Market news

-

23:28

Currencies. Daily history for Dec 14’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0535 -0,84%

GBP/USD $1,2562 -0,75%

USD/CHF Chf1,02 +0,78%

USD/JPY Y117,02 +1,58%

EUR/JPY Y123,28 +0,73%

GBP/JPY Y147,01 +0,85%

AUD/USD $0,7404 -1,27%

NZD/USD $0,7116 -1,21%

USD/CAD C$1,3282 +1,15%

-

23:00

Schedule for today,Thursday, Dec 15’2016 (GMT0)

00:00 Australia Consumer Inflation Expectation November 3.2%

00:30 Australia Unemployment rate November 5.6% 5.6%

00:30 Australia Changing the number of employed November 9.8 20

00:30 Japan Manufacturing PMI (Preliminary) December 51.3 51.5

08:00 France Services PMI (Preliminary) December 51.6 52

08:00 France Manufacturing PMI (Preliminary) December 51.7 51.9

08:30 Germany Services PMI (Preliminary) December 55.1 54.9

08:30 Germany Manufacturing PMI (Preliminary) December 54.3 54.5

08:30 Switzerland SNB Interest Rate Decision -0.75%

08:30 Switzerland SNB Monetary Policy Assessment

08:30 Switzerland SNB Press Conference

09:00 Eurozone Services PMI (Preliminary) December 53.8 53.8

09:00 Eurozone Manufacturing PMI (Preliminary) December 53.7 53.8

09:30 United Kingdom Retail Sales (MoM) November 1.9% 0.2%

09:30 United Kingdom Retail Sales (YoY) November 7.4% 5.9%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

12:00 United Kingdom Asset Purchase Facility 435 435

13:30 Canada Manufacturing Shipments (MoM) October 0.3% 0.4%

13:30 U.S. Continuing Jobless Claims 2005 2025

13:30 U.S. NY Fed Empire State manufacturing index December 1.5 4

13:30 U.S. Philadelphia Fed Manufacturing Survey December 7.6 9

13:30 U.S. Current account, bln Quarter III -119.9 -111.6

13:30 U.S. Initial Jobless Claims 258 255

13:30 U.S. CPI, m/m November 0.4% 0.2%

13:30 U.S. CPI, Y/Y November 1.6% 1.7%

13:30 U.S. CPI excluding food and energy, m/m November 0.1% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y November 2.1% 2.2%

14:45 U.S. Manufacturing PMI (Preliminary) December 54.1 54.2

15:00 U.S. NAHB Housing Market Index December 63 63

21:00 U.S. Net Long-term TIC Flows October -26.2

21:00 U.S. Total Net TIC Flows October -152.9

-

21:30

New Zealand: Business NZ PMI, November 54.4

-

19:00

U.S.: Fed Interest Rate Decision , 0.75% (forecast 0.75%)

-

15:56

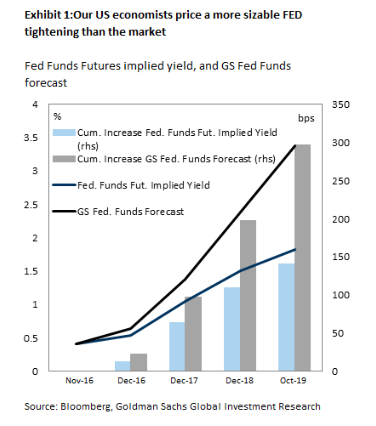

Goldman Sachs expects more gains for USD as market reprices more Fed hikes

"In line with market pricing, we expect the FOMC to raise the federal funds rate by 25bp.

From there, our US economists price a more sizeable tightening cycle than the market (see Exhibit 1), and we expect further USD strength as the market re-prices more tightening from the Fed.

That said, we also think that Chair Yellen will continue to emphasise that monetary policy is not on a pre-set course and that the data will dictate the future path of interest rates.

We expect the USD to continue to move higher and we forecast the TWI USD to appreciate about 7% versus G10 currencies over the next 12 months.

In mid-November, we went short Sterling and the Euro against the Dollar as one of our Top Trade for 2017".

