Market news

-

23:30

Commodities. Daily history for Dec 28’2016:

(raw materials / closing price /% change)

Oil $53.66 -0.74%

Gold $1,142.50 +0.14%

-

23:30

Stocks. Daily history for Dec 28’2016:

(index / closing price / change items /% change)

Nikkei 225 19,401.72 -1.34 -0.01%

Shanghai Composite 3,102.24 -12.43 -0.40%

CAC 40 4,848.01 -0.27 -0.01%

Xetra DAX 11,474.99 +2.75 +0.02%

FTSE 100 7,106.08 +37.91 +0.54%

S&P/TSX Composite 15,361.10 +32.95 +0.21%

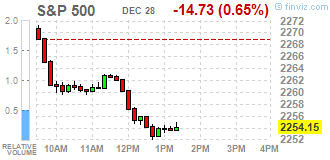

S&P 500 2,249.92 -18.96 -0.84%

Dow Jones 19,833.68 -111.36 -0.56%

-

23:29

Currencies. Daily history for Dec 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0413 -0,42%

GBP/USD $1,2224 -0,37%

USD/CHF Chf1,0282 +0,04%

USD/JPY Y117,22 -0,17%

EUR/JPY Y122,08 -0,58%

GBP/JPY Y143,32 -0,50%

AUD/USD $0,7175 -0,11%

NZD/USD $0,6917 +0,39%

USD/CAD C$1,3559 -0,10%

-

23:01

Schedule for today, Thursday, Dec 29’2016 (GMT0)

09:00 Eurozone Private Loans, Y/Y November 1.8%

09:00 Eurozone M3 money supply, adjusted y/y November 4.4% 4.4%

13:30 U.S. Continuing Jobless Claims 2036 2030

13:30 U.S. Initial Jobless Claims 275 264

16:00 U.S. Crude Oil Inventories December 2.256

-

20:01

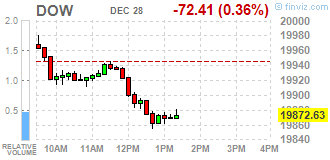

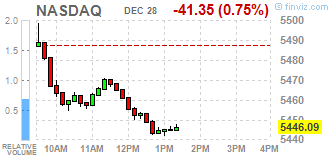

DJIA 19847.33 -97.71 -0.49%, NASDAQ 5441.47 -45.97 -0.84%, S&P 500 2251.75 -17.13 -0.75%

-

18:31

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wednesday due to losses across sectors, hindering the Dow's march 20000, a level it has never breached. U.S. equities have been riding a post-election rally, feeding on optimism that Donald Trump's policies would be business friendly, especially to banks and industrials. The rally has also been supported by a spate of strong economic data.

Most of Dow stocks in negative area (28 of 30). Top gainer - The Travelers Companies, Inc. (TRV, +0.18%). Top loser - Caterpillar Inc. (CAT, -1.18%).

Most of S&P sectors in negative area. Top gainer - Technology (-0.7%).

At the moment:

Dow 19811.00 -65.00 -0.33%

S&P 500 2248.00 -13.00 -0.57%

Nasdaq 100 4929.00 -32.25 -0.65%

Oil 54.17 +0.27 +0.50%

Gold 1140.30 +1.50 +0.13%

U.S. 10yr 2.52 -0.04

-

17:00

European stocks closed: FTSE 7106.08 37.91 0.54%, DAX 11474.99 2.75 0.02%, CAC 4848.01 -0.27 -0.01%

