Market news

-

23:27

Currencies. Daily history for Feb 20’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0611 +0,04%

GBP/USD $1,2461 +0,40%

USD/CHF Chf1,0027 +0,00%

USD/JPY Y113,10 +0,17%

EUR/JPY Y120,02 +0,21%

GBP/JPY Y140,93 +0,57%

AUD/USD $0,7686 +0,25%

NZD/USD $0,7188 +0,07%

USD/CAD C$1,3103 +0,05%

-

22:59

Schedule for today, Tuesday, Feb 21’2017 (GMT0)

00:30 Australia RBA Meeting's Minutes

00:30 Japan Manufacturing PMI (Preliminary) February 52.7

04:30 Japan All Industry Activity Index, m/m December 0.3%

07:00 Switzerland Trade Balance January 2.7

08:00 France Manufacturing PMI (Preliminary) February 53.6 53.5

08:00 France Services PMI (Preliminary) February 54.1 53.7

08:30 Germany Services PMI (Preliminary) February 53.4 53.7

08:30 Germany Manufacturing PMI (Preliminary) February 56.4 56

09:00 Eurozone Manufacturing PMI (Preliminary) February 55.2 55

09:00 Eurozone Services PMI (Preliminary) February 53.7 53.7

09:30 United Kingdom PSNB, bln January -6.42 14.4

10:00 United Kingdom Inflation Report Hearings

14:45 U.S. Manufacturing PMI (Preliminary) February 55 55.2

14:45 U.S. Services PMI (Preliminary) February 55.6 55.7

17:00 U.S. FOMC Member Harker Speaks

21:30 Australia RBA's Governor Philip Lowe Speaks

23:30 Australia Leading Index January 0.4%

-

15:45

Euro area consumer confidence decreased in February

In February 2017, the DG ECFIN flash estimate of the consumer confidence indicator decreased in both the euro area (by 1.4 points to -6.2) and the EU (by 0.9 points to -5.2) compared to January 2017.

-

15:02

French Finance Minister Michel Sapin says he thinks Eurogroup will reach greek deal today

-

15:00

Eurozone: Consumer Confidence, February -6.2 (forecast -4.9)

-

14:51

The European Commission has denied that President Jean-Claude Juncker could resign in March

-

14:25

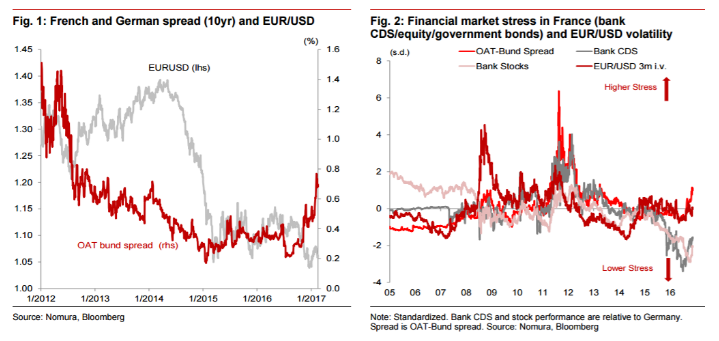

Two important themes currently apparent in the euro area - Nomura

"There are two important themes currently apparent in the euro area: 1) the strong recovery in inflation and in the economy, and 2) political risks ahead of the elections.

Both these themes are euro area bond market unfriendly, especially for the market with the election risks. The risk of a Marine Le Pen victory at the French elections is low, but if political shocks are avoided, ECB tapering concerns will likely kick in swiftly. This makes euro area bond investment less attractive even if we and the market expect political shocks to be avoided.

Recent correlations pointing to wider French/peripheral spreads against Germany are EUR negative. If the correlation shifts further towards a crisis correlation, a 50bp widening in the French-German bond yield spread could weaken EUR/USD by 5.6% and it could test the parity.

This is a risk scenario to us, but fragile bond market dynamics in the euro area bond market will likely cap nearterm upside room for EUR, even though ECB tapering expectations should support EUR into H2 barring no political shocks.

In the medium term, we expect EUR outperformance, but EUR is likely to trade heavily for now".

Copyright © 2017 Nomura, eFXnews™

-

13:39

Canadian wholesale sales rose 0.7% to $57.3 billion in December

Wholesale sales rose 0.7% to $57.3 billion in December, a third consecutive gain. Six of the seven subsectors, representing 82% of total wholesale sales, reported increases. The machinery, equipment and supplies subsector and the building material and supplies subsector contributed the most to the advance.

