Market news

-

23:28

Stocks. Daily history for Dec 13’2016:

(index / closing price / change items /% change)

Nikkei 225 19,250.52 +95.49 +0.50%

Shanghai Composite 3,155.04 +2.07 +0.07%

S&P/ASX 200 5,545.05 0.00 0.00%

FTSE 100 6,968.57 +78.15 +1.13%

CAC 40 4,803.87 +43.10 +0.91%

Xetra DAX 11,284.65 +94.44 +0.84%

S&P 500 2,271.72 +14.76 +0.65%

Dow Jones Industrial Average 19,911.21 +114.78 +0.58%

S&P/TSX Composite 15,385.27 +97.57 +0.64%

-

20:01

DJIA 19914.28 117.85 0.60%, NASDAQ 5471.85 59.31 1.10%, S&P 500 2272.13 15.17 0.67%

-

17:01

European stocks closed: FTSE 6968.57 78.15 1.13%, DAX 11284.65 94.44 0.84%, CAC 4803.87 43.10 0.91%

-

16:32

WSE: Session Results

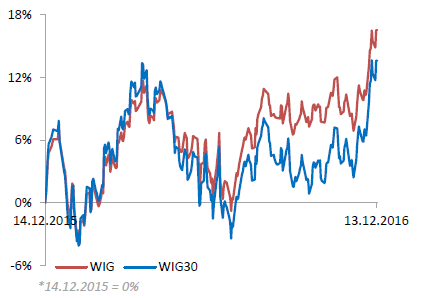

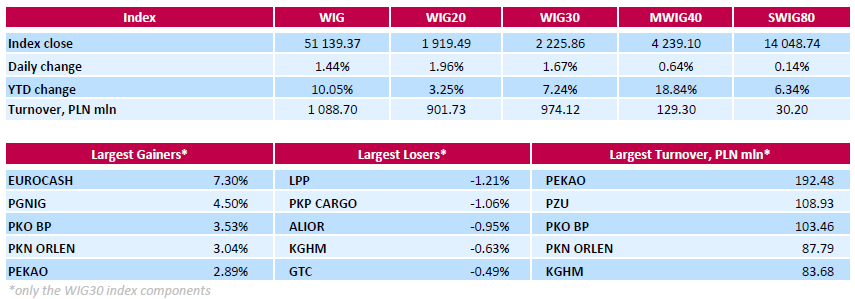

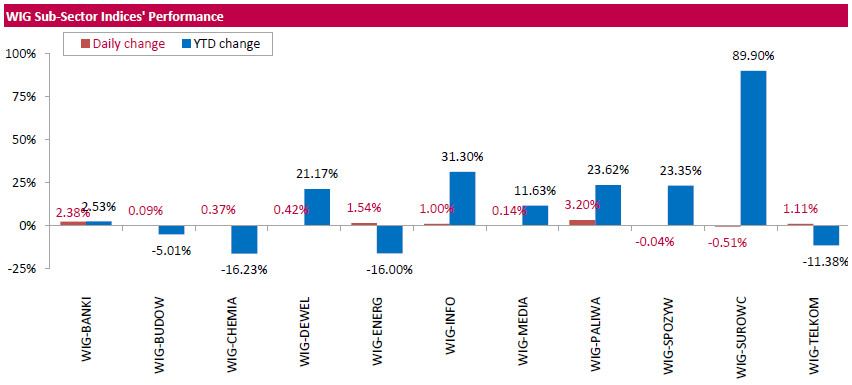

Polish equity market closed higher on higher. The broad market measure, the WIG Index, rose by 1.44%. The WIG sub-sector indices were mainly higher with oil and gas (+3.20%) outperforming.

The large-cap WIG30 Index went up 1.67%. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) was the best-performing name, climbing by 7.3%, more than erasing the previous day's losses of 3.73%. It was followed by oil and gas producer PGNIG (WSE: PGN), oil refiner PKN ORLEN (WSE: PKN) and three banking names PKO BP (WSE: PKO), PEKAO (WSE: PEO) and BZ WBK (WSE: BZW), which added between 2.84% and 4.5%. On the other side of the ledger, clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and bank ALIOR (WSE: ALR) were the biggest decliners, dropping by 1.21%, 1.06% and 0.95% respectively.

