Market news

-

22:29

Commodities. Daily history for May 03’2017:

(raw materials / closing price /% change)

Oil 47.55 -0.56%

Gold 1,238.50 -0.80%

-

22:28

Stocks. Daily history for May 03’2017:

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng +81.00 24696.13 +0.33%

CSI 300 -13.45 3413.13 -0.39%

Euro Stoxx 50 +8.04 3586.25 +0.22%

FTSE 100 -15.52 7234.53 -0.21%

DAX +19.94 12527.84 +0.16%

CAC 40 -3.15 5301.00 -0.06%

DJIA +8.01 20957.90 +0.04%

S&P 500 -3.04 2388.13 -0.13%

NASDAQ -22.81 6072.55 -0.37%

S&P/TSX -76.51 15543.14 -0.49%

-

22:27

Currencies. Daily history for May 03’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0884 -0,40%

GBP/USD $1,2866 -0,53%

USD/CHF Chf0,9943 +0,28%

USD/JPY Y112,66 +0,58%

EUR/JPY Y122,63 +0,16%

GBP/JPY Y144,95 +0,05%

AUD/USD $0,7422 -1,50%

NZD/USD $0,6884 -0,71%

USD/CAD C$1,3729 +0,15%

-

21:59

Schedule for today, Thursday, May 04’2017 (GMT0)

01:00 Australia HIA New Home Sales, m/m March 0.2%

01:30 Australia Trade Balance March 3.57 3.4

01:45 China Markit/Caixin Services PMI April 52.2 52.6

03:10 Australia RBA's Governor Philip Lowe Speaks

05:45 Switzerland SECO Consumer Climate Quarter II -3 3

07:50 France Services PMI (Finally) April 57.5 57.7

07:55 Germany Services PMI (Finally) April 55.6 54.7

08:00 Eurozone Services PMI (Finally) April 56 56.2

08:30 United Kingdom Mortgage Approvals March 68.32 67.4

08:30 United Kingdom Consumer credit, mln March 1441 1300

08:30 United Kingdom Net Lending to Individuals, bln March 4.9 4.5

08:30 United Kingdom Purchasing Manager Index Services April 55 54.5

09:00 Eurozone Retail Sales (YoY) March 1.8% 2.1%

09:00 Eurozone Retail Sales (MoM) March 0.7% 0.1%

11:00 Eurozone ECB's Peter Praet Speaks

12:30 Canada Trade balance, billions March -0.97 -0.85

12:30 U.S. Continuing Jobless Claims 1988 2000

12:30 U.S. Initial Jobless Claims 257 247

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter I 1.7% 2.5%

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter I 1.3% 0.2%

12:30 U.S. International Trade, bln March -43.6 -44.5

14:00 U.S. Factory Orders March 1% 0.4%

16:30 Eurozone ECB President Mario Draghi Speaks

20:25 Canada BOC Gov Stephen Poloz Speaks

23:30 Australia AiG Performance of Construction Index April 51.2

-

20:07

Major US stock indices showed mixed dynamics

Major US stock indexes completed today's trading mostly, reacting to the results of the April meeting of the Fed.

The US Federal Reserve, as expected, left a range of interest rates for federal funds between 0.75% and 1.00%, while saying that it plans to continue a gradual increase in interest rates this year, despite recent weak data. Fed executives noted a slowdown in economic activity, but also pointed to the improvement in the labor market and the growth of companies' investment, which has been slowing over the past few quarters.

"The FOMC expects that economic conditions will evolve in such a way that they will serve as the basis for a gradual increase in the interest rate on federal funds. The federal funds rate is likely to remain below levels for some time, which are expected to prevail in the long term. However, the actual way of betting on federal funds will depend on economic prospects, "the Fed said.

Investors also drew attention to the US statistics on the labor market and business activity in the services sector. Data from ADP showed that: growth rates of employment in the private sector of the US slowed in April, but were slightly stronger than expected. According to the report, in April the number of employed increased by 177 thousand people after an increase of 255 thousand in March (originally reported growth of 263 thousand). Analysts had expected that the number of employed will increase by 175 thousand.

