99

0.06(0.317%)

38355

UnitedHealth Group Inc

UNH

160.65

0.79(0.4942%)

300

Verizon Communications Inc

VZ

51.4

-0.23(-0.4455%)

9852

Visa

V

79.79

0.66(0.8341%)

8828

Wal-Mart Stores Inc

WMT

71.39

0.05(0.0701%)

1348

Walt Disney Co

DIS

103.5

-0.55(-0.5286%)

3613

Yahoo! Inc., NASDAQ

YHOO

39.85

-1.06(-2.5911%)

81291

Yandex N.V., NASDAQ

YNDX

20.91

0.13(0.6256%)

1350

-

13:54

Upgrades and downgrades before the market open

Upgrades:

Chevron (CVX) upgraded to Outperform from Neutral at Macquarie

Visa (V) upgraded to Buy from Neutral at BofA/Merrill

MasterCard (MA) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0450 (EUR 600m) 1.0500 ( 3.91bln) 1.0550 (783m) 1.0600 (927m) 1.0620 (681m)1.0700 (1.34bln) 1.0750 (1.29bln) 1.0770 (1.01bln)

USDJPY 112.00 (USD 1.14bln) 114.00 (635m) 115.00 (722m) 116.00 (958m)

GBPUSD 1.2200 (GBP 627m)

USDCHF 1.0250 (USD 650m)

AUDUSD 0.7350 (AUD 849m) 0.7500 (505m) 0.7550 (502m)

USDCAD 1.3300 (USD 487m)

-

13:41

Canadian Manufacturing Sales down 0.8% in October

Manufacturing sales declined 0.8% to $51.0 billion in October, following two consecutive monthly gains. The largest decreases were in the primary metal, petroleum and coal product, and machinery industries.

Sales fell in 15 of 21 industries, representing 61% of the manufacturing sector. Sales of durable goods decreased 1.1%, while non-durable goods sales were down 0.4%.

Constant dollar sales declined 1.7% in October, reflecting a lower volume of manufactured goods sold. According to the Industrial Product Price Index, prices for the manufacturing sector rose 0.7% in October.

-

13:40

US unemployment claims continue to decline

In the week ending December 10, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 4,000 from the previous week's unrevised level of 258,000. The 4-week moving average was 257,750, an increase of 5,250 from the previous week's unrevised average of 252,500. There were no special factors impacting this week's initial claims. This marks 93 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:38

Business activity grew modestly in New York State

Business activity grew modestly in New York State, according to firms responding to the December 2016 Empire State Manufacturing Survey. The headline general business conditions index climbed eight points to 9.0. The new orders index rose to 11.4, and the shipments index was unchanged at 8.5. Labor market conditions remained weak, with manufacturers reporting declines in employment and hours worked. Inventories continued to fall, and delivery times shortened. The prices paid index rose seven points, pointing to a pickup in input price increases, while the prices received index showed only a slight increase in selling prices.

-

13:36

US current account deficit rose in Q3

The U.S. current account deficit decreased to $113.0 billion (preliminary) in the third quarter of 2016 from $118.3 billion (revised) in the second quarter of 2016, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit decreased to 2.4 percent of current-dollar gross domestic product (GDP) from 2.6 percent in the second quarter.

The $5.3 billion decrease in the current account deficit reflected a $9.0 billion decrease in the deficit on goods that was partly offset by changes in the balances on secondary income, primary income, and services.

-

13:33

US y/y CPI stable at 1.7%

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 1.7 percent before seasonal adjustment.

The shelter and gasoline indexes continued to rise in November, and were again the main reasons for the seasonally adjusted all items increase. The shelter index advanced 0.3 percent in November, while the gasoline index increased 2.7 percent.The all items index rose 1.7 percent for the 12 months ending November; the 12-month all items increase has been rising since it was 0.8 percent in July.

The index for all items less food and energy rose 2.1 percent for the 12 months ending November, and the energy index increased 1.1 percent. In contrast, the food index declined 0.4 percent over the last 12 months.

