Market news

-

23:53

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter IV 18 (forecast 19)

-

23:50

Japan: BoJ Tankan. Manufacturing Index, Quarter IV 10 (forecast 10)

-

23:30

Australia: Westpac Consumer Confidence, December -3.9%

-

23:29

Commodities. Daily history for Dec 13’2016:

(raw materials / closing price /% change)

Oil 52.46 -0.98%

Gold 1,160.10 +0.09%

-

23:28

Stocks. Daily history for Dec 13’2016:

(index / closing price / change items /% change)

Nikkei 225 19,250.52 +95.49 +0.50%

Shanghai Composite 3,155.04 +2.07 +0.07%

S&P/ASX 200 5,545.05 0.00 0.00%

FTSE 100 6,968.57 +78.15 +1.13%

CAC 40 4,803.87 +43.10 +0.91%

Xetra DAX 11,284.65 +94.44 +0.84%

S&P 500 2,271.72 +14.76 +0.65%

Dow Jones Industrial Average 19,911.21 +114.78 +0.58%

S&P/TSX Composite 15,385.27 +97.57 +0.64%

-

23:28

Currencies. Daily history for Dec 13’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0624 -0,09%

GBP/USD $1,2656 -0,17%

USD/CHF Chf1,012 -0,11%

USD/JPY Y115,17 +0,13%

EUR/JPY Y122,38 +0,06%

GBP/JPY Y145,76 -0,01%

AUD/USD $0,7498 +0,04%

NZD/USD $0,7202 +0,19%

USD/CAD C$1,3129 0,00%

-

23:00

Schedule for today,Wednesday, Dec 14’2016 (GMT0)

00:30 Australia New Motor Vehicle Sales (MoM) November -2.4%

00:30 Australia New Motor Vehicle Sales (YoY) November 1.2%

04:30 Japan Industrial Production (MoM) (Finally) October 0.6% 0.1%

04:30 Japan Industrial Production (YoY) (Finally) October 1.5% -1.3%

08:15 Switzerland Producer & Import Prices, m/m November 0.1%

08:15 Switzerland Producer & Import Prices, y/y November -0.2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y October 2.4% 2.6%

09:30 United Kingdom Average Earnings, 3m/y October 2.3% 2.3%

09:30 United Kingdom Claimant count November 9.8 5

09:30 United Kingdom ILO Unemployment Rate October 4.8% 4.8%

10:00 Eurozone Industrial production, (MoM) October -0.8% 0.2%

10:00 Eurozone Industrial Production (YoY) October 1.2% 1%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) December 8.9

13:30 U.S. Retail sales November 0.8% 0.3%

13:30 U.S. Retail Sales YoY November 4.3%

13:30 U.S. Retail sales excluding auto November 0.8% 0.4%

13:30 U.S. PPI, m/m November 0.0% 0.1%

13:30 U.S. PPI, y/y November 0.8% 0.9%

13:30 U.S. PPI excluding food and energy, m/m November -0.2% 0.2%

13:30 U.S. PPI excluding food and energy, Y/Y November 1.2% 1.3%

14:15 U.S. Capacity Utilization November 75.3% 75.1%

14:15 U.S. Industrial Production (MoM) November 0.0% -0.2%

14:15 U.S. Industrial Production YoY November -0.9%

15:00 U.S. Business inventories October 0.1% -0.1%

15:30 U.S. Crude Oil Inventories December -2.389

19:00 U.S. Fed Interest Rate Decision 0.5%

19:00 U.S. FOMC Economic Projections

19:00 U.S. FOMC Statement

19:30 U.S. Federal Reserve Press Conferenc

21:30 New Zealand Business NZ PMI November 55.2

-

20:01

DJIA 19914.28 117.85 0.60%, NASDAQ 5471.85 59.31 1.10%, S&P 500 2272.13 15.17 0.67%

-

17:01

European stocks closed: FTSE 6968.57 78.15 1.13%, DAX 11284.65 94.44 0.84%, CAC 4803.87 43.10 0.91%

