Market news

-

23:33

Commodities. Daily history for Dec 29’2016:

(raw materials / closing price /% change)

Oil $53.85 +0.15%

Gold $1,159.00 +0.08%

-

23:32

Stocks. Daily history for Dec 29’2016:

(index / closing price / change items /% change)

Nikkei -256.58 19145.14 -1.32%

TOPIX -18.41 1518.39 -1.20%

Hang Seng +36.17 21790.91 +0.17%

CSI 300 -4.12 3297.77 -0.12%

FTSE 100 +14.18 7120.26 +0.20%

DAX -23.94 11451.05 -0.21%

CAC 40 -9.54 4838.47 -0.20%

DJIA -13.90 19819.78 -0.07%

S&P 500 -0.66 2249.26 -0.03%

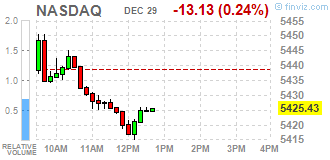

NASDAQ -6.47 5432.09 -0.12%

-

23:32

Currencies. Daily history for Dec 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0488 +0,72%

GBP/USD $1,2260 +0,29%

USD/CHF Chf1,0229 -0,52%

USD/JPY Y116,53 -0,59%

EUR/JPY Y122,22 +0,11%

GBP/JPY Y142,87 -0,31%

AUD/USD $0,7217 +0,58%

NZD/USD $0,6963 +0,66%

USD/CAD C$1,3501 -0,43%

-

23:02

Schedule for today, Friday, Dec 30’2016 (GMT0)

00:30 Australia Private Sector Credit, m/m November 0.5% 0.5%

00:30 Australia Private Sector Credit, y/y November 5.3%

14:45 U.S. Chicago Purchasing Managers' Index December 57.6 57

-

20:00

DJIA 19827.00 -6.68 -0.03%, NASDAQ 5425.33 -13.22 -0.24%, S&P 500 2249.17 -0.75 -0.03%

-

17:44

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes slightly fell on Thursday as weakness in financials offset gains in healthcare companies. A report showed the number of Americans applying for jobless claims fell by 10000 to 265000 last week, indicating sustained strength in the labor market.

Dow stocks mixed (15 vs 15). Top gainer - Verizon Communications Inc. (VZ, +0.67%). Top loser - The Goldman Sachs Group, Inc. (GS, -1.50%).

S&P sectors also mixed. Top gainer - Utilities (+1.0%). Top loser - Conglomerates (-0.5%).

At the moment:

Dow 19757.00 -18.00 -0.09%

S&P 500 2243.50 -1.75 -0.08%

Nasdaq 100 4912.50 -11.25 -0.23%

Oil 53.71 -0.35 -0.65%

Gold 1156.90 +16.00 +1.40%

U.S. 10yr 2.48 -0.06

-

17:00

European stocks closed: FTSE 7109.95 3.87 0.05%, DAX 11440.74 -34.25 -0.30%, CAC 4833.18 -14.83 -0.31%