-

16:01

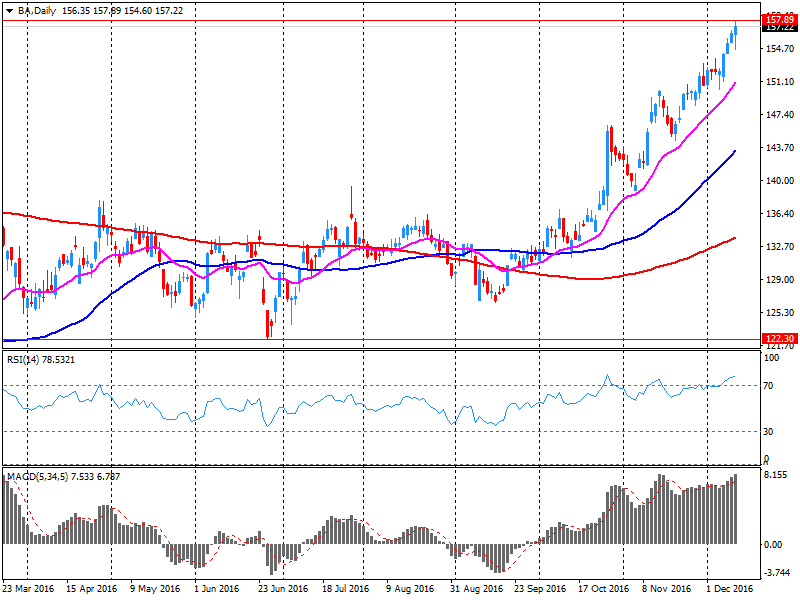

Boeing (BA) approved an increase in quarterly payments of 30% and a new $ 14 billion buy back program

According to Boeing, the company's Board of Directors decided to increase its quarterly payout by 30.3% to $ 1.42 / share from $ 1.09 / share.

In addition, the board approved a new $ 14 billion buy back, which will replace the 2016 program. According to the company, they bought shares in amount of $ 7 billion this year. According to the report, the company will resume repayment in January 2017.

BA shares rose in premarket trading to $ 159.79 (+ 1.67%).

-

15:59

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday. The S&P 500 and the Dow hit fresh record highs as a post-election rally rolled on, with investors also keeping a close watch on the Federal Reserve's two-day meeting where the central bank is widely expected to lift interest rates. The Dow is less than 1% away from hitting the 20,000 mark for the first time.

Most of Dow stocks in positive area (17 of 30). Top gainer - NIKE, Inc. (NKE, +2.73%). Top loser - The Boeing Company (BA, -1.79%).

Most S&P sectors also in positive area. Top gainer - Technology (+1.2%). Top loser - Industrial goods (-0.3%).

At the moment:

Dow 19816.00 +93.00 +0.47%

S&P 500 2261.75 +11.25 +0.50%

Nasdaq 100 4941.50 +75.25 +1.55%

Oil 52.57 -0.26 -0.49%

Gold 1159.00 -6.80 -0.58%

U.S. 10yr 2.47 -0.01

-

14:51

WSE: After start on Wall Street

The market on Wall Street begin from increase of more than 0.3%, which puts the S&P500 index to new historic highs. Their improvement is cosmetic, but in line with the current trend and improved sentiment in Europe. As we may see hardly anyone is afraid of a rate hike by the Federal Reserve, which has been reflected in share prices in developed markets long ago.

Optimism in the US facilitates increases on the Warsaw market at the end of the session.

An hour before the close of trading the WIG20 index was at the level of 1,914 points (+ 1.70%).

-

14:33

U.S. Stocks open: Dow +0.37%, Nasdaq +0.38%, S&P +0.36%

-

14:27

Before the bell: S&P futures +0.35%, NASDAQ futures +0.42%

U.S. stock-index futures rose amid optimism the Fed meeting this week will not disappoint markets as the U.S. regulator boosts interest rates to reflect a strengthening economy.

Global Stocks:

Nikkei 19,250.52 +95.49 +0.50%

Hang Seng 22,446.70 +13.68 +0.06%

Shanghai 3,155.36 +2.39 +0.08%

FTSE 6,935.97 +45.55 +0.66%

CAC 4,784.81 +24.04 +0.50%

DAX 11,244.70 +54.49 +0.49%

Crude $53.02 (+0.36%)

Gold $1,164.70 (-0.09%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.4

0.16(0.5122%)

500

ALTRIA GROUP INC.