-

16:32

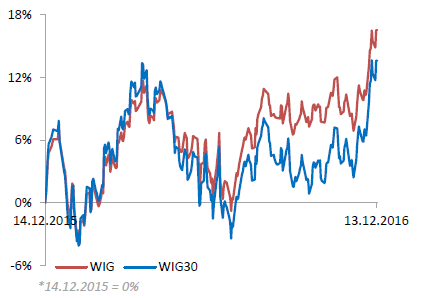

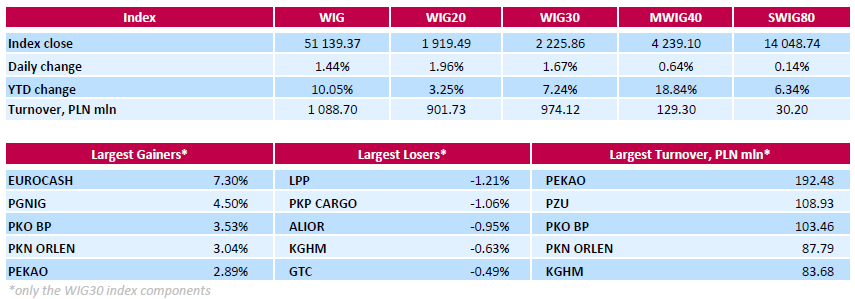

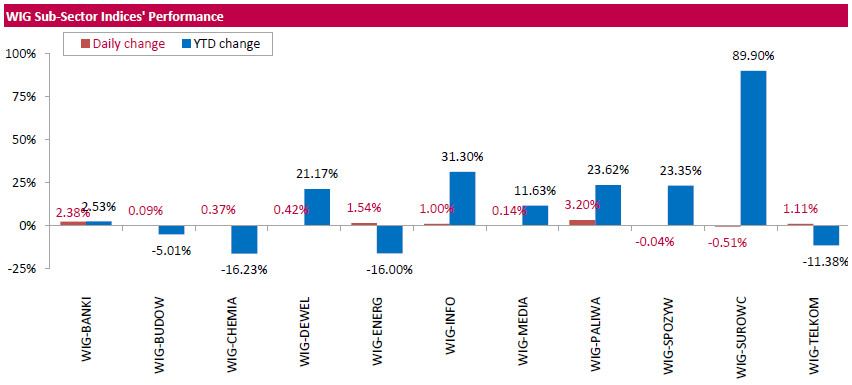

WSE: Session Results

Polish equity market closed higher on higher. The broad market measure, the WIG Index, rose by 1.44%. The WIG sub-sector indices were mainly higher with oil and gas (+3.20%) outperforming.

The large-cap WIG30 Index went up 1.67%. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) was the best-performing name, climbing by 7.3%, more than erasing the previous day's losses of 3.73%. It was followed by oil and gas producer PGNIG (WSE: PGN), oil refiner PKN ORLEN (WSE: PKN) and three banking names PKO BP (WSE: PKO), PEKAO (WSE: PEO) and BZ WBK (WSE: BZW), which added between 2.84% and 4.5%. On the other side of the ledger, clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and bank ALIOR (WSE: ALR) were the biggest decliners, dropping by 1.21%, 1.06% and 0.95% respectively.

-

16:01

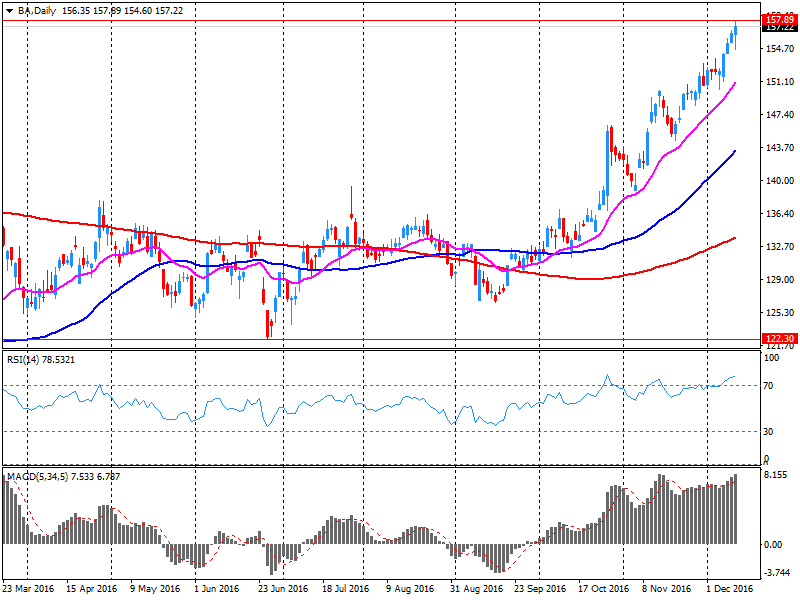

Boeing (BA) approved an increase in quarterly payments of 30% and a new $ 14 billion buy back program

According to Boeing, the company's Board of Directors decided to increase its quarterly payout by 30.3% to $ 1.42 / share from $ 1.09 / share.

In addition, the board approved a new $ 14 billion buy back, which will replace the 2016 program. According to the company, they bought shares in amount of $ 7 billion this year. According to the report, the company will resume repayment in January 2017.

BA shares rose in premarket trading to $ 159.79 (+ 1.67%).