-

13:30

U.S.: CPI, Y/Y, November 1.7% (forecast 1.7%)

-

13:30

U.S.: NY Fed Empire State manufacturing index , December 9 (forecast 4)

-

13:30

Canada: Manufacturing Shipments (MoM), October -0.8% (forecast 0.4%)

-

13:30

U.S.: CPI, m/m , November 0.2% (forecast 0.2%)

-

13:30

U.S.: CPI excluding food and energy, m/m, November 0.2% (forecast 0.2%)

-

13:30

U.S.: Initial Jobless Claims, 254 (forecast 255)

-

13:30

U.S.: CPI excluding food and energy, Y/Y, November 2.1% (forecast 2.2%)

-

13:30

U.S.: Current account, bln, Quarter III -113 (forecast -111.6)

-

13:30

U.S.: Continuing Jobless Claims, 2018 (forecast 2025)

-

13:30

U.S.: Philadelphia Fed Manufacturing Survey, December 21.5 (forecast 9)

-

12:59

Orders

EUR/USD

Offers 1.0525 1.0550-55 1.0585 1.0600 1.0625-30 1.0650 1.0670-75 1.0685 1.0700

Bids 1.0435 1.0400

GBP/USD

Offers 1.2565 1.2580 1.2600 1.2630-35 1.2650 1.2680 1.2700-05 1.2725-30 1.2750-55

Bids 1.2450 1.2420 1.2400 1.2385 1.2350 1.2335 1.2300

EUR/GBP

Offers 0.8385 0.8400-05 0.8420-25 0.8450 0.8460-65 0.8480 0.8500

Bids 0.8345-50 0.8330-35 0.8300 0.8285 0.8250 0.8200-05

EUR/JPY

Offers 123.60 123.85 124.00 124.20 124.50 124.80 125.00

Bids 123.00 122.80 122.50 122.20 122.00 121.75 121.50

USD/JPY

Offers 118.20-25 118.60118.80 119.00

Bids 117.20 117.00 116.80 116.50 116.30 116.00 115.85 115.50 115.00 114.50

AUD/USD

Offers 0.7420 0.7450 0.7485 0.7500 0.7520-25 0.7550 0.7580 0.7600

Bids 0.7355-60 0.7325-30 0.7300 0.7285 0.7250

-

12:36

-

12:15

WSE: Mid session comment

On the Warsaw market today we have to deal with the predominance of demand-side and foreign capital apparently refrain from further purchases. At the halfway point of today's session the WIG20 index was at the level of 1,914 points (-1.03%) and the turnover in the segment of the largest companies was amounted to PLN 224 million. The main European parquets are doing well and increases dominate there. Particularly well doing banking sector.

-

12:07

EUR/USD tumbles to lowest level since January 2003 - zerohedge

-

12:05

BoE Committee voted unanimously to maintain Bank Rate at 0.25%

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 14 December 2016 the Committee voted unanimously to maintain Bank Rate at 0.25%. The Committee voted unanimously to continue with the programme of sterling non-financial investment-grade corporate bond purchases totalling up to £10 billion, financed by the issuance of central bank reserves. The Committee also voted unanimously to continue with the programme of £60 billion of UK government bond purchases to take the total stock of these purchases to £435 billion, financed by the issuance of central bank reserves.

-

12:04

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

12:00

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

11:01

GBP awaits Bank of England’s decision on interest rate and QE. No change expected but possible volatility due to MPC meeting minutes

-

10:33

SNB's Jordan Expects Brexit Negotiations to Be 'Complex and Arduous'

-

10:14

UK retail sales continue to rise - ONS

In November 2016, the quantity of goods bought (volume) in the retail industry was estimated to have increased by 5.9% compared with November 2015; all store types showed growth with the largest contribution coming from non-store retailing.

Compared with October 2016, the quantity bought was estimated to have increased by 0.2%; there was a mixed picture across store types with strong growth reported in some sectors. In particular, within non-food stores, feedback from household goods stores stated that "Black Friday" events had boosted sales in November.

