Market news

-

23:28

Stocks. Daily history for Feb 28’2017:

(index / closing price / change items /% change)

Nikkei +11.52 19118.99 +0.06%

TOPIX +1.32 1535.32 +0.09%

Hang Seng -184.32 23740.73 -0.77%

CSI 300 +6.59 3452.81 +0.19%

Euro Stoxx 50 +10.31 3319.61 +0.31%

FTSE 100 +10.44 7263.44 +0.14%

DAX +11.74 11834.41 +0.10%

CAC 40 +13.40 4858.58 +0.28%

DJIA -25.20 20812.24 -0.12%

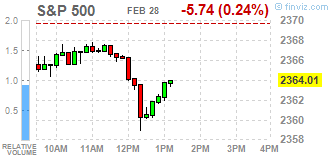

S&P 500 -6.11 2363.64 -0.26%

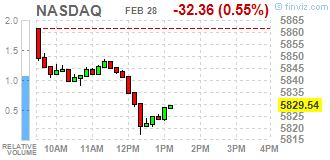

NASDAQ -36.46 5825.44 -0.62%

S&P/TSX -64.26 15399.25 -0.42%

-

20:01

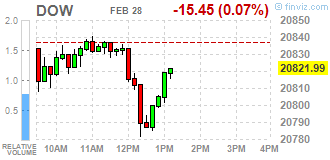

DJIA 20812.47 -24.97 -0.12%, NASDAQ 5826.95 -34.95 -0.60%, S&P 500 2363.13 -6.62 -0.28%

-

18:15

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes slightly fell on Tuesday, dragged down by financial and consumer discretionary shares, with investors awaiting President Donald Trump's first speech to a joint session of Congress. Trump's promises of tax reform, infrastructure spending and simpler regulations have sparked a post-election rally that has propelled the main U.S. market indexes to record highs.

Most of Dow stocks in negative area (21 of 30). Top loser - Wal-Mart Stores, Inc. (WMT, -1.63%). Top gainer - The Boeing Company (BA, +0.71%).

Most of S&P sectors are also in negative area. Top loser - Conglomerates (-1.3%). Top gainer - Utilities (+0.5%).

At the moment:

Dow 20800.00 -13.00 -0.06%

S&P 500 2362.00 -6.25 -0.26%

Nasdaq 100 5328.50 -19.00 -0.36%

Oil 53.32 -0.73 -1.35%

Gold 1257.20 -1.60 -0.13%

U.S. 10yr 2.35 -0.02

-

17:01

European stocks closed: FTSE 7263.44 10.44 0.14%, DAX 11834.41 11.74 0.10%, CAC 4858.58 13.40 0.28%

-

14:33

U.S. Stocks open: Dow -0.09%, Nasdaq -0.17%, S&P -0.17%

-

14:27

Before the bell: S&P futures -0.11%, NASDAQ futures +0.01%

U.S. stock-index futures were flat as investors awaited President Trump's speech to Congress and assessed the second estimate for Q4 GDP.

Global Stocks:

Nikkei 19,118.99 +11.52 +0.06%

Hang Seng 23,740.73 -184.32 -0.77%

Shanghai 3,242.66 +14.00 +0.43%

FTSE 7,255.52 +2.52 +0.03%

CAC 4,846.49 +1.31 +0.03%

DAX 11,816.53 -6.14 -0.05

Crude $53.43 (-1.15%)

Gold $1,256.70 (-0.17%)

-

13:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Hewlett Packard Enterprise (HPE) downgraded to Hold from Buy at Argus

Other:

Apple (AAPL) target raised to $180 from $150 at Guggenheim; Buy

-

08:43

Major European stock markets trading in positive territory: FTSE 100 7,259.13 +6.13 + 0.08%, CAC 40 4,859.66 +14.48 + 0.30%, Xetra DAX 11,836.61 +13.94 + 0.12%

-

07:28

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.1%

-

06:29

Global Stocks

European stocks closed with a small loss on Monday, as drops by Deutsche Börse AG, Direct Line Insurance Group PLC and PostNL NV weighed on the region's main benchmark. Investors appeared to avoid big bets ahead of a key speech Tuesday by U.S. President Donald Trump, who has been credited with sparking a global rally but hasn't yet detailed his plans for boosting the world's largest economy.

U.S. stocks overcame early weakness to push further into record territory on Monday, with the Dow industrials posting a 12th straight record close as investors await a speech Tuesday night by President Donald Trump.

Investors in Asia regained their risk appetite on Tuesday, catching an updraft from gains in U.S. markets, ahead of Donald Trump's speech to Congress. The Nikkei Stock Average NIK, +0.64% rebounded from Monday's losses to stand 0.7% ahead in midday trading, shrugging off poor economic data. Japan posted its first drop in industrial output in six months in January, as production of cars fell and the Lunar New Year holiday lowered demand from China, an important export market.

-