Meanwhile, the final data provided by Markit Economics showed that, taking into account seasonal fluctuations, the US business activity index rose in April to 53.1 points compared to 52.8 in March, which was higher than the preliminary reading (52.5 Item) and experts' forecast (52.5 points). It is worth emphasizing that the index remains in the expansion area, that is, above the 50-point mark, for the 14th consecutive month. In addition, it became known that, taking into account the seasonal fluctuations, the final PMI composite index, which covers the production and service sectors, increased in April to 53.2 points from 52.7 points in March.

Meanwhile, a report from the Institute for Supply Management (ISM) showed that the US business activity index rose to 57.5 points in April from 55.2 in March. It was predicted that the figure would rise to 55.8 points. The ISM said that the expansion of activity in the service sector has been fixed for the 87th month in a row.

The components of the DOW index finished the trades in different directions (14 in negative territory, 16 in positive territory). More shares fell The Walt Disney Company (DIS, -2.44%). The leader of growth were shares of Chevron Corporation (CVX, + 1.50%).

All sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-1.8%).

At closing:

DJIA + 0.03% 20.955.56 +5.67

Nasdaq -0.37% 6.072.55 -22.82

S & P -0.14% 2,387.87 -3.30

-

19:00

DJIA +0.01% 20,952.05 +2.16 Nasdaq -0.47% 6,066.75 -28.62 S&P -0.17% 2,387.07 -4.10

-

18:00

U.S.: Fed Interest Rate Decision , 1% (forecast 1%)

-

16:00

European stocks closed: FTSE 100 -15.52 7234.53 -0.21% DAX +19.94 12527.84 +0.16% CAC 40 -3.15 5301.00 -0.06%

-

14:35

U.S. commercial crude oil inventories decreased by 0.9 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 0.9 million barrels from the previous week. At 527.8 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 0.2 million barrels last week, and are near the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 0.6 million barrels last week but are in the upper half of the average range for this time of year. Propane/propylene inventories increased slightly but remained virtually unchanged from last week and are in the lower half of the average range. Total commercial petroleum inventories increased by 1.3 million barrels last week.

-

14:34

FOMC expected to keep today the interest rate at +1.00%. No press conference at this month’s meeting

Traders will focus on the forecasts for the U.S economy - inflation, employment. Focus also on the statement that the Fed makes, particularly how they view the softness in Q1 in the real sectors of the economy. USD volatility expected.

-

14:30

U.S.: Crude Oil Inventories, April -0.930 (forecast -2.160)

-

14:08

Continued growth in the non-manufacturing sector of US at a faster rate - ISM

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management Non-Manufacturing Business Survey Committee:

"The NMI registered 57.5 percent, which is 2.3 percentage points higher than the March reading of 55.2 percent. This represents continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index increased to 62.4 percent, 3.5 percentage points higher than the March reading of 58.9 percent, reflecting growth for the 93rd consecutive month, at a faster rate in April. The New Orders Index registered 63.2 percent, 4.3 percentage points higher than the reading of 58.9 percent in March.

The Employment Index decreased 0.2 percentage point in April to 51.4 percent from the March reading of 51.6 percent. The Prices Index increased 4.1 percentage points from the March reading of 53.5 percent to 57.6 percent, indicating prices increased for the 13th consecutive month, at a faster rate in April. According to the NMI®, 16 non-manufacturing industries reported growth. In April the non-manufacturing sector reflected strong growth after a slowing in the rate from the previous month. Respondents' comments are mostly positive about business conditions and the overall economy."

-

14:00

U.S.: ISM Non-Manufacturing, April 57.5 (forecast 55.8)

-

13:45

U.S.: Services PMI, April 53.1 (forecast 52.5)

-

13:45

Attention has shifted towards the Fed’s balance sheet policy - Nomura on FOMC

"Attention has shifted towards the Fed's balance sheet policy in recent months with multiple speeches by Fed officials stressing the need for a well-communicated, smooth winding down," Nomura notes.

In that regard, Nomura thinks that it's most likely that there will be no significant change in language as it relates to the balance sheet.

"However, there is some possibility that the committee will attempt to provide more clarity regarding specifics of the long-term trajectory of the adjustment process," Nomura adds - efxnews.

Nomura Research expects no change in short-term interest rate policy at today's FOMC meeting.