Copyright © 2016 Goldman Sachs, eFXnews™

-

15:37

US crude and gasoline inventories decline more than expected, USD/CAD moves down

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 2.6 million barrels from the previous week. At 483.2 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year. Total motor gasoline inventories increased by 0.5 million barrels last week, and are well above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week. Distillate fuel inventories decreased by 0.8 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 3.6 million barrels last week but are near the upper limit of the average range. Total commercial petroleum inventories decreased by 2.0 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, December -2.563 (forecast -1.584)

-

15:12

UK Brexit Minister Davis: Hopes To Trigger Article 50 By End Of March, Earlier If We Can - Reuters

-

15:00

U.S.: Business inventories , October -0.2% (forecast -0.1%)

-

14:21

-

14:17

US industrial production declined 0.4 percent in November

Industrial production declined 0.4 percent in November after edging up 0.1 percent in October. In November, manufacturing output moved down 0.1 percent, and mining posted a gain of 1.1 percent. The index for utilities dropped 4.4 percent, as warmer-than-normal temperatures reduced the demand for heating. At 103.9 percent of its 2012 average, total industrial production in November was 0.6 percent lower than its year-earlier level. Capacity utilization for the industrial sector decreased 0.4 percentage point in November to 75.0 percent, a rate that is 5.0 percentage points below its long-run (1972-2015) average.

-

14:15

U.S.: Capacity Utilization, November 75.0% (forecast 75.1%)

-

14:15

U.S.: Industrial Production (MoM), November -0.4% (forecast -0.2%)

-

14:15

U.S.: Industrial Production YoY , November -0.6%

-

13:47

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0500 (EUR 1.14bln) 1.0550 (887m) 1.0575 (1.21bln) 1.0600 (1.03bln) 1.0675 (924m) 1.0700 (564m) 1.0750 (854m)

USDJPY 113.00 (USD 632m) 114.55 (700m) 117.00 (940m)

USDCHF 1.0150 (USD 506m)

AUDUSD 0.7470 (581m)

-

13:36

US Producer Price Index increased 0.4 percent in November

The Producer Price Index for final demand increased 0.4 percent in November, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices were unchanged in October and advanced 0.3 percent in September. On an unadjusted basis, the final demand index climbed 1.3 percent for the 12 months ended November 2016, the largest rise since moving up 1.3 percent for the 12 months ended November 2014.

In November 2016, over 80 percent of the advance in the final demand index is attributable to a 0.5-percent rise in prices for final demand services. The index for final demand goods increased 0.2 percent. -

13:34

US retail sales rose less than expected

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for November, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $465.5 billion, an increase of 0.1 percent from the previous month, and 3.8 percent above November 2015. Total sales for the September 2016 through November 2016 period were up 3.7 percent from the same period a year ago.

The September 2016 to October 2016 percent change was revised from up 0.8 percent (±0.5%) to up 0.6 percent (±0.2%). Retail trade sales were virtually unchanged from October 2016, and up 3.6 percent from last year. Nonstore retailers were up 11.9 percent from November 2015, while health and personal care stores retailers were up 6.2 percent from last year.

-

13:30

U.S.: Retail sales, November 0.1% (forecast 0.3%)

-

13:30

U.S.: PPI excluding food and energy, m/m, November 0.4% (forecast 0.2%)

-

13:30

U.S.: PPI, m/m, November 0.4% (forecast 0.1%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, November 1.6% (forecast 1.3%)

-

13:30

U.S.: PPI, y/y, November 1.3% (forecast 0.9%)

-

13:30

U.S.: Retail sales excluding auto, November 0.2% (forecast 0.4%)

