Market news

-

23:32

Japan: Tokyo CPI ex Fresh Food, y/y, August 0.4% (forecast 0.3%)

-

23:31

Japan: Tokyo Consumer Price Index, y/y, August 0.4% (forecast 0.3%)

-

23:30

Japan: National Consumer Price Index, y/y, July 0.4% (forecast 0.4%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, July 0.5% (forecast 0.5%)

-

22:28

Commodities. Daily history for Aug 24’2017:

(raw materials / closing price /% change)

Oil 47.62 +0.40%

Gold 1,291.50 -0.04%

-

22:27

Stocks. Daily history for Aug 24’2017:

(index / closing price / change items /% change)

Nikkei -80.87 19353.77 -0.42%

TOPIX -7.85 1592.20 -0.49%

Hang Seng +116.93 27518.60 +0.43%

CSI 300 -21.44 3734.65 -0.57%

Euro Stoxx 50 +6.10 3444.73 +0.18%

FTSE 100 +24.41 7407.06 +0.33%

DAX +6.53 12180.83 +0.05%

CAC 40 -2.26 5113.13 -0.04%

DJIA -28.69 21783.40 -0.13%

S&P 500 -5.07 2438.97 -0.21%

NASDAQ -7.08 6271.33 -0.11%

S&P/TSX +13.00 15076.16 +0.09%

-

22:26

Currencies. Daily history for Aug 24’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1799 -0,08%

GBP/USD $1,2798 -0,01%

USD/CHF Chf0,96494 +0,01%

USD/JPY Y109,54 +0,56%

EUR/JPY Y129,26 +0,48%

GBP/JPY Y140,203 +0,55%

AUD/USD $0,7900 -0,06%

NZD/USD $0,7206 -0,21%

USD/CAD C$1,2513 -0,30%

-

22:00

Schedule for today, Friday, Aug 25’2017 (GMT0)

06:00 Germany GDP (YoY) (Finally) Quarter II 2% 2.1%

06:00 Germany GDP (QoQ) (Finally) Quarter II 0.7% 0.6%

06:45 France Consumer confidence August 104 103

08:00 Germany IFO - Business Climate August 116 115.5

08:00 Germany IFO - Current Assessment August 125.4 125

08:00 Germany IFO - Expectations August 107.3 106.8

12:00 U.S. Jackson Hole Symposium

12:30 U.S. Durable Goods Orders ex Transportation July 0.2% 0.4%

12:30 U.S. Durable Goods Orders July 6.5% -6%

12:30 U.S. Durable goods orders ex defense July 6.7%

14:00 U.S. Fed Chairman Janet Yellen Speaks

17:00 U.S. Baker Hughes Oil Rig Count August 763

19:00 Eurozone ECB President Mario Draghi Speaks

-

20:09

Major US stock indexes finished trading in negative territory

Major US stock indices fell slightly as investors worried about funding the US government, and were waiting for news from the annual conference of the Fed in Jackson Hole.

The theme of the conference this year is "Promoting the dynamics of the global economy." Traditionally, the event will be visited by the heads of many central banks and their statements can have a significant impact on the markets. First of all, attention will be directed to the speech of the head of the Federal Reserve, Janet Yellen, who are expected to hear signals about the further actions of the American regulator in the sphere of monetary policy. Given the recent cooling of the housing market, as well as inflationary pressures, the head of the federal budget is likely to be less optimistic about its estimates than before, which in the end should reduce expectations about the pace of further tightening of the monetary policy of the US central bank.

In addition, according to the Ministry of Labor, the number of people applying for unemployment benefits in the US increased by 2,000 to 234,000 in the week ending August 19 after reaching a six-month low in the previous week. This level of initial appeals is a sign of another month of solid hiring. Economists had expected that applications for state unemployment benefits would increase to 238,000 from 232,000 the previous week.

Sales of housing in the secondary market fell to the lowest level for the year in July, as the dynamics of restrained supply and strong demand continues to strain the housing market. According to the National Association of Realtors, home sales in the secondary market, taking into account seasonal correction reached 5.44 million units. Sales decreased by 1.3% compared to the revised June figure. While the July rate was 2.1% higher than a year ago, it was the lowest since August last year. Economists forecast sales at 5.57 million units

Components of the DOW index finished the session in different directions (14 in positive territory, 16 in negative territory). The leader of growth were the shares of Cisco Systems, Inc. (CSCO, + 1.15%). Wal-Mart Stores, Inc. turned out to be an outsider. (WMT, -2.20%).