-

13:32

U.S. Stocks open: Dow -0.21%, Nasdaq -0.37%, S&P -0.30%

-

13:31

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0800 (EUR 240m) 1.0900-10 (976m) 1.0925 ( 1.38bln) 1.1000 (1.1bln)

USDJPY: 111.25 (USD 240m) 111.50 (391m) 112.00 (270m)

GBPUSD: 1.2775 (GBP 225m)

EURGBP: 0.8608 (EUR 260m)

USDCAD: 1.3800 (USD 330m) 1.3840 (220m)

AUDUSD: 0.7400 (AUD 300m) 0.7520 (227m) 0.7600 (374m)

NZDUSD: 0.6900 (NZD 300m)

-

13:12

Before the bell: S&P futures -0.17%, NASDAQ futures -0.27%

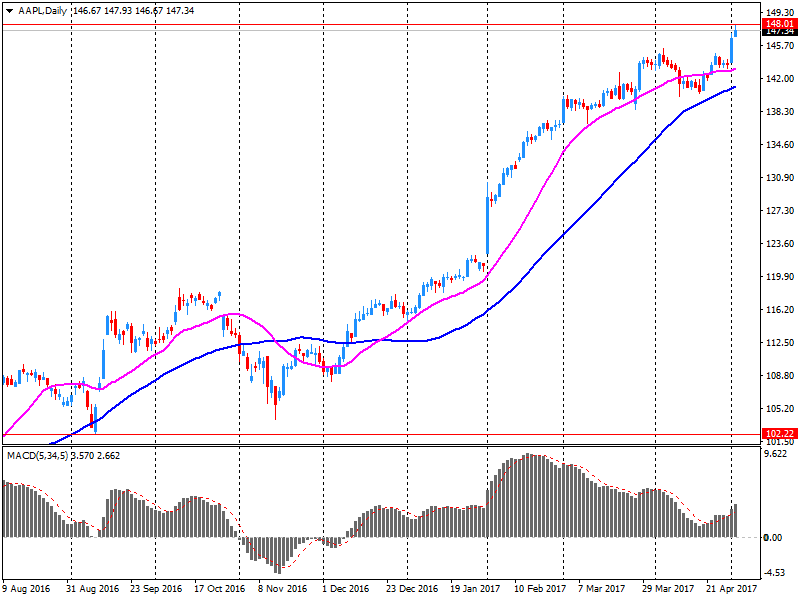

U.S. stock-index futures fell, weighed down by Apple (AAPL) after the world's most valuable company by market capitalization reported a surprise fall in iPhone sales.

Stocks:

Nikkei -

Hang Seng -

Shanghai 3,135.84 -7.88 -0.25%

FTSE 7,228.84 -21.21 -0.29%

CAC 5,294.76 -9.39 -0.18%

DAX 12,498.51 -9.39 -0.08%

Crude $47.96 (+0.61%)

Gold $1,253.60 (-0.27%)

-

13:09

Us 5-year, 30-year yield curve flattens to 115 basis points after Treasury refunding announcement

-

13:06

US Treasury studying 'costs and benefits' of ultra-long bonds @zerohedge

-

13:05

US private sector employment increased by 177,000 jobs from March

Private sector employment increased by 177,000 jobs from March to April according to the April ADP National Employment Report .

"In April we saw a moderate slowdown from the strong pace of hiring in the first quarter," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Despite a dip in job creation, the growth is more than strong enough to accommodate the growing population as the labor market nears full employment. Looking across company sizes, midsized businesses showed persistent growth for the past six months." Mark Zandi, chief economist of Moody's Analytics said, "Job growth slowed in April due to a pullback in construction and retail jobs. The softness in construction is continued payback from outsized growth during the mild winter. Brick-and-mortar retailers cut jobs in response to withering competition from online merchants."

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

70.24

-0.59(-0.83%)

5377

Amazon.com Inc., NASDAQ

AMZN

945.79

-1.15(-0.12%)

7529

American Express Co

AXP

79.55

0.01(0.01%)

300

Apple Inc.

AAPL

145.76

-1.75(-1.19%)

848012

AT&T Inc

T

39.02

0.07(0.18%)

7285

Barrick Gold Corporation, NYSE

ABX

16.37

-0.04(-0.24%)

19803

Cisco Systems Inc

CSCO

34.27

0.03(0.09%)

1005

Citigroup Inc., NYSE

C

59.52

-0.19(-0.32%)

1127

Exxon Mobil Corp

XOM

82.14

0.09(0.11%)

1240

Facebook, Inc.

