Market news

-

23:52

Japan: Industrial Production (YoY), November 4.6%

-

23:50

Japan: Retail sales, y/y, November 1.7% (forecast 0.9%)

-

23:50

Japan: Industrial Production (MoM) , November 1.5% (forecast 1.6%)

-

23:35

Commodities. Daily history for Dec 27’2016:

(raw materials / closing price /% change)

Oil $53.89 -0.02%

Gold $1,139.50 +0.06%

-

23:34

Stocks. Daily history for Dec 27’2016:

(index / closing price / change items /% change)

Nikkei 225 19,403.06 +6.42 +0.03%

Shanghai Composite 3,114.66 -7.90 -0.25%

CAC 4,848.28 +8.60 +0.18%

Xetra DAX 11,472.24 +22.31 +0.19%

FTSE 100 7,068.17 +4.49 +0.06%

S&P/TSX 15,328.15 -7.08 -0.05%

S&P 500 2,268.88 +5.09 +0.22%

Bloomberg 87.60 +1.31 +1.52%

Dow Jones 19,945.04 +11.23 +0.06%

-

23:34

Currencies. Daily history for Dec 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0457 +0,03%

GBP/USD $1,2269 -0,12%

USD/CHF Chf1,0278 +0,08%

USD/JPY Y117,42 +0,31%

EUR/JPY Y122,79 +0,31%

GBP/JPY Y144,03 +0,15%

AUD/USD $0,7183 -0,10%

NZD/USD $0,6890 -0,13%

USD/CAD C$1,3573 +0,48%

-

23:01

Schedule for today, Wednesday, Dec 28’2016 (GMT0)

07:00 Switzerland UBS Consumption Indicator November 1.49

09:30 United Kingdom BBA Mortgage Approvals November 40.85 41.6

-

20:00

DJIA 19953.90 20.09 0.10%, NASDAQ 5491.74 29.05 0.53%, S&P 500 2270.25 6.46 0.29%

-

17:00

European stocks closed: FTSE 7068.17 4.49 0.06%, DAX 11472.24 22.31 0.19%, CAC 4848.28 8.60 0.18%

