Market news

-

23:28

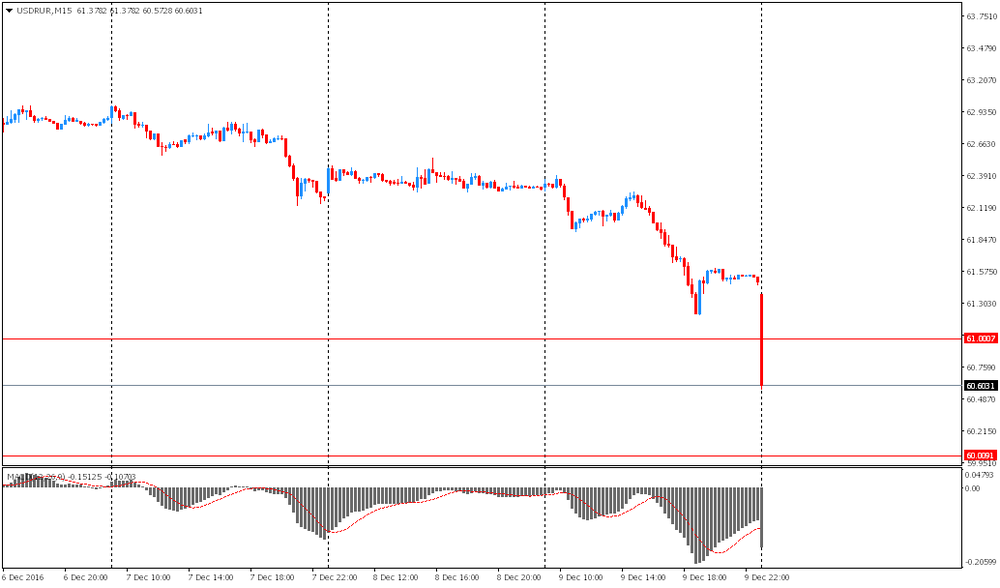

Currencies. Daily history for Dec 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0634 +0,74%

GBP/USD $1,2677 +0,81%

USD/CHF Chf1,0131 -0,45%

USD/JPY Y115,02 -0,18%

EUR/JPY Y122,31 +0,57%

GBP/JPY Y145,77 +0,61%

AUD/USD $0,7495 + 0,63%

NZD/USD $0,7188 +0,74%

USD/CAD C$1,3129 -0,38%

-

23:00

Schedule for today,Tuesday, Dec 13’2016 (GMT0)

00:30 Australia National Australia Bank's Business Confidence November 4

00:30 Australia House Price Index (QoQ) Quarter III 2.0%

02:00 China Fixed Asset Investment October 8.3% 8.3%

02:00 China Retail Sales y/y November 10.0% 10.1%

02:00 China Industrial Production y/y November 6.1% 6.1%

07:00 Germany CPI, m/m (Finally) November 0.2% 0.1%

07:00 Germany CPI, y/y (Finally) November 0.8% 0.8%

09:30 United Kingdom Retail Price Index, m/m November 0.0% 0.2%

09:30 United Kingdom Retail prices, Y/Y November 2.0% 2.1%

09:30 United Kingdom Producer Price Index - Input (MoM) November 4.6% -1.9%

09:30 United Kingdom Producer Price Index - Input (YoY) November 12.2% 13.5%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0.6% 0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) November 2.1% 2.5%

09:30 United Kingdom HICP, m/m November 0.1% 0.2%

09:30 United Kingdom HICP, Y/Y November 0.9% 1.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.2% 1.3%

10:00 Eurozone ZEW Economic Sentiment December 15.8

10:00 Eurozone Employment Change Quarter III 0.4%

10:00 Germany ZEW Survey - Economic Sentiment December 13.8 14

13:30 U.S. Import Price Index November 0.5% -0.4%

23:30 Australia Westpac Consumer Confidence December -1.1%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter IV 6 10

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter IV 18 19

-

19:00

U.S.: Federal budget , November -137 (forecast -135)

-

15:52

US 10-Year Treasury yield above 2.5% on higher oil prices

-

15:10

Turkish Lira May Test 3.60 Per USD This Week, Says ING

-

14:59

BIS report: dollar debt value has reached a record level in the 3rd quarter

The number of dollar-denominated debt issued by financial institutions reached a record high in the third quarter, as the impact of central banks eased. This was reported in the quarterly review of the Bank for International Settlements.

