Market news

-

22:27

Stocks. Daily history for Aug 24’2017:

(index / closing price / change items /% change)

Nikkei -80.87 19353.77 -0.42%

TOPIX -7.85 1592.20 -0.49%

Hang Seng +116.93 27518.60 +0.43%

CSI 300 -21.44 3734.65 -0.57%

Euro Stoxx 50 +6.10 3444.73 +0.18%

FTSE 100 +24.41 7407.06 +0.33%

DAX +6.53 12180.83 +0.05%

CAC 40 -2.26 5113.13 -0.04%

DJIA -28.69 21783.40 -0.13%

S&P 500 -5.07 2438.97 -0.21%

NASDAQ -7.08 6271.33 -0.11%

S&P/TSX +13.00 15076.16 +0.09%

-

20:09

Major US stock indexes finished trading in negative territory

Major US stock indices fell slightly as investors worried about funding the US government, and were waiting for news from the annual conference of the Fed in Jackson Hole.

The theme of the conference this year is "Promoting the dynamics of the global economy." Traditionally, the event will be visited by the heads of many central banks and their statements can have a significant impact on the markets. First of all, attention will be directed to the speech of the head of the Federal Reserve, Janet Yellen, who are expected to hear signals about the further actions of the American regulator in the sphere of monetary policy. Given the recent cooling of the housing market, as well as inflationary pressures, the head of the federal budget is likely to be less optimistic about its estimates than before, which in the end should reduce expectations about the pace of further tightening of the monetary policy of the US central bank.

In addition, according to the Ministry of Labor, the number of people applying for unemployment benefits in the US increased by 2,000 to 234,000 in the week ending August 19 after reaching a six-month low in the previous week. This level of initial appeals is a sign of another month of solid hiring. Economists had expected that applications for state unemployment benefits would increase to 238,000 from 232,000 the previous week.

Sales of housing in the secondary market fell to the lowest level for the year in July, as the dynamics of restrained supply and strong demand continues to strain the housing market. According to the National Association of Realtors, home sales in the secondary market, taking into account seasonal correction reached 5.44 million units. Sales decreased by 1.3% compared to the revised June figure. While the July rate was 2.1% higher than a year ago, it was the lowest since August last year. Economists forecast sales at 5.57 million units

Components of the DOW index finished the session in different directions (14 in positive territory, 16 in negative territory). The leader of growth were the shares of Cisco Systems, Inc. (CSCO, + 1.15%). Wal-Mart Stores, Inc. turned out to be an outsider. (WMT, -2.20%).

Most sectors of the S & P index showed a decline. The largest drop was shown by the consumer goods sector (-0.5%). The healthcare sector grew most (+ 0.3%).

At closing:

DJIA -0.13% 21.782.92 -29.17

Nasdaq -0.11% 6,271.33 -7.08

S & P -0.21% 2,438.97 -5.07

-

19:00

DJIA -0.06% 21,799.27 -12.82 Nasdaq -0.05% 6,275.21 -3.20 S&P -0.12% 2,441.06 -2.98

-

16:00

European stocks closed: FTSE 100 +24.41 7407.06 +0.33% DAX +6.53 12180.83 +0.05% CAC 40 -2.26 5113.13 -0.04%

-

13:31

U.S. Stocks open: Dow +0.17%, Nasdaq +0.26%, S&P +0.18%

-

13:11

Before the bell: S&P futures +0.27%, NASDAQ futures +0.35%

U.S. stock-index futures rose moderately on Thursday following yesterday's modest decline. Investors remained cautious ahead of the start of the annual meeting of central bankers at Jackson Hole, Wyoming.

Global Stocks:

Nikkei 19,353.77 -80.87 -0.42%

Hang Seng 27,518.60 +116.93 +0.43%

Shanghai 3,271.99 -15.71 -0.48%

S&P/ASX 5,745.48 +8.32 +0.14%

FTSE 7,419.66 +37.01 +0.50%

CAC 5,129.80 +14.41 +0.28%

DAX 12,233.92 +59.62 +0.49%

Crude $48.21 (-0.41%)

Gold $1,292.20 (-0.19%)

-

12:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

41.05

-0.01(-0.02%)

5395

ALTRIA GROUP INC.

MO

63.88

0.17(0.27%)

2042

Amazon.com Inc., NASDAQ

AMZN

960.95

2.95(0.31%)

13507

Apple Inc.

AAPL

160.6

0.62(0.39%)

70438

AT&T Inc

T

38

0.08(0.21%)

381

Barrick Gold Corporation, NYSE

ABX

16.95

-0.07(-0.41%)

5850

Boeing Co

BA

238.5

0.41(0.17%)

716

Caterpillar Inc

CAT

114.96

0.21(0.18%)

1275

Citigroup Inc., NYSE

C

67.55

0.32(0.48%)

15978

Exxon Mobil Corp

XOM

76.64

0.03(0.04%)

1133

Facebook, Inc.

FB

169.38

0.67(0.40%)

33489

Ford Motor Co.