-

15:59

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday. The S&P 500 and the Dow hit fresh record highs as a post-election rally rolled on, with investors also keeping a close watch on the Federal Reserve's two-day meeting where the central bank is widely expected to lift interest rates. The Dow is less than 1% away from hitting the 20,000 mark for the first time.

Most of Dow stocks in positive area (17 of 30). Top gainer - NIKE, Inc. (NKE, +2.73%). Top loser - The Boeing Company (BA, -1.79%).

Most S&P sectors also in positive area. Top gainer - Technology (+1.2%). Top loser - Industrial goods (-0.3%).

At the moment:

Dow 19816.00 +93.00 +0.47%

S&P 500 2261.75 +11.25 +0.50%

Nasdaq 100 4941.50 +75.25 +1.55%

Oil 52.57 -0.26 -0.49%

Gold 1159.00 -6.80 -0.58%

U.S. 10yr 2.47 -0.01

-

15:47

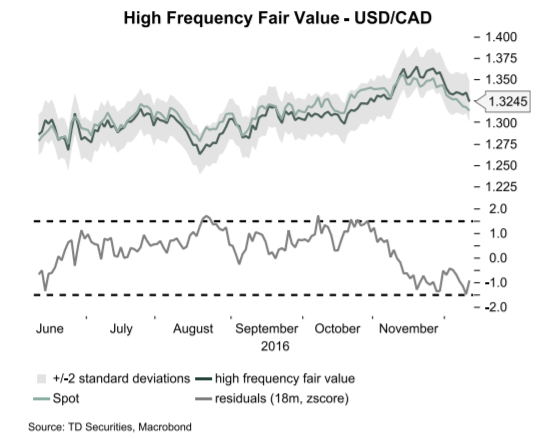

TD is buying USD/CAD dips below 1.31 on stretched valuation

"The songs remains the same for CAD: short covering rally buffeted diverging policy rates. The short squeeze is strongly rooted in the recovery in oil prices following a string of positive news headlines about production cuts. Many have wondered why USDCAD has lagged oil prices but we note that correlation between USDCAD and oil has recently broken down. For instance, oil price levels have only explained about 10% of the variance in USDCAD over the past 3m and close to zero over the past six months. This compares to about 50% over the past year but that number drops to around 35% when you look at the percentage return in USDCAD and oil.

Even so, we believe that the importance of rate differentials and relative output gaps explains the breakdown in oil. Indeed, the BoC still sees about 1.5% worth of slack in the economy while most measures argue that the US economy is close to full capacity. Normally, both countries cycles move is lock-step. However, a mix of cyclical and structural factors have gnawed away at that relationship. This leaves us focused on rate differentials rather than oil and look for the widening rate spreads to continue to drive the pair higher.

We look to buy into dips below 1.31 based on stretched valuation".

Copyright © 2016 TD Securities, eFXnews™

-

15:22

Gold falls ahead of tomorrow's major event

Gold prices fell Tuesday, as the Federal Reserve kicked off a two-day meeting that many investors believe will culminate in a rate increase, according to Dow Jones.

Gold for February delivery was recently down 0.5% at $1160.20 a troy ounce on the Comex division of the New York Mercantile Exchange.

Fed-funds futures showed that traders assigned a 97.2% probability that the central bank will raise rates at the end of its monetary policy meeting Wednesday, according to the CME. Gold struggles to compete with yield-bearing investments when rates rise.

"Gold may not be able to have a clear shot at going substantially higher until the conclusion of the (Fed meeting) on Wednesday," analysts at HSBC wrote in a note to investors.

-

14:54

US small business confidence climbed in November

Small-business owners' confidence about their economic situation climbed in November, according to a report Tuesday, as improvements in the outlook of business conditions and expectations of sales gains followed the election of Donald Trump in the presidential election, says Dow Jones.

The National Federation of Independent Business's small-business optimism index rose to 98.4 last month from October's 94.9, among the highest month-on-month jumps dating back to 2011 and the second-highest rating in that time. Economists surveyed by The Wall Street Journal expected the gauge to climb to 97.0.

-

14:51

WSE: After start on Wall Street

The market on Wall Street begin from increase of more than 0.3%, which puts the S&P500 index to new historic highs. Their improvement is cosmetic, but in line with the current trend and improved sentiment in Europe. As we may see hardly anyone is afraid of a rate hike by the Federal Reserve, which has been reflected in share prices in developed markets long ago.

Optimism in the US facilitates increases on the Warsaw market at the end of the session.

An hour before the close of trading the WIG20 index was at the level of 1,914 points (+ 1.70%).

-

14:33

U.S. Stocks open: Dow +0.37%, Nasdaq +0.38%, S&P +0.36%

-

14:27

Before the bell: S&P futures +0.35%, NASDAQ futures +0.42%

U.S. stock-index futures rose amid optimism the Fed meeting this week will not disappoint markets as the U.S. regulator boosts interest rates to reflect a strengthening economy.