FB

153.22

0.44(0.29%)

145209

Ford Motor Co.

F

10.96

0.04(0.37%)

52133

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.4

-0.32(-2.52%)

116919

General Electric Co

GE

28.93

-0.06(-0.21%)

24851

General Motors Company, NYSE

GM

33.06

-0.14(-0.42%)

2888

Goldman Sachs

GS

225.39

0.27(0.12%)

1500

Google Inc.

GOOG

914.03

-2.41(-0.26%)

2713

HONEYWELL INTERNATIONAL INC.

HON

130.22

-0.97(-0.74%)

843

Intel Corp

INTC

36.7

0.00(0.01%)

7628

JPMorgan Chase and Co

JPM

86.26

-0.24(-0.28%)

2668

McDonald's Corp

MCD

142.02

0.79(0.56%)

10856

Microsoft Corp

MSFT

69.1

-0.20(-0.29%)

13747

Nike

NKE

54.9

-0.17(-0.31%)

397

Pfizer Inc

PFE

33.37

-0.24(-0.71%)

3623

Starbucks Corporation, NASDAQ

SBUX

60.3

-0.20(-0.33%)

1546

Tesla Motors, Inc., NASDAQ

TSLA

317.45

-1.44(-0.45%)

35406

Twitter, Inc., NYSE

TWTR

18.47

0.23(1.26%)

173940

Verizon Communications Inc

VZ

46

0.09(0.20%)

1127

Visa

V

91.55

-0.99(-1.07%)

330

Yandex N.V., NASDAQ

YNDX

26.36

-0.43(-1.61%)

100

-

12:49

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy from Neutral at Goldman

Downgrades:

Other:

Apple (AAPL) target raised to $160 from $155 at Cowen

Apple (AAPL) target raised to $171 from $163 at Maxim Group

-

12:15

U.S.: ADP Employment Report, April 177 (forecast 175)

-

12:14

Company News: Apple (AAPL) Q2 EPS beat analysts’ estimate

Apple (AAPL) reported Q2 FY 2017 earnings of $2.10 per share (versus $1.90 in Q2 FY 2016), beating analysts' consensus estimate of $2.02.

The company's quarterly revenues amounted to $52.896 bln (+4.6% y/y), generally in-line with analysts' consensus estimate of $53.081 bln.

In Q2, it sold 50.8 mln of iPhones (versus 52.5 mln estimated and 51.2 mln sold last year), 8.9 mln iPads (versus 9.6 mln estimated and 10.2 mln sold last year), 4.2 mln of Macs (versus 4.2 mln estimated and 4 mln sold last year).

The company also issued downside guidance for Q3, projecting Q3 revenues of $43.5-45.5 bln versus analysts' consensus estimate of $ 45.65 bln.

AAPL fell to $145.60. (-1.29%) in pre-market trading.

-

12:02

Orders

EUR/USD

Offers: 1.0925 1.0935 1.0950-55 1.0980 1.1000 1.1030 1.1050

Bids: 1.0900 1.0885 1.0865 1.0850 1.0820 1 .0800 1.0780 1.0750 1.0700

GBP/USD

Offers: 1.2950-60 1.2975 1.3000 1.3020 1.3050

Bids: 1.2900 1.2880 1.2860 1.2830 1.2800 1.2775-80 1.2760 1.2750

EUR/JPY

Offers: 122.80 123.00 123.30 123.50 123.75 124.00

Bids: 122.30 122.00 121.85 121.65 121.50 121.00 120.75-80 120.50

EUR/GBP

Offers: 0.8460 0.8480-85 0.8500 0.8530 0.8550

Bids: 0.8435-40 0.8400 0.8385 0.8350

USD/JPY

Offers: 112.20 112.35 112.50 112.80 113.00

Bids: 112.00 111.80 111.50 111.20 111.00

AUD/USD

Offers: 0.7550 0.7565 0.7585 0.7600 0.7630 0.7650

Bids: 0.7500 0.7480 0.7450 0.7430 0.7400

-

10:52

French 10-year govt bond yield extends falls to four-month low of 0.736 percent ahead of election tv debate

-

09:53

Eu's Barnier says never wanted to ask Britain to sign a blank check

-

09:18

In March 2017 industrial producer prices fell by 0.3% in the euro area

In March 2017, compared with February 2017, industrial producer prices fell by 0.3% in the euro area (EA19) and by 0.2% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In February 2017 prices remained stable in both zones. In March 2017, compared with March 2016, industrial producer prices rose by 3.9% in the euro area and by 4.6% in the EU28.

