Market news

-

23:28

Stocks. Daily history for Dec 14’2016:

(index / closing price / change items /% change)

Nikkei 225 19,253.61 +3.09 +0.02%

Shanghai Composite 3,140.80 -14.24 -0.45%

S&P/ASX 200 5,584.62 0.00 0.00%

FTSE 100 6,949.19 -19.38 -0.28%

CAC 40 4,769.24 -34.63 -0.72%

Xetra DAX 11,244.84 -39.81 -0.35%

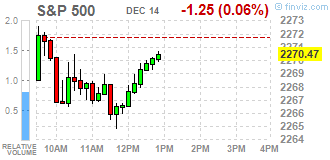

S&P 500 2,253.28 -18.44 -0.81%

Dow Jones Industrial Average 19,792.53 -118.68 -0.60%

S&P/TSX Composite 15,197.18 -188.09 -1.22%

-

20:03

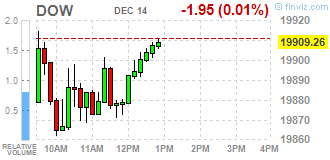

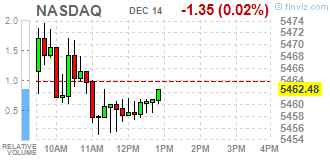

DJIA 19825.34 -85.87 -0.43%, NASDAQ 5449.22 -14.61 -0.27%, S&P 500 2259.24 -12.48 -0.55%

-

17:58

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed. The post-election rally in U.S. stocks took a breather on Wednesday, as investors turned their attention to the outcome of the Federal Reserve's policy meeting.

Most of Dow stocks in positive area (17 of 30). Top gainer - Visa Inc. (V, +0.80%). Top loser - Exxon Mobil Corporation (XOM, -1.22%).

Most S&P sectors in negative area. Top gainer - Technology (+0.1%). Top loser - Conglomerates (-0.6%).

At the moment:

Dow 19850.00 -8.00 -0.04%

S&P 500 2265.00 -2.75 -0.12%

Nasdaq 100 4944.50 +7.00 +0.14%

Oil 51.95 -1.03 -1.94%

Gold 1164.70 +5.70 +0.49%

U.S. 10yr 2.43 -0.05

-

17:01

European stocks closed: FTSE 6949.19 -19.38 -0.28%, DAX 11244.84 -39.81 -0.35%, CAC 4769.24 -34.63 -0.72%

