Market news

-

22:28

Stocks. Daily history for May 02’2017:

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng +81.00 24696.13 +0.33%

CSI 300 -13.17 3426.58 -0.38%

Euro Stoxx 50 +18.62 3578.21 +0.52%

FTSE 100 +46.11 7250.05 +0.64%

DAX +69.89 12507.90 +0.56%

CAC 40 +36.82 5304.15 +0.70%

DJIA +36.43 20949.89 +0.17%

S&P 500 +2.84 2391.17 +0.12%

NASDAQ +3.77 6095.37 +0.06%

S&P/TSX +44.02 15619.65 +0.28%

-

20:08

The major US stock indices showed a slight increase

Major US stock indexes finished trading with a weak increase, as significant losses of the conglomerate sector were offset by the growth of other sectors. Investors also were in anticipation of the Fed meeting and analyzed ambiguous corporate reports.

Market participants predict that the Fed will leave interest rates unchanged, and retain the wording of previous statements about a "gradual rate hike," despite a sharp slowdown in the economy. According to the futures market, now the probability of an increase in the rate of the Fed at the meeting in May is 4.8%.

Meanwhile, given that more than two thirds of S & P500 companies have already submitted quarterly results, firms are likely to report the largest increase in earnings per share since the first quarter of 2011. However, some investors consider the shares in the US expensive compared to historical average estimates, and do not rule out a rollback.

Quotes of oil significantly decreased, as positive news about the decline in oil production by Russia and the major exporters of OPEC were offset by signs of increased oil production in the US, Canada and Libya. The National Oil Company of Libya said yesterday that oil production in the country rose above 760,000 barrels per day, reaching the highest level since December 2014. In addition, the company added that they plan to continue to increase oil production.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 1.94%). More shares fell The Procter & Gamble Company (PG, -1.06%).

Most sectors of the S & P index finished trading in positive territory. The leader of growth was the healthcare sector (+ 0.3%). The conglomerate sector fell most of all (-1.5%).

At closing:

DJIA + 0.17% 20,949.28 +35.82

Nasdaq + 0.06% 6,095.37 +3.77

S & P + 0.12% 2.391.11 + 2.78

-

19:00

DJIA +0.04% 20,920.82 +7.36 Nasdaq -0.13% 6,083.61 -7.99 S%P -0.07% 2,386.62 -1.71

-

16:01

European stocks closed: FTSE 100 +46.117250.05 +0.64% DAX +69.89 12507.90 +0.56% CAC 40 +36.82 5304.15 +0.70%

-

13:32

U.S. Stocks open: Dow +0.17%, Nasdaq +0.14%, S&P +0.16%

-

13:26

Before the bell: S&P futures -0.01%, NASDAQ futures +0.11%

U.S. stock-index futures were flat ahead of the start of the Fed's two-day meeting and Apple's (AAPL) quarterly report.

Stocks:

Nikkei 19,445.70 +135.18 +0.70%

Hang Seng 24,696.13 +81.00 +0.33%

Shanghai 3,143.71 -10.95 -0.35%

FTSE 7,251.14 +47.20 +0.66%

CAC5,293.05 +25.72 +0.49%

DAX 12,469.53 +31.52 +0.25%

Crude $49.05 (+0.43%)

Gold $1,253.70 (-0.14%)

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

195

0.19(0.10%)

300

ALTRIA GROUP INC.

MO

69.8

-1.00(-1.41%)

73908

Amazon.com Inc., NASDAQ

AMZN

951

2.77(0.29%)

21688

Apple Inc.

AAPL

147.21

0.63(0.43%)

314183

AT&T Inc

T

39.16

0.06(0.15%)

897

Barrick Gold Corporation, NYSE

ABX

16.33

-0.03(-0.18%)

66888

Caterpillar Inc

CAT

102.55

0.55(0.54%)

5827

Cisco Systems Inc

CSCO

34.02

0.05(0.15%)

665

Exxon Mobil Corp

XOM

82.21

0.15(0.18%)

1212

Facebook, Inc.

FB

153.2

0.74(0.49%)

148247

Ford Motor Co.

F

11.47

0.05(0.44%)

10309

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.46

-0.08(-0.64%)

46030

General Electric Co

GE

29.07

0.13(0.45%)

9192

General Motors Company, NYSE

GM

34.15

-0.05(-0.15%)

2015

Google Inc.

GOOG

913.56

0.99(0.11%)

3464

Hewlett-Packard Co.

