Market news

-

22:28

Stocks. Daily history for May 03’2017:

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng +81.00 24696.13 +0.33%

CSI 300 -13.45 3413.13 -0.39%

Euro Stoxx 50 +8.04 3586.25 +0.22%

FTSE 100 -15.52 7234.53 -0.21%

DAX +19.94 12527.84 +0.16%

CAC 40 -3.15 5301.00 -0.06%

DJIA +8.01 20957.90 +0.04%

S&P 500 -3.04 2388.13 -0.13%

NASDAQ -22.81 6072.55 -0.37%

S&P/TSX -76.51 15543.14 -0.49%

-

20:07

Major US stock indices showed mixed dynamics

Major US stock indexes completed today's trading mostly, reacting to the results of the April meeting of the Fed.

The US Federal Reserve, as expected, left a range of interest rates for federal funds between 0.75% and 1.00%, while saying that it plans to continue a gradual increase in interest rates this year, despite recent weak data. Fed executives noted a slowdown in economic activity, but also pointed to the improvement in the labor market and the growth of companies' investment, which has been slowing over the past few quarters.

"The FOMC expects that economic conditions will evolve in such a way that they will serve as the basis for a gradual increase in the interest rate on federal funds. The federal funds rate is likely to remain below levels for some time, which are expected to prevail in the long term. However, the actual way of betting on federal funds will depend on economic prospects, "the Fed said.

Investors also drew attention to the US statistics on the labor market and business activity in the services sector. Data from ADP showed that: growth rates of employment in the private sector of the US slowed in April, but were slightly stronger than expected. According to the report, in April the number of employed increased by 177 thousand people after an increase of 255 thousand in March (originally reported growth of 263 thousand). Analysts had expected that the number of employed will increase by 175 thousand.

Meanwhile, the final data provided by Markit Economics showed that, taking into account seasonal fluctuations, the US business activity index rose in April to 53.1 points compared to 52.8 in March, which was higher than the preliminary reading (52.5 Item) and experts' forecast (52.5 points). It is worth emphasizing that the index remains in the expansion area, that is, above the 50-point mark, for the 14th consecutive month. In addition, it became known that, taking into account the seasonal fluctuations, the final PMI composite index, which covers the production and service sectors, increased in April to 53.2 points from 52.7 points in March.

Meanwhile, a report from the Institute for Supply Management (ISM) showed that the US business activity index rose to 57.5 points in April from 55.2 in March. It was predicted that the figure would rise to 55.8 points. The ISM said that the expansion of activity in the service sector has been fixed for the 87th month in a row.

The components of the DOW index finished the trades in different directions (14 in negative territory, 16 in positive territory). More shares fell The Walt Disney Company (DIS, -2.44%). The leader of growth were shares of Chevron Corporation (CVX, + 1.50%).

All sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-1.8%).

At closing:

DJIA + 0.03% 20.955.56 +5.67

Nasdaq -0.37% 6.072.55 -22.82

S & P -0.14% 2,387.87 -3.30

-

19:00

DJIA +0.01% 20,952.05 +2.16 Nasdaq -0.47% 6,066.75 -28.62 S&P -0.17% 2,387.07 -4.10

-

16:00

European stocks closed: FTSE 100 -15.52 7234.53 -0.21% DAX +19.94 12527.84 +0.16% CAC 40 -3.15 5301.00 -0.06%

-

13:32

U.S. Stocks open: Dow -0.21%, Nasdaq -0.37%, S&P -0.30%

-

13:12

Before the bell: S&P futures -0.17%, NASDAQ futures -0.27%

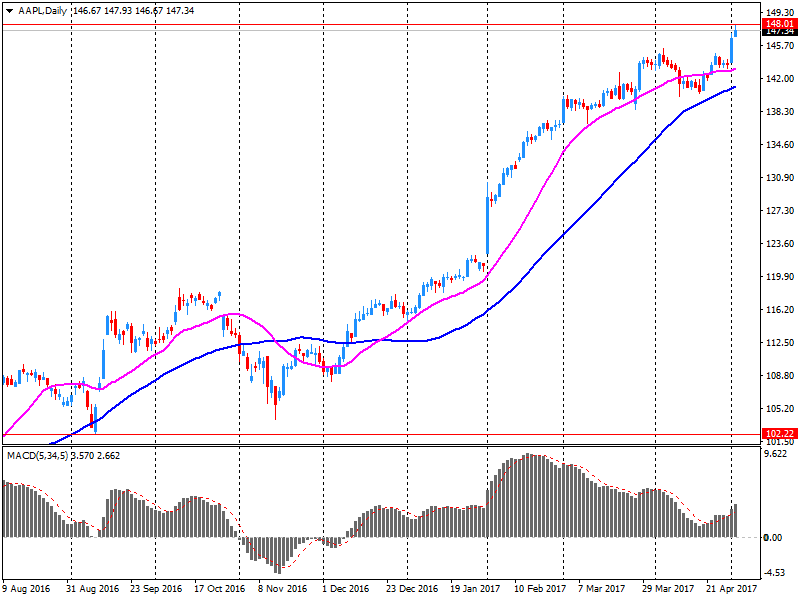

U.S. stock-index futures fell, weighed down by Apple (AAPL) after the world's most valuable company by market capitalization reported a surprise fall in iPhone sales.