-

13:30

U.S.: Retail Sales YoY, November 3.8%

-

13:00

Orders

EUR/USD

Offers 1.0770-75 1.0685 1.0700 1.0730 1.0750 1.0785 1.0800 1.0820 1.0850

Bids 1.0600 1.0585 1.0550 1.0525-30 1.0500 1.0480 1.0450 1.0400

GBP/USD

Offers 1.2700-05 1.2725-30 1.2750-55 1.2775 1.2800 1.2830 1.2850 1.2880 1.2900

Bids 1.2645-50 1.2620 1.2600 1.2585 1.2550-55 1.2530-35 1.2500 1.2480 1.2450

EUR/GBP

Offers 0.8400 0.8420-25 0.8450 0.8460-65 0.8480 0.8500 0.8535 0.8550

Bids 0.8370 0.8350-55 0.8335 0.8300 0.8285 0.8250 0.8200-05

EUR/JPY

Offers 122.80 123.00 123.35 123.50 124.00 124.20 124.50

Bids 122.20 122.00 121.75 121.50 121.20 121.00 120.80-85 120.50

USD/JPY

Offers 115.55-60 115.80 116.00 116.25-30 116.50 116.80 117.00

Bids 114.75-80 114.50 114.20 114.00 113.80 113.50 113.30 113.00

AUD/USD

Offers 0.7500 0.7520-25 0.7550 0.7580 0.7600 0.7630 0.7650

Bids 0.7480 0.7470 0.7445-50 0.7430 0.7400 0.7380 0.7355-60 0.7325-30 0.7300

-

10:54

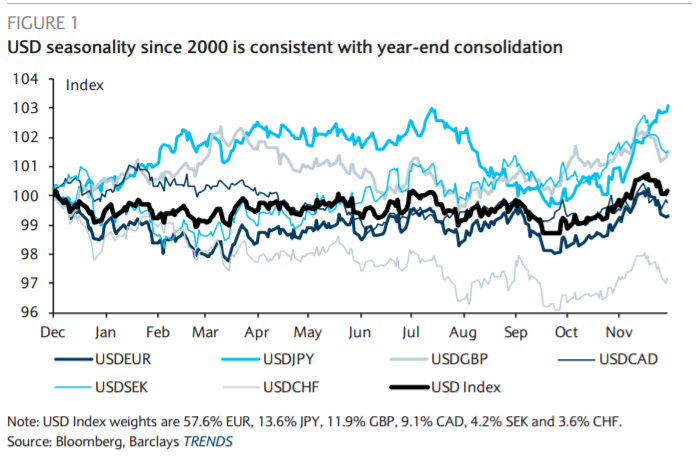

Barclays is selling the facts at today’s FOMC

"Wednesday's FOMC meeting is unlikely to provide a catalyst for further USD strength and may instead encourage profit taking on long USD positions as we approach year-end, particularly in currency pairs where the USD is most expensive.

A 25bp hike is widely expected by both interest rate markets (23bp of hikes priced) and analysts, including ourselves. Furthermore, fed funds futures imply a policy path for the coming year that is broadly consistent with the median FOMC participant September forecast (implied year-end 2017 fed funds rate of 0.96% versus median FOMC forecast of 1.1%). In its forward guidance, we expect Chair Yellen to balance the decision to raise rates with a dovish message of a shallow expected policy path and a willingness to test the potential benefits of running a "high pressure" economy.

Positioning, valuation and seasonal factors also support some near-term USD consolidation. Our FX flow data are consistent with indications from FX futures markets, which suggest that speculative investors remain significantly long the USD. With USD appreciation of about 4% since early October on a trade-weighted basis, to a point where we estimate the USD is close to 20% expensive, we think there is strong incentive for these investors to unwind some of their positions as year-end approaches.

Seasonal considerations also suggest the USD, on an index basis, tends to weaken into year-end".

Copyright © 2016 Barclays Capital, eFXnews™

-

10:30

None of the ZEW survey participants evaluated the current economic situation in Switzerland as "bad"

The ZEW-CS-Indicator for the economic sentiment in Switzerland has continued its rise in December 2016. Growing by 4.0 points, the index now stands at 12.9 points. The indicator's current level is therefore far above the long-term average of about minus 10 points. This marks the continuation of an upward trend observed since October 2016. When it comes to the current economic situation in Switzerland, however, experts are less positive in their evaluation than in the previous month: The corresponding indicator declined by 5.0 points to a level of 9.7. None of the ZEW survey participants evaluated the current economic situation in Switzerland as "bad."

-

10:05

Seasonally adjusted industrial production fell by 0.1% in the euro area

In October 2016 compared with September 2016, seasonally adjusted industrial production fell by 0.1% in the euro area (EA19) and by 0.3% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In September 2016 industrial production fell by 0.9% in the euro area and by 0.7% in the EU28. In October 2016 compared with October 2015, industrial production increased by 0.6% in the euro area and by 0.5% in the EU28.