"Central banks have faded into the background", - said Claudio Borio, head of the Monetary and Economic Department of BIS.

Total issuance of international debt securities fell by 10 percent in the third quarter, reaching $ 1.4 trillion. In the advanced economies, which were seen repayment rates below average, quarterly net issuance rose by 40 per cent since the beginning of the year, reaching its highest level since 2009. As for emerging markets, quarterly net issuance dropped by 35 percent compared to the abnormally high volume in the previous quarter.

-

14:34

UK Conference Board Leading Economic Index up 0.1%

The Conference Board Leading Economic Index®(LEI) for the U.K. increased 0.1 percent in October 2016 to 113.3 (2010=100).

The Conference Board Coincident Economic Index®(CEI) for the U.K. increased 0.2 percent in October 2016 to 108.3 (2010=100).

This index is designed to predict the direction of the economy, but it tends to have a muted impact because most of the indicators used in the calculation are released previously

-

13:49

ECB's Coeure: ECB Has Never Discussed Helicopter Money

-

ECB Policy 'Clearly Supports Investment' by Companies

-

Helicopter Money Not a Well-Defined Concept, Likely to Blur Line With Fiscal Policy

-

Deflation Risks Largely Disappeared But Continued Stimulus Needed

-

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0450 (EUR 1.01bln) 1.0500 (1.52bln) 1.0520 (623m) 1.0600 (924m) 1.0700 (589m) 1.0725 (1.02bln) 1.0800 (1.08bln)

USDJPY 111.00 (USD 2.55bln) 112.00 (1.25bln) 113.00 (1.02bln) 113.50 (600m) 114.00 (486m) 115,00 (1.0bln)

AUDUSD 0.7400 (AUD 932m) 0.7495-0.7505 (763m) 0.7600 (480m)

EURGBP 0.8350 (EUR 650m) 0.8525 (1.23bln)

-

13:06

OECD unemployment rate declined marginally in October

The unemployment rate dropped to 6.2 percent in October from 6.3 percent in September. This was 1.9 percentage points below the January 2013 peak. The Organization for Economic Co-operation and Development said the unemployment rate declined marginally in October.

Across the OECD area, unemployment declined by 10.2 million from January 2013 to 38.8 million.

-

13:00

Orders

EUR/USD

Offers 1.0580 1.0600 1.0630 1.0650 1.0685 1.0700 1.0730 1.0750 1.0785 1.0800 1.0820 1.0850

Bids 1.0550 1.0525-30 1.0500 1.0480 1.0460 1.0400

GBP/USD

Offers 1.2600-10 1.2625-30 1.2660-65 1.2685 1.2700 1.2725-30 1.2750

Bids 1.2570-75 1.2550-55 1.2530-35 1.2500 1.2480 1.2450 1.2425-30 1.2400

EUR/GBP

Offers 0.8400-05 0.8420-25 0.8450 0.8460-65 0.8480 0.8500 0.8535 0.8550

Bids 0.8375-80 0.8350 0.8335 0.8300 0.8285 0.8250 0.8200-05

EUR/JPY

Offers 122.60 122.85 123.00 123.50 124.00

Bids 121.75 121.50 121.20 121.00 120.80-85120.50 120.00 119.50 119.00

USD/JPY

Offers 115.85 116.00 116.25-30 116.50116.80 117.00

Bids 115.50 115.20 115.00 114.70 114.50 114.20 114.00 113.80 113.50 113.30 113.00

AUD/USD

Offers 0.7485 0.7500-05 0.7525-30 0.7550 0.7580 0.7600

Bids 0.7445-50 0.7430 0.7400 0.7380 0.7355-60 0.7325-30 0.7300

-

11:33

10-year UK bonds yields 1.5% for the first time since May

The yield on 10-year UK bonds reached its highest level since May, as the deal between OPEC and other oil producers increased inflation expectations and prompted investors to sell government bonds.

It is worth emphasizing that the yield on 10-year UK bonds rose three-fold from its historic low of 0.5 percent in August, as investors expected the Bank of England to lower interest rates to help offset the economic impact of the country's decision to leave the European Union. Since then, the economy has performed well and is much stronger than expected. Last month the Bank of England said that moves to the neutral position regarding rates.

-

10:54

-

10:24

USD/JPY at 10-month high before FOMC, EUR/USD edges up

-

10:05

CIBC says EUR set to remain under pressure

"In its widely anticipated decision to delay the end of QE past March, the ECB managed to cause some near-term confusion in currency markets. Even though the size of monthly purchases in the extended April-December 2017 period is going to be only 60bn euros, as opposed to the current 80bn, according to Mario Draghi that doesn't constitute a "tapering". So after initially rallying, the euro then ending up retreating again.

