Market news

-

23:50

Japan: Capital Spending, Quarter IV 3.8%

-

23:29

Commodities. Daily history for Feb 28’02’2017:

(raw materials / closing price /% change)

Oil 54.00 -0.02%

Gold 1,248.80 -0.41%

-

23:28

Stocks. Daily history for Feb 28’2017:

(index / closing price / change items /% change)

Nikkei +11.52 19118.99 +0.06%

TOPIX +1.32 1535.32 +0.09%

Hang Seng -184.32 23740.73 -0.77%

CSI 300 +6.59 3452.81 +0.19%

Euro Stoxx 50 +10.31 3319.61 +0.31%

FTSE 100 +10.44 7263.44 +0.14%

DAX +11.74 11834.41 +0.10%

CAC 40 +13.40 4858.58 +0.28%

DJIA -25.20 20812.24 -0.12%

S&P 500 -6.11 2363.64 -0.26%

NASDAQ -36.46 5825.44 -0.62%

S&P/TSX -64.26 15399.25 -0.42%

-

23:28

Currencies. Daily history for Feb 28’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0575 -0,09%

GBP/USD $1,2379 -0,49%

USD/CHF Chf1,0055 -0,33%

USD/JPY Y112,75 +0,04%

EUR/JPY Y119,24 -0,05%

GBP/JPY Y139,58 -0,43%

AUD/USD $0,7655 -0,22%

NZD/USD $0,7190 -0,03%

USD/CAD C$1,3299 +0,91%

-

23:07

Schedule for today,Wednesday, Mar 01’2017 (GMT0)

