Market news

-

23:51

Japan: Industrial Production (MoM) , February 2.0% (forecast 1.2%)

-

23:51

Japan: Industrial Production (YoY), February 3.7%

-

23:46

Japan: Household spending Y/Y, February -3.8% (forecast -1.7%)

-

23:46

Japan: Unemployment Rate, February 2.8% (forecast 3%)

-

23:32

Japan: Tokyo CPI ex Fresh Food, y/y, March -0.4% (forecast -0.2%)

-

23:31

Japan: National CPI Ex-Fresh Food, y/y, February 0.2% (forecast 0.2%)

-

23:31

Japan: National Consumer Price Index, y/y, February 0.3% (forecast 0.3%)

-

23:30

Japan: Tokyo Consumer Price Index, y/y, March -0.4% (forecast -0.2%)

-

22:29

Commodities. Daily history for Mar 30’02’2017:

(raw materials / closing price /% change)

Oil 50.33 -0.04%

Gold 1,241.50 -0.28%

-

22:28

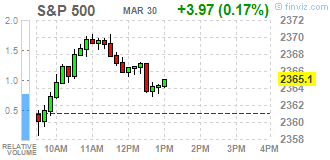

Stocks. Daily history for Mar 30’2017:

(index / closing price / change items /% change)

Nikkei -154.26 19063.22 -0.80%

TOPIX -14.48 1527.59 -0.94%

Hang Seng -90.96 24301.09 -0.37%

CSI 300 -28.43 3436.76 -0.82%

Euro Stoxx 50 +6.31 3481.58 +0.18%

FTSE 100 -4.20 7369.52 -0.06%

DAX +53.43 12256.43 +0.44%

CAC 40 +20.60 5089.64 +0.41%

DJIA +69.17 20728.49 +0.33%

S&P 500 +6.93 2368.06 +0.29%

NASDAQ +16.80 5914.34 +0.28%

S&P/TSX -78.87 15578.76 -0.50%

-

22:28

Currencies. Daily history for Mar 30’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0681 -0,81%

GBP/USD $1,2468 +0,25%

USD/CHF Chf1,0006 +0,46%

USD/JPY Y111,84 +0,75%

EUR/JPY Y119,45 -0,05%

GBP/JPY Y139,43 +0,99%

AUD/USD $0,7645 -0,29%

NZD/USD $0,6998 -0,57%

USD/CAD C$1,3334 +0,05%

-

22:04

Schedule for today,Friday, Mar 31’2017 (GMT0)

00:00 New Zealand ANZ Business Confidence February 16.6

00:30 Australia Private Sector Credit, m/m February 0.2% 0.5%

00:30 Australia Private Sector Credit, y/y February 5.4%

01:00 China Manufacturing PMI March 51.6 51.6

01:00 China Non-Manufacturing PMI March 54.2

05:00 Japan Construction Orders, y/y February 1.1%

05:00 Japan Housing Starts, y/y February 12.8% -1.1%

06:00 United Kingdom Nationwide house price index, y/y March 4.5% 4.1%

06:00 United Kingdom Nationwide house price index March 0.6% 0.4%

06:00 Germany Retail sales, real unadjusted, y/y February 2.3% 0.3%

06:00 Germany Retail sales, real adjusted February -0.8% 0.7%

06:45 France CPI, y/y (Preliminary) March 1.2%

06:45 France CPI, m/m (Preliminary) March 0.1% 0.7%

07:55 Germany Unemployment Rate s.a. March 5.9% 5.9%

07:55 Germany Unemployment Change March -14 -10

08:30 United Kingdom Business Investment, y/y (Finally) Quarter IV -2.2% -0.9%

08:30 United Kingdom Business Investment, q/q (Finally) Quarter IV 0.4% -1%

08:30 United Kingdom Current account, bln Quarter IV -25.5 -16

08:30 United Kingdom GDP, q/q (Finally) Quarter IV 0.6% 0.7%

08:30 United Kingdom GDP, y/y (Finally) Quarter IV 2.2% 2%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) March 0.9%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) March 2% 1.8%