In volume terms, wholesale sales were up 0.9%.

The machinery, equipment and supplies subsector reported the largest gain in dollar terms in December, increasing 2.5% to $11.6 billion. Every industry within the subsector reported higher sales, led by the construction, forestry, mining, and industrial machinery, equipment and supplies industry (+3.9%). This was the largest dollar value gain for the industry since January 2016. Imports of industrial machinery were up in December.

-

13:30

Canada: Wholesale Sales, m/m, December 0.7%

-

13:00

Orders

EUR/USD

Offers 1.0635 1.0650 1.0680 1.0700-05 1.0730 1.0750

Bids 1.0600 1.0585 1.0550 1.0520 1.0500 1.0480-85 1.0450

GBP/USD

Offers 1.2365 1.2480 1.2500 1.2520 1.2550 1.2580 1.2600

Bids 1.2420 1.2400 1.2380 1.2345-50 1.2330 1.2300

EUR/GBP

Offers 0.8550-55 0.8585 0.8600 0.8620 0.8650

Bids 0.8520 0.8500 0.8480-85 0.8450 0.8430 0.8400

EUR/JPY

Offers 120.30 120.50 120.80 121.00 121.35 121.50

Bids 120.00 119.75-80 119.50 119.00

USD/JPY

Offers 113.25-30 113.50 113.80-85 114.00-05 114.20 114.35 114.50

Bids 113.00 112.80 112.50 112.30 112.00

AUD/USD

Offers 0.7700 0.7720 0.7735 0.7750 0.7780 0.7800

Bids 0.7660 0.7620 0.7600 0.7580 0.7550

-

12:41

ECB Schaeuble: EURO exchange rate too weak for Germany @zerohedge

-

11:53

Bundesbank: German Economic Growth Expected To Strengthen In 2017

-

11:06

UK industrial orders at 2 years high - CBI

The survey of 471 firms found that total orders reached a two-year high, with the strengthening in demand led by the mechanical engineering and metal products sectors. Export orders remained stable, and above the long-run average.

Output growth remained robust in the three months to February and is expected to increase at a faster pace over the coming quarter, with expectations at their highest since September 2013.

Firms expect prices to rise strongly over the next three months, with expectations at their firmest since April 2011, as Sterling's depreciation continues to increase the cost of raw materials.

-

11:00

United Kingdom: CBI industrial order books balance, February 8 (forecast 3)

-

10:21

ECB Sabina Lautenshleger said that the ECB should see stabilization of inflation close to the target value

Member of the Executive Board of the ECB Sabina Lautenshleger said that the ECB should see stabilization of inflation close to the target value "a little less than 2 percent" before interest rates can be increased. Meanwhile, it is hoped that the ECB's bond-buying program will be cut before the end of this year.

Consumer prices in the eurozone rose by 1.8 per cent per annum in January, reaching the highest level since February 2013, according to Eurostat estimates. Recall that in December, prices increased by 1.1 per cent per annum.

"I am very pleased to say that we are close to our inflation target," a little less than 2 percent. "But for me it is important that it is not a temporary phenomenon. In January, we do not know for sure. In December, it was pretty part due to energy prices and the so-called base effect, so it is very important to make sure that there is a trend, and inflation is actually returned to its target level ", -. Lautenshleger added.

-

09:25

-

08:18

Today’s events

-

At 11:00 GMT the Bundesbank Monthly Report

-

Also today, the meeting of the Eurogroup

-

US celebrate Presidents' Day

-

-

07:38

Are markets too optimistic about a BoC rate hike? - CIBC

"The Canadian economy's been looking a bit brighter recently. But are markets too optimistic about a BoC rate hike?

Hiring has been strong, but somehow hours worked have actually declined. The trade balance looks healthy in nominal terms, but a glance at volumes paints a drearier picture. And, this week, manufacturing shipments showed a healthy increase, but the gains were by no means broad-based and could be set for a reversal. Early indications suggest that January wasn't a great month for transportation equipment shipments south of the border, and that's often a good predictor of trends in that important sector in Canada.

All told, it's unlikely that the BoC moves this year, and a reduction in pricing should see CAD weaken in the months ahead".

