Market news

-

22:28

Stocks. Daily history for May 04’2017:

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng -12.25 24683.88 -0.05%

CSI 300 -8.74 3404.39 -0.26%

Euro Stoxx 50 +41.63 3627.88 +1.16%

FTSE 100 +13.57 7248.10 +0.19%

DAX +119.94 12647.78 +0.96%

CAC 40 +71.42 5372.42 +1.35%

DJIA -6.43 20951.47 -0.03%

S&P 500 +1.39 2389.52 +0.06%

NASDAQ +2.79 6075.34 +0.05%

S&P/TSX -146.44 15396.70 -0.94%

-

20:08

Major US stock indices showed mixed dynamics

Major US stock indexes finished trading in different directions, but near the zero mark. Pressure on the market had a strong decline in quotations in the sector of basic materials. Investors also evaluated fresh statistics on the US economy and financial statements of large companies.

As it became known, new applications for unemployment benefits in the US fell more than expected last week, and the number of repeated applications for unemployment benefits fell to a 17-year low, indicating a tightening of the labor market, which could prompt the Fed to raise interest rates next month. Initial claims for unemployment benefits fell by 19,000 to 238,000, seasonally adjusted for the week ending April 29.

At the same time, labor productivity unexpectedly fell in the 1st quarter, which led to an increase in labor costs. The Ministry of Labor reported that labor productivity in the non-agricultural sector, which measures the hourly output per employee, decreased by 0.6% year-on-year. This was the weakest indicator for the year and followed an increase of 1.8% in the fourth quarter.

The cost of oil futures collapsed by almost 5%, reaching the lowest level since the end of November. Concerns over the growing global supplies and persistently high oil reserves actually offset most of the positions earned after OPEC reported the first eight-year oil production reduction agreement.

Most components of the DOW index showed a decrease (19 out of 30). Caterpillar Inc. shares fell more than others. (CAT, -2.21%). The leader of growth was UnitedHealth Group Incorporated (UNH, + 0.93%).

The S & P indexes have finished trading without a single dynamic. Most of all fell the sector of main materials (-1.8%). The highest increase was recorded in the consumer goods sector (+ 0.6%).

At closing:

DJIA -0.03% 20.951.24 -6.66

Nasdaq + 0.05% 6.075.34 + 2.79

S & P + 0.06% 2.389.54 +1.41

-

19:00

DJIA -0.15%20,925.42 -32.48 Nasdaq -0.02% 6,071.05 -1.50 S&P -0.05% 2,386.86 -1.27

-

16:00

European stocks closed: FTSE 100 +13.57 7248.10 +0.19% DAX +119.94 12647.78 +0.96% CAC 40 +71.42 5372.42 +1.35%

-

13:33

U.S. Stocks open: Dow +0.12%, Nasdaq +0.11%, S&P +0.13%

-

13:26

Before the bell: S&P futures +0.16%, NASDAQ futures +0.20%

U.S. stock-index futures rose, a day after the Fed left interest rates unchanged and expressed confidence in the strength of the U.S. economy.

Stocks:

Nikkei -

Hang Seng 24,683.88 -12.25 -0.05%

Shanghai 3,127.29 -8.06 -0.26%

S&P/ASX 5,876.37 -15.97 -0.27%

FTSE 7,256.68 +22.15 +0.31%

CAC 5,349.75 +48.75 +0.92%

DAX 12,622.11 +94.27 +0.75%

Crude $46.89 (-1.94%)

Gold $1,228.90 (-1.57%)

-

12:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.51

-0.18(-0.57%)

5848

Amazon.com Inc., NASDAQ

AMZN

944

2.97(0.32%)

