Market news

-

22:28

Stocks. Daily history for Mar 30’2017:

(index / closing price / change items /% change)

Nikkei -154.26 19063.22 -0.80%

TOPIX -14.48 1527.59 -0.94%

Hang Seng -90.96 24301.09 -0.37%

CSI 300 -28.43 3436.76 -0.82%

Euro Stoxx 50 +6.31 3481.58 +0.18%

FTSE 100 -4.20 7369.52 -0.06%

DAX +53.43 12256.43 +0.44%

CAC 40 +20.60 5089.64 +0.41%

DJIA +69.17 20728.49 +0.33%

S&P 500 +6.93 2368.06 +0.29%

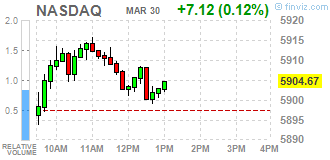

NASDAQ +16.80 5914.34 +0.28%

S&P/TSX -78.87 15578.76 -0.50%

-

20:08

Major US stock indexes completed the session in positive territory

Major US stock indices showed a slight increase against the background of the rise in price of shares in the financial sector after data showed that the US economy grew at a faster pace in the fourth quarter than previously thought.

So, the US economic growth slowed down less than previously reported in the fourth quarter amid high consumer spending, which was partially covered by the growth of imports. Gross domestic product grew 2.1% year-on-year instead of the previously announced rate of 1.9%, the Ministry of Commerce said on Thursday in its third GDP estimate for this period. There are indications that the activity was further strengthened in early 2017.

In addition, the number of Americans applying for unemployment benefits last week fell less than expected, indicating some loss of momentum in the labor market. The primary applications for unemployment benefits in the US for the week ending March 25, fell by 3,000 to 258,000, taking into account seasonal fluctuations, the Ministry of Labor said on Thursday. Data for the previous week remained unchanged.

The components of the DOW index have mostly grown (20 out of 30). Exxon Mobil Corporation (XOM, + 1.49%) was the leader of growth. NIKE, Inc. shares fell most. (NKE, -1.15%).

The S & P Index sectors have completed the bidding in different directions. The utilities sector fell most of all (-0.7%). The leader of growth was the financial sector (+ 0.8%).

At closing:

DJIA + 0.33% 20,727.22 +67.90

Nasdaq + 0.28% 5,914.34 +16.79

S & P + 0.29% 2,368.07 +6.94

-

19:00

DJIA +0.28% 20,716.70 +57.38 Nasdaq +0.23% 5,910.95 +13.40 S&P +0.28% 2,367.67 +6.54

-

17:09

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes slightly higher on Thursday as bank stocks gained after data showed that the domestic economy grew at a faster pace in the fourth-quarter than previously estimated. Gross domestic product increased 2,1%, compared with the previously reported 1,9%, the Commerce Department said.

Most of Dow stocks in positive area (17 of 30). Top loser - NIKE, Inc. (NKE, -1.47%). Top gainer - Wal-Mart Stores, Inc. (WMT, +0.99%).

Most of S&P sectors also in positive area. Top loser - Conglomerates (-1.1%). Top gainer - Financials (+0.5%).

At the moment:

Dow 20628.00 +27.00 +0.13%

S&P 500 2360.75 +3.75 +0.16%

Nasdaq 100 5431.75 -4.25 -0.08%

Oil 50.16 +0.65 +1.31%

Gold 1250.40 -6.40 -0.51%

U.S. 10yr 2.41 -0.02

-

16:00

European stocks closed: FTSE 100 -4.20 7369.52 -0.06% DAX +53.43 12256.43 +0.44% CAC 40 +20.60 5089.64 +0.41%

-

13:34

U.S. Stocks open: Dow +0.01%, Nasdaq +0.04%, S&P -0.03%

-

13:27

Before the bell: S&P futures -0.06%, NASDAQ futures -0.05%

U.S. stock-index futures were flat, as upwardly revised fourth-quarter GDP growth rate helped to pair losses.