-

10:07

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.14bln) 1.0550 (887m) 1.0575 (1.21bln) 1.0600 (1.03bln) 1.0675 (924m) 1.0700 (564m) 1.0750 (854m)

USD/JPY 113.00 (USD 632m) 114.55 (700m) 117.00 (940m)

USD/CHF 1.0150 (USD 506m)

AUD/USD 0.7470 (581m)

Информационно-аналитический отдел TeleTrade

-

09:30

United Kingdom: Retail Sales (MoM), November 0.2% (forecast 0.2%)

-

09:30

United Kingdom: Retail Sales (YoY) , November 6.6% (forecast 5.9%)

-

09:03

Mixed euro zone PMI data

The eurozone economy maintained a robust pace of expansion at the end of 2016, according to PMI survey data, rounding off the best quarter this year. Price pressures meanwhile continued to mount. The Markit Eurozone PMI held steady at 53.9 in December according to the flash estimate, based on around 85% of usual monthly survey responses, indicating that business activity grew at a rate identical to November's 11-month high.

While service sector activity continued to rise, the rate of increase slowed, accompanied by similar moderations in growth of both employment and new business inflows.

-

09:00

Eurozone: Services PMI, December 53.1 (forecast 53.8)

-

09:00

Eurozone: Manufacturing PMI, December 54.9 (forecast 53.7)

-

08:37

Major stock exchanges trading mixed: the FTSE 100 6,944.19 -5.00 -0.07%, DAX 11,293.47 48.63 0.43%, CAC 40 4,794.03 24.79 0.52%, IBEX 35 9,248.70 30.30 0.33%

-

08:36

Growth of Germany’s private sector continued at the robust pace - Markit

Growth of Germany's private sector continued at the robust pace seen in the preceding two months during December. The Markit Flash Germany Composite Output Index posted 54.8, down only slightly from 55.0 in November and 55.1 in October. Together, those three readings pointed to the strongest quarter since Q2 2014 (average: 55.0).

-

08:35

Interest on sight deposits at the SNB is to remain at –0.75%

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at -0.75% and the target range for the three-month Libor is unchanged at between -1.25% and -0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The SNB's expansionary monetary policy is aimed at stabilising price developments and supporting economic activity. The negative interest rate and the SNB's willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive, thereby easing pressure on the currency. The Swiss franc is still significantly overvalued.

-

08:31

Switzerland: SNB Interest Rate Decision, -0.75% (forecast -0.75%)

-

08:30

Germany: Manufacturing PMI, December 55.5 (forecast 54.5)

-

08:30

Germany: Services PMI, December 53.8 (forecast 54.9)

-

08:20

WSE: After opening

WIG20 index opened at 1931.36 points (-0.18%)*

WIG 51257.75 -0.19%

WIG30 2232.76 -0.23%

mWIG40 4208.70 -0.24%

*/ - Change to Previous Close

The futures market started the day from a discount of 0.52% to 1,922 points. Contract for the DAX gain of 0.3% after yesterday's slight decline.. Thus, a negative reaction to the Fed for now is focused on emerging markets, including the WSE.

The cash market opened with cosmetics decline. A large turnover seen in the ABC Data (WSE: ABC) after yesterday's statement to discontinue the proceedings against the company by the Tax Office. Among large companies well-presented Eurocash (WSE: EUR), which informs about qualified approval take over the PDA company. Slightly lose fuel companies in response to falling oil prices.

After fifteen minutes of trading the WIG20 index was at the level of 1,930 points (-0.24%).

-

08:11

Today’s events

-

At 08:30 GMT the SNB decision on the interest rate

-

At 12:00 GMT Bank of England's interest rate decision

-

At 16:15 GMT the Bank of Canada Governor Stephen Poloz will deliver a speech

-

-

08:09

French private sector grew at a solid rate in December

The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 52.8, compared to November's reading of 51.4. The latest reading pointed to a solid rate of growth that was the best in a year-and-a-half.