The 0.3% decrease in industrial producer prices in total industry in the euro area in March 2017, compared with February 2017, is due to a price fall of 1.7% in the energy sector, while prices rose by 0.1% for both capital goods and non-durable consumer goods, by 0.2% for durable consumer goods and by 0.5% for intermediate goods. Prices in total industry excluding energy rose by 0.2%. In the EU28, the 0.2% decrease is due to a price fall of 1.6% in the energy sector, while prices rose by 0.1% for capital goods, by 0.2% for both durable and non-durable consumer goods and by 0.4% for intermediate goods. Prices in total industry excluding energy rose by 0.2%. The largest decreases in industrial producer prices were observed in Denmark (-1.3%), Estonia (-1.1%), Greece (-0.9%), Spain and the Netherlands (both -0.8%), and the highest increases in Cyprus (+1.3%), Lithuania (+1.1%) and Ireland (+0.9%).

-

09:17

GDP rose by 0.5% in the euro area, as expected

Seasonally adjusted GDP rose by 0.5% in the euro area (EA19) and by 0.4% in the EU28 during the first quarter of 2017, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the fourth quarter of 2016, GDP had grown by 0.5% in the euro area and by 0.6% in the EU28. Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7% in the euro area and by 1.9% in the EU28 in the first quarter of 2017, after +1.8% and +1.9% in the previous quarter.

-

09:00

Eurozone: Producer Price Index (YoY), March 3.9% (forecast 4.1%)

-

09:00

Eurozone: GDP (QoQ), Quarter I 0.5% (forecast 0.5%)

-

09:00

Eurozone: Producer Price Index, MoM , March -0.3% (forecast -0.1%)

-

09:00

Eurozone: GDP (YoY), Quarter I 1.7% (forecast 1.7%)

-

08:33

UK construction companies reported a solid start to the second quarter - Markit

UK construction companies reported a solid start to the second quarter of 2017, helped by faster rises in civil engineering and residential building activity. April data also pointed to the strongest upturn in incoming new work so far this year, which survey respondents linked to the resilient economic backdrop and a sustained improvement in client demand.

Greater workloads underpinned a further increase in employment numbers and the most marked rise in input buying since November 2016. Meanwhile, robust demand for construction materials and upward pressure on costs from sterling depreciation resulted in another steep increase in input prices during April. At 53.1, up from 52.2 in March, the seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index pointed to a solid rise in overall construction output.

-

08:30

UK Davis: No Brexit Bill To Pay If UK Walk Away – BB Radio 4

-

08:30

United Kingdom: PMI Construction, April 53.1 (forecast 52)

-

08:01

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0800 (EUR 240m) 1.0900-10 (976m) 1.0925 ( 1.38bln) 1.1000 (1.1bln)

USDJPY: 111.25 (USD 240m) 111.50 (391m) 112.00 (270m)

GBPUSD: 1.2775 (GBP 225m)

EURGBP: 0.8608 (EUR 260m)

USDCAD: 1.3800 (USD 330m) 1.3840 (220m)

AUDUSD: 0.7400 (AUD 300m) 0.7520 (227m) 0.7600 (374m)

NZDUSD: 0.6900 (NZD 300m)

-

07:55

Germany: Unemployment Change, April -15 (forecast -12)

-

07:55

Germany: Unemployment Rate s.a. , April 5.8% (forecast 5.8%)

-

07:43

Major stock exchanges in Europe started trading in the red zone: FTSE 7233.10 -16.95 -0.23%, DAX 12497.28 -10.62 -0.08%, CAC 5291.17 -12.98 -0.24%

-

07:12

Macron seen winning second round run-off vote of French presidential election with 59 pct of votes vs 41 pct for Le Pen- Cevipof poll in Le Monde

-

06:44

Positive start of trading on the main European stock markets expected: DAX + 0.3%, CAC40 + 0.2%, FTSE flat

-

06:43

Trump, Putin also discussed working together against Islamic militants in Middle East and how to resolve North Korea situation - White House