-

16:29

WSE: Session Results

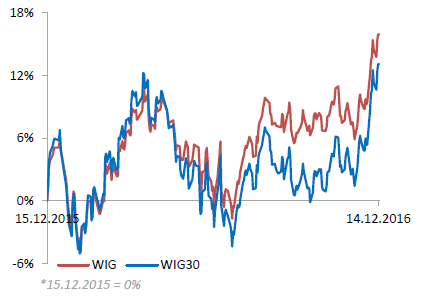

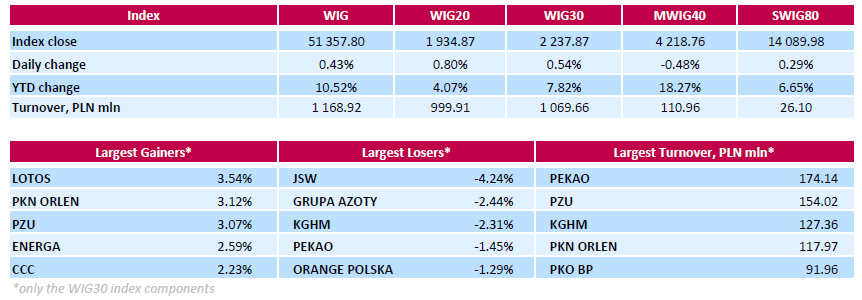

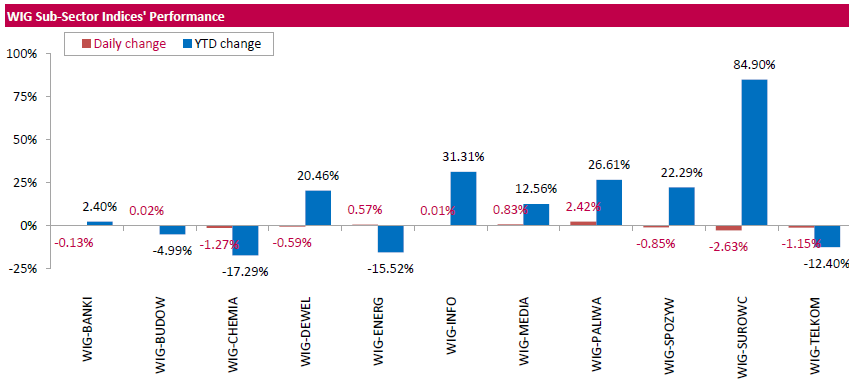

Polish equity market closed higher on Wednesday. The broad market measure, the WIG index, rose by 0.43%. Sector performance within the WIG Index was mixed. Oil and gas (+2.42%) fared the best, while materials (-2.63%) fell the most.

The large-cap stocks' measure, the WIG30 Index, gained 0.54%. In the index basket, two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN) were the biggest advancers, climbing by 3.54% and 3.12% respectively. Other noticeable risers were insurer PZU (WSE: PZU), genco ENERGA (WSE: ENG) and footwear retailer CCC (WSE: CCC), which added between 2.23% and 3.07%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the decliners, dropping by 4.24%. The media reported that unions at the company demand bonuses, which were put on hold due to company's problems caused by low coal prices. JSW's management opposes unions' demands, as the company has to repay PLN 1.3 bln ($312.73 mln) bonds. Among other biggest decliners were chemical producer GRUPA AZOTY (WSE: ATT) and copper producer KGHM (WSE: KGH), which dropped by 2.44% and 2.31% respectively.

-

14:52

WSE: After start on Wall Street

The afternoon data from the US economy were slightly disappointing, mainly the decline in industrial production by 0.4 percent, which means that data from this sector are the worst since March this year. The last four months were not too good, so the data will be read in terms of a warning against a possible weakening of the GDP in the fourth quarter.

Wall Street began sessions at a neutral level, what is typical for the days in which the message of the FOMC is expected. Therefore the last hour of trading on the Warsaw Stock Exchange should not change much.

An hour before the close of trading the WIG20 index was at the level of 1,924 points (+ 0.25%).

-

14:34

U.S. Stocks open: Dow -0.07%, Nasdaq +0.07%, S&P -0.08%

-

14:27

Before the bell: S&P futures -0.11%, NASDAQ futures +0.04%

U.S. stock-index futures were little changed in anticipation of today's FOMC statement and press conference of Fed Chair Yellen's.

Global Stocks:

Nikkei 19,253.61 +3.09 +0.02%

Hang Seng 22,456.62 +9.92 +0.04%

Shanghai 3,140.80 -14.24 -0.45%

FTSE 6,961.60 -6.97 -0.10%

CAC 4,775.11 -28.76 -0.60%

DAX 11,241.93 -42.72 -0.38%

Crude $52.19 (-1.49%)

Gold $1,164.10 (+0.44%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

95.82

-0.20(-0.2083%)

576

AMERICAN INTERNATIONAL GROUP

AIG

95.82

-0.20(-0.2083%)

576

Apple Inc.

AAPL

114.96

-0.23(-0.1997%)

96642

AT&T Inc

T

41.4

0.04(0.0967%)

12171

Barrick Gold Corporation, NYSE

ABX

116

0.11(0.0949%)

311

Boeing Co

BA

156.23

-0.43(-0.2745%)

2100

Caterpillar Inc

CAT

95.82

-0.20(-0.2083%)

576

Chevron Corp

CVX

116.8

-0.62(-0.528%)

2155

Citigroup Inc., NYSE

C

59.27

-0.52(-0.8697%)

33012

Deere & Company, NYSE

DE

116

0.11(0.0949%)

311

Exxon Mobil Corp

XOM

92.19

-0.39(-0.4213%)

12233

Facebook, Inc.