09:00 Eurozone ECB's Benoit Coeure Speaks

12:30 Canada GDP (m/m) January 0.3% 0.3%

12:30 U.S. Personal spending February 0.2% 0.2%

12:30 U.S. Personal Income, m/m February 0.4% 0.4%

12:30 U.S. PCE price index ex food, energy, m/m February 0.3% 0.2%

12:30 U.S. PCE price index ex food, energy, Y/Y February 1.7% 1.7%

13:30 U.S. FOMC Member James Bullard Speaks

13:45 U.S. Chicago Purchasing Managers' Index March 57.4 56.9

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) February 96.3 97.6

14:00 U.S. FOMC Member Kashkari Speaks

21:00 United Kingdom MPC Member Andy Haldane Speaks

-

21:45

New Zealand: Building Permits, m/m, February 14.0%

-

20:08

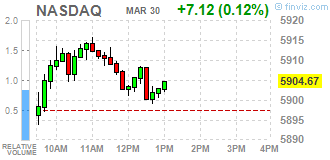

Major US stock indexes completed the session in positive territory

Major US stock indices showed a slight increase against the background of the rise in price of shares in the financial sector after data showed that the US economy grew at a faster pace in the fourth quarter than previously thought.

So, the US economic growth slowed down less than previously reported in the fourth quarter amid high consumer spending, which was partially covered by the growth of imports. Gross domestic product grew 2.1% year-on-year instead of the previously announced rate of 1.9%, the Ministry of Commerce said on Thursday in its third GDP estimate for this period. There are indications that the activity was further strengthened in early 2017.

In addition, the number of Americans applying for unemployment benefits last week fell less than expected, indicating some loss of momentum in the labor market. The primary applications for unemployment benefits in the US for the week ending March 25, fell by 3,000 to 258,000, taking into account seasonal fluctuations, the Ministry of Labor said on Thursday. Data for the previous week remained unchanged.

The components of the DOW index have mostly grown (20 out of 30). Exxon Mobil Corporation (XOM, + 1.49%) was the leader of growth. NIKE, Inc. shares fell most. (NKE, -1.15%).

The S & P Index sectors have completed the bidding in different directions. The utilities sector fell most of all (-0.7%). The leader of growth was the financial sector (+ 0.8%).

At closing:

DJIA + 0.33% 20,727.22 +67.90

Nasdaq + 0.28% 5,914.34 +16.79

S & P + 0.29% 2,368.07 +6.94

-

19:00

DJIA +0.28% 20,716.70 +57.38 Nasdaq +0.23% 5,910.95 +13.40 S&P +0.28% 2,367.67 +6.54

-

17:09

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes slightly higher on Thursday as bank stocks gained after data showed that the domestic economy grew at a faster pace in the fourth-quarter than previously estimated. Gross domestic product increased 2,1%, compared with the previously reported 1,9%, the Commerce Department said.

Most of Dow stocks in positive area (17 of 30). Top loser - NIKE, Inc. (NKE, -1.47%). Top gainer - Wal-Mart Stores, Inc. (WMT, +0.99%).

Most of S&P sectors also in positive area. Top loser - Conglomerates (-1.1%). Top gainer - Financials (+0.5%).

At the moment:

Dow 20628.00 +27.00 +0.13%

S&P 500 2360.75 +3.75 +0.16%

Nasdaq 100 5431.75 -4.25 -0.08%

Oil 50.16 +0.65 +1.31%

Gold 1250.40 -6.40 -0.51%

U.S. 10yr 2.41 -0.02

-

16:00

European stocks closed: FTSE 100 -4.20 7369.52 -0.06% DAX +53.43 12256.43 +0.44% CAC 40 +20.60 5089.64 +0.41%

-

14:38

Fed's Mester supports further rate hikes, though not at each policy meeting

-

Expects unemployment to remain below 5 pct for two years

-

Backing for starting to trim bond portfolio this year

-

U.S economic expansion sound; weak Q1 transitory

-

-

13:57

Trump is looking at new ways to go after countries that game their currencies @cnbc

-

13:53

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600-10 (EUR 980m) 1.0700 (2bln) 1.0730-40 (910m) 1.0775 (528m) 1.0790 (480m) 1.0800 (390m) 1.0820-30 (1.04bln) 1.0850 (540m) 1.0900 (330m)

USDJPY: 110.00 (USD 485m) 110.25 (380m) 110.50 (320m) 111.00-10 (1.85bln) 111.85-90 (575m) 112.00 (1.05bln)) 112.50-60 (570m)

GBPUSD: 1.2400 (GBP 240m) 1.2430 (210m) 1.2450 (435m) 1.2550 (185m) 1.2600 (390m)

EURGBP 0.8500 (EUR 555m) 0.8650 (190m)

USDCHF 0.9880-90 ( USD 420m) 0.9950 (215m) 1.0075 (250m)

AUDUSD: 0.7500 (AUD 374m) 0.7550 (433m) 0.7610 (440m) 0.7630 (205m) 0.7645-55 (650m) 0.7680-90 (260m)

USDCAD 1.3300 (USD 260m) 1.3350 (183m) 1.3400 (490m)

EURJPY 119.50 (EUR 440m) 120.00 (295m)

-

13:34

U.S. Stocks open: Dow +0.01%, Nasdaq +0.04%, S&P -0.03%

-

13:27

Before the bell: S&P futures -0.06%, NASDAQ futures -0.05%

U.S. stock-index futures were flat, as upwardly revised fourth-quarter GDP growth rate helped to pair losses.