HPQ

18.97

0.04(0.21%)

2032

Intel Corp

INTC

36.33

0.02(0.06%)

3505

International Business Machines Co...

IBM

158.89

0.05(0.03%)

902

JPMorgan Chase and Co

JPM

86.89

-0.17(-0.20%)

3543

Merck & Co Inc

MRK

62.18

-0.20(-0.32%)

25802

Microsoft Corp

MSFT

69.67

0.26(0.37%)

13621

Nike

NKE

55

0.01(0.02%)

342

Pfizer Inc

PFE

33.64

-0.14(-0.41%)

28497

Tesla Motors, Inc., NASDAQ

TSLA

321.5

-1.33(-0.41%)

28257

The Coca-Cola Co

KO

43.3

0.08(0.19%)

13549

Twitter, Inc., NYSE

TWTR

17.63

0.09(0.51%)

178324

Verizon Communications Inc

VZ

45.92

0.04(0.09%)

1091

Visa

V

91.36

0.10(0.11%)

333

Walt Disney Co

DIS

114.9

0.17(0.15%)

2054

Yahoo! Inc., NASDAQ

YHOO

48.72

0.11(0.23%)

1250

Yandex N.V., NASDAQ

YNDX

27.73

-0.03(-0.11%)

4700

-

12:12

Company News: MasterCard (MA) Q1 results beat analysts’ forecasts

MasterCard (MA) reported Q1 FY 2017 earnings of $1.00 per share (versus $0.86 in Q1 FY 2016), beating analysts' consensus estimate of $0.95.

The company's quarterly revenues amounted to $2.734 bln (+11.8% y/y), missing analysts' consensus estimate of $2.654 bln.

MA rose to $118.56 (+1.88%) in pre-market trading.

-

11:50

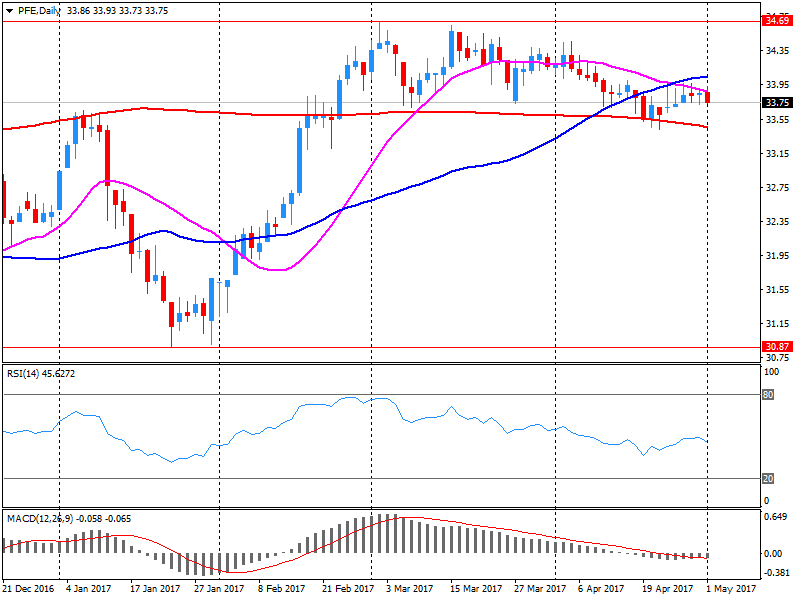

Company News: Pfizer (PFE) posts mixed 1Q financial results

Pfizer (PFE) reported Q1 FY 2017 earnings of $0.69 per share (versus $0.67 in Q1 FY 2016), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $12.779 bln (-1.7% y/y), missing analysts' consensus estimate of $13.089 bln.

PFE fell to $33.50 (-0.83%) in pre-market trading.

