Market news

-

20:00

DJIA 19731.49 -88.29 -0.45%, NASDAQ 5375.07 -57.02 -1.05%, S&P 500 2235.16 -14.10 -0.63%

-

17:00

European stocks closed: FTSE 7142.83 22.57 0.32%, DAX 11481.06 30.01 0.26%, CAC 4862.31 23.84 0.49%

-

16:34

WSE: Session Results

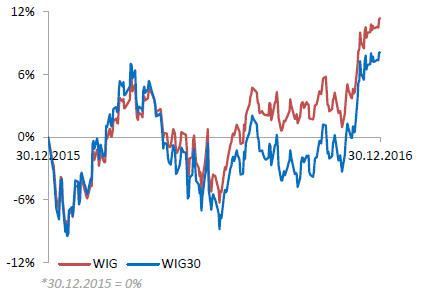

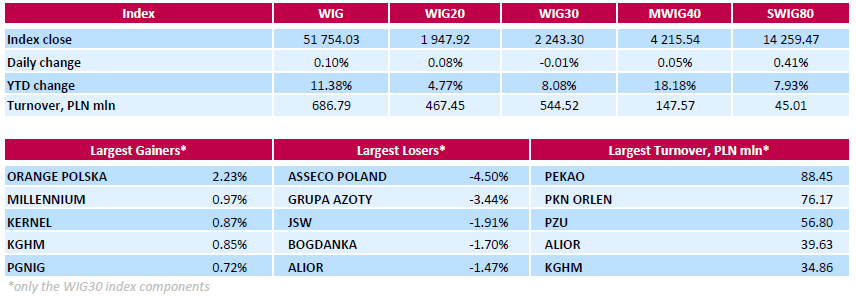

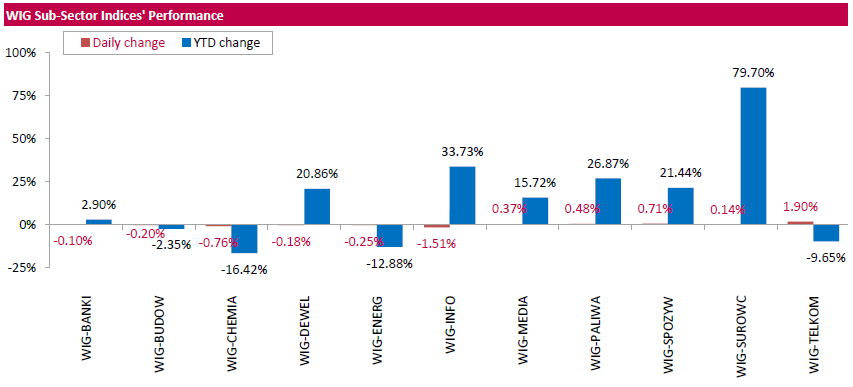

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged up 0.1%. Sector performance within the WIG Index was mixed. Telecoms (+1.90%) outperformed, while informational technology (-1.51%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, inched down 0.01%. Within the index components, IT-company ASSECO POLAND (WSE: ACP) was the session's biggest loser, tumbling by 4.5%. It was reported that the company bought from the European Bank for Reconstruction and Development (EBRD) a 4.28% stake in its subsidiary Asseco South Eastern Europe for PLN 21.1 mln, as the EBRD exercised its put option. According to new put and call option rules for the EBRD's remaining stake of 2.6 mln shares (or 4.99%), the next transaction window will be between December 28, 2017 and March 28, 2018. Other largest decliners were chemical producer GRUPA AZOTY (WSE: ATT) and two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), falling by 3.44%, 1.91% and 1.7% respectively. At the same time, telecommunication services provider ORANGE POLSKA (WSE: OPL) led the gainers with a 2.23% advance, followed by bank MILLENNIUM (WSE: MIL), agricultural producer KERNEL (WSE: KER) and copper producer KGHM (WSE: KGH), adding 0.97%, 0.87% and 0.85% respectively.

The Warsaw Stock Exchange will be open on Monday, January 2nd.

-

16:16

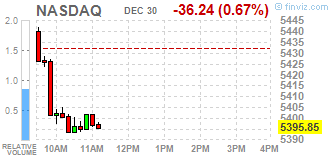

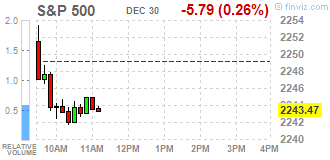

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on the last trading day of 2016 due to losses across most sectors, but still on track to record hefty gains for the year. The markets have shown surprising resilience to major political events, such as Britain's vote in June to leave the European Union and the election of Donald Trump as U.S. president in November. U.S. stocks, which had not priced in a Trump victory in the run-up to the vote, marked a series of record highs on bets that his policies would spur growth.

Most of Dow stocks in negative area (21 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +0.52%). Top loser - Intel Corporation (INTC, -1.06%).

Most of S&P sectors also in negative area. Top gainer - Financials (+0.4%). Top loser - Technology (-0.5%).