12828

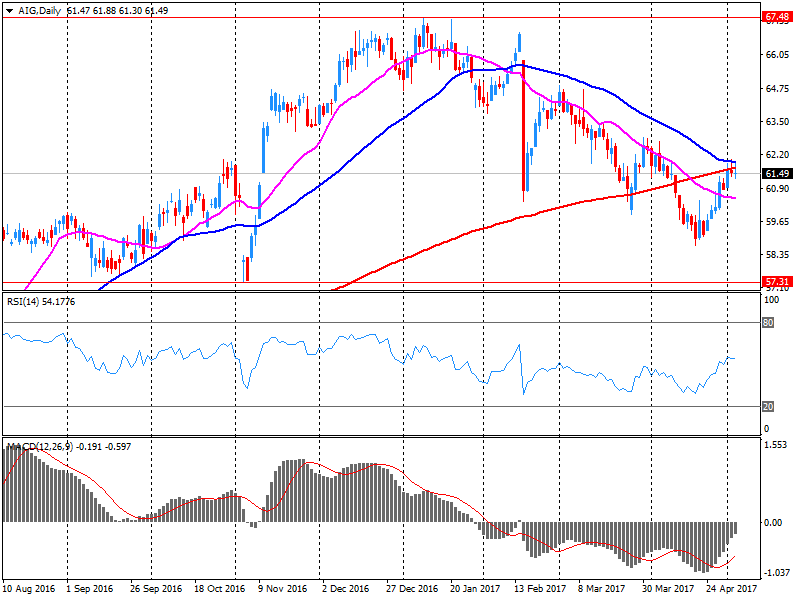

AMERICAN INTERNATIONAL GROUP

AIG

62.4

0.86(1.40%)

142820

Apple Inc.

AAPL

146.72

-0.34(-0.23%)

122715

AT&T Inc

T

38.48

0.08(0.21%)

15934

Barrick Gold Corporation, NYSE

ABX

16

-0.21(-1.30%)

118726

Caterpillar Inc

CAT

101.97

0.43(0.42%)

2003

Chevron Corp

CVX

106.03

-0.69(-0.65%)

619

Cisco Systems Inc

CSCO

34.36

0.11(0.32%)

10215

Citigroup Inc., NYSE

C

60.52

0.28(0.46%)

434480

Exxon Mobil Corp

XOM

82.68

-0.02(-0.02%)

5052

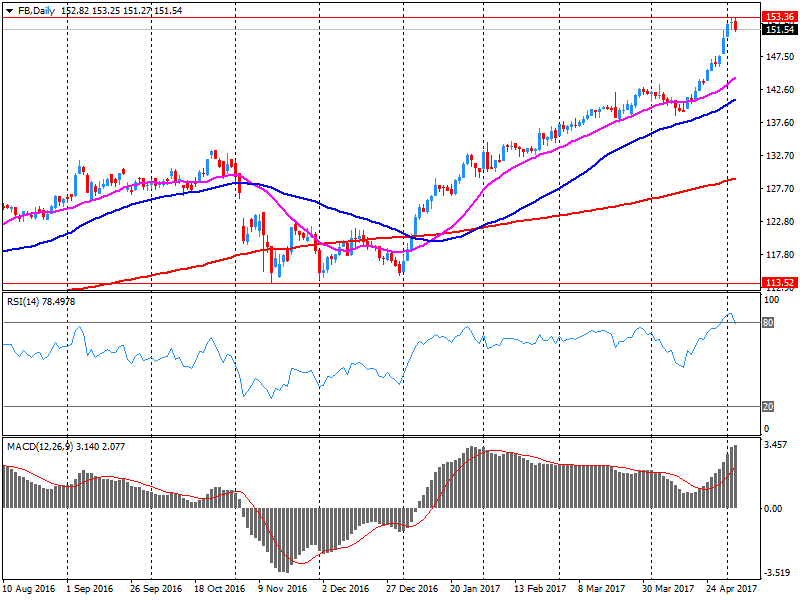

Facebook, Inc.

FB

150.13

-1.67(-1.10%)

1152797

FedEx Corporation, NYSE

FDX

191.5

1.58(0.83%)

200

Ford Motor Co.

F

11.09

0.02(0.18%)

17538

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.85

-0.17(-1.41%)

52295

General Electric Co

GE

29.28

0.05(0.17%)

4983

General Motors Company, NYSE

GM

33.64

0.16(0.48%)

1860

Goldman Sachs

GS

227.55

1.24(0.55%)

58712

Google Inc.

GOOG

925.51

-1.53(-0.17%)

7513

Intel Corp

INTC

37.1

0.12(0.32%)

12638

International Business Machines Co...