Global Stocks:

Nikkei 19,250.52 +95.49 +0.50%

Hang Seng 22,446.70 +13.68 +0.06%

Shanghai 3,155.36 +2.39 +0.08%

FTSE 6,935.97 +45.55 +0.66%

CAC 4,784.81 +24.04 +0.50%

DAX 11,244.70 +54.49 +0.49%

Crude $53.02 (+0.36%)

Gold $1,164.70 (-0.09%)

-

14:03

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.4

0.16(0.5122%)

500

ALTRIA GROUP INC.

MO

66.58

0.09(0.1354%)

1079

Amazon.com Inc., NASDAQ

AMZN

763.97

3.85(0.5065%)

11756

American Express Co

AXP

73.59

0.01(0.0136%)

400

Apple Inc.

AAPL

113.66

0.36(0.3177%)

62794

AT&T Inc

T

41.21

0.09(0.2189%)

10745

Barrick Gold Corporation, NYSE

ABX

15.36

0.05(0.3266%)

20192

Boeing Co

BA

159.79

2.63(1.6734%)

17175

Caterpillar Inc

CAT

95.03

-0.05(-0.0526%)

650

Cisco Systems Inc

CSCO

30.18

0.01(0.0331%)

17027

Citigroup Inc., NYSE

C

59.45

-0.10(-0.1679%)

26661

Exxon Mobil Corp

XOM

91.74

0.76(0.8353%)

41748

Facebook, Inc.

FB

118.19

0.42(0.3566%)

58550

FedEx Corporation, NYSE

FDX

198.74

1.10(0.5566%)

1735

Ford Motor Co.

F

12.87

0.05(0.39%)

39718

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.45

0.09(0.5859%)

64077

General Electric Co

GE

31.93

0.07(0.2197%)

20816

General Motors Company, NYSE

GM

37.2

0.10(0.2695%)

13767

Goldman Sachs

GS

237.42

0.25(0.1054%)

15864

Google Inc.

GOOG

793

3.73(0.4726%)

2188

Hewlett-Packard Co.

HPQ

15.7

-0.13(-0.8212%)

9380

Intel Corp

INTC

35.88

-0.09(-0.2502%)

17516

JPMorgan Chase and Co

JPM

84.62

-0.11(-0.1298%)

16927

Merck & Co Inc

MRK

61.3

0.05(0.0816%)

1505

Microsoft Corp

MSFT

62.3

0.13(0.2091%)

11511

Nike

NKE

51.67

0.13(0.2522%)

2575

Procter & Gamble Co

PG

84.5

-0.63(-0.74%)

6420

Tesla Motors, Inc., NASDAQ

TSLA

193.2

0.77(0.4001%)

8407

The Coca-Cola Co

KO

41.7

-0.20(-0.4773%)

16708

Travelers Companies Inc

TRV

120.75

-0.16(-0.1323%)

484

Twitter, Inc., NYSE

TWTR

19.14

0.21(1.1093%)

77989

United Technologies Corp

UTX

111.03

0.64(0.5798%)

559

Verizon Communications Inc

VZ

51.91

0.15(0.2898%)

2010

Visa

V

78.68

0.18(0.2293%)

310

Wal-Mart Stores Inc

WMT

71.88

0.21(0.293%)

7414

Walt Disney Co

DIS

104.1

0.04(0.0384%)

2362

Yahoo! Inc., NASDAQ

YHOO

41.51

0.21(0.5085%)

200

Yandex N.V., NASDAQ

YNDX

20.6

0.31(1.5278%)

2700

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Procter & Gamble (PG) downgraded to Hold from Buy at Deutsche Bank

Coca-Cola (KO) downgraded to Hold from Buy at Deutsche Bank

Other:

FedEx (FDX) initiated with a Overweight at JP Morgan; target $233

Intel (INTC) initiated with a Buy at Loop Capital

-

13:45

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0400 (EUR 993m) 1.0500 (504m) 1.0600 (1.23bn) 1.0700 (941m)

USDJPY 114.90 (USD 450m)

AUDUSD 0.7400 (AUD 664m) 0.7420 (505m)

USDCAD 1.3275-80 (USD 553m) 1.3465-75 (1.0bln)

USDSGD 1.4150 (USD 1.23bln)

-

13:35

US import and export prices lower in November

U.S. import prices fell 0.3 percent in November, the U.S. Bureau of Labor Statistics reported today, following increases of 0.4 percent and 0.1 percent the 2 previous months. The drop in November was primarily led by decreasing fuel prices. U.S. export prices also declined in November, edging down 0.1

percent, after a 0.2-percent increase the previous month.