Most sectors of the S & P index showed a decline. The largest drop was shown by the consumer goods sector (-0.5%). The healthcare sector grew most (+ 0.3%).

At closing:

DJIA -0.13% 21.782.92 -29.17

Nasdaq -0.11% 6,271.33 -7.08

S & P -0.21% 2,438.97 -5.07

-

19:00

DJIA -0.06% 21,799.27 -12.82 Nasdaq -0.05% 6,275.21 -3.20 S&P -0.12% 2,441.06 -2.98

-

16:00

European stocks closed: FTSE 100 +24.41 7407.06 +0.33% DAX +6.53 12180.83 +0.05% CAC 40 -2.26 5113.13 -0.04%

-

14:36

Germany's 10-year government bond yield touches new eight-week low at 0.37 percent

-

14:03

US existing-home sales slipped 1.3% in July

Total existing-home sales transactions that include single-family homes, townhomes, condominiums and co-ops, slipped 1.3 percent to a seasonally adjusted annual rate of 5.44 million in July from a downwardly revised 5.51 million in June. July's sales pace is still 2.1 percent above a year ago, but is the lowest of 2017.

Lawrence Yun, NAR chief economist, says the second half of the year got off on a somewhat sour note as existing sales in July inched backward. "Buyer interest in most of the country has held up strongly this summer and homes are selling fast, but the negative effect of not enough inventory to choose from and its pressure on overall affordability put the brakes on what should've been a higher sales pace," he said. "Contract activity has mostly trended downward since February and ultimately put a large dent on closings last month."

The median existing-home price for all housing types in July was $258,300, up 6.2 percent from July 2016 ($243,200). July's price increase marks the 65th straight month of year-over-year gains.

-

14:00

U.S.: Existing Home Sales , July 5.44 (forecast 5.57)

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1600-05(1.43 млрд), 1.1660(1.21 млрд), 1.1675-76(1.35 млрд), 1.1700(429 млн), 1.1750(734 млн), 1.1834-35(620 млн), 1.1850-55(979 млн)

GBP/USD: 1.2700(394 млн), 1.2950(903 млн), 1.3050(518 млн)

USD/JPY: 108.00(695 млн), 109.00(369 млн), 110.00(342 млн), 111.25(345 млн), 111.35(300 млн)

USD/CHF: 1.0000(525 млн)

AUD/USD: 0.8000(408 млн)

NZD/USD: 0.7430-35(540 млн)

USD/CAD: 1.2680(360 млн)

-

13:36

Trump says debt ceiling "mess" could have been avoided if republican congressional leaders had followed his advice to link debt ceiling and veterans bill

-

13:31

U.S. Stocks open: Dow +0.17%, Nasdaq +0.26%, S&P +0.18%

-

13:11

Before the bell: S&P futures +0.27%, NASDAQ futures +0.35%

U.S. stock-index futures rose moderately on Thursday following yesterday's modest decline. Investors remained cautious ahead of the start of the annual meeting of central bankers at Jackson Hole, Wyoming.

Global Stocks:

Nikkei 19,353.77 -80.87 -0.42%

Hang Seng 27,518.60 +116.93 +0.43%

Shanghai 3,271.99 -15.71 -0.48%

S&P/ASX 5,745.48 +8.32 +0.14%

FTSE 7,419.66 +37.01 +0.50%

CAC 5,129.80 +14.41 +0.28%

DAX 12,233.92 +59.62 +0.49%

Crude $48.21 (-0.41%)

Gold $1,292.20 (-0.19%)

-

12:59

Belgium: Business Climate, August -2.1 (forecast -1.7)

-

12:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

41.05

-0.01(-0.02%)

5395

ALTRIA GROUP INC.

MO

63.88

0.17(0.27%)

2042

Amazon.com Inc., NASDAQ

AMZN

960.95

2.95(0.31%)

13507

Apple Inc.