-

16:34

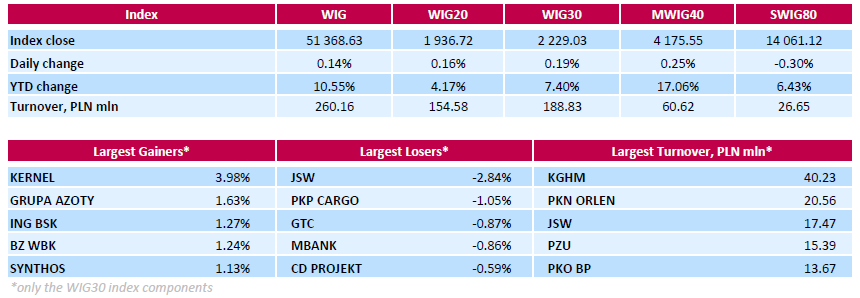

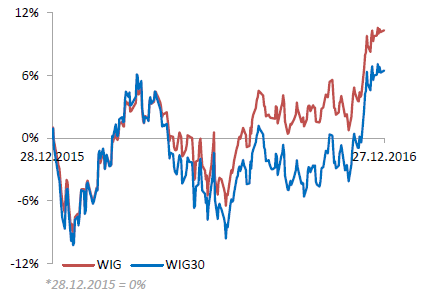

WSE: Session Results

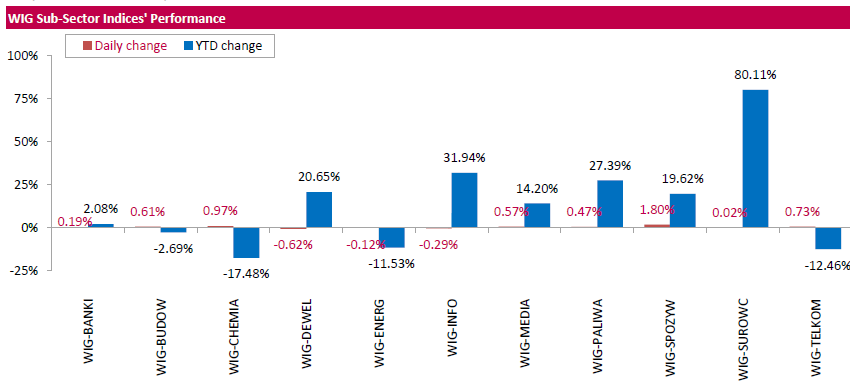

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, gained 0.14%. Sector performance within the WIG Index was mixed. Food sector (+1.80%) outperformed, while developing sector (-0.62%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.19%. In the index basket, agricultural producer KERNEL (WSE: KER) generated the biggest advance, soaring by 3.98%. Other major gainers were two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS) as well as two banks ING BSK (WSE: ING) and BZ WBK (WSE: BZW), adding between 1.13% and 1.63%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the decliners with a 2.84% drop, followed by railway freight transport operator PKP CARGO (WSE: PKP), videogame developer CD PROJEKT (WSE: CDR) and bank MBANK (WSE: MBK), sliding by 1.05%, 0.87% and 0.86% respectively.

-

16:14

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Tuesday, with the Dow Jones Industrial Average resuming its march toward 20000 and the Nasdaq hitting a record, helped by gains in technology shares. Energy stocks also rose, supported by oil prices which up 1,4%.

Most of Dow stocks in positive area (22 of 30). Top gainer - Apple Inc. (AAPL, +0.89%). Top loser - The Procter & Gamble Company (PG, -0.54%).

Most of S&P sectors in positive area. Top gainer - Technology (+0.5%). Top loser - Conglomerates (-0.3%).

At the moment:

Dow 19910.00 +36.00 +0.18%

S&P 500 2268.00 +8.00 +0.35%

Nasdaq 100 4985.75 +43.50 +0.88%

Oil 53.70 +0.68 +1.28%

Gold 1137.70 +4.10 +0.36%

U.S. 10yr 2.57 +0.03

-

15:03

US consumer confidence once again at pre-recession levels - Conference Board

The Conference Board Consumer Confidence Index, which had declined in October, increased significantly in November. The Index now stands at 107.1 (1985=100), up from 100.8 in October. The Present Situation Index increased from 123.1 to 130.3, while the Expectations Index improved from 86.0 last month to 91.7.

"Consumer confidence improved in November after a moderate decline in October, and is once again at pre-recession levels," said Lynn Franco, Director of Economic Indicators at The Conference Board. (The Index stood at 111.9 in July 2007.) "A more favorable assessment of current conditions coupled with a more optimistic short-term outlook helped boost confidence. And while the majority of consumers were surveyed before the presidential election, it appears from the small sample of post-election responses that consumers' optimism was not impacted by the outcome. With the holiday season upon us, a more confident consumer should be welcome news for retailers."

-

15:00

U.S.: Consumer confidence , December 113.7 (forecast 108.5)

-

14:59

U.S.: Richmond Fed Manufacturing Index, December 8 (forecast 5)

-

14:53

WSE: After start on Wall Street

The beginning of the session on Wall Street was stronger than indicated by quotations of futures contracts. This higher opening did not impress the Warsaw market, which in the last hour of today's trading comes at the level of 1,935 points (+ 0.09%) in the case of the WIG20 index.

-

14:33

U.S. Stocks open: Dow +0.09%, Nasdaq +0.17%, S&P +0.14%

-

14:23

Before the bell: S&P futures +0.13%, NASDAQ futures +0.16%

Before the bell: S&P futures +0.13%, NASDAQ futures +0.16%

U.S. stock-index futures advanced in the first day of the shortened holiday week. Trading activity remain low as the market participants gear up for another three-day weekend.

Global Stocks:

Nikkei 19,403.06 +6.42 +0.03%

Hang Seng Closed

Shanghai 21,574.76 -61.44 -0.28%

FTSE Closed

CAC 4,844.18 +4.50 +0.09%

DAX 11,463.75 +13.82 +0.12%

Crude $53.29 (+0.08%)

Gold $1,143.00 (+0.69%)

-

14:09

The S&P Case-Shiller U.S. National Home Price NSA Index reported a 5.6% annual gain in October

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in October, up from 5.4% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a year-over-year gain of 5.1%, up from 5.0% in September. Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last nine months. In October, Seattle led the way with a 10.7% year-over-year price increase, followed by Portland with 10.3%, and Denver with an 8.3% increase. 10 cities reported.

