Market news

-

23:29

Commodities. Daily history for Dec 12’2016:

(raw materials / closing price /% change)

Oil 52.44 -0.74%

Gold 1,164.20 -0.14%

-

23:28

Stocks. Daily history for Dec 12’2016:

(index / closing price / change items /% change)

Nikkei 225 19,155.03 +158.66 +0.84%

Shanghai Composite 3,152.47 -80.41 -2.49%

S&P/ASX 200 5,562.83 0.00 0.00%

FTSE 100 6,890.42 -63.79 -0.92%

CAC 40 4,760.77 -3.30 -0.07%

Xetra DAX 11,190.21 -13.42 -0.12%

S&P 500 2,256.96 -2.57 -0.11%

Dow Jones Industrial Average 19,796.43 +39.58 +0.20%

S&P/TSX Composite 15,287.70 -24.50 -0.16%

-

23:28

Currencies. Daily history for Dec 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0634 +0,74%

GBP/USD $1,2677 +0,81%

USD/CHF Chf1,0131 -0,45%

USD/JPY Y115,02 -0,18%

EUR/JPY Y122,31 +0,57%

GBP/JPY Y145,77 +0,61%

AUD/USD $0,7495 + 0,63%

NZD/USD $0,7188 +0,74%

USD/CAD C$1,3129 -0,38%

-

23:00

Schedule for today,Tuesday, Dec 13’2016 (GMT0)

00:30 Australia National Australia Bank's Business Confidence November 4

00:30 Australia House Price Index (QoQ) Quarter III 2.0%

02:00 China Fixed Asset Investment October 8.3% 8.3%

02:00 China Retail Sales y/y November 10.0% 10.1%

02:00 China Industrial Production y/y November 6.1% 6.1%

07:00 Germany CPI, m/m (Finally) November 0.2% 0.1%

07:00 Germany CPI, y/y (Finally) November 0.8% 0.8%

09:30 United Kingdom Retail Price Index, m/m November 0.0% 0.2%

09:30 United Kingdom Retail prices, Y/Y November 2.0% 2.1%

09:30 United Kingdom Producer Price Index - Input (MoM) November 4.6% -1.9%

09:30 United Kingdom Producer Price Index - Input (YoY) November 12.2% 13.5%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0.6% 0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) November 2.1% 2.5%

09:30 United Kingdom HICP, m/m November 0.1% 0.2%

09:30 United Kingdom HICP, Y/Y November 0.9% 1.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.2% 1.3%

10:00 Eurozone ZEW Economic Sentiment December 15.8

10:00 Eurozone Employment Change Quarter III 0.4%

10:00 Germany ZEW Survey - Economic Sentiment December 13.8 14

13:30 U.S. Import Price Index November 0.5% -0.4%

23:30 Australia Westpac Consumer Confidence December -1.1%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter IV 6 10

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter IV 18 19

-

20:00

DJIA 19777.71 20.86 0.11%, NASDAQ 5404.83 -39.67 -0.73%, S&P 500 2254.51 -5.02 -0.22%

-

19:00

U.S.: Federal budget , November -137 (forecast -135)

-

17:00

European stocks closed: FTSE 6890.42 -63.79 -0.92%, DAX 11190.21 -13.42 -0.12%, CAC 4760.77 -3.30 -0.07%

