Market news

-

23:28

Stocks. Daily history for Dec 12’2016:

(index / closing price / change items /% change)

Nikkei 225 19,155.03 +158.66 +0.84%

Shanghai Composite 3,152.47 -80.41 -2.49%

S&P/ASX 200 5,562.83 0.00 0.00%

FTSE 100 6,890.42 -63.79 -0.92%

CAC 40 4,760.77 -3.30 -0.07%

Xetra DAX 11,190.21 -13.42 -0.12%

S&P 500 2,256.96 -2.57 -0.11%

Dow Jones Industrial Average 19,796.43 +39.58 +0.20%

S&P/TSX Composite 15,287.70 -24.50 -0.16%

-

20:00

DJIA 19777.71 20.86 0.11%, NASDAQ 5404.83 -39.67 -0.73%, S&P 500 2254.51 -5.02 -0.22%

-

17:00

European stocks closed: FTSE 6890.42 -63.79 -0.92%, DAX 11190.21 -13.42 -0.12%, CAC 4760.77 -3.30 -0.07%

-

16:32

WSE: Session Results

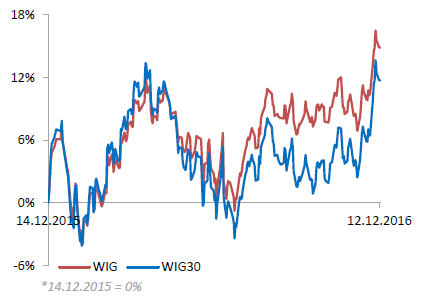

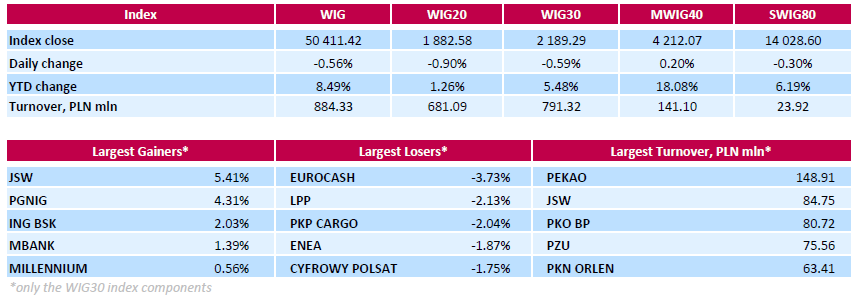

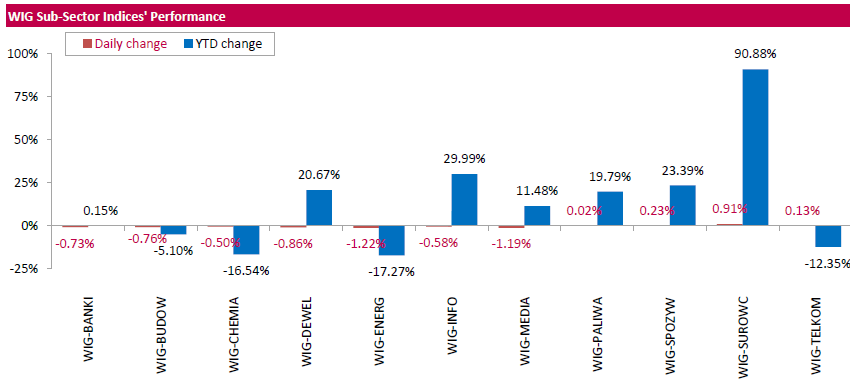

Polish equities were lower on Monday, with the broad-market measure, the WIG index, losing 0.56%. Sector-wise, materials (+0.91%) fared the best, while utilities (-1.22%) posted the worst result.

The large-cap stocks' measure, the WIG30 Index, fell by 0.59%. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) recorded the steepest daily decline of 3.73%. Other largest underperformers were clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and genco ENEA (WSE: ENA), which plunged by 2.13%, 2.04% and 1.87% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) topped the gainers list, correcting upwards by 5.41% after significant fall in the previous week. It was followed by oil and gas producer PGNIG (WSE: PGN) and two bank ING BSK (WSE: ING) and MBANK (WSE: MBK), advancing 4.31%, 2.03% and 1.39% respectively.

-

14:52

WSE: After start on Wall Street

The opening on Wall Street is neutral and only the Nasdaq is slightly more adjusted. This week is the Fed is the dominant topic and comments today indicate waiting for the decision to raise interest rates. The S&P500 index is at historic highs and remain in the short-term and long-term uptrend. In turn, on the Warsaw Stock Exchange we do not see any larger rebound after a morning decline and peaceful start na Wall Street facilitates a return over the level of 1,880 points.

An hour before the close of trading the WIG20 index was at the level of 1,889 points (+0,55%).