Whether this is a taper or not, the fact remains that the ECB's QE program hasn't been able to boost inflation, and failure to do so going forward keeps alive the very real possibility that the scheme will be extended again in the future.

Unless inflation starts to pick up, expect the euro to remain under pressure".

-

10:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0450 (EUR 1.01bln) 1.0500 (1.52bln) 1.0520 (623m) 1.0600 (924m) 1.0700 (589m) 1.0725 (1.02bln) 1.0800 (1.08bln)

USD/JPY 111.00 (USD 2.55bln) 112.00 (1.25bln) 113.00 (1.02bln) 113.50 (600m) 114.00 (486m) 115,00 (1.0bln)

AUD/USD 0.7400 (AUD 932m) 0.7495-0.7505 (763m) 0.7600 (480m)

EUR/GBP 0.8350 (EUR 650m) 0.8525 (1.23bln)

Информационно-аналитический отдел TeleTrade

-

09:19

Romania's inflation and trade balance below estimates - Rttnews

Romania's consumer prices decreased at a faster-than-expected pace in November, figures from the National Institute of Statistics showed Monday.

The consumer price index fell 0.7 percent year-over-year in November, which was worse than the 0.4 percent drop in October. That was also above the 0.5 percent decline expected by economists.

Foreign trade deficit increased in October from a year ago, as imports grew faster than exports, figures from the National Institute of Statistics showed Monday.

The trade deficit rose to EUR 971 million in October from EUR 873.7 million in the corresponding month last year. In September, the shortfall was EUR 781 million.

-

09:08

Turkish lira falls after GDP data

The Turkish lira sharply extends falls after data showed the Turkish economy shrank 1.8% year-on-year in the third quarter and by far more than the average forecast for a 0.4% drop in a Wall Street Journal poll. USD/TRY trades up 1.7% at 3.5480, compared with around 3.51 just before the data was released.

-

08:38

Today’s events

-

At 14:30 GMT UK Leading Indicators October 113.2 0.1% m / m

-

At 18:01 GMT the United States will hold an auction of 10-year bonds

-

-

08:16

China's State Information Center: in 2017 the economy will grow by 6.5%

According to SIC, Beijing authorities estimate that in 2017 China's economy will grow by + 6.5%. "In 2017, China will experience an economic activity which eliminates the structural problems in particular, caution is observed in relation to the real estate market and the financing of regional projects" - noted SIC.

-

07:37

-

07:28

Goldman Sachs staying long USD vs GBP & EUR

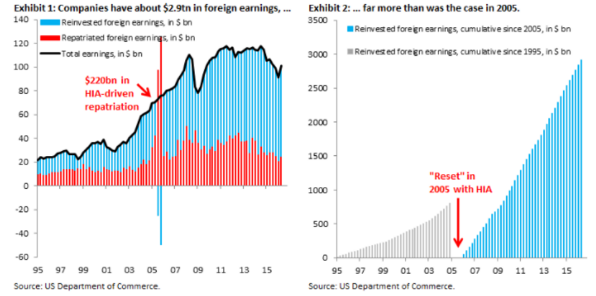

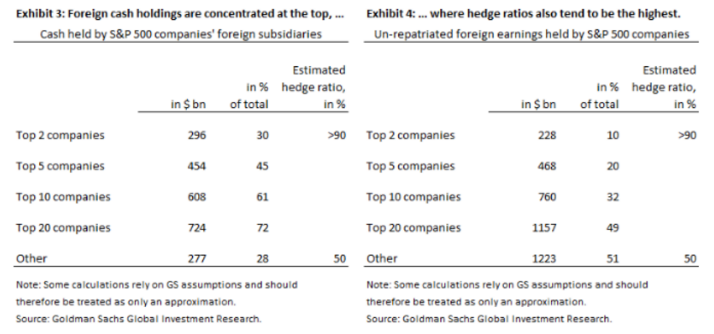

"Corporate tax reform has been an especially hot topic since the US election. We look at the impact one component of that reform,a one-time low-tax holiday for repatriated earnings - often referred to as "HIA2," - might have on FX markets.

Our bottom line is that while the headline numbers seem huge (with $2.9tn in undistributed foreign earnings since 2005), the actual FX impact from a potential "tax holiday" is likely quite small.