-

16:32

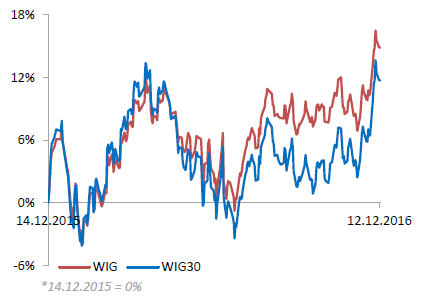

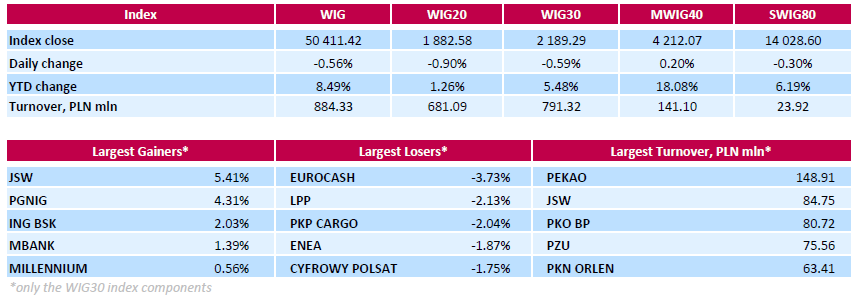

WSE: Session Results

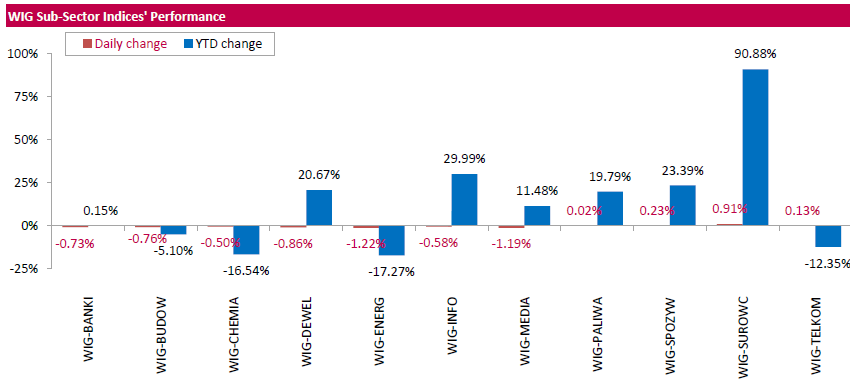

Polish equities were lower on Monday, with the broad-market measure, the WIG index, losing 0.56%. Sector-wise, materials (+0.91%) fared the best, while utilities (-1.22%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, fell by 0.59%. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) recorded the steepest daily decline of 3.73%. Other largest underperformers were clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and genco ENEA (WSE: ENA), which plunged by 2.13%, 2.04% and 1.87% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) topped the gainers list, correcting upwards by 5.41% after significant fall in the previous week. It was followed by oil and gas producer PGNIG (WSE: PGN) and two bank ING BSK (WSE: ING) and MBANK (WSE: MBK), advancing 4.31%, 2.03% and 1.39% respectively.

-

15:52

US 10-Year Treasury yield above 2.5% on higher oil prices

-

15:36

Gold fell but recovers setting up a larger up move

Gold prices pulled back on Monday as investors positioned themselves ahead of an expected U.S. interest rate increase this week.

The precious metal fell 0.4% to $1,153.31 a troy ounce in midmorning trade in London. Other precious metals were mixed.

The prospect of the U.S. Federal Reserve hiking interest rates on Wednesday continued to hit investor sentiment in gold, which doesn't bear interest and struggles to compete when rates rise, says Dow Jones.

Traders in the market for fed-funds futures, derivatives used to bet on the timing of Fed interest-rate decisions, reflect a 100% probability of a rate rise this week, according to CME Group.

-

15:10

Turkish Lira May Test 3.60 Per USD This Week, Says ING

-

14:59

BIS report: dollar debt value has reached a record level in the 3rd quarter

The number of dollar-denominated debt issued by financial institutions reached a record high in the third quarter, as the impact of central banks eased. This was reported in the quarterly review of the Bank for International Settlements.

"Central banks have faded into the background", - said Claudio Borio, head of the Monetary and Economic Department of BIS.

Total issuance of international debt securities fell by 10 percent in the third quarter, reaching $ 1.4 trillion. In the advanced economies, which were seen repayment rates below average, quarterly net issuance rose by 40 per cent since the beginning of the year, reaching its highest level since 2009. As for emerging markets, quarterly net issuance dropped by 35 percent compared to the abnormally high volume in the previous quarter.