-

16:38

WSE: Session Results

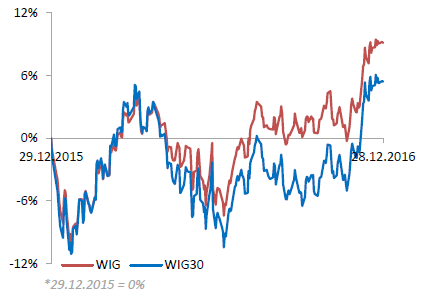

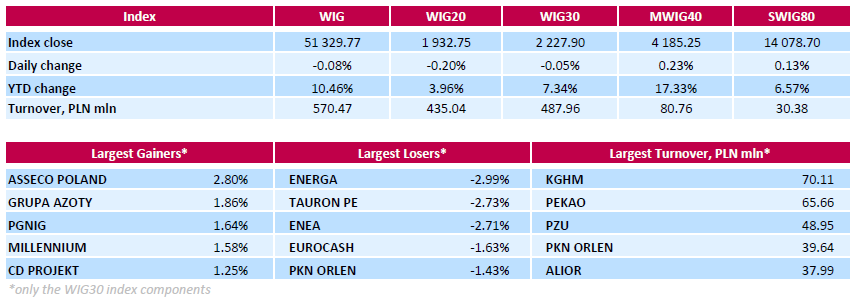

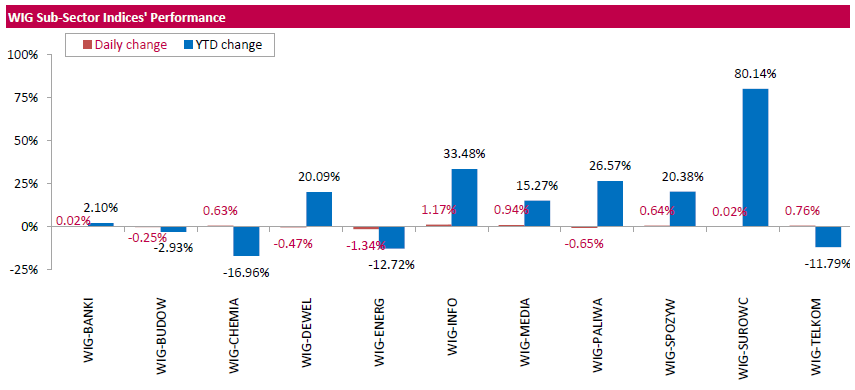

Polish equity market closed flat on Wednesday. The broad market measure, the WIG index, edged down 0.08%. Sector performance within the WIG Index was mixed. Utilities (-1.34%) underperformed, while informational technology (+1.17%) fared the best.

The large-cap stocks' gauge, the WIG30 Index, inched down 0.05%. In the index basket, three gencos ENERGA (WSE: ENG), TAURON PE (WSE: TPE) and ENEA (WSE: ENA) suffered the biggest daily declines, tumbling by 2.99%, 2.73% and 2.71% respectively. Other largest losers were FMCG-wholesaler EUROCASH (WSE: EUR) and oil refiner PKN ORLEN (WSE: PKN), plunging by 1.63% and 1.43% respectively. At the same time, IT-company ASSECO POLAND (WSE: ACP), chemical company GRUPA AZOTY (WSE: ATT), oil and gas producer PGNIG (WSE: PGN) and bank MILLENNIUM (WSE: MIL) led the gainers, adding between 1.58% and 2.8%.

-

15:00

U.S.: Pending Home Sales (MoM) , November -2.5% (forecast 0.5%)

-

14:53

WSE: After start on Wall Street

Today's quotations on Wall Street began with a slight strengthening noticeable on all major indexes. This may suggest further attempts to overcome the psychological resistance. In European markets volatility still is close to zero. On the Warsaw Stock Exchange the supply side has enabled, which in a shallow market easily stretched graph of the WIG20 index on the red side.

An hour before the close of trading the WIG20 index was at the level of 1,933 points (-0.16%).

-

14:32

U.S. Stocks open: Dow +0.14%, Nasdaq +0.20%, S&P +0.10%

-

14:26

Before the bell: S&P futures +0.26%, NASDAQ futures +0.30%

U.S. stock-index futures advanced. Trading activity remain low as the market participants gear up for another three-day weekend.

Global Stocks:

Nikkei 19,401.72 -1.34 -0.01%

Hang Seng 21,754.74 +179.98 +0.83%

Shanghai 3,102.54 -12.12 -0.39%

FTSE 7,104.93 +36.76 +0.52%

CAC 4,847.35 -0.93 -0.02%

DAX 11,471.47 -0.77 -0.01%

Crude $53.82 (-0.15%)

Gold $1,139.40 (+0.05%)

-

14:06

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

776.8

5.40(0.70%)

38214

Apple Inc.

AAPL

117.65

0.39(0.3326%)

45125

AT&T Inc

T

42.7

0.05(0.1172%)

2085

Barrick Gold Corporation, NYSE

ABX

14.78

-0.08(-0.5384%)

28318

Boeing Co

BA

157.25

-0.23(-0.1461%)

954

Caterpillar Inc

CAT

94.98

0.43(0.4548%)

2304

Cisco Systems Inc

CSCO

30.74

0.06(0.1956%)

5070

Citigroup Inc., NYSE

C

61.19

0.10(0.1637%)

754

Deere & Company, NYSE

DE

103.9

0.60(0.5808%)

314

E. I. du Pont de Nemours and Co

DD

74.29

-0.67(-0.8938%)

100

Facebook, Inc.

FB

118.15

0.14(0.1186%)

30193

Ford Motor Co.

F

12.36

-0.03(-0.2421%)

10150

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.84

0.08(0.5814%)

33609

General Electric Co

GE

31.87

-0.03(-0.094%)

738

General Motors Company, NYSE

GM

35.55

0.01(0.0281%)

135

Goldman Sachs

GS

242.8

1.24(0.5133%)

6735

Intel Corp

INTC

37.16

0.09(0.2428%)

1341

International Business Machines Co...