Commenting on the Flash PMI data, Alex Gill, Economist at IHS Markit said: "According to latest survey data, the French private sector grew at a solid rate in December. Underpinning the expansion was a marked rise in manufacturing output, driven by stronger domestic and foreign demand conditions. Service sector activity also improved, albeit to a lesser extent. In turn, firms hired additional staff members for the second successive month. Encouraging signs for France as the country seeks to combat a high level of unemployment."

-

08:00

France: Services PMI, December 52.6 (forecast 52)

-

08:00

France: Manufacturing PMI, December 53.5 (forecast 51.9)

-

07:26

WSE: Before opening

Open Market Committee of the US Federal Reserve decided that increases key interest rate by 25 basis points to 0.5-0.75 percent, as expected. At the same time Fed signaled faster than previously announced a series of rate hikes in 2017. The bank said that policymakers now expect three rate hikes of 25 basis points in 2017, while in September two only was expected.

All this affected the sell-off of stocks (the S&P500 fell by 0.8%, the Nasdaq lost 0.5%), strengthening of the dollar and rise of the US bond yields. At the same time dropped the price of oil and gold.

From the point of view of the Warsaw Stock Exchange we may expect initial negative reaction. Proposed by Fed policy change global risk aversion, and this will adversely affect the perception of emerging markets.

In the macro calendar will be announced today a lot of data; the weekly data from the US labor market (14.30 Warsaw time) reading of PMI for the services sector and industry, among others from France (9.00), Germany (9.30), Euroland (10.00) and the USA (15.45; only for the industry).

-

07:24

Options levels on thursday, December 15, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0801 (1499)

$1.0741 (201)

$1.0698 (250)

Price at time of writing this review: $1.0479

Support levels (open interest**, contracts):

$1.0455 (1097)

$1.0405 (1662)

$1.0347 (2800)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 41784 contracts, with the maximum number of contracts with strike price $1,1500 (3247);

- Overall open interest on the PUT options with the expiration date March, 13 is 42525 contracts, with the maximum number of contracts with strike price $1,0000 (3602);

- The ratio of PUT/CALL was 1.02 versus 1.01 from the previous trading day according to data from December, 14

GBP/USD

Resistance levels (open interest**, contracts)

$1.2815 (385)

$1.2720 (413)

$1.2625 (1006)

Price at time of writing this review: $1.2543

Support levels (open interest**, contracts):

$1.2482 (468)

$1.2386 (277)

$1.2289 (357)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9753 contracts, with the maximum number of contracts with strike price $1,2600 (1106);

- Overall open interest on the PUT options with the expiration date March, 13 is 12768 contracts, with the maximum number of contracts with strike price $1,1500 (2966);

- The ratio of PUT/CALL was 1.31 versus 1.29 from the previous trading day according to data from December, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:18

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.9%, CAC40 -0.8%, FTSE -0.5%

-

07:16

Australian Consumer Inflationary Expectations rose by 0.2

The expected inflation rate (30-per-cent trimmed mean measure), reported in the Melbourne Institute Survey of Consumer Inflationary Expectations, rose by 0.2 percentage points to 3.4 per cent in December from 3.2 per cent in November.

In December, the weighted proportion of respondents (excluding the 'don't know' category) expecting the inflation rate to fall within the 0-5 per cent range fell by 5.2 percentage points to 67.9 per cent. The weighted mean of responses within this range fell slightly from 2.3 per cent last month to 2.2 per cent in December

-

07:15

Improvement in manufacturing conditions of Japan - Markit

Flash Japan Manufacturing PMI at 51.9 in December (51.3 in November), signalling the greatest improvement in manufacturing conditions since January.