-

14:52

WSE: After start on Wall Street

The opening on Wall Street is neutral and only the Nasdaq is slightly more adjusted. This week is the Fed is the dominant topic and comments today indicate waiting for the decision to raise interest rates. The S&P500 index is at historic highs and remain in the short-term and long-term uptrend. In turn, on the Warsaw Stock Exchange we do not see any larger rebound after a morning decline and peaceful start na Wall Street facilitates a return over the level of 1,880 points.

An hour before the close of trading the WIG20 index was at the level of 1,889 points (+0,55%).

-

14:34

UK Conference Board Leading Economic Index up 0.1%

The Conference Board Leading Economic Index®(LEI) for the U.K. increased 0.1 percent in October 2016 to 113.3 (2010=100).

The Conference Board Coincident Economic Index®(CEI) for the U.K. increased 0.2 percent in October 2016 to 108.3 (2010=100).

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously

-

14:34

U.S. Stocks open: Dow -0.04%, Nasdaq -0.41%, S&P -0.10%

-

14:30

Before the bell: S&P futures +0.04%, NASDAQ futures +0.02%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 19,155.03 +158.66 +0.84%

Hang Seng 22,433.02 -327.96 -1.44%

Shanghai 3,152.47 -80.41 -2.49%

FTSE 6,917.85 -36.36 -0.52%

CAC 4,762.23 -1.84 -0.04%

DAX 11,171.96 -31.67 -0.28%

Crude $53.68 (+4.23%)

Gold $1,159.90 (-0.17%)

-

14:04

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.27

0.22(0.6864%)

7735

ALTRIA GROUP INC.

MO

66.22

-0.05(-0.0754%)

1083

Amazon.com Inc., NASDAQ

AMZN

766.6

-2.06(-0.268%)

8766

AMERICAN INTERNATIONAL GROUP

AIG

66

0.17(0.2582%)

501

Apple Inc.

AAPL

113.48

-0.47(-0.4125%)

108584

AT&T Inc

T

40.63

0.25(0.6191%)

12670

Barrick Gold Corporation, NYSE

ABX

15.46

0.01(0.0647%)

32210

Boeing Co

BA

156

-0.49(-0.3131%)

12759

Caterpillar Inc

CAT

95.95

0.42(0.4396%)

1327

Chevron Corp

CVX

117

1.19(1.0275%)

21367

Cisco Systems Inc

CSCO

30.02

-0.04(-0.1331%)

6340

Citigroup Inc., NYSE

C

60.07

0.03(0.05%)

113137

Deere & Company, NYSE

DE

103.77

0.15(0.1448%)

550

E. I. du Pont de Nemours and Co

DD

75

0.15(0.2004%)

450

Exxon Mobil Corp

XOM

90.16

1.16(1.3034%)

97349

Facebook, Inc.

FB

119.3

-0.38(-0.3175%)

83392

Ford Motor Co.

F

13.15

-0.02(-0.1519%)

14501

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.95

0.20(1.2698%)

155433

General Electric Co

GE

31.74

-0.04(-0.1259%)

25362

General Motors Company, NYSE

GM

37.8

0.14(0.3717%)

15643

Goldman Sachs

GS

241.28

-0.57(-0.2357%)

22742

Google Inc.

GOOG

785.42

-3.87(-0.4903%)

1482

Intel Corp

INTC

35.7

-0.06(-0.1678%)

3805

International Business Machines Co...