00:30 Australia Gross Domestic Product (YoY) Quarter IV 1.8% 1.9%

00:30 Australia Gross Domestic Product (QoQ) Quarter IV -0.5% 0.7%

00:30 Japan Manufacturing PMI (Finally) February 52.7 53.5

01:00 China Non-Manufacturing PMI February 54.6

01:00 China Manufacturing PMI February 51.3 51.1

01:45 China Markit/Caixin Manufacturing PMI February 51.0 50.8

02:00 U.S. President Trump Speaks

07:00 United Kingdom Nationwide house price index February 0.2% 0.2%

07:00 Switzerland UBS Consumption Indicator January 1.5

08:30 Switzerland Manufacturing PMI February 54.6

08:50 France Manufacturing PMI (Finally) February 53.6 52.3

08:55 Germany Manufacturing PMI (Finally) February 56.4 57

08:55 Germany Unemployment Rate s.a. February 5.9% 5.9%

08:55 Germany Unemployment Change February -26 -10

09:00 Eurozone Manufacturing PMI (Finally) February 55.2 55.5

09:30 United Kingdom Consumer credit, mln January 1039 1400

09:30 United Kingdom Mortgage Approvals January 67.9 68.8

09:30 United Kingdom Net Lending to Individuals, bln January 4.8

09:30 United Kingdom Purchasing Manager Index Manufacturing February 55.9 55.5

13:00 Germany CPI, m/m (Preliminary) February -0.6% 0.5%

13:00 Germany CPI, y/y (Preliminary) February 1.9% 2.1%

13:30 Canada Current Account, bln Quarter IV -18.3

13:30 U.S. Personal Income, m/m January 0.3% 0.3%

13:30 U.S. Personal spending January 0.5% 0.3%

13:30 U.S. PCE price index ex food, energy, m/m January 0.1% 0.2%

13:30 U.S. PCE price index ex food, energy, Y/Y January 1.7%

14:45 U.S. Manufacturing PMI (Finally) February 55

15:00 Canada Bank of Canada Rate 0.5% 0.5%

15:00 Canada BOC Rate Statement

15:00 U.S. Construction Spending, m/m January -0.2% 0.7%

15:00 U.S. ISM Manufacturing February 56 56.3

15:30 U.S. Crude Oil Inventories February 0.564

17:30 U.S. FOMC Member Kaplan Speak

19:00 U.S. Fed's Beige Book

20:00 U.S. Total Vehicle Sales, mln February 17.61 17.5

23:00 U.S. FOMC Member Brainard Speaks

-

22:46

Australia: AIG Manufacturing Index, February 59.3

-

20:01

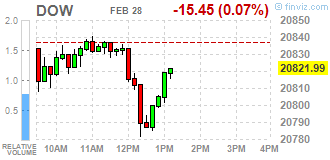

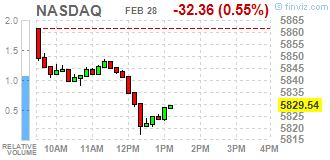

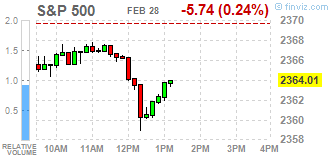

DJIA 20812.47 -24.97 -0.12%, NASDAQ 5826.95 -34.95 -0.60%, S&P 500 2363.13 -6.62 -0.28%

-

18:15

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes slightly fell on Tuesday, dragged down by financial and consumer discretionary shares, with investors awaiting President Donald Trump's first speech to a joint session of Congress. Trump's promises of tax reform, infrastructure spending and simpler regulations have sparked a post-election rally that has propelled the main U.S. market indexes to record highs.

Most of Dow stocks in negative area (21 of 30). Top loser - Wal-Mart Stores, Inc. (WMT, -1.63%). Top gainer - The Boeing Company (BA, +0.71%).

Most of S&P sectors are also in negative area. Top loser - Conglomerates (-1.3%). Top gainer - Utilities (+0.5%).

At the moment:

Dow 20800.00 -13.00 -0.06%

S&P 500 2362.00 -6.25 -0.26%

Nasdaq 100 5328.50 -19.00 -0.36%

Oil 53.32 -0.73 -1.35%

Gold 1257.20 -1.60 -0.13%

U.S. 10yr 2.35 -0.02

-

17:01

European stocks closed: FTSE 7263.44 10.44 0.14%, DAX 11834.41 11.74 0.10%, CAC 4858.58 13.40 0.28%

-

15:41

US dollar falls to 111.78 japanese yen, weakest since february 9

-

15:14

US consumer confidence increased in February and remains at a 15-year high

The Conference Board Consumer Confidence Index, which had declined moderately in January, increased in February. The Index now stands at 114.8 (1985=100), up from 111.6 in January. The Present Situation Index rose from 130.0 to 133.4 and the Expectations Index increased from 99.3 last month to 102.4.

"Consumer confidence increased in February and remains at a 15-year high (July 2001, 116.3)," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers rated current business and labor market conditions more favorably this month than in January. Expectations improved regarding the short-term outlook for business, and to a lesser degree jobs and income prospects. Overall, consumers expect the economy to continue expanding in the months ahead."

-

15:06

U.S.: Richmond Fed Manufacturing Index, February 17

-

15:00

U.S.: Consumer confidence , February 114.8 (forecast 111)

-

14:51

Stellar Chicago PMI not helping the dollar as traders await Trump’s speech. EUR/USD near the session highs

-

14:45

U.S.: Chicago Purchasing Managers' Index , February 57.4 (forecast 53.0)

-

14:33

U.S. Stocks open: Dow -0.09%, Nasdaq -0.17%, S&P -0.17%

-

14:27

Before the bell: S&P futures -0.11%, NASDAQ futures +0.01%

U.S. stock-index futures were flat as investors awaited President Trump's speech to Congress and assessed the second estimate for Q4 GDP.