MO

66.58

0.09(0.1354%)

1079

Amazon.com Inc., NASDAQ

AMZN

763.97

3.85(0.5065%)

11756

American Express Co

AXP

73.59

0.01(0.0136%)

400

Apple Inc.

AAPL

113.66

0.36(0.3177%)

62794

AT&T Inc

T

41.21

0.09(0.2189%)

10745

Barrick Gold Corporation, NYSE

ABX

15.36

0.05(0.3266%)

20192

Boeing Co

BA

159.79

2.63(1.6734%)

17175

Caterpillar Inc

CAT

95.03

-0.05(-0.0526%)

650

Cisco Systems Inc

CSCO

30.18

0.01(0.0331%)

17027

Citigroup Inc., NYSE

C

59.45

-0.10(-0.1679%)

26661

Exxon Mobil Corp

XOM

91.74

0.76(0.8353%)

41748

Facebook, Inc.

FB

118.19

0.42(0.3566%)

58550

FedEx Corporation, NYSE

FDX

198.74

1.10(0.5566%)

1735

Ford Motor Co.

F

12.87

0.05(0.39%)

39718

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.45

0.09(0.5859%)

64077

General Electric Co

GE

31.93

0.07(0.2197%)

20816

General Motors Company, NYSE

GM

37.2

0.10(0.2695%)

13767

Goldman Sachs

GS

237.42

0.25(0.1054%)

15864

Google Inc.

GOOG

793

3.73(0.4726%)

2188

Hewlett-Packard Co.

HPQ

15.7

-0.13(-0.8212%)

9380

Intel Corp

INTC

35.88

-0.09(-0.2502%)

17516

JPMorgan Chase and Co

JPM

84.62

-0.11(-0.1298%)

16927

Merck & Co Inc

MRK

61.3

0.05(0.0816%)

1505

Microsoft Corp

MSFT

62.3

0.13(0.2091%)

11511

Nike

NKE

51.67

0.13(0.2522%)

2575

Procter & Gamble Co

PG

84.5

-0.63(-0.74%)

6420

Tesla Motors, Inc., NASDAQ

TSLA

193.2

0.77(0.4001%)

8407

The Coca-Cola Co

KO

41.7

-0.20(-0.4773%)

16708

Travelers Companies Inc

TRV

120.75

-0.16(-0.1323%)

484

Twitter, Inc., NYSE

TWTR

19.14

0.21(1.1093%)

77989

United Technologies Corp

UTX

111.03

0.64(0.5798%)

559

Verizon Communications Inc

VZ

51.91

0.15(0.2898%)

2010

Visa

V

78.68

0.18(0.2293%)

310

Wal-Mart Stores Inc

WMT

71.88

0.21(0.293%)

7414

Walt Disney Co

DIS

104.1

0.04(0.0384%)

2362

Yahoo! Inc., NASDAQ

YHOO

41.51

0.21(0.5085%)

200

Yandex N.V., NASDAQ

YNDX

20.6

0.31(1.5278%)

2700

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Procter & Gamble (PG) downgraded to Hold from Buy at Deutsche Bank

Coca-Cola (KO) downgraded to Hold from Buy at Deutsche Bank

Other:

FedEx (FDX) initiated with a Overweight at JP Morgan; target $233

Intel (INTC) initiated with a Buy at Loop Capital

-

12:04

WSE: Mid session comment

The first half of today's session brought strong gains in the Warsaw market and positively distinguished our parquet from the background of the European environment.

Exceptionally well behaves today banking sector, which together with energy companies support the main index. Today's impulse seems as movement ended a 2-day process of cooling down the market. Given the scale of withdrawal (shallow adjustment in relation to the scale of earlier increases), it still reflects the strong attitude of buyers.

The turnover in the market is considerable and at the halfway point of today's session in the segment of the largest companies was amounted to PLN 370 million, the WIG20 index at the same time was at the level of 1,906 points (+ 1.29%).

-

11:44

Major stock indices in Europe trading higher

European stocks rose moderately, returning to 11-month high, helped by banking sector shares rally as well as the increase in oil prices.