FB

120.25

-0.06(-0.0499%)

108741

Ford Motor Co.

F

12.56

-0.21(-1.6445%)

196778

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.94

-0.10(-0.6649%)

67335

General Electric Co

GE

92.19

-0.39(-0.4213%)

12233

General Motors Company, NYSE

GM

136.26

-0.28(-0.2051%)

582

Goldman Sachs

GS

236.75

-1.80(-0.7546%)

3549

Google Inc.

GOOG

796.91

0.81(0.1017%)

4340

Hewlett-Packard Co.

HPQ

95.82

-0.20(-0.2083%)

576

Home Depot Inc

HD

136.26

-0.28(-0.2051%)

582

Intel Corp

INTC

95.82

-0.20(-0.2083%)

576

International Business Machines Co...

IBM

168.5

0.21(0.1248%)

1426

Johnson & Johnson

JNJ

116

0.11(0.0949%)

311

JPMorgan Chase and Co

JPM

84.16

-0.60(-0.7079%)

11238

Microsoft Corp

MSFT

63.04

0.06(0.0953%)

14994

Pfizer Inc

PFE

32.84

0.01(0.0305%)

7964

Procter & Gamble Co

PG

85.19

0.01(0.0117%)

156

Tesla Motors, Inc., NASDAQ

TSLA

198.7

0.55(0.2776%)

13322

The Coca-Cola Co

KO

41.7

-0.06(-0.1437%)

8605

Twitter, Inc., NYSE

TWTR

19.35

-0.02(-0.1033%)

18979

Verizon Communications Inc

VZ

52.31

-0.05(-0.0955%)

622

Walt Disney Co

DIS

95.82

-0.20(-0.2083%)

576

Yahoo! Inc., NASDAQ

YHOO

116

0.11(0.0949%)

311

Yandex N.V., NASDAQ

YNDX

116.8

-0.62(-0.528%)

2155

-

12:05

WSE: Mid session comment

In the first hour of today's session the WIG20 index set a new maximum on local wave of growth. Against bulls is the waiting for the evening statement of Fed, which stabilizes the underlying markets and we should reconsider a continuation of the consolidation. However, there is a noticeable excess of demand and about a 10-percent increase in WIG20 within one month does not exhaust the appetites of buyers. European markets behave stable, what do not interfere with increases in Warsaw. Slowly attention begins to shift on Wall Street, which should introduce additional stabilizing element.

At the halfway point of today's trading the WIG20 index was at the level of 1,924 points (+ 0.24%), the turnover in the segment of the largest companies was amounted to PLN 360 million.

-

11:43

Major stock indices in Europe show a negative trend

European stocks traded in the red zone after yesterday reached the highest level since January. Selling influenced by increased caution of investors on the eve of the FOMC meeting.

"Investors have traditionally been cautious in anticipation of the Fed's verdict, especially today, given expectations of a interest rate hike, as well as updated forecasts for further rate hikes in the US, which is likely to affect pricing across all asset classes", - said Accendo Markets analyst Mike van Dulko.

Recall the results of the December Fed meeting will be announced today at 19:00 GMT.

Some influence on the course of trading also provided statistical data from the UK and the eurozone. The Office for National Statistics said that the number of people employed in the UK has fallen for the first time in more than a year, reflecting a slowdown in the labor market after Brexit. According to the data, the unemployment rate in the period from August to October remained at around 4.8 percent, which corresponds to the forecast of economists. However, the number of employed decreased by 6,000, recording the first decline since the second quarter of last year. Meanwhile, the number of unemployed decreased by 16,000 from August to October, as fewer people looked for work. The ONS also said that the number of applications for unemployment benefits rose by 2,400 in November after increasing by 13,300 in October (revised to 9800). Economists had expected the index to rise by 5 000. Meanwhile, the salary for the period from August to October showed strong growth. The total income of employees, including bonuses, rose by 2.5 per cent per annum, compared with an increase of 2.4 percent in the three months to September. Last growth rate was the highest in over a year.