Global Stocks:

Nikkei 19,118.99 +11.52 +0.06%

Hang Seng 23,740.73 -184.32 -0.77%

Shanghai 3,242.66 +14.00 +0.43%

FTSE 7,255.52 +2.52 +0.03%

CAC 4,846.49 +1.31 +0.03%

DAX 11,816.53 -6.14 -0.05

Crude $53.43 (-1.15%)

Gold $1,256.70 (-0.17%)

-

14:16

Rates futures imply 33% chance of a Fed rate hike in March, little changed from monday - CME Fedwatch

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, December 5.6% (forecast 5.3%)

-

13:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Hewlett Packard Enterprise (HPE) downgraded to Hold from Buy at Argus

Other:

Apple (AAPL) target raised to $180 from $150 at Guggenheim; Buy

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0490-1.0501 (EUR 1,442 M) 1.0520-1.0525 (EUR 710 M) 1.0550 (EUR 1,513 M) 1.0575 (EUR 970 M) 1.0585-1.0600 (EUR 403 M) 1.0650-1.0655 (EUR 419 M) 1.0665-1.0675 (EUR 251 M) 1.0700-1.0715 (EUR 1,449 M)

GBP/USD 1.2450-1.2461 (GBP 352 M) 1.2500 (GBP 473 M) 1.2580-1.2590 (GBP 314 M) 1.2600-1.2615 (GBP 213 M)

EUR/GBP 0.8485-0.8500 (EUR 187 M)

USD/JPY 111.00-111.05 (USD 376 M) 111.45-111.55 (USD 330 M) 111.95-112.00 (USD 643 M) 112.20-112.35 (USD 880 M) 112.50 (USD 550 M) 112.75 (USD 970 M) 113.15-113.25 (USD 361 M) 113.50-113.65 (USD 700 M) 113.70-113.75 (USD 245 M) 114.00-114.10 (USD 1,063 M)

USD/CHF 1.0100-1.0115 (USD 300 M)

AUD/USD 0.7525-0.7540 (AUD 664 M) 0.7600-0.7610 (AUD 396 M) 0.7640-0.7655 (AUD 242 M)

USD/CAD 1.3080-1.3095 (USD 605 M) 1.3100-1.3112 (USD 603 M) 1.3120 (USD 365 M) 1.3150-1.3165 (USD 381 M) 1.3185-1.3200 (USD 330 M) 1.3215-1.3220 (USD 270 M) 1.3285-1.3300 (USD 262 M)

NZD/USD 0.7150-0.7155 (NZD 208 M) 0.7400 (NZD 277 M)

-

13:40

US trade balance deficit widened in January

The international trade deficit was $69.2 billion in January, up $4.9 billion from $64.4 billion in December. Exports of goods for January were $126.2 billion, $0.4 billion less than December exports. Imports of goods for January were $195.4 billion, $4.4 billion more than December imports.

-

13:39

US wholesale inventories improved in January

Wholesale inventories for January, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $599.9 billion, down 0.1 percent from December 2016, and were up 2.2 percent from January 2016. The November 2016 to December 2016 percentage change was revised from up 1.0 percent to up 0.9 percent.

-

13:36

Canadian Industrial Product Price Index rose due to higher prices for energy and petroleum products

The Industrial Product Price Index (IPPI) rose 0.4% in January, mainly due to higher prices for energy and petroleum products. The Raw Materials Price Index (RMPI) increased 1.7%, led by higher prices for animals and animal products.

The IPPI (+0.4%) increased for a fifth consecutive month in January, following a 0.3% gain in December. Of the 21 major commodity groups, 6 were up, 10 were down and 5 were unchanged.

Prices for energy and petroleum products (+2.7%) were largely responsible for the gain in the IPPI in January. The increase in this commodity group was mainly attributable to higher prices for motor gasoline (+3.0%) and heavy fuel oils (+8.6%). The price of lubricants and other petroleum refinery products (+4.5%), diesel fuel (+1.3%) and jet fuel (+4.5%) also contributed to the increase in energy and petroleum products, but to a lesser extent. The IPPI excluding energy and petroleum products edged up 0.1%.

-

13:34

US Q4 preliminary GDP rose less than expected

Real gross domestic product (GDP) increased at an annual rate of 1.9 percent in the fourth quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.5 percent.