IBM

167.21

0.07(0.0419%)

1731

JPMorgan Chase and Co

JPM

87.18

0.05(0.0574%)

25058

McDonald's Corp

MCD

123.21

0.14(0.1138%)

600

Microsoft Corp

MSFT

63.39

0.11(0.1738%)

3515

Nike

NKE

51.4

0.11(0.2145%)

1395

Pfizer Inc

PFE

32.58

0.05(0.1537%)

3053

Procter & Gamble Co

PG

84.55

-0.05(-0.0591%)

1143

Starbucks Corporation, NASDAQ

SBUX

57.03

0.17(0.299%)

2657

Tesla Motors, Inc., NASDAQ

TSLA

221.84

2.31(1.0522%)

33996

The Coca-Cola Co

KO

41.53

-0.08(-0.1923%)

4976

Twitter, Inc., NYSE

TWTR

16.68

0.07(0.4214%)

69723

Verizon Communications Inc

VZ

53.86

0.22(0.4101%)

689

Walt Disney Co

DIS

104.96

-0.21(-0.1997%)

3030

Yahoo! Inc., NASDAQ

YHOO

39.1

0.18(0.4625%)

1501

-

14:04

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Amazon (AMZN) reiterated with Buy at Cantor Fitzgerald

Amazon (AMZN) named Top Pick for 2017 at Evercore

NIKE (NKE) maintained with an Outperform at Credit Suisse; target $60

-

13:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0450 (EUR 256 M) 1.0590-1.0605 (EUR 376 M)

EUR/GBP 0.8496 (EUR 920 M) 0.8530-0.8545 (EUR 373 M)

USD/JPY 116.00 (USD 250 M) 118.15-118.20 (USD 254 M) 119.00 (USD 300 M)

AUD/USD 0.7320 (AUD 366 M)

USD/CAD 1.3370-1.3386 (USD 252 M) 1.3410-1.3425 (USD 229 M)

-

12:59

Orders

EUR/USD

Offers 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids 1.0400 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids 1.2220-25 1.2200 1.2185 1.2150 1.2100 1.2080 1.2050 1.2000

EUR/GBP

Offers 0.8530 0.8550 0.8575-80 0.8600

Bids 0.8485 0.8460 0.8435-40 0.8400

EUR/JPY

Offers 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids 122.60 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers 117.80-85 118.00 118.20-25 118.45-50 118.80 119.00

Bids 117.00 116.70 116.50-55 116.30 116.00 115.85 115.50

AUD/USD

Offers 0.7230 0.7260 0.7280 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids 0.7175-80 0.7145-50 0.7100-10 0.7065 0.7030 0.7000

-

12:05

WSE: Mid session comment

In the Warsaw market reigns today stable low market activity and there is no desire to trade. All indications shows that with such situation we will probably have to deal for the rest of the year. Identical trade prevails on other European parquets and the changes in the German DAX are (in percent) at the second decimal place.

At the halfway point of today's trading the WIG20 index was at the level of 1,942 points (+ 0.30%).

-

10:27

UK consumer credit growth continues to be strong, despite falling back a little in November

"Consumer credit growth continues to be strong, despite falling back a little in November, reflecting strong retail sales in recent months.

The reduction in interest rates in August may have boosted remortgaging approvals, with consumers looking to take advantage of the current economic conditions and lock-in lower interest rates.

A corollary of a low interest rate environment is a growth in deposits and we've seen personal deposits, in particular, grow more strongly in recent months as consumers hoard cash in the absence of higher-yielding, liquid investment opportunities. This growth in personal deposits may also suggest that consumers are looking to grow their cash reserves against potential economic uncertainties, such as an expectation of lower wage growth", said Dr Rebecca Harding, BBA Chief Economist.

-

09:30

United Kingdom: BBA Mortgage Approvals, November 40.66 (forecast 41.6)

-

08:57

Major European stock markets began trading without significant changes: FTSE 100 7,075.71 7.54 0.11%, DAX 11,468.76 -3.48 -0.03%, CAC 40 4,846.71 -1.57 -0.03%, IBEX 35 9,364.20 -12.40 -0.13%

-

08:22

WSE: After opening

WIG20 index opened at 1935.38 points (-0.07%)

WIG 51378.58 0.02%

WIG30 2229.46 0.02%

mWIG40 4181.90 0.15%

*/ - change to previous close

Wednesday's session in the spot market began with the rhythm similar to the yesterday's changes. Cosmetic volatility and low turnover is a problem that probably we will struggle until the end of the year.