-

Trump, Russia's Putin agreed in phone call that "all parties must do all they can to end the violence" in Syria

-

Putin, Trump agreed to step up dialogue between Lavrov and Tillerson for resolution of Syria crisis - Ria cites Kremlin

-

Putin, Trump call was business-like, constructive - Kremlin

-

Putin, Trump placed emphasis in phone call on coordinating russian, U.S actions on fighting international terrorism - Tass

-

-

06:41

Options levels on wednesday, May 3, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1044 (3222)

$1.1011 (4307)

$1.0989 (4183)

Price at time of writing this review: $1.0920

Support levels (open interest**, contracts):

$1.0861 (1384)

$1.0808 (1447)

$1.0741 (2097)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 75549 contracts, with the maximum number of contracts with strike price $1,1000 (8525);

- Overall open interest on the PUT options with the expiration date June, 9 is 77040 contracts, with the maximum number of contracts with strike price $1,0400 (5402);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from May, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.3205 (1668)

$1.3107 (2145)

$1.3011 (2741)

Price at time of writing this review: $1.2897

Support levels (open interest**, contracts):

$1.2792 (1282)

$1.2695 (851)

$1.2597 (1475)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 25448 contracts, with the maximum number of contracts with strike price $1,3000 (2741);

- Overall open interest on the PUT options with the expiration date June, 9 is 29270 contracts, with the maximum number of contracts with strike price $1,2500 (5029);

- The ratio of PUT/CALL was 1.15 versus 1.16 from the previous trading day according to data from May, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:37

Britain's Brexit minister David Davis says of FT report of 100 billion euro Brexit bill: we have not seen a figure, will not be paying that amount - ITV Twitter feed

-

06:36

New Zeeland unemployment rate fell to 4.9 percent in the March

The unemployment rate fell to 4.9 percent in the March 2017 quarter (down from 5.2 percent in the previous quarter), while employment continued to grow, Stats NZ said today.

"In the March quarter, 6,000 fewer people were unemployed," labour market and household statistics senior manager Mark Gordon said. "The unemployment rate for men fell from 4.8 percent to 4.2 percent, making it the lowest rate since the December 2008 quarter. However, the unemployment rate for women was unchanged."

Unemployed people are those who are available to work, and who had either actively sought work or had a new job to start within the next four weeks.

The number of employed people increased 1.2 percent (29,000 people) in the March 2017 quarter. Men provided the main contribution to this increase, with more males in both full-time and part-time employment. For the sixth quarter in a row, employment growth exceeded growth in the working-age population (which was 0.7 percent). This meant New Zealand's employment rate was up by 0.3 percentage points, to 67.1 percent.

-

06:34

The Australian Industry Group Australian Performance of Services Index improved by 1.3 points in April

The Australian Industry Group Australian Performance of Services Index improved by 1.3 points to 53.0 points in April (seasonally adjusted) marking the seventh month of expansion or stable conditions for the sector. Results above 50 points indicate expansion, with higher numbers indicating a stronger rate of expansion.

Four of the five activity sub-indexes in the Australian PSI indicated growth in April (seasonally adjusted). Sales rose to 55.0 points, new orders improved to 54.5 points, employment continued to grow (but at a slower rate than the previous month, at 51.9 points) and supplier deliveries moved into growth (53.1 points) from contraction. Stocks continued to shrink in April but at a slower pace, registering 47.0 points in the month.

-

06:29

UK Brexit Davis: May & Juncker Dinner Rumours Are Just ‘Gossip And Spin’ – ITV

-

05:30

Global Stocks

European stocks closed firmly higher on Tuesday, getting a lift after Greece signed a deal to release the next tranche of bailout aid and after data showed eurozone manufacturing output on the rise.

U.S. stocks ended with a slight upward bias on Tuesday, though investors mostly held off on making big bets with the Federal Reserve engaged in a two-day policy meeting, which ends on Wednesday. Caution was high as the Fed's meeting got underway; while central bankers are expected to keep rates on hold at this meeting, analysts are looking for any comments on the recent slowdown in U.S. economic activity.

Stock prices increased early Wednesday in Asia, where some major markets are closed for holidays as traders await the latest statement from the U.S. Federal Reserve. But Australian stocks lagged behind for a second session as bank stocks continue to weigh on activity there.

-