CIBC targets USD/CAD at 1.3400, 1.3600, 1.3900 by the end of Q1, Q2, and Q3 respectively.

Copyright © 2017 CIBC, eFXnews™

-

07:35

The FAKE NEWS media (failing @nytimes, @NBCNews, @ABC, @CBS, @CNN) is not my enemy, it is the enemy of the American People! @realDonaldTrump

-

07:24

New Zeeland producer output prices were mainly influenced by higher prices received by dairy product manufacturers

Producer output prices rose 1.5 percent in the December 2016 quarter, and producer input prices rose 1.0 percent, Statistics New Zealand said today.

Producer output prices were mainly influenced by higher prices received by dairy product manufacturers (up 14 percent), and higher farm-gate milk prices received by dairy cattle farmers (up 13 percent).

"Producer prices were driven by a higher forecasted farm-gate milk price, which rose to $6.00 a kilo in mid-November 2016. This compares to $4.60 a kilo a year before, and $8.65 a kilo in the March 2014 quarter, when prices received by dairy cattle farmers were at their peak," business prices manager Sarah Williams said.

-

07:20

German producer prices up 2.4% in January

In January 2017 the index of producer prices for industrial products rose by 2.4% compared with the corresponding month of the preceding year. This was the highest annual rate of change since March 2012 (+2.6%). In December 2016 the annual rate of change all over had been 1.0%.

Compared with the preceding month December 2016 the overall index rose by 0.7% in January 2017 (0.4% in December and 0.3% in November).

In January 2017 the price indices of all main industrial groups rose compared with January 2016: Energy prices increased by 4.0%, though prices of the different energy carriers diverged. Prices of petroleum products increased by 19.7%, whereas prices of natural gas (distribution) decreased by 7.8%. Prices of intermediate goods rose by 2.4%, prices of non-durable consumer goods by 2.2%. Prices of durable consumer goods increased by 1.0% and prices of capital goods by 0.9%.

-

07:01

Germany: Producer Price Index (YoY), January 2.4% (forecast 2%)

-

07:00

Germany: Producer Price Index (MoM), January 0.7% (forecast 0.3%)

-

06:05

Options levels on monday, February 20, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0765 (4457)

$1.0726 (3008)

$1.0668 (3188)

Price at time of writing this review: $1.0612

Support levels (open interest**, contracts):

$1.0547 (5195)

$1.0515 (5522)

$1.0478 (6163)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 71025 contracts, with the maximum number of contracts with strike price $1,0800 (4872);

- Overall open interest on the PUT options with the expiration date March, 13 is 86412 contracts, with the maximum number of contracts with strike price $1,0500 (6163);

- The ratio of PUT/CALL was 1.22 versus 1.19 from the previous trading day according to data from February, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.2701 (2368)

$1.2602 (2279)

$1.2505 (2908)

Price at time of writing this review: $1.2423

Support levels (open interest**, contracts):

$1.2296 (3253)

$1.2198 (1466)

$1.2099 (1464)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33671 contracts, with the maximum number of contracts with strike price $1,2800 (3028);

- Overall open interest on the PUT options with the expiration date March, 13 is 35955 contracts, with the maximum number of contracts with strike price $1,2300 (3253);

- The ratio of PUT/CALL was 1.07 versus 1.11 from the previous trading day according to data from February, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:26

Currencies. Daily history for Feb 17’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0607 -0,62%

GBP/USD $1,2411 -0,62%

USD/CHF Chf1,0027 +0,60%

USD/JPY Y112,91 -0,28%

EUR/JPY Y119,77 -0,90%

GBP/JPY Y140,13 -0,88%

AUD/USD $0,7667 -0,34%

NZD/USD $0,7183 -0,33%

USD/CAD C$1,3097 +0,21%

-

01:02

Schedule for today, Monday, Feb 20’2017 (GMT0)

07:00 Germany Producer Price Index (MoM) January 0.4% 0.3%

07:00 Germany Producer Price Index (YoY) January 1.0% 2%

11:00 United Kingdom CBI industrial order books balance February 5 3

11:00 Germany Bundesbank Monthly Report

12:00 U.S. Bank holiday

13:30 Canada Wholesale Sales, m/m December 0.2%

15:00 Eurozone Consumer Confidence (Preliminary) February -4.7 -4.9

-