-

16:34

WSE: Session Results

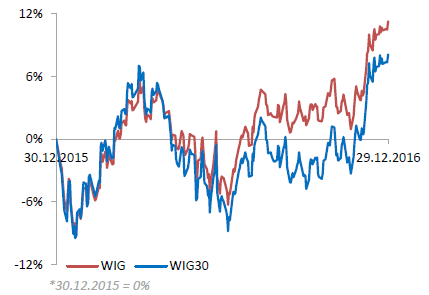

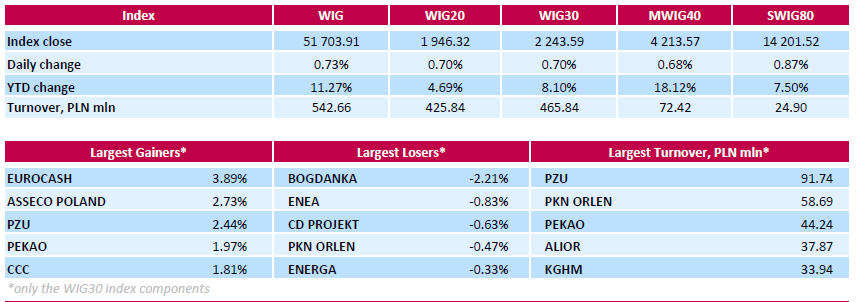

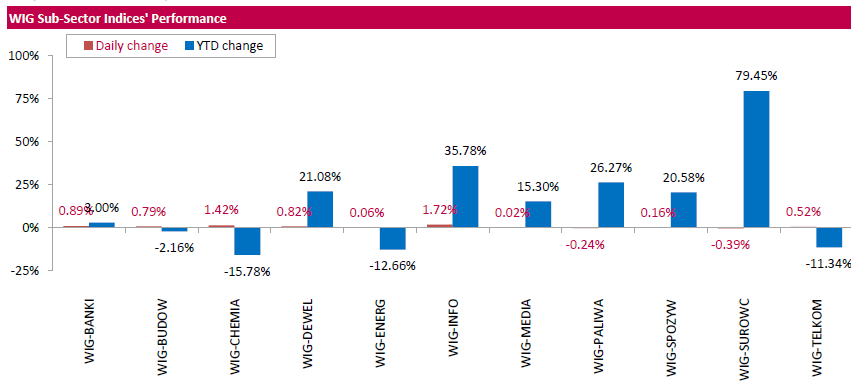

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, surged by 0.73%. Most sectors rose with informational technology (+1.72%) posting the biggest advance.

The large-cap stocks grew by 0.7%, as measured by the WIG30 Index. Within the index components, FMCG-wholesaler EUROCASH (WSE: EUR) led the gainers pack with a 3.89% advance, followed by IT-company ASSECO POLAND (WSE: ACP) and insurer PZU (WSE: PZU), climbing by 2.73% and 2.44% respectively. On the other side of the ledger, thermal coal miner BOGDANKA (WSE: LWB) recorded the biggest drop of 2.21%. Other major decliners were genco ENEA (WSE: ENA), videogame developer CD PROJEKT (WSE: CDR) and oil refiner PKN ORLEN (WSE: PKN), plunging by 0.83%, 0.63% and 0.47% respectively.

-

16:00

U.S.: Crude Oil Inventories, December 0.614 (forecast -2.060)

-

14:52

WSE: After start on Wall Street

The most important report of the day, which was the number of newly registered unemployed persons in the United States, hit the forecast. Number of new applications for unemployment benefits fell to 265 thousand from 275 thousand in the previous week. Reading does not have a significant impact on trading. Wall Street began sessions with modest changes that have been previously signaled by derivatives trading.

For the Warsaw market is important the lack of new discount impulses. With low turnover and low volatility the WIG20 lived on a slight positive territory to see the US session, and probably at this level will last until the end of today's trading. An hour before the end of the session the WIG 20 index was at the level of 1,941 points (+ 0.47%).

-

14:31

U.S. Stocks open: Dow +0.08%, Nasdaq +0.02%, S&P +0.09%

-

14:20

Before the bell: S&P futures +0.06%, NASDAQ futures +0.03%

U.S. stock-index futures were flat. Trading activity remain low as the market participants gear up for another three-day weekend.