-

14:34

U.S. Stocks open: Dow -0.04%, Nasdaq -0.41%, S&P -0.10%

-

14:30

Before the bell: S&P futures +0.04%, NASDAQ futures +0.02%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 19,155.03 +158.66 +0.84%

Hang Seng 22,433.02 -327.96 -1.44%

Shanghai 3,152.47 -80.41 -2.49%

FTSE 6,917.85 -36.36 -0.52%

CAC 4,762.23 -1.84 -0.04%

DAX 11,171.96 -31.67 -0.28%

Crude $53.68 (+4.23%)

Gold $1,159.90 (-0.17%)

-

14:04

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.27

0.22(0.6864%)

7735

ALTRIA GROUP INC.

MO

66.22

-0.05(-0.0754%)

1083

Amazon.com Inc., NASDAQ

AMZN

766.6

-2.06(-0.268%)

8766

AMERICAN INTERNATIONAL GROUP

AIG

66

0.17(0.2582%)

501

Apple Inc.

AAPL

113.48

-0.47(-0.4125%)

108584

AT&T Inc

T

40.63

0.25(0.6191%)

12670

Barrick Gold Corporation, NYSE

ABX

15.46

0.01(0.0647%)

32210

Boeing Co

BA

156

-0.49(-0.3131%)

12759

Caterpillar Inc

CAT

95.95

0.42(0.4396%)

1327

Chevron Corp

CVX

117

1.19(1.0275%)

21367

Cisco Systems Inc

CSCO

30.02

-0.04(-0.1331%)

6340

Citigroup Inc., NYSE

C

60.07

0.03(0.05%)

113137

Deere & Company, NYSE

DE

103.77

0.15(0.1448%)

550

E. I. du Pont de Nemours and Co

DD

75

0.15(0.2004%)

450

Exxon Mobil Corp

XOM

90.16

1.16(1.3034%)

97349

Facebook, Inc.

FB

119.3

-0.38(-0.3175%)

83392

Ford Motor Co.

F

13.15

-0.02(-0.1519%)

14501

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.95

0.20(1.2698%)

155433

General Electric Co

GE

31.74

-0.04(-0.1259%)

25362

General Motors Company, NYSE

GM

37.8

0.14(0.3717%)

15643

Goldman Sachs

GS

241.28

-0.57(-0.2357%)

22742

Google Inc.

GOOG

785.42

-3.87(-0.4903%)

1482

Intel Corp

INTC

35.7

-0.06(-0.1678%)

3805

International Business Machines Co...

IBM

166.5

-0.02(-0.012%)

6415

International Paper Company

IP

52.92

-0.91(-1.6905%)

350

Johnson & Johnson

JNJ

113

0.74(0.6592%)

6152

JPMorgan Chase and Co

JPM

85.3

-0.19(-0.2222%)

8280

McDonald's Corp

MCD

121.1

-0.16(-0.1319%)

1802

Microsoft Corp

MSFT

61.81

-0.16(-0.2582%)

8119

Nike

NKE

51.8

0.08(0.1547%)

3188

Pfizer Inc

PFE

31.75

0.05(0.1577%)

5591

Procter & Gamble Co

PG

84.3

-0.07(-0.083%)

3805

Starbucks Corporation, NASDAQ

SBUX

58.6

-0.15(-0.2553%)

1865

Tesla Motors, Inc., NASDAQ

TSLA

191.51

-0.67(-0.3486%)

5293

The Coca-Cola Co

KO

41.87

-0.13(-0.3095%)

9595

Twitter, Inc., NYSE

TWTR

19.59

-0.06(-0.3053%)

38367

United Technologies Corp

UTX

109.14

-0.65(-0.592%)

4910

Visa

V

79.62

0.48(0.6065%)

4698

Wal-Mart Stores Inc

WMT

70.07

-0.01(-0.0143%)

1200

Yandex N.V., NASDAQ

YNDX

20.3

0.44(2.2155%)

43117

-

14:02

Upgrades and downgrades before the market open

Upgrades:

Travelers (TRV) upgraded to Outperform from Market Perform at BMO Capital

American Intl (AIG) upgraded to Outperform from Market Perform at BMO Capital

AT&T (T) upgraded to Outperform from Neutral at Robert W. Baird; target raised to $44 from $39

Downgrades:

Other:

-

12:02

WSE: Mid session comment

The beginning of the new week passes under the sign of calm and light falls suggesting rather consolidation than attack of demand. Investors' attention is focused today on the various sectors of the market. Thereby gaining fuel companies and Italian banks, which today stand out positively and as a consequence, this translates into good behavior of parquet in Milan.

In the middle of today's session the WIG20 index was at the level of 1,890 points (-0,52%), the turnover in the blue-chips segment was amounted to PLN 236 million.

-

11:42

Major stock indices in Europe little changed

European stock indices show moderate declines. "In general, the mood remains positive, and any sales seen by investors as opportunities for entering longs, - said Markus Huber, trader at City of London Markets.