The decrease of 0.1% in industrial production in the euro area in October 2016, compared with September 2016, is due to production of non-durable consumer goods falling by 1.5% and intermediate goods by 0.5%, while production of energy rose by 0.8%, capital goods by 1.0% and durable consumer goods by 1.5%. In the EU28, the decrease of 0.3% is due to production of non-durable consumer goods falling by 0.7% and intermediate goods by 0.5%, while production of energy rose by 0.1%, capital goods by 0.3% and durable consumer goods by 1.1%. Among Member States for which data are available, the largest decreases in industrial production were registered in Ireland (-3.6%), Sweden (-2.9%) and Luxembourg (-2.2%), and the highest increases in Denmark (+4.7%), Greece (+4.5%), Lithuania (+2.7%) and Latvia (+2.5%).

-

10:00

Switzerland: Credit Suisse ZEW Survey (Expectations), December 12.9

-

10:00

Eurozone: Industrial production, (MoM), October -0.1% (forecast 0.2%)

-

10:00

Eurozone: Industrial Production (YoY), October 0.6% (forecast 0.8%)

-

09:35

UK unemployment rate stable, average earnings up - ONS

There were 31.76 million people in work, little changed compared with May to July 2016 but 342,000 more than for a year earlier.

There were 23.20 million people working full-time, 235,000 more than for a year earlier. There were 8.56 million people working part-time, 107,000 more than for a year earlier.

The unemployment rate was 4.8%, down from 5.2% for a year earlier. It has not been lower since July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.5% including bonuses and by 2.6% excluding bonuses compared with a year earlier.

-

09:30

United Kingdom: ILO Unemployment Rate, October 4.8% (forecast 4.8%)

-

09:30

United Kingdom: Claimant count , November 2.4 (forecast 5)

-

09:30

United Kingdom: Average earnings ex bonuses, 3 m/y, October 2.6% (forecast 2.5%)

-

09:30

United Kingdom: Average Earnings, 3m/y , October 2.5% (forecast 2.3%)

-

09:28

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.14bln) 1.0550 (887m) 1.0575 (1.21bln) 1.0600 (1.03bln) 1.0675 (924m) 1.0700 (564m) 1.0750 (854m)

USD/JPY 113.00 (USD 632m) 114.55 (700m) 117.00 (940m)

USD/CHF 1.0150 (USD 506m)

AUD/USD 0.7470 (581m)

Информационно-аналитический отдел TeleTrade

-

08:26

Swiss Producer and import price index rises by 0.1 percent

The index of producer and import prices rose by 0.1% in November 2016 compared to the previous month, reaching 99.9 points (December 2015 = 100 basis). The slight rise is mainly due to higher prices for scrap and petroleum products. Compared with November 2015, the price level of the total supply of domestic and imported products fell by 0.6 per cent. This is evident from the figures of the Federal Statistical Office (FSO).

-

08:15

Switzerland: Producer & Import Prices, m/m, November 0.1% (forecast -0.1%)

-

08:15

Switzerland: Producer & Import Prices, y/y, November -0.6%

-

08:14

In November 2016 French consumer prices remained stable

In November 2016, the Consumer Prices Index (CPI) remained stable over a month. Seasonally adjusted, it rose slightly (+0.1%) after a stability in October. Year on year, the CPI accelerated slightly, to 0.5% after +0.4% in the previous month.

This month-on-month stability resulted from a lower increase in energy prices and a modest rebound in food prices, offset by a fall in services and manufactured product prices.

Energy prices remained dynamic but slowed down (+0.9% after +1.3% in the previous month). However, year on year, they accelerated sharply (+2.1% after +0.7% the previous month).

The slowdown over a month came from that in petroleum product prices (+1.3% after +2.4% in October; +4,1% year-on-year). In contrast, town gas and natural gas prices, index-linked to the changes in oil prices with a time lag, picked up sharply (+1.5% after −0.7% in October; −5.7% year-on-year). Electricity fares were stable for the third consecutive month (+1.8% year-on-year).