F

10.75

0.04(0.37%)

4082

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.38

0.09(0.59%)

15641

General Electric Co

GE

24.44

0.05(0.21%)

13202

General Motors Company, NYSE

GM

35.55

0.06(0.17%)

1538

Goldman Sachs

GS

224

1.26(0.57%)

868

Google Inc.

GOOG

931

4.00(0.43%)

1523

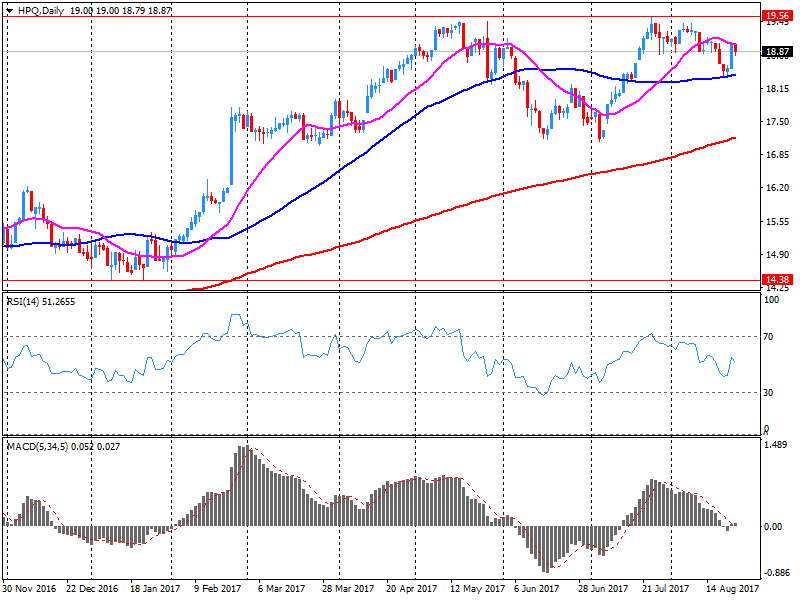

Hewlett-Packard Co.

HPQ

18.5

-0.36(-1.91%)

13241

Home Depot Inc

HD

149.3

0.20(0.13%)

3116

Intel Corp

INTC

34.88

0.22(0.63%)

7785

International Business Machines Co...

IBM

142.8

0.66(0.46%)

558

McDonald's Corp

MCD

159.1

0.29(0.18%)

5156

Merck & Co Inc

MRK

62.55

0.40(0.64%)

220

Microsoft Corp

MSFT

72.92

0.20(0.28%)

3551

Pfizer Inc

PFE

33.19

-0.05(-0.15%)

395

Starbucks Corporation, NASDAQ

SBUX

54.29

0.21(0.39%)

1982

Tesla Motors, Inc., NASDAQ

TSLA

352.8

0.03(0.01%)

20591

Twitter, Inc., NYSE

TWTR

17.04

0.08(0.47%)

16880

Wal-Mart Stores Inc

WMT

80.45

0.49(0.61%)

3220

Walt Disney Co

DIS

101.51

0.01(0.01%)

189

Yandex N.V., NASDAQ

YNDX

30.07

0.13(0.43%)

13910

-

12:41

Target price changes before the market open

HP Inc. (HPQ) target raised to $22 from $21 at Maxim Group

-

12:06

Company News: HP Inc. (HPQ) quarterly results beat analysts’ expectations

HP Inc. (HPQ) reported Q3 FY 2017 earnings of $0.43 per share (versus $0.48 in Q3 FY 2016), beating analysts' consensus estimate of $0.42.

The company's quarterly revenues amounted to $13.060 bln (+9.8% y/y), beating analysts' consensus estimate of $12.306 bln.

HPQ fell to $18.79 (-0.37%) in pre-market trading.

-

07:42

Major European stock exchanges trading in the green zone: FTSE 7403.42 +20.77 + 0.28%, DAX 12195.63 +21.33 + 0.18%, CAC 5131.00 +15.61 + 0.31%

-

06:50

Slow start of trading expected on the main European stock markets: DAX -0.06%, CAC 40 + 0.06%, FTSE 100 + 0.03%

-

05:26

Global Stocks

European stocks slumped Wednesday, with investors assessing fresh data on the health of the eurozone economy, as market participants counted down to a key meeting of central bankers. The Stoxx Europe 600 index SXXP, -0.50% lost 0.5% to close at 373.92, partly erasing a 0.8% jump from Tuesday, when the benchmark ended a three-session losing streak.

U.S. stocks traded at their lowest volume of the year on Wednesday as traders awaited the kickoff of the Kansas City Federal Reserve's Jackson Hole, Wyo., meeting of central bankers. Total composite volume for U.S. stocks finished at 5 billion shares Wednesday, its lightest volume of the year excluding half-day trading sessions, according to Dow Jones data.

Asian stocks and the dollar edged up on Thursday, shaking off the risk aversion that gripped financial markets overnight after President Donald Trump threatened to shut down the U.S. government and end the North American Free Trade Agreement.

-