AAPL

160.6

0.62(0.39%)

70438

AT&T Inc

T

38

0.08(0.21%)

381

Barrick Gold Corporation, NYSE

ABX

16.95

-0.07(-0.41%)

5850

Boeing Co

BA

238.5

0.41(0.17%)

716

Caterpillar Inc

CAT

114.96

0.21(0.18%)

1275

Citigroup Inc., NYSE

C

67.55

0.32(0.48%)

15978

Exxon Mobil Corp

XOM

76.64

0.03(0.04%)

1133

Facebook, Inc.

FB

169.38

0.67(0.40%)

33489

Ford Motor Co.

F

10.75

0.04(0.37%)

4082

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.38

0.09(0.59%)

15641

General Electric Co

GE

24.44

0.05(0.21%)

13202

General Motors Company, NYSE

GM

35.55

0.06(0.17%)

1538

Goldman Sachs

GS

224

1.26(0.57%)

868

Google Inc.

GOOG

931

4.00(0.43%)

1523

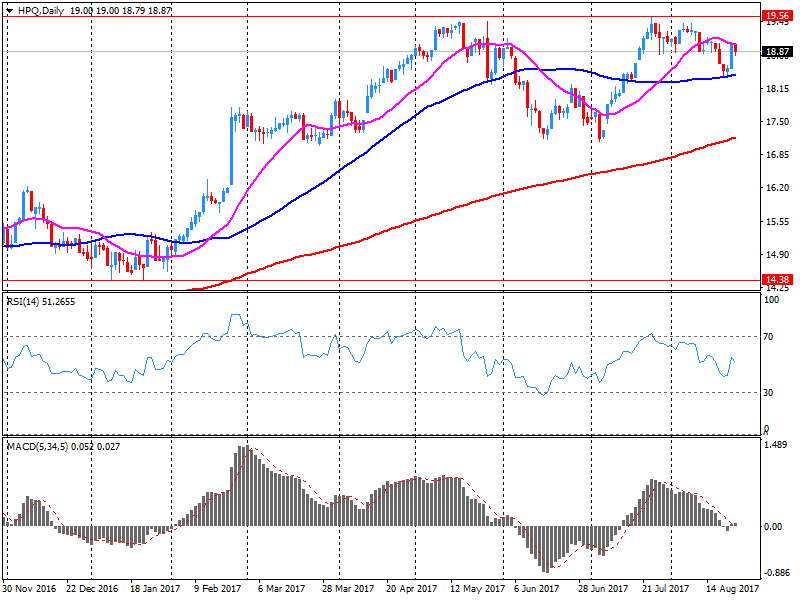

Hewlett-Packard Co.

HPQ

18.5

-0.36(-1.91%)

13241

Home Depot Inc

HD

149.3

0.20(0.13%)

3116

Intel Corp

INTC

34.88

0.22(0.63%)

7785

International Business Machines Co...

IBM

142.8

0.66(0.46%)

558

McDonald's Corp

MCD

159.1

0.29(0.18%)

5156

Merck & Co Inc

MRK

62.55

0.40(0.64%)

220

Microsoft Corp

MSFT

72.92

0.20(0.28%)

3551

Pfizer Inc

PFE

33.19

-0.05(-0.15%)

395

Starbucks Corporation, NASDAQ

SBUX

54.29

0.21(0.39%)

1982

Tesla Motors, Inc., NASDAQ

TSLA

352.8

0.03(0.01%)

20591

Twitter, Inc., NYSE

TWTR

17.04

0.08(0.47%)

16880

Wal-Mart Stores Inc

WMT

80.45

0.49(0.61%)

3220

Walt Disney Co

DIS

101.51

0.01(0.01%)

189

Yandex N.V., NASDAQ

YNDX

30.07

0.13(0.43%)

13910

-

12:48

Canadian corporations earned $91.4 billion in operating profits in the second quarter

Overall, Canadian corporations earned $91.4 billion in operating profits in the second quarter, up $60 million or 0.1% from the first quarter. An increase in operating profits for the non-financial industries was offset by a decrease in the financial industries.

Compared with the second quarter of 2016, operating profits for Canadian corporations were up 25.5% in the second quarter.

In the non-financial industries, operating profits increased 2.6% from the first quarter to $62.1 billion in the second quarter, while operating revenues increased 1.4% or $12.5 billion. Overall, operating profits were up in 14 of 17 non-financial industries.

Compared with the second quarter of 2016, operating profits for Canadian non-financial corporations increased 21.3% in the second quarter.