Global Stocks:

Nikkei 19,063.22 -154.26 -0.80%

Hang Seng 24,301.09 -90.96 -0.37%

Shanghai 3,208.93 32.39 -1.00%

FTSE 7,365.12 -8.60 -0.12%

CAC 5,073.81 +4.77 +0.09%

DAX 12,207.68 +4.68 +0.04%

Crude $49.91 (+0.81%)

Gold $1,246.10 (-0.61%)

-

13:25

Trump says conservative house freedom caucus "will hurt the entire republican agenda ... we must fight them, & dems"

-

13:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33

0.09(0.27%)

1438

ALTRIA GROUP INC.

MO

72.9

-0.06(-0.08%)

403

Amazon.com Inc., NASDAQ

AMZN

875.38

1.06(0.12%)

17580

Apple Inc.

AAPL

144.35

0.23(0.16%)

95726

AT&T Inc

T

41.55

0.10(0.24%)

2516

Barrick Gold Corporation, NYSE

ABX

19.03

-0.16(-0.83%)

23142

Chevron Corp

CVX

108.2

0.13(0.12%)

2523

Cisco Systems Inc

CSCO

33.85

0.11(0.33%)

1100

E. I. du Pont de Nemours and Co

DD

82.85

0.98(1.20%)

103

Exxon Mobil Corp

XOM

82.27

0.25(0.30%)

1818

Facebook, Inc.

FB

142.5

-0.15(-0.11%)

27241

FedEx Corporation, NYSE

FDX

192.13

1.21(0.63%)

1742

Ford Motor Co.

F

11.69

0.01(0.09%)

11796

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.79

0.07(0.55%)

23770

General Electric Co

GE

29.69

0.01(0.03%)

771

General Motors Company, NYSE

GM

35.49

-0.05(-0.14%)

1131

Goldman Sachs

GS

228.68

0.23(0.10%)

2260

Google Inc.

GOOG

832.38

0.97(0.12%)

1905

JPMorgan Chase and Co

JPM

88.4

0.13(0.15%)

2710

Microsoft Corp

MSFT

65.53

0.06(0.09%)

2446

Nike

NKE

56.32

-0.36(-0.64%)

6505

Pfizer Inc

PFE

34.3

-0.03(-0.09%)

1030

Procter & Gamble Co

PG

90.7

0.10(0.11%)

1315

Starbucks Corporation, NASDAQ

SBUX

57.39

-0.15(-0.26%)

267

Tesla Motors, Inc., NASDAQ

TSLA

277.7

0.32(0.12%)

4346

Twitter, Inc., NYSE

TWTR

15.03

-0.01(-0.07%)

23244

Verizon Communications Inc

VZ

49.08

-0.05(-0.10%)

2481

Yahoo! Inc., NASDAQ

YHOO

46.91

0.13(0.28%)

814

Yandex N.V., NASDAQ

YNDX

22.38

0.14(0.63%)

300

-

12:46

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Positive from Neutral at Susquehanna

Downgrades:

Other:

-

12:40

Canadian Industrial Product Price Index edged up 0.1% in February

The Industrial Product Price Index (IPPI) edged up 0.1% in February, primarily due to higher prices for meat, fish and dairy products and primary non-ferrous metal products. The Raw Materials Price Index (RMPI) increased 1.2%, mainly as a result of higher prices for animals and animal products.

The IPPI (+0.1%) increased for a sixth consecutive month in February, following a 0.6% gain the previous month. Of the 21 major commodity groups, 8 were up, 10 were down and 3 were unchanged.

The growth in the IPPI was largely attributable to higher prices for meat, fish and dairy products (+1.5%) and primary non-ferrous metal products (+1.5%).

-

12:39

US unemployment claims fall apparently stopped

In the week ending March 25, the advance figure for seasonally adjusted initial claims was 258,000, a decrease of 3,000 from the previous week's unrevised level of 261,000. The 4-week moving average was 254,250, an increase of 7,750 from the previous week's unrevised average of 246,500.