IBM

166.5

-0.02(-0.012%)

6415

International Paper Company

IP

52.92

-0.91(-1.6905%)

350

Johnson & Johnson

JNJ

113

0.74(0.6592%)

6152

JPMorgan Chase and Co

JPM

85.3

-0.19(-0.2222%)

8280

McDonald's Corp

MCD

121.1

-0.16(-0.1319%)

1802

Microsoft Corp

MSFT

61.81

-0.16(-0.2582%)

8119

Nike

NKE

51.8

0.08(0.1547%)

3188

Pfizer Inc

PFE

31.75

0.05(0.1577%)

5591

Procter & Gamble Co

PG

84.3

-0.07(-0.083%)

3805

Starbucks Corporation, NASDAQ

SBUX

58.6

-0.15(-0.2553%)

1865

Tesla Motors, Inc., NASDAQ

TSLA

191.51

-0.67(-0.3486%)

5293

The Coca-Cola Co

KO

41.87

-0.13(-0.3095%)

9595

Twitter, Inc., NYSE

TWTR

19.59

-0.06(-0.3053%)

38367

United Technologies Corp

UTX

109.14

-0.65(-0.592%)

4910

Visa

V

79.62

0.48(0.6065%)

4698

Wal-Mart Stores Inc

WMT

70.07

-0.01(-0.0143%)

1200

Yandex N.V., NASDAQ

YNDX

20.3

0.44(2.2155%)

43117

-

14:02

Upgrades and downgrades before the market open

Upgrades:

Travelers (TRV) upgraded to Outperform from Market Perform at BMO Capital

American Intl (AIG) upgraded to Outperform from Market Perform at BMO Capital

AT&T (T) upgraded to Outperform from Neutral at Robert W. Baird; target raised to $44 from $39

Downgrades:

Other:

-

13:49

ECB's Coeure: ECB Has Never Discussed Helicopter Money

-

ECB Policy 'Clearly Supports Investment' by Companies

-

Helicopter Money Not a Well-Defined Concept, Likely to Blur Line With Fiscal Policy

-

Deflation Risks Largely Disappeared But Continued Stimulus Needed

-

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0450 (EUR 1.01bln) 1.0500 (1.52bln) 1.0520 (623m) 1.0600 (924m) 1.0700 (589m) 1.0725 (1.02bln) 1.0800 (1.08bln)

USDJPY 111.00 (USD 2.55bln) 112.00 (1.25bln) 113.00 (1.02bln) 113.50 (600m) 114.00 (486m) 115,00 (1.0bln)

AUDUSD 0.7400 (AUD 932m) 0.7495-0.7505 (763m) 0.7600 (480m)

EURGBP 0.8350 (EUR 650m) 0.8525 (1.23bln)

-

13:06

OECD unemployment rate declined marginally in October

The unemployment rate dropped to 6.2 percent in October from 6.3 percent in September. This was 1.9 percentage points below the January 2013 peak. The Organization for Economic Co-operation and Development said the unemployment rate declined marginally in October.

Across the OECD area, unemployment declined by 10.2 million from January 2013 to 38.8 million.

-

13:00

Orders

EUR/USD

Offers 1.0580 1.0600 1.0630 1.0650 1.0685 1.0700 1.0730 1.0750 1.0785 1.0800 1.0820 1.0850

Bids 1.0550 1.0525-30 1.0500 1.0480 1.0460 1.0400

GBP/USD

Offers 1.2600-10 1.2625-30 1.2660-65 1.2685 1.2700 1.2725-30 1.2750

Bids 1.2570-75 1.2550-55 1.2530-35 1.2500 1.2480 1.2450 1.2425-30 1.2400

EUR/GBP

Offers 0.8400-05 0.8420-25 0.8450 0.8460-65 0.8480 0.8500 0.8535 0.8550

Bids 0.8375-80 0.8350 0.8335 0.8300 0.8285 0.8250 0.8200-05

EUR/JPY

Offers 122.60 122.85 123.00 123.50 124.00

Bids 121.75 121.50 121.20 121.00 120.80-85120.50 120.00 119.50 119.00

USD/JPY

Offers 115.85 116.00 116.25-30 116.50116.80 117.00

Bids 115.50 115.20 115.00 114.70 114.50 114.20 114.00 113.80 113.50 113.30 113.00

AUD/USD

Offers 0.7485 0.7500-05 0.7525-30 0.7550 0.7580 0.7600

Bids 0.7445-50 0.7430 0.7400 0.7380 0.7355-60 0.7325-30 0.7300

-

12:02

WSE: Mid session comment

The beginning of the new week passes under the sign of calm and light falls suggesting rather consolidation than attack of demand. Investors' attention is focused today on the various sectors of the market. Thereby gaining fuel companies and Italian banks, which today stand out positively and as a consequence, this translates into good behavior of parquet in Milan.