Commenting on the Japanese Manufacturing PMI survey data, Amy Brownbill, economist at IHS Markit, which compiles the survey, said:

"Latest survey data pointed to a further improvement in the Japanese manufacturing sector. Output and new orders both increased at sharper rates, with new work inflows rising at the quickest pace since January. As a result, goods producers were more optimistic towards taking on additional workers, with the rate of job creation picking up to a 32-month high. Manufacturers also increased their input buying at the quickest rate in ten months. However, cost inflationary pressures accelerated to a 13-month peak, with reports of steep rises in raw material costs driving up input prices."

-

07:13

Bank of Korea keeps base rate unchanged at 1.25%, as expected - Livesquawk

-

07:12

Mixt data for Australian labor force

-

Employment increased 39,100 to 11,973,200. Full-time employment increased 39,300 to 8,166,200 and part-time employment decreased 200 to 3,807,000.

-

Unemployment increased 17,000 to 725,200. The number of unemployed persons looking for full-time work increased 15,100 to 512,100 and the number of unemployed persons only looking for part-time work decreased 1,900 to 213,100.

-

Unemployment rate increased 0.1 pts to 5.7%.

-

Participation rate increased 0.2 pts to 64.6%.

-

Monthly hours worked in all jobs decreased 10.4 million hours to 1663.3 million hours.

-

-

07:09

Modest acceleration of Swiss GDP expected

Economic forecasts by the Federal Government's Expert Group. After displaying positive development over several quarters, Switzerland's GDP nearly stagnated in the third quarter of 2016. However, preliminary indicators now point to a renewed pick-up in growth, and the global economy is expected to continue generating momentum.

The Expert Group therefore maintains its previous assessment and anticipates a GDP growth of 1.5% for full-year 2016. It expects to see a modest acceleration of GDP growth to 1.8% in 2017 and 1.9% in 2018, driven by both domestic demand and foreign trade. As the recovery continues, the unemployment rate will likely decline gradually from 3.3% (2016) to 3.2% (2017), and then to 3.1% (2018). The economic outlook thus remains positive, even if the "Swiss franc shock" will likely continue to have some impact on the economy.

-

07:06

0.25% rate hike, 3 more expected next year. Dollar surges

The Federal Reserve on Wednesday raised its key interest rate for only the second time in a decade, by a quarter-point to 0.5%-0.75%.

The Fed last hiked the benchmark rate a year ago, but a winter economic slowdown global uncertainties prevented subsequent tightening, until now, says rttnews.

With the jobs market improving, inflation picking up, and U.S. stocks at record highs, policy makers ran out of reasons to delay any further.

"Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year," the Fed statement read.

Markets are expected to take today's rate hike in stride, but the outlook on interest rates for 2017 remains somewhat murky. The Fed's 'dot plots' now predict three rate hikes in 2017, one more than previously estimated.

-

06:15

Global Stocks

European stocks finished lower Wednesday, stepping away from their best level in 11 months, as investors prepared for a likely interest-rate increase by the U.S. Federal Reserve.

U.S. stocks ended a volatile session lower on Wednesday, as investors grappled with the prospect of a faster pace of rate increases in 2017 than had been previously forecast. The Federal Reserve raised its key short-term rate on Wednesday, as had been universally expected, but it also forecast three rate increases in 2017, compared with the two that had been anticipated at its previous meeting in September. While the revised outlook could be taken as a positive sign-the Fed has said it would only raise rates when it deems the economy strong enough to withstand such a move-it added an element of uncertainty to the market.

Asian markets were down across the board Thursday after the U.S. Federal Reserve overnight indicated it would raise interest rates faster than expected in 2017. Overnight, the Federal Reserve raised the federal-funds rate by a quarter of a percentage point to between 0.50% and 0.75%, and said it expected to raise short-term rates next year by another 0.75 percentage points, spread over three rate increases.

-

00:31

Japan: Manufacturing PMI, December 51.9 (forecast 51.5)

-

00:31

Australia: Changing the number of employed, November 39.1 (forecast 20)

-

00:30

Australia: Unemployment rate, November 5.7% (forecast 5.6%)

-

00:00

Australia: Consumer Inflation Expectation, November 3.4%

-