Global Stocks:

Nikkei 19,063.22 -154.26 -0.80%

Hang Seng 24,301.09 -90.96 -0.37%

Shanghai 3,208.93 32.39 -1.00%

FTSE 7,365.12 -8.60 -0.12%

CAC 5,073.81 +4.77 +0.09%

DAX 12,207.68 +4.68 +0.04%

Crude $49.91 (+0.81%)

Gold $1,246.10 (-0.61%)

-

13:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33

0.09(0.27%)

1438

ALTRIA GROUP INC.

MO

72.9

-0.06(-0.08%)

403

Amazon.com Inc., NASDAQ

AMZN

875.38

1.06(0.12%)

17580

Apple Inc.

AAPL

144.35

0.23(0.16%)

95726

AT&T Inc

T

41.55

0.10(0.24%)

2516

Barrick Gold Corporation, NYSE

ABX

19.03

-0.16(-0.83%)

23142

Chevron Corp

CVX

108.2

0.13(0.12%)

2523

Cisco Systems Inc

CSCO

33.85

0.11(0.33%)

1100

E. I. du Pont de Nemours and Co

DD

82.85

0.98(1.20%)

103

Exxon Mobil Corp

XOM

82.27

0.25(0.30%)

1818

Facebook, Inc.

FB

142.5

-0.15(-0.11%)

27241

FedEx Corporation, NYSE

FDX

192.13

1.21(0.63%)

1742

Ford Motor Co.

F

11.69

0.01(0.09%)

11796

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.79

0.07(0.55%)

23770

General Electric Co

GE

29.69

0.01(0.03%)

771

General Motors Company, NYSE

GM

35.49

-0.05(-0.14%)

1131

Goldman Sachs

GS

228.68

0.23(0.10%)

2260

Google Inc.

GOOG

832.38

0.97(0.12%)

1905

JPMorgan Chase and Co

JPM

88.4

0.13(0.15%)

2710

Microsoft Corp

MSFT

65.53

0.06(0.09%)

2446

Nike

NKE

56.32

-0.36(-0.64%)

6505

Pfizer Inc

PFE

34.3

-0.03(-0.09%)

1030

Procter & Gamble Co

PG

90.7

0.10(0.11%)

1315

Starbucks Corporation, NASDAQ

SBUX

57.39

-0.15(-0.26%)

267

Tesla Motors, Inc., NASDAQ

TSLA

277.7

0.32(0.12%)

4346

Twitter, Inc., NYSE

TWTR

15.03

-0.01(-0.07%)

23244

Verizon Communications Inc

VZ

49.08

-0.05(-0.10%)

2481

Yahoo! Inc., NASDAQ

YHOO

46.91

0.13(0.28%)

814

Yandex N.V., NASDAQ

YNDX

22.38

0.14(0.63%)

300

-

12:46

Upgrades and downgrades before the market open

Upgrades:

FedEx (FDX) upgraded to Positive from Neutral at Susquehanna

Downgrades:

Other:

-

07:41

Major stock markets in Europe trading in the green zone: FTSE 7376.08 +2.36 + 0.03%, DAX 12213.73 +10.73 + 0.09%, CAC 5073.26 +4.22 + 0.08%

-

05:31

Global Stocks

European stocks rose for a second straight day Wednesday, as investors largely ignored the official commencement of the U.K.'s negotiations to break from the European Union, dubbed Brexit.

U.S. stocks ended Wednesday's lackluster session mostly higher, with the Nasdaq Composite logging its fourth consecutive daily gain. A rally in energy shares following a gain in oil prices CLK7, +0.08% helped the S&P 500 finish in positive territory.

Stock markets were broadly down early Thursday following a mixed session in the U.S. overnight, though shares in Australia outperformed the rest of the region thanks to firmer oil prices. But the declines have been mild so far, as markets largely shrugged off headlines noting the official start of a two-year countdown for the U.K.'s divorce from the European Union. Meanwhile, better-than-expected U.S. oil data buoyed energy-related stocks.

-