-

08:12

Today’s events

-

At 12:15 GMT the Bank of England Governor Mark Carney will deliver a speech

-

At 14:15 GMT BoE Deputy Governor Sam Woods will deliver a speech

-

At 19:00 GMT FOMC decision on the basic interest rate

-

-

07:33

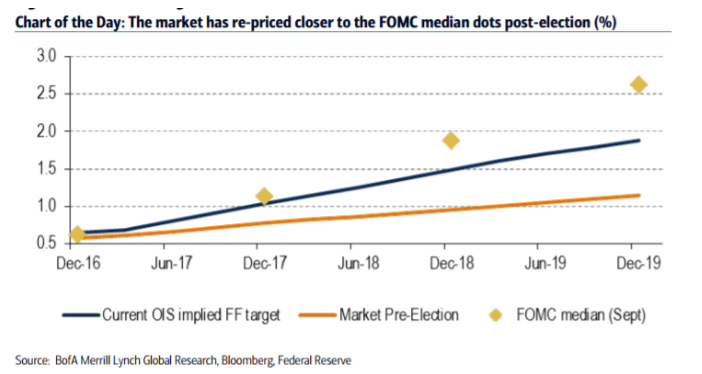

The day we have all been waiting for - Bank of America Merrill

"It is the day we have all been waiting for - the FOMC is very likely to hike 25bp to a range of 50-75bp at the 14th December meeting. This is the second hike in the cycle, following the move last December. Since the rate hike is largely expected, the focus will be on the statement, SEP (specifically the dots) and the press conference. Since the Presidential election, the market has priced in a faster trajectory of hikes, putting it much closer to the Fed's expectations for the next two years (see Chart of the Day).

We think the risk is that the FOMC statement and SEP lean hawkish, given the potential for an upward shift in the dots and the possible limited extent of concern about the recent tightening in financial conditions. However, Chair Yellen is likely to maintain a cautious tone at the press conference.

In our view, the risk is for near-term rates to increase and the dollar to strengthen following the meeting.

FX: focus on 2017 and 2018…

Similar to the market response after the December 2015 hike, we think the key for the FX market will be the signal of the pace of hikes in 2017 and 2018 The main determinant here will be the dot plots, tone of press conference, as well as any nod (implicit or explicit) to the recent tightening of financial conditions amid higher yields and a stronger USD. While market rates have consistently traded below the dots in recent years, the risk of an upward trend in wages and inflation likely means market rates will continue to shift further towards the dots going forward. Indeed, as our rates team has argued, if market rates matched the dot plot, 5-year rates would rise 50 basis points. Therefore, a shift up in the 2017 dots from 2 to 3 hikes would provide USD support through higher front-end yields. That said, given the dollar's over-3% rise since the election and with hedge fund positioning looking stretched, we will need to see further evidence on the data front supporting a faster pace of Fed hikes for the move to be sustained.

Aside from the impact of a mechanical rise in yields, we think short-term USD gains could be tempered by Yellen's tone. She will be careful to not engender a further tightening of financial conditions and will likely adopt a cautiously optimistic tone, reiterating the gradual pace of hikes relative to historical cycles. However, with growth rebounding, inflation rising, and the unemployment rate through the Fed's estimate of NAIRU, we are unlikely to get strong pushback against tighter financial conditions (and a stronger USD) for now.

The dollar is certainly a risk to growth and inflation but given that the recent moves have been driven by US factors (better growth expectations) and not foreign central bank easing, we expect the Fed is more likely to see it as a positive sign. Additionally, while the trade-weighted dollar has rallied a few percent since the election, the year-over-year changes are still flat; so, the growth impact will be muted for now. Despite this, any signs of concern from the Fed would limit near-term USD gains, in our view".