UniCredit, Italy's largest bank, presented a program aimed at increasing its balance sheet. Under this program, the bank intends to reduce staff by another 6.5 thousand man in the next 3 years. It is expected that this measure will help reduce the cost by 1.7 billion euros per year until 2019. Among the priorities of the bank - to get rid of bad loans. UniCredit plans to sell these assets in the amount of EUR 17.7 billion. UniCredit shares rose by 8.25 per cent,

Oil rose after IEA raised its forecast for oil demand in 2017 with 110,000 barrels a day to 1.3 million barrels per day. Meanwhile, demand for 2016 was increased by 120 thousand barrels a day to 1.4 million barrels a day. In addition, the IEA reported that in November the world's oil reserves have broken a record figure of 98.2 million barrels. OECD stocks in October fell by 75 million barrels after a noted record high of 3.102 billion barrels in July.

Investors are also preparing for the FOMC meeting. It is expected that the Fed will raise short-term interest rates. According to the futures market, the likelihood of tighter monetary is 93.2% against 94.9% the previous day. However, the more investors will be focused on Fed's forecasts about future levels of interest rates.

The composite index of the largest companies in the region Stoxx Europe 600 is trading with an increase of 0.8%..

Quotes of Monte dei Paschi di Siena rose 1.7 percent, as the source in the Ministry of Finance of Italy said that the country is ready, if necessary, to save the bank.

Shares of media companies rose approaching the highest level since late October. Mediaset SpA's capitalization increased by 21.4 per cent, recording the maximum increase in 20 years, after Vivendi SA acquired a 3 percent stake in the company and said it could buy about 20 percent.

At the moment:

FTSE 100 +34.21 6924.63 + 0.50%

DAX +94.30 11284.51 + 0.84%

CAC 40 +35.55 4796.32 + 0.75%

-

08:33

Major stock exchanges trading mixed: FTSE -0.1%, DAX + 0.1%, CAC40 -0.2%, FTMIB -0.4%, IBEX -0.5%

-

08:18

WSE: After opening

WIG20 index opened at 1886.78 points (+0.22%)*

WIG 50463.54 0.10%

WIG30 2191.91 0.12%

mWIG40 4210.07 -0.05%

*/ - change to previous close

The cash market opens with a rise of 0.22% to 1,886 points and with the turnover focused this time on the shares of JSW. In Euroland the German DAX opened neutral, but in the first few bars slightly rising in the wake of the contracts. Somewhat also they gain contracts in the United States. In general picture of the situation should therefore foster a certain stability after yesterday's decline and so it presents the Warsaw Stock Exchange.

After fifteen minutes of trading the WIG20 index was at the level of 1,889 points (+ 0.39%).

-

07:25

WSE: Before opening

Yesterday's session on Wall Street ended with a small loss, which are trying to be made up by contracts this morning. In Asia prevail mixed feelings, but in most cases the changes are minor. Thus, the market situation in the morning feels stable.

Therefore, beginning in Europe promises to be neutral and any possible more traffic will result from internal inspiration, and not from the trends that have shaped after closing the parquets on the Old Continent yesterday.

In today's calendar will be announced reading of the German ZEW index, which is projected to increase in December only symbolically and should not have a major impact on the markets. No need to remind that tomorrow will be a crucial day of the week, it's obviously about the meeting of the Federal Reserve.

On Tuesday morning trading the currency market does not bring any significant changes to the valuation of Polish currency, which continues the consolidation movements from Monday. The zloty is valued by the market as follows: PLN 4.4489 per euro, 4.1852 PLN against the US dollar. Yields on domestic debt amounts to 3,644% for 10-year bonds.

-

07:18

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.2%, FTSE -0.1%

-

06:13

Global Stocks

European stock markets fell from an 11-month high on Monday as investors started to focus on the U.S. Federal Reserve's policy meeting later this week. "After recent gains, investors are quite rightly proceeding with caution," said Rebecca O'Keeffe, head of investment at stockbroker Interactive Investor, in a note. "Although the Federal Reserve meeting this week is almost certain to see the first U.S. interest-rate rise this year, what the Fed will do next year remains pivotal for markets," she added.

U.S. stocks struggled for direction on Monday, with the Dow notching the latest in a string of record closes, while the S&P 500 and Nasdaq finished lower. Major indexes had fluctuated between positive and negative territory with investors appearing reluctant to push shares higher following pronounced gains for Wall Street ahead of a key meeting by the Federal Reserve.

Asian shares were muted on Tuesday, with investors displaying caution ahead of the U.S. Federal Reserve meeting this week. The two-day Federal Open Market Committee meeting will kick off later in the global trading day, when U.S. central bankers will decide whether to raise interest rates. According to CME Group's FedWatch tool, the likelihood of a rate increase is 95.4%, up from 94.9% on Monday.

-