After twenty minutes of trading, the WIG index was at the level of 1,944 points (+0.40%).

-

08:01

Moderately positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.2%

-

08:00

Japanese retail sales higher than forecast in November

Retail sales rose by 0.2% after rising 2.5% in October, said today the Ministry of Economy, Trade and Industry of Japan. In annual terms, this index (seasonally adjusted) was 1.7%, higher than economists' forecast of 0.9%. The previous value was revised from -0.1% to -0.2%.

The volume of retail sales - an indicator that assesses the total volume of sales through specialized outlets involved in the sale of goods and related services to the population. Consumer spending - an important indicator of the state of the Japanese economy.

Despite the growth of sales, the Japanese currency fell after the publication of the indicator due to year end flows.

-

07:57

The U.S. Consumer Confidence Index for December surged nearly four points to 113.7, THE HIGHEST LEVEL IN MORE THAN 15 YEARS! Thanks Donald! From @realDonaldTrump

-

07:56

Japan’s industrial production rose in November

According to preliminary data of the Ministry of Economy, Trade and Industry of Japan the index of industrial production increased by 1.5%, after flat in October. Economists had expected an increase of 1.7%. On an annual basis Japan industrial activity grew by 4.6%, much higher than the previous value of -1.4%. Industrial production - an indicator of the volume of production plants, factories and mining enterprises, main indicator of the strength and health of the manufacturing sector. A high value is considered positive for the Japanese currency.

As for the future, the manufacturers expect industrial production growth at about 2.0% in December and 2.2% in January.

The Ministry of Commerce noted that industrial production is gaining momentum on the back of export growth and improving global demand.

-

07:25

WSE: Before opening

Tuesday's session on the New York stock markets brought slight increases in the major indexes. Technological Nasdaq Comp. climbed to the highest level in history and broke the record of 20 December by 3 pts., although during the session was higher, for the first time beating the barrier of 5,500 points. The DJI index was lacking 30 points to set the same day historic high. Small variations were noted on Tuesday by the dollar. Increased price of crude oil.

The impact of the neutral behavior of Wall Street may be seen in Asia, where the Nikkei dropping 0.1 percent. Similar changes record Eurodollar, oil and the zloty pairs, which together give a neutral context before the start of the session in Europe.

The macro calendar does not carry today new content, thereby Wednesday promises to be an extension of yesterday's silence. Back into the play is London today, which may lead to more activity on the Warsaw market.

-

07:11

Options levels on wednesday, December 28, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0740 (2003)

$1.0665 (563)

$1.0610 (233)

Price at time of writing this review: $1.0468

Support levels (open interest**, contracts):

$1.0400 (1103)

$1.0361 (2218)

$1.0313 (2851)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44593 contracts, with the maximum number of contracts with strike price $1,1500 (3200);

- Overall open interest on the PUT options with the expiration date March, 13 is 54015 contracts, with the maximum number of contracts with strike price $1,0000 (5007);

- The ratio of PUT/CALL was 1.21 versus 1.21 from the previous trading day according to data from December, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.2513 (434)

$1.2417 (238)

$1.2322 (111)

Price at time of writing this review: $1.2285

Support levels (open interest**, contracts):

$1.2183 (577)

$1.2286 (428)

$1.1989 (1319)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 13615 contracts, with the maximum number of contracts with strike price $1,2800 (2995);

- Overall open interest on the PUT options with the expiration date March, 13 is 116631 contracts, with the maximum number of contracts with strike price $1,1500 (3014);

- The ratio of PUT/CALL was 1.22 versus 1.22 from the previous trading day according to data from December, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:00

Switzerland: UBS Consumption Indicator, November 1.43

-

06:24

Global Stocks

European stocks finished slightly higher Tuesday, as volumes remained thin with little news to give markets any clear direction on the first trading day after the long holiday weekend. Plans for a government bailout will need to be approved by the European Union to ensure state-aid rules aren't breached, European Central Bank Governing Council member Jens Weidmann said Monday.

U.S. stocks rose in a thinly traded session on Tuesday, with the Nasdaq hitting its latest in a series of records as the market's recent upward bias continued, helped by a gain in technology shares. The 20,000 milestone, meanwhile, remained elusive for the Dow Jones Industrial Average, which came within 20 points of the psychologically important level only to give up most of the day's gains.

Asian shares were broadly higher Wednesday, with strength on Wall Street driving up Australian stocks, while equity markets in Southeast Asia were boosted by the return of some foreign funds. The Tokyo exchange lifted a trading suspension of the shares after Hitachi said that nothing has been decided. Nikkei said the possible deal could exceed Y150 billion ($1.27 billion).

-