-

12:47

US initial jobless claims declined in the previous week

In the week ending August 19, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 2,000 from the previous week's unrevised level of 232,000. The 4-week moving average was 237,750, a decrease of 2,750 from the previous week's unrevised average of 240,500.

-

12:41

Target price changes before the market open

HP Inc. (HPQ) target raised to $22 from $21 at Maxim Group

-

12:30

U.S.: Continuing Jobless Claims, 1954 (forecast 1950)

-

12:30

U.S.: Initial Jobless Claims, 234 (forecast 238)

-

12:06

Company News: HP Inc. (HPQ) quarterly results beat analysts’ expectations

HP Inc. (HPQ) reported Q3 FY 2017 earnings of $0.43 per share (versus $0.48 in Q3 FY 2016), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $13.060 bln (+9.8% y/y), beating analysts' consensus estimate of $12.306 bln.

HPQ fell to $18.79 (-0.37%) in pre-market trading.

-

11:22

Hungarian central bank says it monitors the evolution of monetary conditions persistently, Sept inflation report will shed light on any macroeconomic effects due to changes in conditions - Reuters

-

10:42

Fitch - rapid loan growth at turkish banks in H1 highlights the significant impact of a government initiative to stimulate lending

-

Turkish H1 loan growth highlights stimulus impact

-

-

10:03

UK retail sales fell at the fastest pace since July 2016 - CBI

The survey of 117 firms, of which 57 were retailers, showed that, in the year to August, the volume of sales fell at the fastest pace since July 2016, with orders placed on suppliers also falling considerably year-on-year. Overall, sales for the time of year were considered to be below seasonal norms to the greatest extent since October 2014.

Looking ahead to next month, retailers expect sales volumes to rebound in the year to September, while orders are expected to stabilise.

Within the retail sector, grocers saw stable sales on the year, following strong growth last month, and footwear and leather performed well, whilst specialist food & drink stores reported another month of significantly falling sales.

Year-on-year internet sales growth slowed, edging further below the long-run average, but growth is expected to pick up next month.

-

10:00

Fall in EU net migration to Britain was driven by an increase in emigration for EU citizens - ONS

-

10:00

United Kingdom: CBI retail sales volume balance, August -10 (forecast 15)

-

09:00

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1600-05(1.43 b), 1.1660(1.21 b), 1.1675-76(1.35 b), 1.1700(429 m), 1.1750(734 m), 1.1834-35(620 m), 1.1850-55(979 m)

GBP/USD: 1.2700(394 m), 1.2950(903 m), 1.3050(518 m)

USD/JPY: 108.00(695 m), 109.00(369 m), 110.00(342 m), 111.25(345 m), 111.35(300 m)

USD/CHF: 1.0000(525 m)

AUD/USD: 0.8000(408 m)

NZD/USD: 0.7430-35(540 m)

USD/CAD: 1.2680(360 m)

-

08:37

UK business investment broadly unchanged at £43.8 billion in Quarter 2

Gross fixed capital formation (GFCF), in volume terms, was estimated to have increased by 0.7% to £79.4 billion in Quarter 2 (Apr to June) 2017 from £78.9 billion in Quarter 1 (Jan to Mar) 2017.

Business investment was estimated to have been broadly unchanged at £43.8 billion in Quarter 2 2017 at 0.0%.

Between Quarter 2 2016 and Quarter 2 2017, GFCF was estimated to have increased by 2.5%, from £77.5 billion and business investment was estimated to be broadly unchanged from Quarter 2 2016 (£43.7 billion).

The sectors contributing most to GFCF growth between Quarter 1 2017 and Quarter 2 2017 were general government, public sector dwellings and private sector transfer costs.

-

08:35

UK gross domestic product (GDP) was estimated to have increased by 0.3% in Q2

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.3% between Quarter 1 (Jan to Mar) and Quarter 2 (Apr to June) 2017, unrevised from the preliminary estimate.

In the output measure of GDP, growth was driven by services, which grew by 0.5% between Quarter 1 and Quarter 2.

In the expenditure measure of GDP there was relatively strong growth in government spending and investment; there was, however, a slowdown in growth in both household spending and business investment, to 0.1% and 0.0% respectively in Quarter 2.

UK GDP growth in volume terms increased by 1.7% between Quarter 2 2016 and Quarter 2 2017.