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, October 5.1% (forecast 5.0%)

-

13:59

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

29.9

0.19(0.6395%)

421

Amazon.com Inc., NASDAQ

AMZN

762.3

1.71(0.2248%)

7106

Apple Inc.

AAPL

116.68

0.16(0.1373%)

23184

AT&T Inc

T

42.74

0.01(0.0234%)

2423

Barrick Gold Corporation, NYSE

ABX

14.83

0.28(1.9244%)

77745

Boeing Co

BA

157.99

0.18(0.1141%)

1393

Caterpillar Inc

CAT

94.28

-0.04(-0.0424%)

250

Ford Motor Co.

F

12.45

-0.01(-0.0803%)

2930

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.88

0.07(0.5069%)

25343

General Electric Co

GE

31.83

-0.05(-0.1568%)

6700

General Motors Company, NYSE

GM

35.68

-0.01(-0.028%)

12276

Intel Corp

INTC

36.9

-0.07(-0.1893%)

2748

JPMorgan Chase and Co

JPM

87.1

0.05(0.0574%)

5605

Microsoft Corp

MSFT

63.4

0.16(0.253%)

2505

Nike

NKE

51.9

-0.01(-0.0193%)

4669

Pfizer Inc

PFE

32.53

0.05(0.1539%)

218

Procter & Gamble Co

PG

84.88

-0.08(-0.0942%)

600

Starbucks Corporation, NASDAQ

SBUX

57.04

0.03(0.0526%)

1202

Twitter, Inc., NYSE

TWTR

16.56

0.06(0.3636%)

31787

UnitedHealth Group Inc

UNH

162.5

-0.53(-0.3251%)

1165

Wal-Mart Stores Inc

WMT

69.39

-0.15(-0.2157%)

3323

Yahoo! Inc., NASDAQ

YHOO

38.62

-0.04(-0.1035%)

400

Yandex N.V., NASDAQ

YNDX

20.63

0.24(1.177%)

2000

-

13:40

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0350 (EUR 971m) 1.0400 (572m) 1.0450 (627m) 1.0490-1.0500 (520m) 1.0525 (473m) 1.0600 (521m) 1.0800 (1.98bln)

USDJPY 115.00 (USD 2.67bln) 116.00 (870m) 116.50 (1.07bln) 117.00 (975m) 117.50 (1.01bln) 118.00 (760m)

GBPUSD 1.2000 (GBP 2.76bln) 1.2600 (2.75bln)

AUDUSD 0.7200 (AUD 516m)

USDCAD 1.3500-05 (USD 630m) 1.3600 (403m)

-

13:26

-

13:00

Orders

EUR/USD

Offers 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids 1.0425-30 1.0400 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids 1.2250 1.2220-25 1.2200 1.2185 1.2150 1.2100 1.2080 1.2050 1.2000

EUR/GBP

Offers 0.8530 0.8550 0.8575-80 0.8600

Bids 0.8485 0.8460 0.8435-40 0.8400

EUR/JPY

Offers 123.00 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers 117.50-55 117.80-85 118.00 118.20-25 118.45-50 118.80 119.00

Bids 117.00 116.70 116.50-55 116.30 116.00 115.85 115.50

AUD/USD

Offers 0.7230 0.7260 0.7280 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids 0.7175-80 0.7145-50 0.7100-10 0.7065 0.7030 0.7000

-

12:01

WSE: Mid session comment

In the markets today it happens virtually nothing of interest. Trading everywhere is very sluggish and the situation does not improve the forenoon phase of trade.

Practically from the beginning of the trading market signaled that activity will be miserable today. Together with lack of activity goes a volatility. Formally, in the Warsaw market trading takes place, and practically takes only waiting for the final fixing.

At the halfway point of today's session the WIG20 index was at the level of 1,935 points (+0,07%).

-

09:42

Major European stock markets little changed: FTSE 100 closed, DAX 11,449.93 -6.17 -0.05%, CAC 40 4,839.68 5.05 0.10%, IBEX 35 9,367.70 34.10 0.37%

-

08:25

The world was gloomy before I won - there was no hope. Now the market is up nearly 10% and Christmas spending is over a trillion dollars! @realDonaldTrump

-

08:19

WSE: After opening

WIG20 index opened at 1933.10 points (-0.03%)*

WIG 51314.38 0.04%

WIG30 2225.98 0.06%

mWIG40 4167.65 0.06%

*/ - change to previous close

The opening of the cash market in Warsaw was very peaceful. In the first minutes everything seems clear. On the market we do not see any compelling attention activity, which so far is part of the baseline scenario in terms of the attractiveness of trading this week. Low volume limited technical reliability of the signals sent by the graph and morning and does not bring new events.