The price index for overall exports edged down 0.1 percent in November, after increasing 0.2 percent in October and 0.3 percent in September. In November, declining nonagricultural prices led the overall decrease. U.S. export prices also fell over the past 12 months, decreasing 0.3 percent. Export prices have not risen on a 12-month basis since the index rose 0.4 percent between August 2013 and August 2014. -

13:30

U.S.: Import Price Index, November -0.3% (forecast -0.4%)

-

12:59

Orders

EUR/USD

Offers 1.0650-55 1.0685 1.0700 1.0730 1.0750 1.07851.0800 1.0820 1.0850

Bids 1.0600 1.0585 1.0550 1.0525-30 1.0500

GBP/USD

Offers 1.2700-05 1.2725-30 1.2750-55 1.2775 1.2800

Bids 1.2655-60 1.2625 1.2600 1.2585 1.2550-55 1.2530-35 1.2500 1.2480 1.2450

EUR/GBP

Offers 0.8400-05 0.8420-25 0.8450 0.8460-65 0.8480 0.8500 0.8535 0.8550

Bids 0.8355-60 0.8335 0.8300 0.8285 0.8250 0.8200-05

EUR/JPY

Offers 122.85 123.00 123.35 123.50 124.00 124.20 124.50

Bids 122.20 122.00 121.75 121.50 121.20 121.00 120.80-85 120.50

USD/JPY

Offers 115.55-60 115.80 116.00 116.25-30 116.50 116.80 117.00

Bids 115.00 114.75-80 114.50 114.20 114.00 113.80 113.50 113.30 113.00

AUD/USD

Offers 0.7500 0.7520-25 0.7550 0.7580 0.7600 0.7630 0.7650

Bids 0.7470 0.7445-50 0.7430 0.7400 0.7380 0.7355-60 0.7325-30 0.7300

-

12:25

Trump to nominate Rex Tillerson as Secretary of State

-

12:04

WSE: Mid session comment

The first half of today's session brought strong gains in the Warsaw market and positively distinguished our parquet from the background of the European environment.

Exceptionally well behaves today banking sector, which together with energy companies support the main index. Today's impulse seems as movement ended a 2-day process of cooling down the market. Given the scale of withdrawal (shallow adjustment in relation to the scale of earlier increases), it still reflects the strong attitude of buyers.

The turnover in the market is considerable and at the halfway point of today's session in the segment of the largest companies was amounted to PLN 370 million, the WIG20 index at the same time was at the level of 1,906 points (+ 1.29%).

-

11:44

Major stock indices in Europe trading higher

European stocks rose moderately, returning to 11-month high, helped by banking sector shares rally as well as the increase in oil prices.

UniCredit, Italy's largest bank, presented a program aimed at increasing its balance sheet. Under this program, the bank intends to reduce staff by another 6.5 thousand man in the next 3 years. It is expected that this measure will help reduce the cost by 1.7 billion euros per year until 2019. Among the priorities of the bank - to get rid of bad loans. UniCredit plans to sell these assets in the amount of EUR 17.7 billion. UniCredit shares rose by 8.25 per cent,

Oil rose after IEA raised its forecast for oil demand in 2017 with 110,000 barrels a day to 1.3 million barrels per day. Meanwhile, demand for 2016 was increased by 120 thousand barrels a day to 1.4 million barrels a day. In addition, the IEA reported that in November the world's oil reserves have broken a record figure of 98.2 million barrels. OECD stocks in October fell by 75 million barrels after a noted record high of 3.102 billion barrels in July.

Investors are also preparing for the FOMC meeting. It is expected that the Fed will raise short-term interest rates. According to the futures market, the likelihood of tighter monetary is 93.2% against 94.9% the previous day. However, the more investors will be focused on Fed's forecasts about future levels of interest rates.

The composite index of the largest companies in the region Stoxx Europe 600 is trading with an increase of 0.8%..

Quotes of Monte dei Paschi di Siena rose 1.7 percent, as the source in the Ministry of Finance of Italy said that the country is ready, if necessary, to save the bank.

Shares of media companies rose approaching the highest level since late October. Mediaset SpA's capitalization increased by 21.4 per cent, recording the maximum increase in 20 years, after Vivendi SA acquired a 3 percent stake in the company and said it could buy about 20 percent.

At the moment:

FTSE 100 +34.21 6924.63 + 0.50%

DAX +94.30 11284.51 + 0.84%

CAC 40 +35.55 4796.32 + 0.75%

-

10:49

ECB Hansson: QE reduction was a very welcome change

-

10:20

The ZEW Indicator of Economic Sentiment for Germany has remained unchanged

The ZEW Indicator of Economic Sentiment for Germany has remained unchanged at a level of 13.8 points (long-term average: 24.0 points) in December 2016.