The advance seasonally adjusted insured unemployment rate was 1.5 percent for the week ending March 18, an increase of 0.1 percentage point from the previous week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending March 18 was 2,052,000, an increase of 65,000 from the previous week's revised level

-

12:38

US GDP rose 2.1% in Q4, PCE little changed

Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the fourth quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter of 2016, real GDP increased 3.5 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 1.9 percent.

With this third estimate for the fourth quarter, the general picture of economic growth remains largely the same; personal consumption expenditures (PCE) increased more than previously estimated. The PCE price index increased 2.0 percent, compared with an increase of 1.5 percent. Excluding food and energy prices, the PCE price index increased 1.3 percent, compared with an increase of 1.7 percent

-

12:30

U.S.: Initial Jobless Claims, 258 (forecast 248)

-

12:30

U.S.: PCE price index ex food, energy, q/q, Quarter IV 1.3% (forecast 1.2%)

-

12:30

U.S.: GDP, q/q, Quarter IV 2.1% (forecast 2%)

-

12:30

U.S.: Continuing Jobless Claims, 2052 (forecast 2020)

-

12:30

Canada: Industrial Product Price Index, y/y, February 3.5%

-

12:30

Canada: Industrial Product Price Index, m/m, February 0.1% (forecast 0.3%)

-

12:08

German preliminary CPI rose less than expected in March

The inflation rate in Germany as measured by the consumer price index is expected to be 1.6% in March 2017. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.2% on February 2017.

In March 2017, the harmonised index of consumer prices for Germany, which is calculated for European purposes, is expected to increase by 1.5% year on year and 0.1% on February 2017.

The final results for March 2017 will be released on 13 April 2017.

-

12:00

Germany: CPI, y/y , March 1.6% (forecast 1.9%)

-

12:00

Germany: CPI, m/m, March 0.2% (forecast 0.4%)

-

11:19

ECB’s Knot: Should Bring Forward Tapering ‘Only If Economy Performs Better Than Expected’ - Reuters

-

11:17

EUR/USD setting up for a rally? US GDP and PCE prices the main fundamental events expected

-

10:15

China FX Regulator SAFE: to take measures to attract cross-border capital inflows this year @LiveSquawk

-

09:56

France's Hollande believes UK's Brexit talks must be held in clear and constructive way to remove uncertainties

-

09:18

EU Economic Sentiment continued following the broad sideways movement

In March, the Economic Sentiment Indicator (ESI) continued following the broad sideways movement it had embarked upon at the beginning of the year, both in the euro area (-0.1 points to 107.9) and the EU (+0.2 points to 109.1). March thus constitutes the third consecutive month of a broadly unchanged ESI.

-

09:00

Eurozone: Business climate indicator , March 0.82 (forecast 0.9)

-

09:00

Eurozone: Economic sentiment index , March 107.9 (forecast 108.3)

-

09:00

Eurozone: Industrial confidence, March 1.2 (forecast 1)

-

09:00

Eurozone: Consumer Confidence, March -5 (forecast -5)

-

08:18

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0600-10 (EUR 980m) 1.0700 (2bln) 1.0730-40 (910m) 1.0775 (528m) 1.0790 (480m) 1.0800 (390m) 1.0820-30 (1.04bln) 1.0850 (540m) 1.0900 (330m)

USDJPY: 110.00 (USD 485m) 110.25 (380m) 110.50 (320m) 111.00-10 (1.85bln) 111.85-90 (575m) 112.00 (1.05bln)) 112.50-60 (570m)

GBPUSD: 1.2400 (GBP 240m) 1.2430 (210m) 1.2450 (435m) 1.2550 (185m) 1.2600 (390m)

EURGBP 0.8500 (EUR 555m) 0.8650 (190m)

USDCHF 0.9880-90 ( USD 420m) 0.9950 (215m) 1.0075 (250m)

AUDUSD: 0.7500 (AUD 374m) 0.7550 (433m) 0.7610 (440m) 0.7630 (205m) 0.7645-55 (650m) 0.7680-90 (260m)

USDCAD 1.3300 (USD 260m) 1.3350 (183m) 1.3400 (490m)

EURJPY 119.50 (EUR 440m) 120.00 (295m)

-

08:11

Hungarian Central Bank director Virag says monetary council wanted to signal that it is reacting to changes in global monetary framework but wants to maintain loose monetary conditions

-

07:41

Major stock markets in Europe trading in the green zone: FTSE 7376.08 +2.36 + 0.03%, DAX 12213.73 +10.73 + 0.09%, CAC 5073.26 +4.22 + 0.08%

-

07:40

Spanish CPI flat in March

The estimated annual inflation in March 2017 is 2.3%, according to the advance indicator prepared by INE. This indicator provides an advance of the CPI which, if confirmed, would decrease of seven tenths in its annual rate, since in the month of February this variation was 3.0%.