The increase in real GDP in the fourth quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, residential fixed investment, nonresidential fixed investment, and state and local government spending. These increases were partly offset by negative contributions from exports and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The deceleration in real GDP in the fourth quarter primarily reflected a downturn in exports, an acceleration in imports, and a downturn in federal government spending that were partly offset by an upturn in residential fixed investment, an acceleration in private inventory investment, and an upturn in state and local government spending.

-

13:31

U.S.: Goods Trade Balance, $ bln., January -69.2

-

13:30

U.S.: GDP, q/q, Quarter IV 1.9% (forecast 2.1%)

-

13:30

Canada: Industrial Product Price Index, m/m, January 0.4%

-

13:30

Canada: Industrial Product Price Index, y/y, January 2.3%

-

13:30

U.S.: PCE price index ex food, energy, q/q, Quarter IV 1.2%

-

13:30

U.S.: PCE price index, q/q, Quarter IV 1.9% (forecast 2.2%)

-

13:10

Fed’s Kaplan: Exact Timing Of Rate Move Is Not Important, Path Of Rate Move Is - Livesquawk

-

13:08

Nigeria oil minister says aims to increase oil production to above 2.2 mln bpd by end of 2017

-

12:33

UK finance minister Hammond says most economical way for government to fund infrastructure is through conventional bonds, not its own infrastructure bonds

-

11:59

Bishkek-Russia's Putin says possible UN sanctions against Syria would be inappropriate

-

10:34

Bank of England's Hogg says do not think QE has created a problem of overvaluation in the gilt market

-

10:13

Italian preliminary CPI above expectations in February

In February 2017, according to preliminary estimates, the Italian consumer price index for the whole nation (NIC) increased by 0.3% on monthly basis and by 1.5% with respect to February 2016, up from +1.0% in January 2017.

The increase, in February, of the annual rate of change of All items index was mainly due to the speed-up of the annual growth of prices of Unprocessed food (+8.8%, from +5.3% in January), of Non-regulated energy products (+12.1%, from +9.0% in the previous month) and of Services related to transport (+2.4%, from +1.0% in January).

Therefore, excluding energy and unprocessed food, core inflation was +0.6%, up from +0.5% in the previous month; excluding energy the inflation was +1.3%, from +0.8% in January.

The annual rate of change of prices of Goods was +1.9% (up from +1.2% in January) and the annual rate of change of prices of Services was +0.9% (up from +0.7% in the previous month). As a consequence, the negative inflationary gap between Services and Goods doubled with respect to January (-1.0 percentage points from -0.5 in January).

-

09:49

Bank of England's Hogg says when time comes to unwind QE, even if that is likely some way off, we will do so in a way that is mindful of the need to maintain orderly markets

-

Any reduction of the stock of gilts, via natural run off or a programme of sales, would be done in close cooperation with dmo

-

Mpc will need to be clear about its intentions when unwinding QE in order to avoid an unintended move in gilt yields

-

Distributional effects qe have not been sufficiently strong to skew overall distribution of wealth and income in UK

-

Forward guidance needs to cover things like boe statements on how to exit QE

-

-

09:22

Norway Central Bank will sell foreign exchange equivalent to NOK 850 mln per day in March vs NOK 1000 mln per day in Feb

-

08:43

Major European stock markets trading in positive territory: FTSE 100 7,259.13 +6.13 + 0.08%, CAC 40 4,859.66 +14.48 + 0.30%, Xetra DAX 11,836.61 +13.94 + 0.12%

-

08:25

Swiss KOF Economic Barometer rose on positive contributions from the manufacturing industry

In February 2017, the KOF Economic Barometer climbed from 102.0 in January (revised up from 101.7) by 5.2 points to a level of 107.2, which is markedly above its long-term average and as high as it had last stood in the end of 2013. The Swiss franc appreciation shock from early 2015 hence by now appears to have been largely overcome.

The strongest positive contributions to this result come from the manufacturing industry, followed with a clear gap by the hospitality industry. Slightly positive signals stem from the financial sector, the exporting industry and the construction sector, whilst the indicators relating to domestic private consumption have practically remained unchanged compared to January.