-

11:44

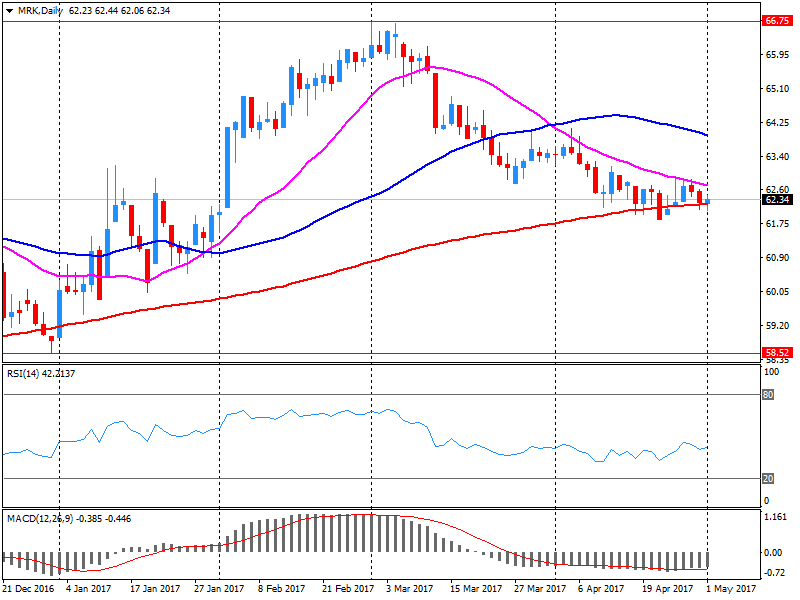

Company News: Merck (MRK) Q1 results beat analysts’ expectations

Merck (MRK) reported Q1 FY 2017 earnings of $0.88 per share (versus $0.89 in Q1 FY 2016), beating analysts' consensus estimate of $0.83.

The company's quarterly revenues amounted to $9.434 bln (+1.3% y/y), beating analysts' consensus estimate of $9.254 bln.

MRK rose to $62.61 (+0.37%) in pre-market trading.

-

11:37

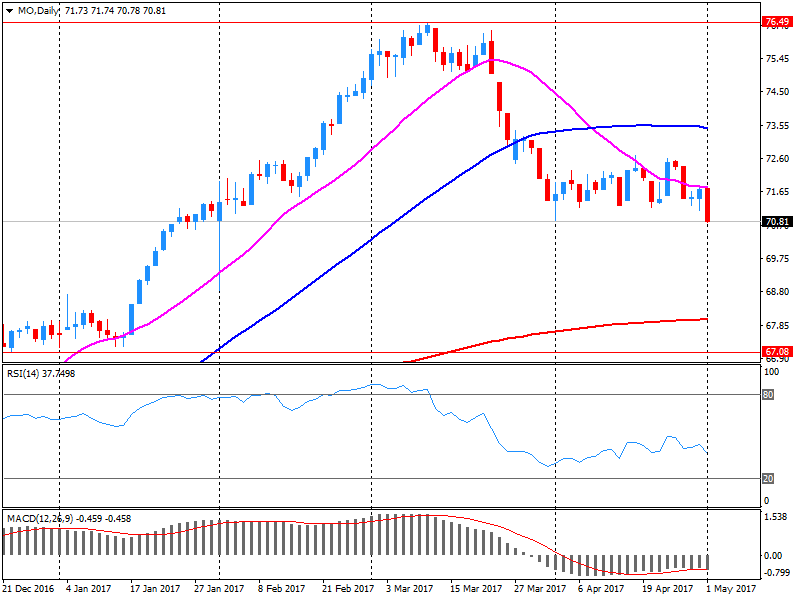

Company News: Altria (MO) Q1 EPS miss analysts’ estimate

Altria (MO) reported Q1 FY 2017 earnings of $0.73 per share (versus $0.72 in Q1 FY 2016), missing analysts' consensus estimate of $0.74.

The company's quarterly revenues amounted to $4.589 bln (+1.3% y/y), generally in-line with analysts' consensus estimate of $4.631 bln.

MO fell to $68.50 (-3.25%) in pre-market trading.

-

08:20

Major stock markets in Europe trading in the green zone: FTSE 7231.58 +27.64 + 0.38%, DAX 12484.90 +46.89 + 0.38%, CAC 5288.69 +21.36 + 0.41%

-

06:40

Positive start of trading on the main European stock markets is expected: DAX + 0.4%, CAC40 + 0.2%, FTSE + 0.1%

-

05:31

Global Stocks

The Nasdaq rallied on Monday to a new record on the back of strong gains in large-cap tech shares even as the broader market finished out the session mixed. Big gains in Amazon.com Inc. AMZN, +2.51% Apple Inc. appl and Netflix Inc. NFLX, +2.07% underpinned the Nasdaq's rise in a day devoid of big earnings or economic data.

Asian equities broadly rose Tuesday, with strong earnings from technology companies in the U.S. overnight providing a shot in the arm to regional technology companies. Investors also sought to reposition themselves as many markets returned from the Labor Day holiday. In Japan, Tuesday is the last trading day of the week before holidays there.

-