Stocks:

Nikkei -

Hang Seng -

Shanghai 3,135.84 -7.88 -0.25%

FTSE 7,228.84 -21.21 -0.29%

CAC 5,294.76 -9.39 -0.18%

DAX 12,498.51 -9.39 -0.08%

Crude $47.96 (+0.61%)

Gold $1,253.60 (-0.27%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

70.24

-0.59(-0.83%)

5377

Amazon.com Inc., NASDAQ

AMZN

945.79

-1.15(-0.12%)

7529

American Express Co

AXP

79.55

0.01(0.01%)

300

Apple Inc.

AAPL

145.76

-1.75(-1.19%)

848012

AT&T Inc

T

39.02

0.07(0.18%)

7285

Barrick Gold Corporation, NYSE

ABX

16.37

-0.04(-0.24%)

19803

Cisco Systems Inc

CSCO

34.27

0.03(0.09%)

1005

Citigroup Inc., NYSE

C

59.52

-0.19(-0.32%)

1127

Exxon Mobil Corp

XOM

82.14

0.09(0.11%)

1240

Facebook, Inc.

FB

153.22

0.44(0.29%)

145209

Ford Motor Co.

F

10.96

0.04(0.37%)

52133

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.4

-0.32(-2.52%)

116919

General Electric Co

GE

28.93

-0.06(-0.21%)

24851

General Motors Company, NYSE

GM

33.06

-0.14(-0.42%)

2888

Goldman Sachs

GS

225.39

0.27(0.12%)

1500

Google Inc.

GOOG

914.03

-2.41(-0.26%)

2713

HONEYWELL INTERNATIONAL INC.

HON

130.22

-0.97(-0.74%)

843

Intel Corp

INTC

36.7

0.00(0.01%)

7628

JPMorgan Chase and Co

JPM

86.26

-0.24(-0.28%)

2668

McDonald's Corp

MCD

142.02

0.79(0.56%)

10856

Microsoft Corp

MSFT

69.1

-0.20(-0.29%)

13747

Nike

NKE

54.9

-0.17(-0.31%)

397

Pfizer Inc

PFE

33.37

-0.24(-0.71%)

3623

Starbucks Corporation, NASDAQ

SBUX

60.3

-0.20(-0.33%)

1546

Tesla Motors, Inc., NASDAQ

TSLA

317.45

-1.44(-0.45%)

35406

Twitter, Inc., NYSE

TWTR

18.47

0.23(1.26%)

173940

Verizon Communications Inc

VZ

46

0.09(0.20%)

1127

Visa

V

91.55

-0.99(-1.07%)

330

Yandex N.V., NASDAQ

YNDX

26.36

-0.43(-1.61%)

100

-

12:49

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy from Neutral at Goldman

Downgrades:

Other:

Apple (AAPL) target raised to $160 from $155 at Cowen

Apple (AAPL) target raised to $171 from $163 at Maxim Group

-

12:14

Company News: Apple (AAPL) Q2 EPS beat analysts’ estimate

Apple (AAPL) reported Q2 FY 2017 earnings of $2.10 per share (versus $1.90 in Q2 FY 2016), beating analysts' consensus estimate of $2.02.

The company's quarterly revenues amounted to $52.896 bln (+4.6% y/y), generally in-line with analysts' consensus estimate of $53.081 bln.

In Q2, it sold 50.8 mln of iPhones (versus 52.5 mln estimated and 51.2 mln sold last year), 8.9 mln iPads (versus 9.6 mln estimated and 10.2 mln sold last year), 4.2 mln of Macs (versus 4.2 mln estimated and 4 mln sold last year).

The company also issued downside guidance for Q3, projecting Q3 revenues of $43.5-45.5 bln versus analysts' consensus estimate of $ 45.65 bln.

AAPL fell to $145.60. (-1.29%) in pre-market trading.

-

07:43

Major stock exchanges in Europe started trading in the red zone: FTSE 7233.10 -16.95 -0.23%, DAX 12497.28 -10.62 -0.08%, CAC 5291.17 -12.98 -0.24%

-

06:44

Positive start of trading on the main European stock markets expected: DAX + 0.3%, CAC40 + 0.2%, FTSE flat

-

05:30

Global Stocks

European stocks closed firmly higher on Tuesday, getting a lift after Greece signed a deal to release the next tranche of bailout aid and after data showed eurozone manufacturing output on the rise.

U.S. stocks ended with a slight upward bias on Tuesday, though investors mostly held off on making big bets with the Federal Reserve engaged in a two-day policy meeting, which ends on Wednesday. Caution was high as the Fed's meeting got underway; while central bankers are expected to keep rates on hold at this meeting, analysts are looking for any comments on the recent slowdown in U.S. economic activity.

Stock prices increased early Wednesday in Asia, where some major markets are closed for holidays as traders await the latest statement from the U.S. Federal Reserve. But Australian stocks lagged behind for a second session as bank stocks continue to weigh on activity there.

-