Market news

-

20:07

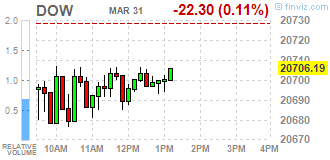

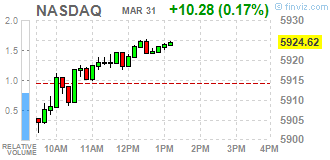

Major US stock indexes finished trading below the zero mark

Major US stock indexes finished the session below zero amid mixed data on the US. Meanwhile, in the 1st quarter the indices of the S & P 500 and Dow Jones showed the strongest dynamics in four years. Wall Street has achieved a series of record highs since the election of President Trump against the backdrop of the fact that he promised to reduce taxes and increase spending on infrastructure.

As it became known today, consumer spending in the US rose slightly in February amid delays in the payment of income tax, but the largest annual inflation rate for almost five years confirmed expectations for further rate hikes this year. The Ministry of Commerce reported that consumer spending rose 0.1%. This was the smallest increase since August and followed the 0.2% growth in January. In addition, the Chicago Purchasing Managers Index stabilized at 57.7 in March after a significant increase of 7.1 points in February to 57.4. On average, the index for the first quarter was 55.1, which is the highest since the fourth quarter of 2014. However, the final results of the studies submitted by Thomson-Reuters and the Michigan Institute showed that in March the consumer sentiment index rose to 96.9 points compared with the final reading for February 96.3 points and the preliminary value for March 97.6 points . It was predicted that the index will be 97.6 points.

The components of the DOW index mostly decreased (19 out of 30). Exxon Mobil Corporation shares dropped the most (XOM, -1.90%). The leader of growth was shares of Intel Corporation (INTC, + 0.98%).

Most sectors of the S & P index closed in positive territory. The financial sector fell most of all (-0.3%). The growth leader was the conglomerate sector (+ 0.6%).

At closing:

Dow -0.32% 20.662.60 -65.89

Nasdaq -0.04% 5,911.74 -2.60

S & P -0.23% 2,362.69 -5.37

-

19:00

DJIA -0.27% 20,673.33 -55.16 Nasdaq +0.03% 5,915.98 +1.64 S&P -0.14% 2,364.75 -3.31

-

17:15

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday, with the S&P 500 and the Dow Jones Industrial Average firmly on course to book their biggest first-quarter gains in four years. Wall Street has hit a series of record highs following the election of President Donald Trump on bets that he would introduce tax cuts and boost infrastructure spending. The rally has also benefited from a raft of robust economic data.

Most of Dow stocks in negative area (17 of 30). Top loser - Exxon Mobil Corporation (XOM, -2.00%). Top gainer - Intel Corporation (INTC, +1.08%).

Most of S&P sectors in positive area. Top loser - Financials (-0.2%). Top gainer - Utilities (+0.7%).

At the moment:

Dow 20632.00 -28.00 -0.14%

S&P 500 2363.25 -1.25 -0.05%

Nasdaq 100 5447.25 +9.75 +0.18%

Oil 50.37 +0.02 +0.04%

Gold 1248.10 -5.60 -0.45%

U.S. 10yr 2.40 -0.01

-

16:00

European stocks closed: FTSE 100 -46.60 7322.92 -0.63% DAX +56.44 12312.87 +0.46% CAC 40 +32.87 5122.51 +0.65%

-

13:34

U.S. Stocks open: Dow -0.22%, Nasdaq -0.21%, S&P -0.22%

-

13:26

Before the bell: S&P futures -0.10%, NASDAQ futures -0.02%

U.S. stock-index futures were flat on last day of the best first quarter for Wall Street in four years.

Global Stocks:

Nikkei 18,909.26 -153.96 -0.81%

Hang Seng 24,111.59 -189.50 -0.78%

Shanghai 3,222.60 +12.37 +0.39%

FTSE 7,341.15 -28.37 -0.38%

CAC 5,089.27 -0.37 -0.01%

DAX 12,264.16 +7.73 +0.06%

Crude $50.19 (-0.32%)

Gold $1,240.20 (-0.39%)

-

12:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

34.2

0.71(2.12%)

45296

ALTRIA GROUP INC.

MO

71.92

-0.13(-0.18%)

1501

Amazon.com Inc., NASDAQ

AMZN

877.9

1.56(0.18%)

8189

Apple Inc.

AAPL

143.89

-0.04(-0.03%)

27003

AT&T Inc

T

41.87

0.11(0.26%)

3408

Barrick Gold Corporation, NYSE

ABX

18.76

-0.08(-0.42%)

22963

Boeing Co

BA

178.02

0.04(0.02%)

930

Chevron Corp

CVX

107.64

-0.14(-0.13%)

130

Cisco Systems Inc

CSCO

33.72

-0.02(-0.06%)

1713

Citigroup Inc., NYSE

C

60.45

-0.06(-0.10%)

2887

Exxon Mobil Corp

XOM

83.49

-0.21(-0.25%)

17987

Facebook, Inc.

FB

142.49

0.08(0.06%)

9275

Ford Motor Co.

F

11.65

-0.03(-0.26%)

44437

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.28

-0.03(-0.23%)

73958

General Electric Co

GE

29.84

-0.03(-0.10%)

6980

General Motors Company, NYSE

GM

35.42

0.01(0.03%)

1333

Goldman Sachs

GS

231.15

-0.07(-0.03%)

4404

Hewlett-Packard Co.

HPQ

17.6

-0.05(-0.28%)

125

Intel Corp

INTC

35.85

0.10(0.28%)

1819

Microsoft Corp

MSFT

65.7

-0.01(-0.02%)

2384

Nike

NKE

55.83

-0.21(-0.37%)

4556

Procter & Gamble Co

PG

90.08

-0.12(-0.13%)

203

Tesla Motors, Inc., NASDAQ

TSLA

279

1.08(0.39%)

12348

The Coca-Cola Co

KO

42.55

-0.05(-0.12%)

427

Twitter, Inc., NYSE

TWTR

14.95

0.03(0.20%)

17335

Verizon Communications Inc

VZ

49.15

0.09(0.18%)

797

Wal-Mart Stores Inc

WMT

71.47

-0.12(-0.17%)

522

-

12:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Intel (INTC) initiated with an Outperform at Macquarie

Amazon (AMZN) initiated with a Buy at Loop Capital

Alphabet (GOOG) initiated with a Hold at Loop Capital

Arconic (ARNC) initiated with a Neutral at Longbow

-

06:40

Negative start of trading expected on the main European stock markets: DAX -0.4%, CAC40 -0.2%, FTSE -0.1%

-

05:40

Global Stocks

European stocks rose for a third straight day on Thursday, with the German benchmark logging its highest close since April 2015 on the back of a sliding euro. The advance in Frankfurt came as the euro EURUSD, +0.0187% slumped to an almost two-week low after disappointing German inflation data and a Reuters report that the European Central Bank is trying to rein in expectations that a rate hike could come as soon as December.

U.S. stocks closed higher Thursday as financial shares rallied following a positive reading of economic growth and the tech-heavy Nasdaq returned to finish in record territory after a month-long wait. Earlier, the government said the U.S. economy, as measured by gross domestic product, expanded at a 2.1% annualized pace in the fourth quarter, slightly faster than the previously reported 1.9% rate. Separately, jobless claims fell by 3,000 to 258,000 in the latest week, near their lowest level in decades.

Asian stocks began the last day of the quarter Friday little changed, after what has broadly been a strong start to 2017 for equities in the region amid worries over the global effect of issues such as potential U.S. protectionism.

-