At the moment:

Dow 19739.00 -20.00 -0.10%

S&P 500 2239.75 -5.25 -0.23%

Nasdaq 100 4877.50 -41.00 -0.83%

Oil 53.58 -0.19 -0.35%

Gold 1158.30 +0.20 +0.02%

U.S. 10yr 2.46 -0.02

-

14:51

WSE: After start on Wall Street

Some of European parquets (London and Frankfurt) has completed listing for this year. FTSE gained per year over 14 percent and the German DAX nearly 7 percent.

Wall Street began with a slight rise, and this market may be a guide for the Warsaw Stock Exchange on the road to the final of this year. More and more clearly we may also observe rising prices at the end of the year. In the segment of the largest companies the main beneficiaries of this process are the PZU and KGHM.

An hour before the close of trading the WIG20 index was at the level of 1,951 points (+0,27%) ant the turnover among the blue chips was amounted to PLN 310 million.

-

14:46

U.S.: Chicago Purchasing Managers' Index , December 54.6 (forecast 57)

-

14:34

U.S. Stocks open: Dow +0.08%, Nasdaq +0.10%, S&P +0.11%

-

14:29

Before the bell: S&P futures +0.25%, NASDAQ futures +0.21%

U.S. stock-index futures rose. Trading activity remain low as the market participants gear up for another three-day weekend.

Global Stocks:

Nikkei 19,114.37 -30.77 -0.16%

Hang Seng 22,000.56 +209.65 +0.96%

Shanghai 3,103.40 +7.31 +0.24%

FTSE 7,142.83 +22.57 +0.32%

CAC 4,854.23 +15.76 +0.33%

DAX 11,481.06 +30.01 +0.26%

Crude $53.58 (-0.35%)

Gold $1,157.40 (-0.06%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

29

0.11(0.3808%)

134

ALTRIA GROUP INC.

MO

67.79

-0.06(-0.0884%)

382

Amazon.com Inc., NASDAQ

AMZN

767.5

2.35(0.3071%)

6445

Apple Inc.

AAPL

116.9

0.17(0.1456%)

41215

AT&T Inc

T

42.74

0.08(0.1875%)

8525

Barrick Gold Corporation, NYSE

ABX

16.36

-0.03(-0.183%)

161339

Boeing Co

BA

155.71

0.02(0.0129%)

451

Caterpillar Inc

CAT

92.98

-0.31(-0.3323%)

1654

Chevron Corp

CVX

117.48

-0.34(-0.2886%)

4689

Cisco Systems Inc

CSCO

30.55

0.09(0.2955%)

1049

Exxon Mobil Corp

XOM

90.11

-0.24(-0.2656%)

3750

Facebook, Inc.

FB

116.67

0.32(0.275%)

14502

Ford Motor Co.

F

12.22

-0.01(-0.0818%)

27023

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.58

0.10(0.7418%)

21392

General Electric Co

GE

31.64

-0.07(-0.2208%)

26017

General Motors Company, NYSE

GM

35.26

0.12(0.3415%)

2400

Goldman Sachs

GS

239.49

1.31(0.55%)

1256

Home Depot Inc

HD

135.45

0.35(0.2591%)

1105

Intel Corp

INTC

36.75

0.09(0.2455%)

2350

International Business Machines Co...

IBM

166.18

-0.42(-0.2521%)

3565

JPMorgan Chase and Co

JPM

86.25

0.36(0.4191%)

3526

Microsoft Corp

MSFT

62.98

0.08(0.1272%)

2001

Nike

NKE

31.64

-0.07(-0.2208%)

26017

Pfizer Inc

PFE

32.36

-0.13(-0.4001%)

9829

Procter & Gamble Co

PG

84.33

-0.02(-0.0237%)

1221

Starbucks Corporation, NASDAQ

SBUX

56.12

-0.20(-0.3551%)

678

Tesla Motors, Inc., NASDAQ

TSLA

217.1

2.42(1.1273%)

30808

The Coca-Cola Co

KO

41.62

0.02(0.0481%)

942

Twitter, Inc., NYSE

TWTR

16.41

0.02(0.122%)

19191

Verizon Communications Inc

VZ

53.6

-0.14(-0.2605%)

540

Visa

V

78.63

0.30(0.383%)

300

Wal-Mart Stores Inc

WMT

69.1

-0.16(-0.231%)

5581

Yahoo! Inc., NASDAQ

YHOO

38.75

0.11(0.2847%)

2061

Yandex N.V., NASDAQ

YNDX

20.61

0.26(1.2776%)

600

-

13:50

Option expiries for today's 10:00 ET NY cut

USDJPY 114.00 (540m) 116.00 117.00 (1.97bn), 117.80 118.00 (731m), 118.20/25/30/35/40/45/50 (683m)

EURUSD 1.0100 (2.79bn) 1.0200 1.0300, 1.0350/55 (931m), 1.0395/1.0400 (675m) 1.0430, 1.0450/53 (3.44bn), 1.0475 1.0500 (1.57bn) 1.0600 1.0610/15/20/25/30, 1.0640, 1.0660, 1.0670/75 (654m) 1.0700, 1.0750 (669m)

GBPUSD 1.2400 1.2600 (672m)