Global Stocks:

Nikkei 19,145.14 -256.58 -1.32%

Hang Seng 21,790.91 +36.17 +0.17%

Shanghai 3,096.56 -5.67 -0.18%

FTSE 7,103.26 -2.82 -0.04%

CAC 4,841.20 -6.81 -0.14%

DAX 11,444.49 -30.50 -0.27%

Crude $53.89 (-0.31%)

Gold $1,146.80 (+0.52%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

178.22

0.14(0.0786%)

200

Amazon.com Inc., NASDAQ

AMZN

772.15

0.02(0.0026%)

4635

AMERICAN INTERNATIONAL GROUP

AIG

240.9

0.25(0.1039%)

2058

AT&T Inc

T

240.9

0.25(0.1039%)

2058

Barrick Gold Corporation, NYSE

ABX

15.4

0.12(0.7853%)

39085

Caterpillar Inc

CAT

93.19

0.04(0.0429%)

400

Chevron Corp

CVX

240.9

0.25(0.1039%)

2058

Citigroup Inc., NYSE

C

240.9

0.25(0.1039%)

2058

E. I. du Pont de Nemours and Co

DD

240.9

0.25(0.1039%)

2058

Facebook, Inc.

FB

240.9

0.25(0.1039%)

2058

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.59

0.02(0.1474%)

21384

General Electric Co

GE

31.8

0.10(0.3155%)

5745

General Motors Company, NYSE

GM

35.01

-0.14(-0.3983%)

481

Goldman Sachs

GS

240.9

0.25(0.1039%)

2058

Google Inc.

GOOG

32.38

0.03(0.0927%)

104

Intel Corp

INTC

36.67

0.04(0.1092%)

300

JPMorgan Chase and Co

JPM

86.49

-0.01(-0.0116%)

4675

Merck & Co Inc

MRK

59.5

0.23(0.3881%)

1727

Microsoft Corp

MSFT

240.9

0.25(0.1039%)

2058

Nike

NKE

51.25

0.23(0.4508%)

1731

Pfizer Inc

PFE

32.38

0.03(0.0927%)

104

Procter & Gamble Co

PG

240.9

0.25(0.1039%)

2058

Tesla Motors, Inc., NASDAQ

TSLA

219.69

-0.05(-0.0228%)

12261

The Coca-Cola Co

KO

32.38

0.03(0.0927%)

104

Visa

V

78.23

-0.07(-0.0894%)

1591

Walt Disney Co

DIS

104.51

0.21(0.2013%)

1476

Yahoo! Inc., NASDAQ

YHOO

38.85

0.12(0.3098%)

100

Yandex N.V., NASDAQ

YNDX

32.38

0.03(0.0927%)

104

-

13:50

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0320, 1.0350, 1.0375 1.0475 1.0575 1.0600, 1.0650 (939m)

USDJPY 114.0/09 (670m) 115.00, 115.50/55/60, 115.75 116.00, 116.25, 116.50 117.45/50/52 (865m)

AUDUSD 0.7000 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200 1.3444/45

EURJPY 120.45/50, 120.60 123.00

-

13:35

US trade balance deficit rose. Wholesale inventories increased

The international trade deficit was $65.3 billion in November, up $3.4 billion from $61.9 billion in October. Exports of goods for November were $121.7 billion, $1.2 billion less than October exports. Imports of goods for November were $187.0 billion, $2.2 billion more than October imports.

Wholesale inventories for November, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $594.5 billion, up 0.9 percent (±0.2 percent) from October 2016, and were up 1.2 percent (±1.1 percent) from November 2015. The September 2016 to October 2016 percentage change was revised from down 0.4 percent (±0.4 percent)* to down 0.1 percent (±0.4 percent).

-

13:33

US unemployment claims little changed

In the week ending December 24, the advance figure for seasonally adjusted initial claims was 265,000, a decrease of 10,000 from the previous week's unrevised level of 275,000. The 4-week moving average was 263,000, a decrease of 750 from the previous week's unrevised average of 263,750.

There were no special factors impacting this week's initial claims. This marks 95 consecutive weeks of initial claims below 300,000, the longest streak since 1970.