"The ZEW Indicator of Economic Sentiment remains at the same level; however, given the fact that the evaluation of the current situation has once again recorded an improvement, the overall assessment is quite positive. This is supported by the recently published positive GDP growth figures for the euro area in the third quarter. The considerable economic risks arising from the tense situation in the Italian banking sector, as well as the political risks surrounding upcoming elections in Europe, seem to have faded into the background at the moment," comments ZEW President Professor Achim Wambach.

-

10:19

Euro zone employment change lower than forecast

The number of persons employed increased by 0.2% in both the euro area (EA19) and the EU28 in the third quarter of 2016 compared with the previous quarter, according to national accounts estimates published by Eurostat, the statistical office of the European Union.

In the second quarter of 2016, employment rose by 0.4% in the euro area and by 0.3% in the EU28. These figures are seasonally adjusted. Compared with the same quarter of the previous year, employment increased by 1.2% in the euro area and by 1.1% in the EU28 in the third quarter of 2016 (after +1.3% and +1.4% respectively in the second quarter of 2016).

Eurostat estimates that, in the third quarter of 2016, 232.5 million men and women were employed in the EU28 (highest level ever recorded); of which 153.4 million were in the euro area (highest level since the fourth quarter of 2008). These figures are seasonally adjusted. These quarterly data on employment provide a picture of labour input consistent with the output and income measure of national accounts.

-

10:01

Eurozone: ZEW Economic Sentiment, December 18.1

-

10:00

Germany: ZEW Survey - Economic Sentiment, December 13.8 (forecast 14)

-

10:00

Eurozone: Employment Change, Quarter III 0.2% (forecast 0.3%)

-

09:59

Oil little changed in early trading

This morning, New York crude oil futures for Brent and WTI traded almost flat. The black gold has stabilized after the recent fluctuations. Market participants began taking profits when oil prices have updated the annual highs. Recall OPEC and non-state concluded a first agreement in last 15 years to jointly cut production after almost a year of negotiations.

-

09:43

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 993m) 1.0500 (504m) 1.0600 (1.23bn) 1.0700 (941m)

USD/JPY 114.90 (USD 450m)

AUD/USD 0.7400 (AUD 664m) 0.7420 (505m)

USD/CAD 1.3275-80 (USD 553m) 1.3465-75 (1.0bln)

USD/SGD 1.4150 (USD 1.23bln)

Информационно-аналитический отдел TeleTrade

-

09:38

GBP/USD trying to stabilize above 1.27 after better inflation data

-

09:35

The price of goods bought and sold by UK manufacturers rose again

The price of goods bought and sold by UK manufacturers, as estimated by the Producer Price Index, rose again in the year to November 2016. This is the fifth consecutive increase following 2 years of falls and the largest increase since April 2012. Between October and November, total output prices showed no movement, compared with an increase of 0.7% the previous month.

Factory gate prices (output prices) for goods produced by UK manufacturers rose 2.3% in the year to November 2016, compared with an increase of 2.1% in the year to October 2016.

Core factory gate prices, which exclude the more volatile food, beverage, tobacco and petroleum products, rose 2.2% in the year to November 2016, the largest increase since February 2012.

-

09:32

UK CPI rose 1.2% in November due to higher prices of clothing, motor fuels

The Consumer Prices Index (CPI) rose by 1.2% in the year to November 2016, compared with a 0.9% rise in the year to October.

The rate in November was the highest since October 2014, when it was 1.3%.

Rises in the prices of clothing, motor fuels and a variety of recreational and cultural goods and services, most notably data processing equipment, were the main contributors to the increase in the rate.

These upward pressures were partially offset by falls in air and sea fares.

CPIH (not a National Statistic) rose by 1.4% in the year to November 2016, up from 1.2% in October.

-

09:31

United Kingdom: Producer Price Index - Input (MoM), November -1.1% (forecast -1.9%)

-

09:31

United Kingdom: Producer Price Index - Output (YoY) , November 2.3% (forecast 2.5%)

-

09:31

United Kingdom: Producer Price Index - Output (MoM), November 0.0% (forecast 0.2%)

-

09:30

United Kingdom: HICP, Y/Y, November 1.2% (forecast 1.1%)

-

09:30

United Kingdom: HICP, m/m, November 0.2% (forecast 0.2%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, November 1.4% (forecast 1.3%)

-

09:30

United Kingdom: Retail prices, Y/Y, November 2.2% (forecast 2.1%)

-

09:30

United Kingdom: Retail Price Index, m/m, November 0.3% (forecast 0.2%)

-

09:30

United Kingdom: Producer Price Index - Input (YoY) , November 12.9% (forecast 13.5%)

-

09:15

Italian industrial production flat in October

In October 2016 the seasonally adjusted industrial production index was unchanged compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +1.6.