When we go through the numbers, we note that the actual tax bill would be much smaller. But more importantly for our markets, we find that the vast majority - perhaps 80 percent - of "overseas" cash is probably held in Dollars already.

As a result, US Dollar cash and future revenues could probably cover the cost of the tax bill without any forced FX conversion. That is not to say that FX markets should ignore this area of policy completely. When we last discussed this topic, we emphasized that a "tax holiday" is likely only in the event of broader tax reform.

As our US team has highlighted, aspects of the House Republican blueprint - notably destination-based taxation - could have major Dollar implications. And as we discussed in our recent FX Views, we think the Dollar rally can extend much further if there is meaningful fiscal stimulus in an economy that is already close to full capacity.

We expect the USD to continue to move higher and we forecast the TWI USD to appreciate about 7% versus G10 currencies over the next 12 months.

Sterling, EUR and RMB downside are also positions we like In addition to USD strength, we also like some other idiosyncratic themes in G10 space.

Sterling downside has fallen out of favor, but we think Sterling remains one of the most actionable themes.

In mid-November, we went short Sterling and the Euro against the Dollar as one of our Top Trade for 2017".

Copyright © 2016 Goldman Sachs, eFXnews™

-

07:04

FOMC pricing set to dominate this weeks trading. Rate hike to 0.75% expected. Buy the rumors, sell the facts potential scenario

-

06:57

Producer prices in Japan up 0.4% m/m. New multi-month highs for USD/JPY

Producer prices in Japan picked up 0.4 percent on month in November, the Bank of Japan said, cited by rttnews.

That beat expectations for 0.3 percent following the 0.1 percent decline in 0.1 percent in October.

On a yearly basis, producer prices slid 2.2 percent versus forecasts for a fall of 2.3 percent following the 2.7 percent slide in the previous month.

Export prices added 0.4 percent on month and 0.1 percent on year, the bank said, while import prices gained 2.2 percent on month and fell 1.7 percent on year.

-

06:54

Japanese orders for products in mechanical engineering increased

According to data released by the Cabinet of Ministers of Japan, orders for engineering products increased by 4.1% in October after a decline of -3.3% in September. Analysts had expected an increase of 1.0%. However, on an annualized basis, this indicator decreased by 5.6% after rising by 4.3% a year earlier. The report on orders for engineering products reflects the total volume of orders placed in large companies producing in Japan. This formal contracts concluded between consumers and producers, for the supply of goods and services.

-

06:45

Asking prices for properties in the UK will rise by 2% in 2017 - Rightmove

Asking prices for properties in the UK will rise by 2% in 2017, although sellers in inner London will be asking less as the bubble "continues to deflate", property website Rightmove has predicted.

Sellers entering the market over the past month have priced properties 2.1% lower than those putting homes up for sale the previous month, at an average of £299,159, but Rightmove said it expected next year to be a seventh consecutive year of rising prices.

Despite uncertainty over the UK's decision to leave the EU and stretched affordability, new asking prices are 3.4% higher than in December 2015, and the firm said it expected high demand to continue to lift prices.

-

06:04

Options levels on monday, December 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0918 (893)

$1.0809 (1438)

$1.0706 (100)

Price at time of writing this review: $1.0560

Support levels (open interest**, contracts):

$1.0485 (1144)

$1.0444 (1197)

$1.0394 (1543)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 38399 contracts, with the maximum number of contracts with strike price $1,1500 (3149);

- Overall open interest on the PUT options with the expiration date March, 13 is 40166 contracts, with the maximum number of contracts with strike price $1,0000 (3447);

- The ratio of PUT/CALL was 1.05 versus 0.8 from the previous trading day according to data from December, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.2815 (466)

$1.2719 (413)

$1.2624 (1110)

Price at time of writing this review: $1.2584

Support levels (open interest**, contracts):

$1.2480 (468)

$1.2384 (326)

$1.2287 (348)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9749 contracts, with the maximum number of contracts with strike price $1,2600 (1110);

- Overall open interest on the PUT options with the expiration date March, 13 is 11896 contracts, with the maximum number of contracts with strike price $1,1500 (2946);

- The ratio of PUT/CALL was 1.22 versus 1.02 from the previous trading day according to data from December, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:59

Japan: Prelim Machine Tool Orders, y/y , November -5.6%

-

04:32

Japan: Tertiary Industry Index , November 0,2%

-