-

13:30

U.S.: Initial Jobless Claims, 265 (forecast 264)

-

13:30

U.S.: Continuing Jobless Claims, 2102 (forecast 2030)

-

12:59

Orders

EUR/USD

Offers 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600

Bids 1.0400 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids 1.2200 1.2185 1.2150 1.2100 1.2080 1.2050 1.2000

EUR/GBP

Offers 0.8550 0.8575-80 0.8600

Bids 0.8500 0.8485 0.8460 0.8435-40 0.8400

EUR/JPY

Offers 122.20 122.60 123.30 123.60 123.85 124.00-10

Bids 121.50 121.00 120.50 120.00

USD/JPY

Offers 117.00 117.80-85 118.00 118.20-25 118.45-50 118.80 119.00

Bids 116.30 116.00 115.85 115.50

AUD/USD

Offers 0.7230 0.7260 0.7280 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids 0.7175-80 0.7145-50 0.7100-10 0.7065 0.7030 0.7000

-

12:02

WSE: Mid session comment

The morning phase of the session on the Warsaw market showed relative strength of our parquet, although ruling today activity is still lower than yesterday and it's hard to talk here about the reliability of such behavior. Low volatility and a flat drift at levels of prior consolidatio6n shows that today's session will not bring major changes in the balance of power.

We are waiting than to enter the game by Americans because only they can influence the increase in volatility in the markets.

At the halfway point of today's quotations the WIG 20 index was at the level of 1,937 points (+ 0.27%), the turnover in segment of largest companies was amounted to PLN 150 million.

-

09:39

Option expiries for today's 10:00 ET NY cut

USDJPY 114.0/09 (670m), 115.00, 115.50/55/60, 115.75, 116.00, 116.25, 116.50, 117.45/50/52 (865m)

EURUSD 1.0320, 1.0350, 1.0375, 1.0475, 1.0575, 1.0600, 1.0650 (939m)

AUDUSD 0.7000, 0.7175

NZDUSD 0.6800

AUDNZD 1.0465 (225m)

USDCAD 1.3200, 1.3444/45

EURJPY 120.45/50, 120.60, 123.00

Информационно-аналитический отдел TeleTrade

-

09:23

Euro area broad monetary aggregate M3 increased to 4.8% in November

The annual growth rate of the broad monetary aggregate M3 increased to 4.8% in November 2016, from 4.4% in October, averaging 4.7% in the three months up to November. The components of M3 showed the following developments.

The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), increased to 8.7% in November, from 8.0% in October.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was more negative at -2.0% in November, from -1.7% in October. The annual growth rate of marketable instruments (M3-M2) increased to 2.4% in November, from 1.8% in October.

-

09:02

Eurozone: Private Loans, Y/Y, November 1.9%

-

09:00

Eurozone: M3 money supply, adjusted y/y, November 4.8% (forecast 4.4%)

-

08:29

Bank of Japan: the yield curve was formed smoothly

This report includes forecasts of the central bank on inflation and economic growth, and is published 8 times a year, approximately 10 days after the decision on monetary policy.

At the December meeting, the Bank of Japan left monetary policy unchanged:

-

the use of the previously fixed interest rate yield curve shows difficulty

-

weak yen only pushes up prices in the short term

-

improved personal consumption

-

the United States economy could further strengthen under the new president

-

growth in manufacturing was recorded all over the world

-

the Bank of Japan should firmly support the current policy stance

-

it is necessary to go a long way to reach the inflation target of 2%

-

the yield curve was formed smoothly

-

-

08:26

WSE: After opening

WIG20 index opened at 1934.69 points (+0.10%)*

WIG 51334.68 0.01%

WIG30 2226.33 -0.07%

mWIG40 4189.89 0.11%

*/ - change to previous close

The beginning of trading on the cash market was in favor of the bulls. With quite small turnover the demand side in the first fifteen minutes of the session worked out most of the losses incurred at the yesterday's close.

After twenty minutes of trading the WIG20 index was at the level of 1,938 points (+ 0.32%).