IBM

158.2

-0.43(-0.27%)

635

Johnson & Johnson

JNJ

123.61

0.28(0.23%)

962

JPMorgan Chase and Co

JPM

87.3

0.30(0.34%)

533581

Merck & Co Inc

MRK

63.55

-0.08(-0.13%)

2114

Microsoft Corp

MSFT

69.1

0.02(0.03%)

2334

Nike

NKE

54.94

0.41(0.75%)

595

Pfizer Inc

PFE

33.34

-0.13(-0.39%)

9518

Procter & Gamble Co

PG

86.11

-0.32(-0.37%)

100

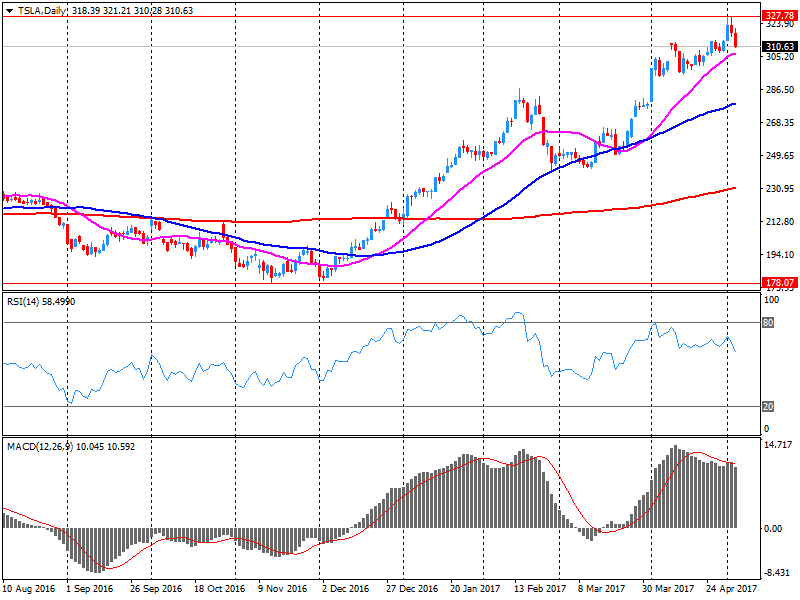

Tesla Motors, Inc., NASDAQ

TSLA

305

-6.02(-1.94%)

108217

Twitter, Inc., NYSE

TWTR

18.65

0.08(0.43%)

345490

Verizon Communications Inc

VZ

46.22

0.07(0.15%)

4170

Visa

V

92.94

0.50(0.54%)

511

Walt Disney Co

DIS

112

0.38(0.34%)

1117

Yandex N.V., NASDAQ

YNDX

26.73

-0.48(-1.76%)

2045

-

12:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Facebook (FB) target raised to $170 from $165 at Stifel Research

Facebook (FB) target raised to $165 from $160 at Aegis Capital

-

12:22

-

12:18

Company News: Facebook (FB) Q1 results beat analysts’ forecasts

Facebook (FB) reported Q1 FY 2017 earnings of $1.04 per share (versus $0.77 in Q1 FY 2016), beating analysts' consensus estimate of $0.86.

The company's quarterly revenues amounted to $8.032 bln (+49.2% y/y), beating analysts' consensus estimate of $7.829 bln.

The company reiterated meaningful slowdown in advertisement growth revenue in 2017 and CapEx of $7.0-7.5 bln.

FB fell to $151.07 (-0.49%) in pre-market trading.

-

12:04

Company News: Tesla (TSLA) Q1 loss beats analysts’ estimate

Tesla (TSLA) reported Q1 FY 2017 loss of $1.33 per share (versus -$0.57 in Q1 FY 2016), missing analysts' consensus estimate of -$0.78.

The company's quarterly revenues amounted to $2.696 bln (+135.1% y/y), beating analysts' consensus estimate of $2.610 bln.

The company also noted its H1 FY2017 outlook remained unchanged at 47,000 to 50,000 deliveries.

TSLA fell to $305.50 (-1.77%) in pre-market trading.

-

06:54

Mixed start of trading expected on major European stock exchanges: DAX + 0.2%, CAC40 + 0.1%, FTSE -0.4%

-

05:27

Global Stocks

European stock markets finished down slightly from a 20-month high on Wednesday, holding lower after a reading on eurozone economic growth matched the market's expectations.

U.S. stocks closed mostly lower Wednesday after the Federal Reserve left interest rates unchanged, as widely expected, and deemed a recent patch of economic weakness as temporary. The main indexes traded in a narrow range over the past several sessions, unable to break to new highs.

Asian stocks tilted lower, with Australian stocks continuing to lag behind, as investors were largely unmoved by an as-expected policy announcement from the Federal Reserve.

-