Copyright © 2016 BofAML, eFXnews™

-

07:29

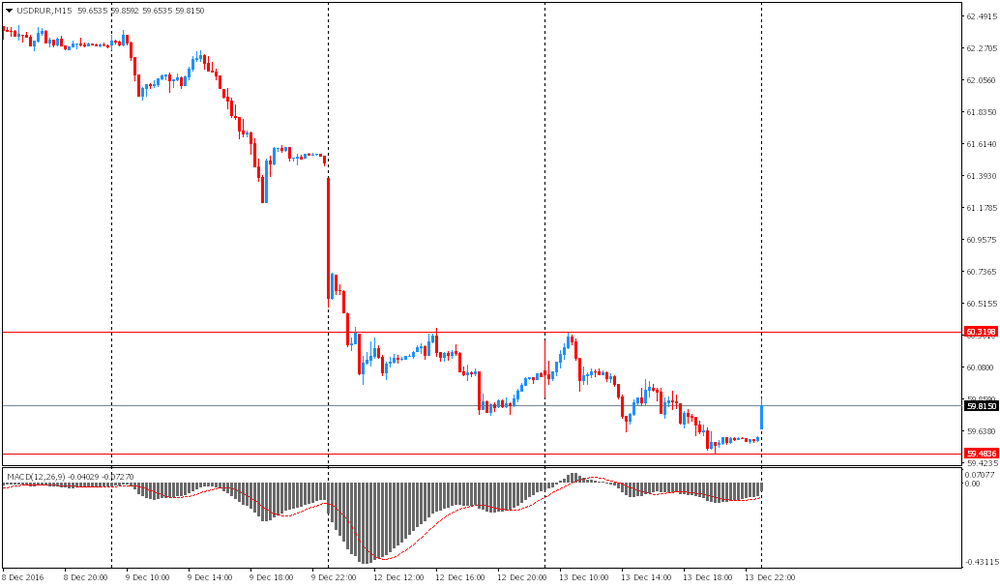

USD / RUR opened with a slight increase

USD / RUR jumped to the level of 59.81 after opening. It is worth noting that this morning Brent crude slipped slightly by 0.7%, which had a negative impact on the ruble. Nevertheless, the overall trend for the pair remains downward. Support at yesterday's low (59.81), and resistance - yesterday's high (60.31).

-

07:26

Japan large enterprises Tankan index increased in the fourth quarter

The index rose to its highest level since December last year. This index reflects the general business conditions for large Japanese manufacturing companies and is an economic indicator that is highly dependent on industry, causes the growth of export-oriented economy. The index value greater than 0 (zero - the middle line) is positive and the value of the indicator below the 0 - negative for the Japanese currency.

It also became known that the index of business activity in the Tankan services sector in the third quarter remained unchanged at 18, while analysts expected the growth rate to 19.

The index of expected capital investments increased by + 5.5%, lower than the previous value of 6.3% and economists' forecast of + 6.1% in the current fiscal year.

-

07:25

Options levels on wednesday, December 14, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0835 (1451)

$1.0799 (290)

$1.0746 (200)

Price at time of writing this review: $1.0651

Support levels (open interest**, contracts):

$1.0574 (2107)

$1.0537 (1171)

$1.0490 (1147)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 41427 contracts, with the maximum number of contracts with strike price $1,1500 (3247);

- Overall open interest on the PUT options with the expiration date March, 13 is 42036 contracts, with the maximum number of contracts with strike price $1,0000 (3520);

- The ratio of PUT/CALL was 1.01 versus 1.03 from the previous trading day according to data from December, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.2914 (274)

$1.2818 (463)

$1.2723 (416)

Price at time of writing this review: $1.2660

Support levels (open interest**, contracts):

$1.2580 (720)

$1.2484 (477)

$1.2387 (325)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9777 contracts, with the maximum number of contracts with strike price $1,2600 (1105);

- Overall open interest on the PUT options with the expiration date March, 13 is 12577 contracts, with the maximum number of contracts with strike price $1,1500 (2966);

- The ratio of PUT/CALL was 1.29 versus 1.23 from the previous trading day according to data from December, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:17

Japan’s Industrial production flat in October

According to data released today by the Ministry of Economy, Trade and Industry of Japan, the volume of industrial production in October was unchanged (0%), while most analysts had expected a small growth rate of 0.1%. On an annual basis, industrial production fell in October 1.4%, after + 1.5% in the previous year.

Delivery volumes increased by 2.0% compared to the previous reporting period. At the same time, stocks of inventory levels decreased by 2.1%. The data also showed that the capacity utilization rate rose in October by 1.4% on monthly basis, compared with a 2.0% growth in September.

-

07:12

Westpac-Melbourne Institute survey of consumer sentiment fell 3.9% this month

The Westpac-Melbourne Institute survey of consumer sentiment fell 3.9% this month, following a decline of 1.1% in November.

The Westpac consumer confidence survey is based on responses from 1,200 adults aged 18 and over from across Australia. The survey is usually administered in the first four days of each month.

Underlying consumer confidence took a hit after the economy contracted in the third quarter for the first time since 2011. Gross domestic product (GDP) shrank at a seasonally adjusted 0.5% in the three months through September, following an upwardly revised 0.6% gain the previous quarter, government data showed last week.

-

04:32

Japan: Industrial Production (MoM) , October 0% (forecast 0.1%)

-

04:32

Japan: Industrial Production (YoY), October -1.4% (forecast -1.3%)

-

00:31

Australia: New Motor Vehicle Sales (MoM) , November -0.6%

-

00:31

Australia: New Motor Vehicle Sales (YoY) , November -1.1%

-