USDCAD 1.3310/15/20, 1.3390/95/1.3400/05 1.3417/18/20/25 1.3500/05/10/13 1.3600

EURGBP 0.8695 (460m)

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Yandex N.V. (YNDX) initiated with an Outperform at Credit Suisse; target $26

Tesla Motors (TSLA) named Top 2017 Pick at at Robert W. Baird

-

13:05

Orders

EUR/USD

Offers 1.0550-55 1.0585 1.0600 1.0650 1.0700

Bids 1.0500 1.0400 1.0380-85 1.0365 1.0350 1.0335 1.0300

GBP/USD

Offers 1.2300 1.2330 1.2350 1.2380-85 1.2400

Bids 1.2200 1.2185 1.2150 1.2100 1.2080 1.2050 1.2000

EUR/GBP

Offers 0.8600 0.8650 0.8700

Bids 0.8500 0.8485 0.8460 0.8435-40 0.8400

EUR/JPY

Offers 123.30 123.60 123.85 124.00-10

Bids 122.00 121.50 121.00 120.50 120.00

USD/JPY

Offers 117.00 117.80-85 118.00 118.20-25 118.45-50 118.80 119.00

Bids 116.00 115.85 115.50

AUD/USD

Offers 0.7260 0.7280 0.7300 0.7320 0.7350 0.7365 0.7380 0.7400

Bids 0.7175-80 0.7145-50 0.7100-10 0.7065 0.7030 0.7000

-

12:06

WSE: Mid session comment

The forenoon phase of session showed that trade on the Warsaw market is balanced and conservative and marked by low activity and low volatility. On the German market we may see a slight discount. To the end of the year there is still four hours, in which the market can still try to close up as high as possible.

At the halfway point of today's quotations the WIG20 index was at the level of 1,947 points (+ 0.04%) and the turnover was amounted to PLN 200 million.

-

07:15

Options levels on friday, December 30, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0745 (2026)

$1.0672 (594)

$1.0619 (236)

Price at time of writing this review: $1.0531

Support levels (open interest**, contracts):

$1.0446 (1095)

$1.0416 (1103)

$1.0376 (2218)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 44314 contracts, with the maximum number of contracts with strike price $1,1500 (3205);

- Overall open interest on the PUT options with the expiration date March, 13 is 54442 contracts, with the maximum number of contracts with strike price $1,0000 (5027);

- The ratio of PUT/CALL was 1.23 versus 1.23 from the previous trading day according to data from December, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.2512 (489)

$1.2415 (238)

$1.2320 (113)

Price at time of writing this review: $1.2276

Support levels (open interest**, contracts):

$1.2182 (744)

$1.2086 (453)

$1.1989 (1392)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 14129 contracts, with the maximum number of contracts with strike price $1,2800 (2996);

- Overall open interest on the PUT options with the expiration date March, 13 is 16912 contracts, with the maximum number of contracts with strike price $1,1500 (2967);

- The ratio of PUT/CALL was 1.20 versus 1.20 from the previous trading day according to data from December, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:31

Global Stocks

U.K. stocks rose for a fourth straight day after a choppy session on Thursday, settling at a record closing high as oil companies popped higher. Thursday's gain came as oil companies advanced after U.S. government data showed a smaller rise in domestic inventories than had been signaled by an industry estimate. Oil prices briefly moved into positive territory, but had slipped back into the red at the time of the European market close.

U.S. stocks closed fractionally lower on Thursday as investors remained reluctant to make big bets in a thinly-traded session ahead of long holiday weekend. All three main indexes are on track to post solid monthly gains and double-digit annual returns with one trading session to go in 2016.

Asian shares were mixed early Friday in the last trading session of 2016, with a weaker dollar hurting the competitiveness of exports in the region, while an overnight drop in oil prices sent key energy stocks lower. The greenback's rally has shown signs of slowing in recent days as doubts rose over the assumption of the U.S. Federal Reserve's rapid interest rate increases. Earlier this week, the National Association of Realtors showed pending home sales dropped in November, a sign of weakening momentum for the U.S. housing market.

-

06:25

WSE: before opening

Thursday's session on Wall Street ended with little drop. Investors received data on initial jobless claims in line with consensus, higher than expected turned out to be wholesalers supplies. Barack Obama announced that the United States expel 35 Russian diplomats under sanctions for interfering Russia in presidential election.

The Dow Jones Industrial dropped at the closing of 0.07 percent, the S&P500 lost 0.03 percent and the Nasdaq Composite went down by 0.12 percent.

Given the flat trading in Asia and a slight increase in trading of futures on the US indices morning in Europe promises to be quiet. Today ends in both the quarter and the year in the markets and this may bring unusual price movements associated with attempts to improve the periodic results by institutional players.

On the Warsaw market after yesterday's booster by 0.7 percent the WIG20 index reached the highest close level in the month, however, to overcome the level of 2,000 points it seems unlikely today. -

00:30

Australia: Private Sector Credit, m/m, November 0.5% (forecast 0.5%)

-

00:30

Australia: Private Sector Credit, y/y, November 5.4%

-