In the middle of today's session the WIG20 index was at the level of 1,890 points (-0,52%), the turnover in the blue-chips segment was amounted to PLN 236 million.

-

11:42

Major stock indices in Europe little changed

European stock indices show moderate declines. "In general, the mood remains positive, and any sales seen by investors as opportunities for entering longs, - said Markus Huber, trader at City of London Markets.

Little impact on trading had news that the British Chamber of Commerce (BCC) has improved its forecast for economic growth next year, but lowered its forecast for 2018. According to BCC estimates that GDP growth in 2017 will be 1.1 percent. Previously it predicted +1.0 percent. The BCC explained that improved their forecasts in response to stronger-than-expected economic indicators after the referendum. BCC also added that the UK economy is likely to grow by 2.1 percent this year, which roughly corresponds to the long-term average. However, the business group said it expects the current economic slowdown in the momentum over the next two years. BCC lowered its forecast for GDP growth in 2018 to 1.4 percent from 1.8 percent, citing the continuation of Brexit effects. "The weaker economic activity and a slowdown in growth in real wages caused by the collapse of the pound after the referendum is expected to curb household consumption and business investment". Inflation is expected to exceed the target value of the Bank of England (2 per cent) in 2017. The BCC expect higher +2.1% inflation in 2017 and 2.4 percent in 2018.

The composite index of the largest companies in the region Stoxx Europe 600 traded down 0.4 percent after it recorded the maximum weekly gain in nearly two years.

The price of Deutsche Lufthansa AG, Air France-KLM and IAG SA fell more than 2.2 percent, as a significant rise in oil prices suggests growth in costs.

The Italian FTSE MIB index rose 1.2 percent after on Friday gained 0.63 percent. Part of the reason for the increase of the index was the statement of the European Commissioner Moscovici, who ruled out the possibility of a banking crisis in Italy or a financial crisis in Europe.

Health sector shares fell by more than 0.7 per cent. Lonza announced that it is negotiating the purchase of US drugmaker Capsugel. The deal could reach more than $ 5 billion.

Capitalization of Sky Plc fell 1.2 percent amid reports that the major shareholders of Sky will oppose a takeover bid by Twenty-First Century Fox.

At the moment:

FTSE 100 6933.83 -20.38 -0.29%

DAX -30.89 11172.74 -0.28%

CAC 40 -1.56 4762.51 -0.03%

-

11:33

10-year UK bonds yields 1.5% for the first time since May

The yield on 10-year UK bonds reached its highest level since May, as the deal between OPEC and other oil producers increased inflation expectations and prompted investors to sell government bonds.

It is worth emphasizing that the yield on 10-year UK bonds rose three-fold from its historic low of 0.5 percent in August, as investors expected the Bank of England to lower interest rates to help offset the economic impact of the country's decision to leave the European Union. Since then, the economy has performed well and is much stronger than expected. Last month the Bank of England said that moves to the neutral position regarding rates.

-

10:54

-

10:24

USD/JPY at 10-month high before FOMC, EUR/USD edges up

-

10:05

CIBC says EUR set to remain under pressure

"In its widely anticipated decision to delay the end of QE past March, the ECB managed to cause some near-term confusion in currency markets. Even though the size of monthly purchases in the extended April-December 2017 period is going to be only 60bn euros, as opposed to the current 80bn, according to Mario Draghi that doesn't constitute a "tapering". So after initially rallying, the euro then ending up retreating again.