UK GDP in current prices increased by 0.8% between Quarter 1 and Quarter 2 2017.

-

08:31

United Kingdom: Business Investment, y/y, Quarter II 0% (forecast 0.5%)

-

08:31

United Kingdom: Business Investment, q/q, Quarter II 0% (forecast 0.4%)

-

08:30

United Kingdom: BBA Mortgage Approvals, July 41.58

-

08:30

United Kingdom: GDP, y/y, Quarter II 1.7% (forecast 1.7%)

-

08:30

United Kingdom: GDP, q/q, Quarter II 0.3% (forecast 0.3%)

-

07:42

Major European stock exchanges trading in the green zone: FTSE 7403.42 +20.77 + 0.28%, DAX 12195.63 +21.33 + 0.18%, CAC 5131.00 +15.61 + 0.31%

-

06:50

Slow start of trading expected on the main European stock markets: DAX -0.06%, CAC 40 + 0.06%, FTSE 100 + 0.03%

-

06:29

Options levels on thursday, August 24, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1904 (4250)

$1.1885 (2026)

$1.1851 (2024)

Price at time of writing this review: $1.1794

Support levels (open interest**, contracts):

$1.1757 (1350)

$1.1731 (2580)

$1.1701 (3133)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date September, 8 is 128135 contracts (according to data from August, 23) with the maximum number of contracts with strike price $1,1600 (5085);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2940 (1517)

$1.2909 (572)

$1.2868 (169)

Price at time of writing this review: $1.2783

Support levels (open interest**, contracts):

$1.2732 (2007)

$1.2702 (1844)

$1.2666 (1772)

Comments:

- Overall open interest on the CALL options with the expiration date September, 8 is 34780 contracts, with the maximum number of contracts with strike price $1,3000 (3381);

- Overall open interest on the PUT options with the expiration date September, 8 is 30612 contracts, with the maximum number of contracts with strike price $1,2850 (2643);

- The ratio of PUT/CALL was 0.88 versus 0.88 from the previous trading day according to data from August, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:03

U.S. sells $13 bln 1-year, 11-month floating rate notes at high discount margin of 0.060 pct, 47.88 pct awarded at high rate

-

U.S. 1-year, 11-month frn bid-to-cover ratio 3.09

-

-

06:00

Trump and Mcconnell "remain united" on middle class tax relief, strengthening the military, constructing a border wall, and other issues - White House

-

05:59

20-year JGB yield falls to 0.535 pct, lowest since December 2016

-

05:54

New Zealand trade balance surplus better than expected in July

A recovery in dairy export prices helped boost July 2017 exports, compared with July 2016, Stats NZ said today. This led to a rare July trade surplus of $85 million in 2017.

"July months are typically deficits," overseas trade manager Tehseen Islam said. "This is the first July surplus since 2012 ($98 million) and only the 11th July surplus since 1960. This month's surplus compares with a $351 million deficit in July 2016, in part reflecting a large aircraft import back then."

Exports rose $668 million (17 percent) in July 2017, compared with July 2016. The rise in exports was led by higher values across a variety of commodities, especially milk powder, butter, and cheese - up $426 million (51 percent).

The rise in dairy was the largest for any month since March 2014. The value of whole milk powder per tonne was one-third higher than a year ago, while the quantity was up 12 percent. International dairy product auction prices rose sharply in the second half of 2016.

-

05:51

Hansson: ECB easing bias doesn't have to focus on bond target @zerohedge

-

05:26

Global Stocks

European stocks slumped Wednesday, with investors assessing fresh data on the health of the eurozone economy, as market participants counted down to a key meeting of central bankers. The Stoxx Europe 600 index SXXP, -0.50% lost 0.5% to close at 373.92, partly erasing a 0.8% jump from Tuesday, when the benchmark ended a three-session losing streak.

U.S. stocks traded at their lowest volume of the year on Wednesday as traders awaited the kickoff of the Kansas City Federal Reserve's Jackson Hole, Wyo., meeting of central bankers. Total composite volume for U.S. stocks finished at 5 billion shares Wednesday, its lightest volume of the year excluding half-day trading sessions, according to Dow Jones data.

Asian stocks and the dollar edged up on Thursday, shaking off the risk aversion that gripped financial markets overnight after President Donald Trump threatened to shut down the U.S. government and end the North American Free Trade Agreement.

-