The report submitted by Eurostat, showed that the seasonally adjusted volume of industrial production in the euro area fell in October by 0.1% after falling 0.9% in the previous month (revised from -0.8%). The experts predicted an increase of 0.2%. Meanwhile, industrial production in the EU fell by 0.3% after falling 0.7% the previous month. On an annual basis, industrial production increased by 0.6% in the euro area and by 0.5% in the EU. It was expected that production in the euro zone will grow by 0.8% after rising 1.3% in September (revised from + 1.2%).

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.45 per cent after yesterday recorded a growth of 1.06 percent. 16 out of 19 industry groups showing a decrease, led by the health sector and the mining segment. Shares of oil companies are getting cheaper for the first time in six days, in response to the decline of oil prices.

Capitalization of Actelion Ltd fell 5.9 percent after Johnson & Johnson announced that it has completed the discussion of the potential transaction with the Swiss drugmaker.

Inditex shares decreased by 2.8 percent, despite reports that the net profit for the first nine months (February to October) increased by 9% to 2.2 billion euros.

Securities of Monte dei Paschi di Siena fell to 1.7 percent, as the Italian lender confirmed that the ECB has rejected a request to extend the deadline for raising funds.

Metro shares rose 4.8% on news that the company's profit before tax and one-off factors in the 4th increased by 31%, to 568 million euros, beating analysts' forecast.

At the moment:

FTSE 100 6956.93 -11.64 -0.17%

DAX -34.71 11249.94 -0.31%

CAC 40 4772.43 -31.44 -0.65%

-

08:37

Major stock markets were traded in the red: FTSE -0.2%, DAX -0.3%, CAC40 -0.5%, FTMIB -0.6%, IBEX -0.4%

-

08:18

WSE: After opening

WIG20 index opened at 1917.77 points (-0.09%)*

WIG 51064.67 -0.15%

WIG30 2220.02 -0.26%

mWIG40 4242.93 0.09%

*/ - change to previous close

The futures market started the day in the area of yesterday's close. The first minutes on the cash market both in Warsaw and in Euroland was under a sign of a fast descent of the market and then return, which may suggest checking the level at which there is demand.

After fifteen minutes of trading the WIG20 index was at the level of 1,908 points (-0.56%).

-

07:30

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 + 0.2%, FTSE flat

-

07:25

WSE: Before opening

Tuesday's session on the New York stock exchange ended with increases in the major indexes, which reported the new records of all time. At the close the Dow Jones Industrial rose by 0.58 percent, the S&P500 by 0.65 percent and the Nasdaq Composite gained 0.95 percent.

In the morning we see a slight withdrawal in Asia and slightly weaker attitude of derivatives on the S&P500 and the DAX, which may lead to modest declines at the opening of the European markets. The movements should not be serious. Investors are waiting for the most important and probably the last major event of the year, which is the evening message from the Federal Open Market Committee (FOMC).

Europe will be tomorrow able to refer to what the market will send the Fed this evening, so we might want to reckon with conservative trade today.

The today's macro calendar will show readings of the industrial production dynamics in Europe and the USA.

On the Warsaw market overcome of a several weeks consolidation and the psychological barrier of 1,900 points opened the way to a meeting by the WIG20 index with this year's peaks and the upper limit of consolidation at 2000 points.

-

06:21

Global Stocks

European stocks jumped to an 11-month high on Tuesday as Italian bank shares strengthened after the country's largest lender, UniCredit SpA, rolled out a restructuring plan.

U.S. stocks set fresh records on Tuesday with the Dow Jones Industrial Average closing at a high for the seventh session in a row as it moved within 100 points of the 20,000 milestone ahead of the Federal Reserve's interest-rate decision Wednesday. The market is pricing in a nearly 100% chance that the Federal Open Market Committee will lift key interest rates, which leaves much attention on clues for future policy decisions.

Asian markets remained in limbo Wednesday ahead of critical meeting by the U.S. Federal Reserve, which is widely expected to raise interest rates. Asian markets have been in lockdown so far this week, with traders avoiding the risk of being caught out by a surprise Fed inaction. Traders are also waiting for guidance on the Fed's plans for rate rises in 2017.

-