-

08:23

French CPI inflation almost flat m/m (January)

According to the provisional estimate made at the end of February, the Consumer Price Index (CPI) should barely slacken (+1.2% year on year) after a sharp acceleration in January (+1.3% after +0.6% in December). This slight slowdown is expected to be the result of a sharp decline in manufactured products prices, largely offset by an acceleration in the prices of tobacco and energy and a more moderate one for food and services prices.

Over one month, consumer prices should pick up slightly : +0.1% after −0,2% in the previous month. This slight rise should come from a rebound in services prices and an increase in tobacco prices. Food prices are set to slown down sligtly due to fresh food. Winter sales having continued in February, manufactured products prices should fall again, thus mitigating the overall rebound. Finally, energy prices should stabilise after five months of sustained increase.

-

08:00

Switzerland: KOF Leading Indicator, February 107.2 (forecast 102)

-

07:58

French GDP in line with expectations in Q4

In Q4 2016, GDP in volume terms accelerated: +0.4%, after +0.2% in Q3. On average over the year, GDP rose by 1.1%, practically as much as in 2015 (+1.2%). Without working day adjustment, GDP growth amounts to +1.2% in 2016, after +1.3% in 2015.

Household consumption expenditures accelerated in Q4 (+0.6% after +0.1%), as well as total gross fixed capital formation (GFCF; +0.4% after +0.2%). All in all, final domestic demand excluding inventory changes gathered momentum, contributing more to GDP growth: +0.5 points after +0.2 points.

Exports were more dynamic (+1.3% after +0.8%) while imports slowed down (+1.0% after +2.7%). All in all, foreign trade balance contributed slightly to GDP growth in Q4: +0.1 points after −0.6 points. Conversely, changes in inventories contributed negatively (−0.1 points after +0.7 points).

-

07:56

Today’s events

-

At 20:00 GMT FOMC members Patrick T. Harker will deliver a speech

-

At 20:30 GMT FOMC member John Williams will deliver a speech

-

At 23:50 GMT FOMC member James Bullard will give a speech

-

-

07:28

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.1%

-

07:11

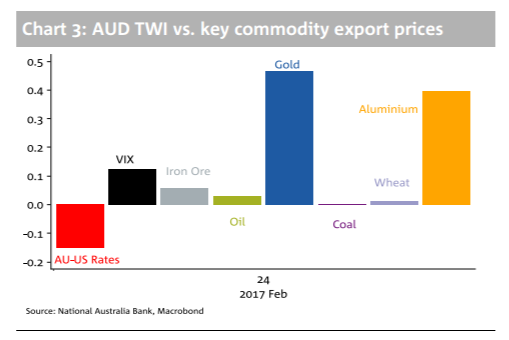

The AUD has continued to defy predictions - NAB

"The AUD has continued to defy predictions - including our own - for its imminent descent from the high to the low 0.70s.

Alongside the inability of the USD to recapture almost any of the ground it lost in January, the global economy, commodity prices and risk appetite have all been travelling on a higher plane than we envisaged when reaffirming our AUD forecasts earlier in the year.

To the extent this momentum can continue for a while longer, commodity currencies can hold up for an extended period.

Alongside general revisions to our USD forecasts for the next few quarters, we are lifting our AUD/USD forecast to 0.77 for end Q1 (was 0.73); to 0.75 for Q3 (0.72) and to 0.73 for Q3 (0.70). We retain our 0.70 end-2017 forecast and still contend we can spend some time slightly below there in 2018.

A resumption of USD strength, weaker commodity prices and less buoyant risk appetite are all implicit in this view".

Copyright © 2017 NAB, eFXnews™

-

07:06

UK consumer confidence has decreased this month - GfK

GfK's long-running Consumer Confidence Index has decreased one point this month to -6. Three of the five measures saw decreases in February, and two measures saw increases.