-

08:24

Major stock exchanges in Europe trading lower: DAX -0.2%, CAC40 -0.3%, FTSE -0.3%

-

08:22

UK house price growth in 2016 was one of relative stability

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "The story of UK house price growth in 2016 was one of relative stability. Annual house price growth ended 2016 at 4.5%, the same as the rate recorded in 2015. "There were signs that London's significant period of outperformance may be drawing to a close. For the first year since 2008, annual house price growth in the capital was lower than the UK average, with prices increasing by 3.7% over the year, down from 12.2% in 2015. "The South of England as a whole continued to see slightly stronger price growth than the North of England, though the differential narrowed. "Price growth in Wales, Scotland and Northern Ireland remained subdued, though each saw small gains overall in 2016 (see page 3 for more detail on regional price trends).

-

07:25

WSE: Before opening

Wednesday's session on the New York stock exchange ended with declines in major indices. At the close the Dow Jones fell by 0.56 percent, Nasdaq Composite went down by 0.89 percent and the S&P500 lost 0.84 percent. We may say that the psychological levels have changed into technical resistance. We may also venture to say that the market is ripe for a correction after the post-election rally.

From the European markets point of view it is important that the S&P500 doubled its loss after the close of trading in Europe, so this morning can bring adjustment to valuations in the US. Tokyo's Nikkei index responded to this situation with decrease of 1.3 percent.

The only major report in today's macro calendar is weekly data from the US labor market, which should strengthen the interest in situation on Wall Street. In addition, investors are waiting for information from the US markets, the next day of declines will signal that the end of the year will be held under the dictation of the bears.

Yesterday's downward impulse from Wall Street had an impact on the end of trading in Warsaw and the last sessions indicate the fluctuation in demand in the region of 1,950 points what limits the possibility of meeting the WIG20 index with the level of 2,000 points this year.

-

07:16

United Kingdom: Nationwide house price index, y/y, December 4.5% (forecast 3.8%)

-

07:16

United Kingdom: Nationwide house price index , December 0.8% (forecast 0.2%)

-

07:11

Options levels on thursday, December 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0725 (2002)

$1.0643 (593)

$1.0582 (236)

Price at time of writing this review: $1.0458

Support levels (open interest**, contracts):

$1.0394 (1113)

$1.0368 (1103)

$1.0334 (2218)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 43935 contracts, with the maximum number of contracts with strike price $1,1500 (3202);

- Overall open interest on the PUT options with the expiration date March, 13 is 54257 contracts, with the maximum number of contracts with strike price $1,0000 (5021);

- The ratio of PUT/CALL was 1.23 versus 1.21 from the previous trading day according to data from December, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.2511 (489)

$1.2415 (238)

$1.2319 (111)

Price at time of writing this review: $1.2253

Support levels (open interest**, contracts):

$1.2180 (744)

$1.2086 (433)

$1.1988 (1321)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 13979 contracts, with the maximum number of contracts with strike price $1,2800 (2995);

- Overall open interest on the PUT options with the expiration date March, 13 is 16753 contracts, with the maximum number of contracts with strike price $1,1500 (2968);

- The ratio of PUT/CALL was 1.20 versus 1.22 from the previous trading day according to data from December, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:37

Global Stocks

European stock markets closed mixed in light postholiday trade on Wednesday, with miners pushing higher, while Italian banks led decliners on ongoing concerns about the future of Banca Monte dei Paschi di Siena.

U.S. stocks fell on Wednesday, slumping in a broad decline as the market's multiweek rally-which has taken indexes to repeated records and the Dow within mere points of the 20,000 milestone-stalled. All 11 of the S&P 500's primary sectors ended lower on the day, while the benchmark index itself suffered its biggest one-day point and percentage drop since October. Financials and materials, two of the best-performing industries of late, were among the hardest hit, with both down about 1%.

Major Asian markets were broadly lower Thursday following declines on Wall Street. "It's largely a response to a negative U.S. session [but] volumes are so thin it's hard to read into any particular move," said Alex Furber, sales trader at CMC Markets.

-