The calendar adjusted industrial production index increased by 1.3% compared with October 2015 (calendar working days being 21 versus 22 days in October 2015); in the period January-October 2016 the percentage change was +1.1 compared with the same period of 2015.

The unadjusted industrial production index decreased by 1.8% compared with October 2015.

-

09:04

GBP/USD traders await important UK inflation data. CPI expected to rise 1.1% in November due to the pounds decline

-

08:33

Major stock exchanges trading mixed: FTSE -0.1%, DAX + 0.1%, CAC40 -0.2%, FTMIB -0.4%, IBEX -0.5%

-

08:32

Spain's inflation stable in November

Spain's inflation held steady in November as initially estimated, final data from the statistical office INE, cited by rttnes, showed Tuesday.

Consumer prices climbed 0.7 percent year-on-year in November, the same pace of growth as seen in October and in line with flash estimate. Prices have been rising for three straight months.

On a monthly basis, consumer prices moved up 0.4 percent instead of preliminary estimate of 0.3 percent. But this was slower than October's 1.1 percent increase.

-

08:18

WSE: After opening

WIG20 index opened at 1886.78 points (+0.22%)*

WIG 50463.54 0.10%

WIG30 2191.91 0.12%

mWIG40 4210.07 -0.05%

*/ - change to previous close

The cash market opens with a rise of 0.22% to 1,886 points and with the turnover focused this time on the shares of JSW. In Euroland the German DAX opened neutral, but in the first few bars slightly rising in the wake of the contracts. Somewhat also they gain contracts in the United States. In general picture of the situation should therefore foster a certain stability after yesterday's decline and so it presents the Warsaw Stock Exchange.

After fifteen minutes of trading the WIG20 index was at the level of 1,889 points (+ 0.39%).

-

08:01

Today’s events

-

At 18:01 GMT the United States will hold an auction of 30-year bonds

-

-

08:00

Reserve Bank of India May Cut Rates Early in 2017 - DBS

-

07:37

-

07:33

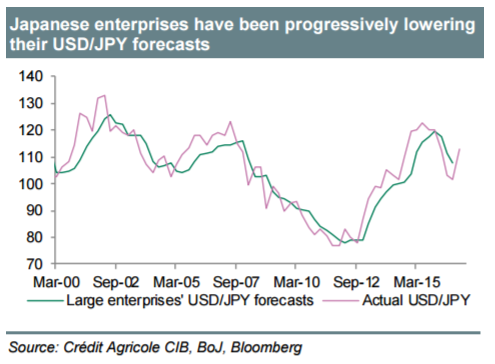

Credit Agricole thinks this weak's Tankan Survey will provide an important signal for USD/JPY

"Investment spending and large manufacturers' forecasts for the USD/JPY are likely to be the highlights in this week's Tankan survey. Despite sentiment remaining above average, investment spending has not followed in 2016.

One of the reasons for this has been the stronger JPY. The JPY's recent weakening could improve the outlook for investment in Japan.

Large enterprises have progressively been lowering their forecasts for average USD/JPY in 2016, but the recent rally may have halted these revisions, which would be indicative of Japanese exporters not feeling pressured to sell USD/JPY on rallies for hedging purposes. It would also be a good sign for investment".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

07:26

Options levels on tuesday, December 13, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0846 (1477)

$1.0809 (290)

$1.0757 (200)

Price at time of writing this review: $1.0644

Support levels (open interest**, contracts):

$1.0575 (2107)

$1.0536 (1142)

$1.0489 (1159)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 40668 contracts, with the maximum number of contracts with strike price $1,1500 (3166);

- Overall open interest on the PUT options with the expiration date March, 13 is 41889 contracts, with the maximum number of contracts with strike price $1,0000 (3481);

- The ratio of PUT/CALL was 1.03 versus 1.05 from the previous trading day according to data from December, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.2915 (271)

$1.2819 (463)

$1.2724 (416)

Price at time of writing this review: $1.2671

Support levels (open interest**, contracts):

$1.2580 (699)

$1.2484 (468)

$1.2387 (326)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9756 contracts, with the maximum number of contracts with strike price $1,2600 (1115);

- Overall open interest on the PUT options with the expiration date March, 13 is 11952 contracts, with the maximum number of contracts with strike price $1,1500 (2946);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from December, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:25

WSE: Before opening

Yesterday's session on Wall Street ended with a small loss, which are trying to be made up by contracts this morning. In Asia prevail mixed feelings, but in most cases the changes are minor. Thus, the market situation in the morning feels stable.

Therefore, beginning in Europe promises to be neutral and any possible more traffic will result from internal inspiration, and not from the trends that have shaped after closing the parquets on the Old Continent yesterday.

