Market news

-

20:06

The main US stock indexes completed the session in the red zone

The main US stock markets after sharp fluctuations closed below the zero mark. The US missile strike on Syria forced investors to look for safe areas, while weak workplace data affected financial stocks.

Employers from the US added the lowest number of employees in 10 months in March, but the decline in the unemployment rate to a nearly 10-year low of 4.5% showed that the labor market continues to tighten. The number of non-farm workers increased by 98,000 jobs last month, as the retail sector lost its jobs for the second consecutive month, the Ministry of Labor said on Friday. This was the smallest growth since May last year. Economists predicted that last month employment growth was 180,000, while unemployment remained unchanged at 4.7%.

At the same time, the report published by the Ministry of Trade showed that wholesale stocks in the US increased in February in accordance with the estimates of economists. According to the data, wholesale stocks increased by 0.4 percent in February after a decrease of 0.2 percent in January. Inventories of non-durable goods in February rose by 0.7% after falling by 0.2% in January, while oil and agricultural products increased significantly.

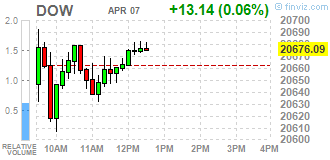

Components of the DOW index finished the trades in different directions (20 in negative territory, 10 in positive territory). The shares of E.I. du Pont de Nemours and Company fell more than others (DD, -0.84%). Leader of growth were shares of Wal-Mart Stores, Inc. (WMT, + 2.11%).

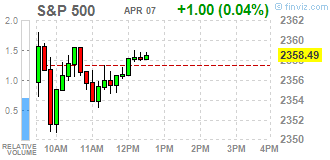

Most sectors of the S & P index showed negative dynamics. The utilities sector fell most of all (-0.5%). The leader of growth was the sector of industrial goods (+ 0.3%).

At closing:

Dow -0.03% 20.656.03 -6.92

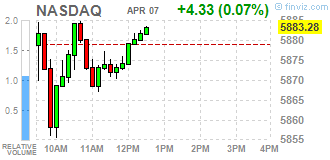

Nasdaq -0.02% 5,877.81 -1.14

S & P -0.08% 2,355.58 -1.91

-

19:00

DJIA +0.11% 20,685.44 +22.49 Nasdaq +0.06% 5,882.66 +3.71 S&P +0.08% 2,359.40 +1.91

-

16:37

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed in choppy trading on Friday after a U.S. missile strike on Syria sent investors scurrying to safe-havens, while weak jobs data weighed on financial stocks. U.S. employers added about 98,000 jobs in March, well below economists' expectation of 180,000. While the job additions were the lowest in 10 months, the Labor Department report was seen as an outlier amid a spate of recent positive economic data.

Dow stocks mixed (15 vs 15). Top loser - The Goldman Sachs Group, Inc. (GS, -0.72%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.86%).

Most of S&P sectors in positive area. Top loser - Financials (-0.1%). Top gainer - Industrial goods (+0.5%).

At the moment:

Dow 20616.00 +11.00 +0.05%

S&P 500 2354.75 +1.00 +0.04%

Nasdaq 100 5424.25 +1.50 +0.03%

Oil 52.23 +0.53 +1.03%

Gold 1267.30 +14.00 +1.12%

U.S. 10yr 2.34 -0.01

-

16:00

European stocks closed: FTSE 100 +46.17 7349.37 +0.63% DAX -5.83 12225.06 -0.05% CAC 40 +13.84 5135.28 +0.27%

-

13:35

U.S. Stocks open: Dow -0.09%, Nasdaq -0.11%, S&P -0.10%

-

13:30

Before the bell: S&P futures -0.22%, NASDAQ futures -0.19%

U.S. stock-index rose fell on the back of weak jobs data and news the U.S. Navy launched a missile attack on the Shayrat airbase in Syria.