Whether this is a taper or not, the fact remains that the ECB's QE program hasn't been able to boost inflation, and failure to do so going forward keeps alive the very real possibility that the scheme will be extended again in the future.

Unless inflation starts to pick up, expect the euro to remain under pressure".

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0450 (EUR 1.01bln) 1.0500 (1.52bln) 1.0520 (623m) 1.0600 (924m) 1.0700 (589m) 1.0725 (1.02bln) 1.0800 (1.08bln)

USD/JPY 111.00 (USD 2.55bln) 112.00 (1.25bln) 113.00 (1.02bln) 113.50 (600m) 114.00 (486m) 115,00 (1.0bln)

AUD/USD 0.7400 (AUD 932m) 0.7495-0.7505 (763m) 0.7600 (480m)

EUR/GBP 0.8350 (EUR 650m) 0.8525 (1.23bln)

Информационно-аналитический отдел TeleTrade

-

09:42

Huge rise for oil prices

This morning the New York futures for Brent rose 5.1% to $ 57.10 and WTI rose 5.18% to $ 54.17 per barrel. Thus, the black gold is trading with a significant increase after OPEC and other oil producers were able to sign the first agreement from 2001 to jointly cut production. This was done in order to reduce excess supply and the stabilisation of the black gold market. OPEC plans to cut production by 1.2 million barrels per day from 1 January.

-

09:19

Romania's inflation and trade balance below estimates - Rttnews

Romania's consumer prices decreased at a faster-than-expected pace in November, figures from the National Institute of Statistics showed Monday.

The consumer price index fell 0.7 percent year-over-year in November, which was worse than the 0.4 percent drop in October. That was also above the 0.5 percent decline expected by economists.

Foreign trade deficit increased in October from a year ago, as imports grew faster than exports, figures from the National Institute of Statistics showed Monday.

The trade deficit rose to EUR 971 million in October from EUR 873.7 million in the corresponding month last year. In September, the shortfall was EUR 781 million.

-

09:08

Turkish lira falls after GDP data

The Turkish lira sharply extends falls after data showed the Turkish economy shrank 1.8% year-on-year in the third quarter and by far more than the average forecast for a 0.4% drop in a Wall Street Journal poll. USD/TRY trades up 1.7% at 3.5480, compared with around 3.51 just before the data was released.

-

08:39

Major stock markets started trading slightly higher: FTSE + 0.1%, DAX -0.2%, CAC40 + 0.2%, FTMIB + 0.6%, IBEX flat

-

08:38

Today’s events

-

At 14:30 GMT UK Leading Indicators October 113.2 0.1% m / m

-

At 18:01 GMT the United States will hold an auction of 10-year bonds

-

-

08:24

WSE: After opening

WIG20 index opened at 1904.31 points (+0.24%)*

WIG 50779.39 0.17%

WIG30 2206.01 0.17%

mWIG40 4215.56 0.28%

*/ - change to previous close

The cash market opens with a rise of 0.24% to 1,904 points with modest like by the standards of the last day's turnover. Positively distinguished are fuel companies, but it does not apply to banks sector. The WIG 20 index is at the psychological level of 1,900 points and the beginning can be considered as neutral. Similarly, the case looks in Frankfurt.

After twenty minutes of trading the WIG20 index stood at the level 1,895 points (-0.23%).

-

08:16

China's State Information Center: in 2017 the economy will grow by 6.5%

According to SIC, Beijing authorities estimate that in 2017 China's economy will grow by + 6.5%. "In 2017, China will experience an economic activity which eliminates the structural problems in particular, caution is observed in relation to the real estate market and the financing of regional projects" - noted SIC.

-

07:37

-

07:29

WSE: Before opening

This weekend OPEC and non-OPEC countries signed a formal agreement on the reduction of raw material extraction. Therefore we the week starts with the price of oil at 54 USD, i.e. an increase of over 4%.