In today's calendar will be announced reading of the German ZEW index, which is projected to increase in December only symbolically and should not have a major impact on the markets. No need to remind that tomorrow will be a crucial day of the week, it's obviously about the meeting of the Federal Reserve.

On Tuesday morning trading the currency market does not bring any significant changes to the valuation of Polish currency, which continues the consolidation movements from Monday. The zloty is valued by the market as follows: PLN 4.4489 per euro, 4.1852 PLN against the US dollar. Yields on domestic debt amounts to 3,644% for 10-year bonds.

-

07:18

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.2%, FTSE -0.1%

-

07:17

Australian house prices rose in Q3 by 1.5%

According to data released today by the Australian Bureau of Statistics, property prices in the 3rd quarter increased by 1.5% compared to the previous quarter. Most economists had expected the index to rise by 2.5% after rising 2.0% in the second quarter. In annual terms, house prices rose by 3.5%, which is well below the forecast of 4.6% and the previous value of 4.1%.

Sydney property prices rose by 2.6% q / q in Hobart by 2.3%, in Melbourne 1.7%, Adelaide 0.9%, Canberra by 0.8% and in Brisbane 0.2 %. Housing prices fell only in Perth and Darwin by 1.6% compared with the previous quarter.

-

07:13

Donald Trump remains winner of Wisconsin following statewide recount showing few changes in vote totals

-

07:13

China’s retail sales increased in November

Retail sales increased by 10.8%, after rising earlier by 10.0%. Economists had expected an increase of 10.1%. Retail sales - the indicator published by the National Bureau of Statistics of China and estimate the total amount of cash proceeds from the sale of consumer goods to end consumers. The index takes into account the total consumer goods delivered by various industries for households and social groups through a variety of channels in the retail trade. This is an important indicator that allows to study the changes in the retail market in China and reflects the level of economic well-being.

The report of the National Statistical Department noted that the volume of online retail sales rose from January to November 2016 compared to the same period last year by 26.2%.

-

07:08

German wholesale prices increased by 0.8% in November

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 0.8% in November 2016 from the corresponding month of the preceding year. In October and in September 2016 the annual rates of change were +0.5% and -0.3%, respectively.

From October 2016 to November 2016 the index rose by 0.1%.

-

07:06

German final CPI for November in line with expectations

Consumer prices in Germany were 0.8% higher in November 2016 than in November 2015. This means that the inflation remains at the two-year-high reached in the previous month. Compared with October 2016, the consumer price index rose by 0.1% in November 2016. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 29 November 2016.

The development of energy prices (-2.7% on November 2015) had a downward effect on the overall rise in prices in November 2016, as had been the case in the preceding months. The year-on-year decrease in energy prices thus accelerated (in October 2016 it had been -1.4% on October 2015). Compared with a year earlier, household energy prices were down in November 2016 (-2.9%, including charges for central and district heating: -6.9%; heating oil: -6.7%; gas: -4.1%), as were motor fuel prices (-2.2%). Excluding energy prices, the inflation rate in November 2016 would have been +1.2%.

-

07:01

Germany: CPI, m/m, November 0.1% (forecast 0.1%)

-

07:00

Germany: CPI, y/y , November 0.8% (forecast 0.8%)

-

06:13

Global Stocks

European stock markets fell from an 11-month high on Monday as investors started to focus on the U.S. Federal Reserve's policy meeting later this week. "After recent gains, investors are quite rightly proceeding with caution," said Rebecca O'Keeffe, head of investment at stockbroker Interactive Investor, in a note. "Although the Federal Reserve meeting this week is almost certain to see the first U.S. interest-rate rise this year, what the Fed will do next year remains pivotal for markets," she added.

U.S. stocks struggled for direction on Monday, with the Dow notching the latest in a string of record closes, while the S&P 500 and Nasdaq finished lower. Major indexes had fluctuated between positive and negative territory with investors appearing reluctant to push shares higher following pronounced gains for Wall Street ahead of a key meeting by the Federal Reserve.

Asian shares were muted on Tuesday, with investors displaying caution ahead of the U.S. Federal Reserve meeting this week. The two-day Federal Open Market Committee meeting will kick off later in the global trading day, when U.S. central bankers will decide whether to raise interest rates. According to CME Group's FedWatch tool, the likelihood of a rate increase is 95.4%, up from 94.9% on Monday.

-

02:00

China: Industrial Production y/y, November 6.2% (forecast 6.1%)

-

02:00

China: Retail Sales y/y, November 10.8% (forecast 10.1%)

-

02:00

China: Fixed Asset Investment, October 8.3% (forecast 8.3%)

-

00:30

Australia: National Australia Bank's Business Confidence, November 5

-

00:30

Australia: House Price Index (QoQ), Quarter III 1.5%

-