After fifteen minutes of trading the WIG20 index was at the level of 1,936 points (+0,15%).

-

07:40

Moderately positive start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 + 0.1%, FTSE closed

-

07:39

Japan’s unemployment rate increased

The unemployment rate published by the Ministry of Health, Labour and Welfare and the Bureau of Statistics of Japan, was 3.1% in November which is higher than the previous value of 3.0%. Was expected that the index to remain at 3.0%.

Household spending dropped significantly in November compared with the previous month. As reported by the Ministry of Internal Affairs and Communications, spending was down 1.5% year on year, after declining by 0.4% in October. The level of expenditure can be used as an indicator of consumer optimism. The indicator is also a barometer of economic growth. As can be seen from the data, consumer spending declined, which is negative for the Japanese economy and Japanese currency.

-

07:34

The DJT Foundation, unlike most foundations, never paid fees, rent, salaries or any expenses. 100% of money goes to wonderful charities! @realDonaldTrump

-

07:30

Japan National Consumer Price Index increased in November

The National Consumer Price Index (CPI), published by the Bureau of Statistics of Japan increased by 0.5% after rising 0.1% in October. This indicator reflects the assessment of price movements obtained by comparison of the retail prices of the relevant basket of goods and services. CPI - the most important barometer of changes in purchasing trends.

The base consumer price index in Tokyo for the last month decreased contrary to expectations. According to the report, seasonally adjusted inflation was down 0.6% compared with -0.4% in the previous month. Economists expect that the index will remain unchanged at -0.4%

National consumer price index excluding fresh food, remained unchanged at -0.4%, but was lower than the forecast of -0.3%. The national consumer price index excluding food and energy, prices rose 0.1%, after declining by -0.4% previously.

-

07:28

WSE: Before opening

Main markets are returning today to the game after the Christmas break, it does not apply to the market in London, which is closed today.

During the Friday session on Wall Street indexes moved around levels of Thursday's close and ended the day with light increases. The Dow Jones Industrial rose at the close of 0.07 percent, S&P 500 was firmer by 0.13 percent, while the Nasdaq Comp. went up by 0.28 percent.

In the macro calendar today there is no data that can revive the trade. There will come data from the US (indices: S&P / Case-Shiller Composite, the Conference Board, Richmond Fed), but the US markets are focused now on a good end of the year and meeting of indices with round-psychological levels.

On the Warsaw market the WIG20 index ended the previous week hesitantly in the region of 1,950 pts., but it seems that investors have an appetite for a confrontation of 2000 points and to end the year with the stroke of consolidation between 2,000 and 1,650 points. Therefore, the last four days of the year will be a game for as high as possible close end start of the new year with optimism.

-

06:08

Options levels on tuesday, December 27, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0739 (2004)

$1.0662 (563)

$1.0605 (233)

Price at time of writing this review: $1.0444

Support levels (open interest**, contracts):

$1.0390 (1086)

$1.0352 (2218)

$1.0306 (2849)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44692 contracts, with the maximum number of contracts with strike price $1,1500 (3209);

- Overall open interest on the PUT options with the expiration date March, 13 is 53993 contracts, with the maximum number of contracts with strike price $1,0000 (5030);

- The ratio of PUT/CALL was 1.21 versus 1.21 from the previous trading day according to data from December, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2513 (434)

$1.2417 (238)

$1.2322 (111)

Price at time of writing this review: $1.2275

Support levels (open interest**, contracts):

$1.2183 (574)

$1.2286 (428)

$1.1989 (1322)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 13552 contracts, with the maximum number of contracts with strike price $1,2800 (2994);

- Overall open interest on the PUT options with the expiration date March, 13 is 16595 contracts, with the maximum number of contracts with strike price $1,1500 (3014);

- The ratio of PUT/CALL was 1.22 versus 1.22 from the previous trading day according to data from December, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:05

Japan: Construction Orders, y/y, November -0,6%

-

05:03

Japan: Housing Starts, y/y, November 6.7% (forecast 10.2%)

-