As a result starts the game under the rise in inflation. In Asia it means higher prices for energy and mining companies and the higher interest of banks. Same changes at the level of the major indices are not a significant. Only the Nikkei stands out positively because of the strength of the dollar against the yen. Outside of Japan there is lack of noticeable growth and China may be seen even a clear correction of more than 2%.

Friday's session in the US was successful with the approach of the main index by 0.6% and new records. Today morning the US futures market falls slightly and Europe may begin sessions with mixed feelings. Selected sectors will be benefited on what can be seen on oil and the expected consequences for inflationary trends. On the Warsaw market on Friday came to a halt of growth. Today the investors attention should be focused on the banks sector.

-

07:28

Goldman Sachs staying long USD vs GBP & EUR

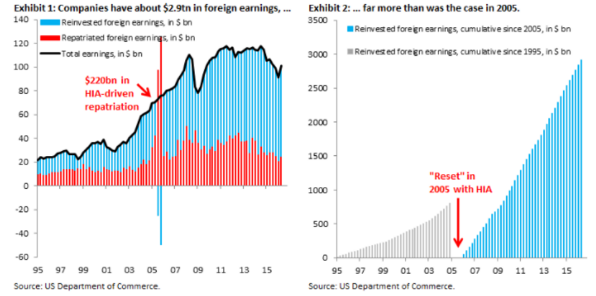

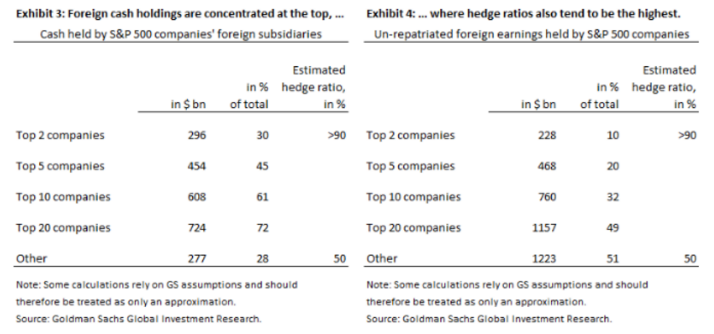

"Corporate tax reform has been an especially hot topic since the US election. We look at the impact one component of that reform,a one-time low-tax holiday for repatriated earnings - often referred to as "HIA2," - might have on FX markets.

Our bottom line is that while the headline numbers seem huge (with $2.9tn in undistributed foreign earnings since 2005), the actual FX impact from a potential "tax holiday" is likely quite small.

When we go through the numbers, we note that the actual tax bill would be much smaller. But more importantly for our markets, we find that the vast majority - perhaps 80 percent - of "overseas" cash is probably held in Dollars already.

As a result, US Dollar cash and future revenues could probably cover the cost of the tax bill without any forced FX conversion. That is not to say that FX markets should ignore this area of policy completely. When we last discussed this topic, we emphasized that a "tax holiday" is likely only in the event of broader tax reform.

As our US team has highlighted, aspects of the House Republican blueprint - notably destination-based taxation - could have major Dollar implications. And as we discussed in our recent FX Views, we think the Dollar rally can extend much further if there is meaningful fiscal stimulus in an economy that is already close to full capacity.

We expect the USD to continue to move higher and we forecast the TWI USD to appreciate about 7% versus G10 currencies over the next 12 months.

Sterling, EUR and RMB downside are also positions we like In addition to USD strength, we also like some other idiosyncratic themes in G10 space.

Sterling downside has fallen out of favor, but we think Sterling remains one of the most actionable themes.

In mid-November, we went short Sterling and the Euro against the Dollar as one of our Top Trade for 2017".