Joe Staton, Head of Market Dynamics at GfK, says:

"Against a backdrop of rising food and fuel prices, sterling depreciation, nominal earnings growth and a burgeoning fear of rapid inflation, concern about our personal financial situation for 2017 has contributed to a drop in UK consumer confidence this month (to -6). Any momentum behind the post-Brexit, debt-fuelled, consumer-spending boom now appears to be softening. Mounting pressures on disposable income are starting to bite as witnessed by two months of falling retail sales (ONS) and a further drop in the Major Purchase Index (this month down by five points). Consumer spending continues to drive economic growth in the UK so any further fall in confidence could support forecasts for a slowdown of the overall economy this year."

-

07:03

Higher export commodity prices contributed to a narrowing of the current account deficit of Australia

For the second quarter in succession, higher export commodity prices contributed to a narrowing of the current account deficit in the December quarter 2016, according to latest figures from the Australian Bureau of Statistics (ABS).

The seasonally adjusted current account deficit fell $6,348 million (62 per cent) to $3,853 million in the December quarter 2016. In seasonally adjusted terms, the balance on goods and services surplus in the December quarter 2016 is the highest on record at $4,667m. Exports of goods and services rose $9,668 million (12 per cent) and imports of goods and services rose $1,462 million (2 per cent). The primary income deficit rose $1,843 million (30 per cent).

In volume terms exports grew faster than imports this quarter and so international trade is expected to contribute 0.2 percentage points to growth in the December quarter 2016 Gross Domestic Product. In seasonally adjusted chain volume terms, the balance on goods and services surplus increased $700 million (49 per cent) to $2,124 million.

-

07:01

Japan’s industrial production fell in January

According to a report published by the Ministry of Economy, Trade and Industry of Japan, industrial production fell by 0.8% after rising 0.7% in December, while analysts had expected an increase of 0.4% in January. In annual terms, Japan's industrial production remained at the same level of growth of 3.2%.

The report on industrial production reflects the volume of production plants, factories and mining companies of Japan. This indicator has attracted attention because it is the main indicator of the strength and health of the manufacturing sector.

The Ministry of Economy, Trade and Industry of Japan note, industrial production fell for the first six months against the backdrop of the reduction in car sales and the New Year celebrations, which lowered demand from China.

However, despite an unexpected decline in production, the ministry left its assessment of production unchanged, noting that the recovery trend persists. The ministry forecast industrial production growth of 3.5% in February.

-

06:57

BoJ Gov Kuroda: Boj's yield curve control will ensure yields won't rise beyond levels that reflect improvements in economy, prices

-

06:29

Global Stocks

European stocks closed with a small loss on Monday, as drops by Deutsche Börse AG, Direct Line Insurance Group PLC and PostNL NV weighed on the region's main benchmark. Investors appeared to avoid big bets ahead of a key speech Tuesday by U.S. President Donald Trump, who has been credited with sparking a global rally but hasn't yet detailed his plans for boosting the world's largest economy.

U.S. stocks overcame early weakness to push further into record territory on Monday, with the Dow industrials posting a 12th straight record close as investors await a speech Tuesday night by President Donald Trump.

Investors in Asia regained their risk appetite on Tuesday, catching an updraft from gains in U.S. markets, ahead of Donald Trump's speech to Congress. The Nikkei Stock Average NIK, +0.64% rebounded from Monday's losses to stand 0.7% ahead in midday trading, shrugging off poor economic data. Japan posted its first drop in industrial output in six months in January, as production of cars fell and the Lunar New Year holiday lowered demand from China, an important export market.

-

05:10

Japan: Housing Starts, y/y, January 12.8% (forecast 3.2%)

-

05:01

Japan: Construction Orders, y/y, January 1.1%

-

00:31

Australia: Current Account, bln, Quarter IV -3.9 (forecast -3.6)

-

00:31

Australia: Private Sector Credit, y/y, January 5.4%

-

00:30

Australia: Private Sector Credit, m/m, January 0.2%

-

00:08

United Kingdom: Gfk Consumer Confidence, February -6 (forecast -6)

-

00:01

Australia: HIA New Home Sales, m/m, January -2.2%

-

00:00

New Zealand: ANZ Business Confidence, January 16.6

-