Little impact on trading had news that the British Chamber of Commerce (BCC) has improved its forecast for economic growth next year, but lowered its forecast for 2018. According to BCC estimates that GDP growth in 2017 will be 1.1 percent. Previously it predicted +1.0 percent. The BCC explained that improved their forecasts in response to stronger-than-expected economic indicators after the referendum. BCC also added that the UK economy is likely to grow by 2.1 percent this year, which roughly corresponds to the long-term average. However, the business group said it expects the current economic slowdown in the momentum over the next two years. BCC lowered its forecast for GDP growth in 2018 to 1.4 percent from 1.8 percent, citing the continuation of Brexit effects. "The weaker economic activity and a slowdown in growth in real wages caused by the collapse of the pound after the referendum is expected to curb household consumption and business investment". Inflation is expected to exceed the target value of the Bank of England (2 per cent) in 2017. The BCC expect higher +2.1% inflation in 2017 and 2.4 percent in 2018.

The composite index of the largest companies in the region Stoxx Europe 600 traded down 0.4 percent after it recorded the maximum weekly gain in nearly two years.

The price of Deutsche Lufthansa AG, Air France-KLM and IAG SA fell more than 2.2 percent, as a significant rise in oil prices suggests growth in costs.

The Italian FTSE MIB index rose 1.2 percent after on Friday gained 0.63 percent. Part of the reason for the increase of the index was the statement of the European Commissioner Moscovici, who ruled out the possibility of a banking crisis in Italy or a financial crisis in Europe.

Health sector shares fell by more than 0.7 per cent. Lonza announced that it is negotiating the purchase of US drugmaker Capsugel. The deal could reach more than $ 5 billion.

Capitalization of Sky Plc fell 1.2 percent amid reports that the major shareholders of Sky will oppose a takeover bid by Twenty-First Century Fox.

At the moment:

FTSE 100 6933.83 -20.38 -0.29%

DAX -30.89 11172.74 -0.28%

CAC 40 -1.56 4762.51 -0.03%

-

08:39

Major stock markets started trading slightly higher: FTSE + 0.1%, DAX -0.2%, CAC40 + 0.2%, FTMIB + 0.6%, IBEX flat

-

08:24

WSE: After opening

WIG20 index opened at 1904.31 points (+0.24%)*

WIG 50779.39 0.17%

WIG30 2206.01 0.17%

mWIG40 4215.56 0.28%

*/ - change to previous close

The cash market opens with a rise of 0.24% to 1,904 points with modest like by the standards of the last day's turnover. Positively distinguished are fuel companies, but it does not apply to banks sector. The WIG 20 index is at the psychological level of 1,900 points and the beginning can be considered as neutral. Similarly, the case looks in Frankfurt.

After twenty minutes of trading the WIG20 index stood at the level 1,895 points (-0.23%).

-

07:29

WSE: Before opening

This weekend OPEC and non-OPEC countries signed a formal agreement on the reduction of raw material extraction. Therefore we the week starts with the price of oil at 54 USD, i.e. an increase of over 4%.

As a result starts the game under the rise in inflation. In Asia it means higher prices for energy and mining companies and the higher interest of banks. Same changes at the level of the major indices are not a significant. Only the Nikkei stands out positively because of the strength of the dollar against the yen. Outside of Japan there is lack of noticeable growth and China may be seen even a clear correction of more than 2%.

Friday's session in the US was successful with the approach of the main index by 0.6% and new records. Today morning the US futures market falls slightly and Europe may begin sessions with mixed feelings. Selected sectors will be benefited on what can be seen on oil and the expected consequences for inflationary trends. On the Warsaw market on Friday came to a halt of growth. Today the investors attention should be focused on the banks sector.

-

07:03

Global Stocks

U.S. stocks closed at a record on Friday with the S&P 500 notching its best winning streak since June 2014 and the Dow Jones Industrial Average extending gains for a fifth week. "The S&P 500 is up more than 5% since election day [as the] outlook for lower regulatory hurdles, lower taxes, and higher infrastructure investments all paint the picture of a resurgence in growth prospects," said Karen Hiatt, a portfolio manager at Allianz Global Investors. "The euphoria surrounding higher cyclical growth after years of stagnation has driven investors to reposition portfolios for 2017 earlier than typical."

Asian stock market reaction to perceived policy easing by the European Central Bank was mostly positive, even as currencies in the region took a hit. The ECB said Thursday it would extend its bond-purchase program by nine months to December 2017, but cut its monthly purchases to 60 billion euros from €80 billion, as of April. The ECB action mixed tightening and loosening measures, but market chose to focus on the extension of the asset-purchase program, known as quantitative easing (QE).

-

06:59

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.5%, CAC40 -0.5%, FTSE -0.2%

-