Copyright © 2016 Goldman Sachs, eFXnews™

-

07:04

FOMC pricing set to dominate this weeks trading. Rate hike to 0.75% expected. Buy the rumors, sell the facts potential scenario

-

07:03

Global Stocks

U.S. stocks closed at a record on Friday with the S&P 500 notching its best winning streak since June 2014 and the Dow Jones Industrial Average extending gains for a fifth week. "The S&P 500 is up more than 5% since election day [as the] outlook for lower regulatory hurdles, lower taxes, and higher infrastructure investments all paint the picture of a resurgence in growth prospects," said Karen Hiatt, a portfolio manager at Allianz Global Investors. "The euphoria surrounding higher cyclical growth after years of stagnation has driven investors to reposition portfolios for 2017 earlier than typical."

Asian stock market reaction to perceived policy easing by the European Central Bank was mostly positive, even as currencies in the region took a hit. The ECB said Thursday it would extend its bond-purchase program by nine months to December 2017, but cut its monthly purchases to 60 billion euros from €80 billion, as of April. The ECB action mixed tightening and loosening measures, but market chose to focus on the extension of the asset-purchase program, known as quantitative easing (QE).

-

06:59

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.5%, CAC40 -0.5%, FTSE -0.2%

-

06:57

Producer prices in Japan up 0.4% m/m. New multi-month highs for USD/JPY

Producer prices in Japan picked up 0.4 percent on month in November, the Bank of Japan said, cited by rttnews.

That beat expectations for 0.3 percent following the 0.1 percent decline in 0.1 percent in October.

On a yearly basis, producer prices slid 2.2 percent versus forecasts for a fall of 2.3 percent following the 2.7 percent slide in the previous month.

Export prices added 0.4 percent on month and 0.1 percent on year, the bank said, while import prices gained 2.2 percent on month and fell 1.7 percent on year.

-

06:54

Japanese orders for products in mechanical engineering increased

According to data released by the Cabinet of Ministers of Japan, orders for engineering products increased by 4.1% in October after a decline of -3.3% in September. Analysts had expected an increase of 1.0%. However, on an annualized basis, this indicator decreased by 5.6% after rising by 4.3% a year earlier. The report on orders for engineering products reflects the total volume of orders placed in large companies producing in Japan. This formal contracts concluded between consumers and producers, for the supply of goods and services.

-

06:45

Asking prices for properties in the UK will rise by 2% in 2017 - Rightmove

Asking prices for properties in the UK will rise by 2% in 2017, although sellers in inner London will be asking less as the bubble "continues to deflate", property website Rightmove has predicted.

Sellers entering the market over the past month have priced properties 2.1% lower than those putting homes up for sale the previous month, at an average of £299,159, but Rightmove said it expected next year to be a seventh consecutive year of rising prices.

Despite uncertainty over the UK's decision to leave the EU and stretched affordability, new asking prices are 3.4% higher than in December 2015, and the firm said it expected high demand to continue to lift prices.

-

06:04

Options levels on monday, December 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0918 (893)

$1.0809 (1438)

$1.0706 (100)

Price at time of writing this review: $1.0560

Support levels (open interest**, contracts):

$1.0485 (1144)

$1.0444 (1197)

$1.0394 (1543)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 38399 contracts, with the maximum number of contracts with strike price $1,1500 (3149);

- Overall open interest on the PUT options with the expiration date March, 13 is 40166 contracts, with the maximum number of contracts with strike price $1,0000 (3447);

- The ratio of PUT/CALL was 1.05 versus 0.8 from the previous trading day according to data from December, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.2815 (466)

$1.2719 (413)

$1.2624 (1110)

Price at time of writing this review: $1.2584

Support levels (open interest**, contracts):

$1.2480 (468)

$1.2384 (326)

$1.2287 (348)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9749 contracts, with the maximum number of contracts with strike price $1,2600 (1110);

- Overall open interest on the PUT options with the expiration date March, 13 is 11896 contracts, with the maximum number of contracts with strike price $1,1500 (2946);

- The ratio of PUT/CALL was 1.22 versus 1.02 from the previous trading day according to data from December, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:59

Japan: Prelim Machine Tool Orders, y/y , November -5.6%

-

04:32

Japan: Tertiary Industry Index , November 0,2%

-