This behavior highlights the drop in the prices of fuels (diesel and Gasoline) compared to the increase they experienced last year, as well as the Prices of electricity. On the other hand, the annual variation of the leading indicator of the HICP is in March 2.1%.

-

07:00

Switzerland: KOF Leading Indicator, March 107.6 (forecast 106)

-

06:58

Moody's on Croatia - expects the general government debt-to-gdp ratio to maintain its downward trend and reach 78.6% in 2020

-

Expect economy to continue to grow by 2.5% each year on average over next few yrs, whilst debt-to-gdp ratio is expected to fall this year

-

BA2 rating of Croatia balances weak fiscal position with high incomes and positive growth

-

Croatia's rating continues to be constrained at BA2 level by structural weaknesses in economy, given absence of a structural reform agenda

-

-

06:44

SNB Jordan: Far Away From Policy Normalisation - Blick

-

06:44

A positive start of trading on the main European stock markets is expected: DAX + 0.3%, CAC40 + 0.4%, FTSE + 0.3%

-

06:43

BoJ's Iwata: no need to buy US treasuries directly from Fed as BoJ able to achieve sufficient monetary easing via JGB purchases

-

QE was effective in spurring growth but has been made more powerful by combining it with yield curve control

-

Appropriate to continue powerful monetary easing as inflation still distant from 2 pct

-

Japan's economic recovery gaining momentum reflecting improvements in overseas economies

-

-

06:40

British Brexit minister says we will meet our legal obligations to the EU as part of Brexit deal - ITV

-

The era of huge sums being paid to the EU is coming to an end

-

We're not expecting to have to pay anything like the 51 bln gbp bill suggested in media reports

-

-

06:38

Australian new home sales nudged up 0.2% in February

The Housing Industry Association (HIA) reported that its monthly survey of large-volume builders showed new home sales nudged up 0.2% in February, following a drop of 2.2% the previous month.

After a period of relative instability, Australia's housing market is expected to stabilize throughout the year as government grant programs encourage more homebuyers to enter the market. For decades, the government has assisted residents of mineral-rich Western Australia in purchasing homes through a low-deposit loan program.

-

06:34

Options levels on thursday, March 30, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0908 (734)

$1.0882 (1037)

$1.0846 (450)

Price at time of writing this review: $1.0759

Support levels (open interest**, contracts):

$1.0709 (631)

$1.0668 (518)

$1.0618 (752)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 43983 contracts, with the maximum number of contracts with strike price $1,1450 (3940);

- Overall open interest on the PUT options with the expiration date June, 9 is 47712 contracts, with the maximum number of contracts with strike price $1,0350 (3809);

- The ratio of PUT/CALL was 1.08 versus 1.10 from the previous trading day according to data from March, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.2710 (885)

$1.2614 (337)

$1.2518 (810)

Price at time of writing this review: $1.2435

Support levels (open interest**, contracts):

$1.2383 (585)

$1.2287 (250)

$1.2190 (529)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 15496 contracts, with the maximum number of contracts with strike price $1,3000 (1195);

- Overall open interest on the PUT options with the expiration date June, 9 is 17623 contracts, with the maximum number of contracts with strike price $1,1500 (3056);

- The ratio of PUT/CALL was 1.14 versus 1.15 from the previous trading day according to data from March, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:31

Global Stocks

European stocks rose for a second straight day Wednesday, as investors largely ignored the official commencement of the U.K.'s negotiations to break from the European Union, dubbed Brexit.

U.S. stocks ended Wednesday's lackluster session mostly higher, with the Nasdaq Composite logging its fourth consecutive daily gain. A rally in energy shares following a gain in oil prices CLK7, +0.08% helped the S&P 500 finish in positive territory.

Stock markets were broadly down early Thursday following a mixed session in the U.S. overnight, though shares in Australia outperformed the rest of the region thanks to firmer oil prices. But the declines have been mild so far, as markets largely shrugged off headlines noting the official start of a two-year countdown for the U.K.'s divorce from the European Union. Meanwhile, better-than-expected U.S. oil data buoyed energy-related stocks.

-

00:01

Australia: HIA New Home Sales, m/m, February 0.2%

-