Stocks:

Nikkei 18,664.63 +67.57 +0.36%

Hang Seng 24,267.30 -6.42 -0.03%

Shanghai 3,287.02 +6.02 +0.18%

FTSE 7,299.69 -3.51 -0.05%

CAC 5,104.84 -16.60 -0.32%

DAX 12,156.59 -74.30 -0.61%

Crude $52.00 (+0.58%)

Gold $1,270.90 (+1.40%)

-

13:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

71.28

-0.14(-0.20%)

1642

Amazon.com Inc., NASDAQ

AMZN

898.9

0.62(0.07%)

23719

AMERICAN INTERNATIONAL GROUP

AIG

61.3

-0.54(-0.87%)

397

Apple Inc.

AAPL

143.43

-0.23(-0.16%)

53673

AT&T Inc

T

40.59

-0.01(-0.02%)

38428

Barrick Gold Corporation, NYSE

ABX

19.66

0.38(1.97%)

259261

Boeing Co

BA

178

0.63(0.36%)

3557

Caterpillar Inc

CAT

95.7

-0.12(-0.13%)

11796

Chevron Corp

CVX

109.36

0.07(0.06%)

1751

Cisco Systems Inc

CSCO

33.02

-0.06(-0.18%)

1416

Citigroup Inc., NYSE

C

59.29

-0.60(-1.00%)

67603

Exxon Mobil Corp

XOM

83.25

0.24(0.29%)

19886

Facebook, Inc.

FB

140.85

-0.32(-0.23%)

46844

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.4

-0.16(-1.18%)

94649

General Electric Co

GE

29.87

-0.06(-0.20%)

29507

General Motors Company, NYSE

GM

34.13

-0.03(-0.09%)

1202

Goldman Sachs

GS

226.6

-2.04(-0.89%)

15636

Google Inc.

GOOG

825.97

-1.91(-0.23%)

1665

Intel Corp

INTC

36.01

-0.02(-0.06%)

14519

International Business Machines Co...

IBM

172.49

0.04(0.02%)

3352

JPMorgan Chase and Co

JPM

85.73

-0.75(-0.87%)

91470

Merck & Co Inc

MRK

62.8

-0.44(-0.70%)

43321

Microsoft Corp

MSFT

65.52

-0.21(-0.32%)

4214

Nike

NKE

54.79

-0.35(-0.63%)

931

Pfizer Inc

PFE

34.07

-0.04(-0.12%)

2572

Starbucks Corporation, NASDAQ

SBUX

57.54

-0.38(-0.66%)

4917

Tesla Motors, Inc., NASDAQ

TSLA

297

-1.70(-0.57%)

34965

The Coca-Cola Co

KO

42.62

-0.05(-0.12%)

3295

Twitter, Inc., NYSE

TWTR

14.28

-0.11(-0.76%)

47405

Verizon Communications Inc

VZ

48.54

0.11(0.23%)

1892

Visa

V

88.91

-0.18(-0.20%)

2255

Wal-Mart Stores Inc

WMT

71.86

0.43(0.60%)

14344

Walt Disney Co

DIS

112.8

-0.25(-0.22%)

3493

Yandex N.V., NASDAQ

YNDX

22.49

-0.41(-1.79%)

4744

-

12:57

Upgrades and downgrades before the market open

Upgrades:

Wal-Mart (WMT) upgraded to Outperform from Market Perform at Telsey Advisory Group; target raised to $82

Downgrades:

Other:

Walt Disney (DIS) target raised to $116 from $113 at FBR & Co.; Market Perform

FedEx (FDX) initiated with a Buy at Loop Capital; target $234

-

05:35

Global Stocks

European stocks ended slightly higher on Thursday, after swinging between gains and losses through the session, as investors were reluctant to take any big risks ahead of a summit between U.S. President Donald Trump and his Chinese counterpart Xi Jinping.

U.S. stocks closed off intraday highs Thursday as President Donald Trump hosted his Chinese counterpart Xi Jinping for their first official meeting, as investors sought clues to how the leaders of the world's economic powerhouses will tackle trade and geopolitical issues.

Asian equity markets erased early gains and the yen and oil prices rose sharply after the U.S. launched cruise missiles at a Syrian airbase in response to a recent chemical attack. The strikes represented the first time a U.S. military operation has deliberately targeted the regime of President Bashar al-Assad.

-