Market news

-

22:28

Stocks. Daily history for Apr 06’2017:

(index / closing price / change items /% change)

Nikkei -264.21 18597.06 -1.40%

TOPIX -24.48 1480.18 -1.63%

Hang Seng -127.08 24273.72 -0.52%

CSI 300 +10.16 3514.05 +0.29%

Euro Stoxx 50 +16.99 3489.57 +0.49%

FTSE 100 -28.48 7303.20 -0.39%

DAX +13.35 12230.89 +0.11%

CAC 40 +29.59 5121.44 +0.58%

DJIA +14.80 20662.95 +0.07%

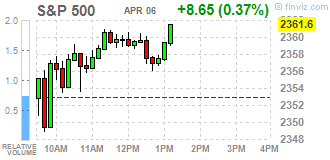

S&P 500 +4.54 2357.49 +0.19%

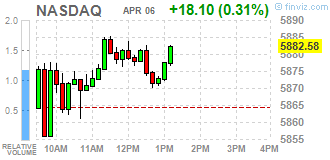

NASDAQ +14.47 5878.95 +0.25%

S&P/TSX +54.19 15697.18 +0.35%

-

20:06

Major US stock indexes finished trading above the zero mark

Major US stock indices rose slightly on Thursday amid positive US data, as well as higher quotations in the core materials sector

The further increase was restrained by the cautiousness of investors on the eve of the meeting of the leaders of the United States and China and the uncertainty about the rapid financial pressure of the United States. President Trump and his Chinese counterpart Jinping are starting their two-day meeting later today, and at the top of the agenda is the possibility of using Trump trade links between the US and China to put pressure on Beijing to curb the military cooperation program with North Korea.

As for the data, the initial claims for unemployment benefits in the US recorded their biggest drop in almost two years last week, indicating further tightening in the labor market. Initial applications for unemployment benefits fell by 25,000 units and, taking into account seasonal fluctuations, reached 234,000 for the week to April 1, the Ministry of Labor said on Thursday. The fall was the largest in the week ending April 25, 2015.

In addition, market participants expect a report on employment in the non-agricultural sector of the US, which will be released on Friday. Current forecasts indicate that in March the number of employed increased by 180 thousand after an increase of 235 thousand in February, while the unemployment rate remained at around 4.7%. Experts note that strong data may force the markets to take into account the possibility of four rate hikes in 2017.

Components of the DOW index finished the session in different directions (17 in positive territory, 13 in negative). Most fell shares Verizon Communications Inc. (VZ, -1.11%). Caterpillar Inc. was the growth leader. (CAT, + 1.66%).

Most sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 0.6%). The utilities sector fell most of all (-0.3%).

At closing:

DJIA + 0.08% 20.664.79 +16.64

Nasdaq + 0.25% 5,878.95 +14.47

S & P + 0.20% 2.357.58 +4.63

-

19:00

DJIA +0.10% 20,668.73 +20.58 Nasdaq +0.00% 5,864.62 +0.14 S&P +0.01% 2,353.15 +0.20

-

17:21

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes rose on Thursday, led by energy companies and a rebound in financials, but gains were kept in check by cautious trading ahead of the Trump-Xi meeting and on uncertainty about quick U.S. fiscal stimulus. President Donald Trump and his Chinese counterpart, Xi Jinping, start their two-day meeting later in the day, and top of the agenda is the possibility of Trump using U.S.-China trade ties to pressure Beijing to do more to rein in North Korea's arms program.

Most of Dow stocks in positive area (27 of 30). Top loser - Verizon Communications Inc. (VZ, -1.15%). Top gainer - Caterpillar Inc. (CAT, +1.97%).

Most of S&P sectors in positive area. Top loser - Utilities (-0.3%). Top gainer - Basic Materials (+0.7%).

At the moment:

Dow 20649.00 +72.00 +0.35%

S&P 500 2356.50 +10.00 +0.43%

Nasdaq 100 5424.75 +8.50 +0.16%

Oil 51.71 +0.56 +1.09%

Gold 1254.00 +5.50 +0.44%

U.S. 10yr 2.35 +0.00

-

16:00

European stocks closed: FTSE 100 -28.48 7303.20 -0.39% DAX +13.35 12230.89 +0.11% CAC 40 +29.59 5121.44 +0.58%

-

13:35

U.S. Stocks open: Dow -0.02%, Nasdaq +0.06%, S&P -0.07%

-

13:28

Before the bell: S&P futures +0.13%, NASDAQ futures +0.12%

U.S. stock-index rose slightly, a day after Wall Street saw its biggest reversal in 14 months following signals that the Federal Reserve could start unwinding its balance sheet this year. Optimism was provided by lower-than-expected initial claims.

Stocks:

Nikkei 18,597.06 -264.21 -1.40%

Hang Seng 24,273.72 -127.08 -0.52%

Shanghai 3,281.60 +11.29 +0.35%

FTSE 7,301.56 -30.12 -0.41%

CAC 5,106.41 +14.56 +0.29%

DAX 12,195.13 -22.41 -0.18%

Crude $51.43 (+0.55%)

Gold $1,253.80 (+0.42%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33.86

0.01(0.03%)

1571

Amazon.com Inc., NASDAQ

AMZN

913

3.72(0.41%)

43108

AMERICAN INTERNATIONAL GROUP

AIG

61.5

-0.12(-0.19%)

1000

AT&T Inc

T

41.1

0.08(0.20%)

26661

Barrick Gold Corporation, NYSE

ABX

19.33

-0.03(-0.16%)

50181

Caterpillar Inc

CAT

94.32

0.08(0.08%)

967

Chevron Corp

CVX

109

0.36(0.33%)

1365

Cisco Systems Inc

CSCO

32.89

-0.11(-0.33%)

1555

Citigroup Inc., NYSE

C

59.69

0.10(0.17%)

25001

Exxon Mobil Corp

XOM

82.75

0.22(0.27%)

540

Facebook, Inc.

FB

142.09

0.24(0.17%)

32471

Ford Motor Co.

F

11.32

0.06(0.53%)

22366

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.55

0.11(0.82%)

22824

General Motors Company, NYSE

GM

34.2

0.20(0.59%)

9996

Goldman Sachs

GS

227.35

-0.31(-0.14%)

3090

Google Inc.

GOOG

830.25

-1.16(-0.14%)

927

Intel Corp

INTC

36.37

0.15(0.41%)

1218

International Business Machines Co...

IBM

173.13

0.25(0.14%)

1732

JPMorgan Chase and Co

JPM

86

-0.19(-0.22%)

36335

Merck & Co Inc

MRK

63.74

0.17(0.27%)

358

Microsoft Corp

MSFT

65.59

0.03(0.05%)

7345

Nike

NKE

54.99

0.01(0.02%)

1772

Pfizer Inc

PFE

34.47

0.28(0.82%)

15201

Starbucks Corporation, NASDAQ

SBUX

58.23

0.01(0.02%)

1363

Tesla Motors, Inc., NASDAQ

TSLA

296.85

1.85(0.63%)

77958

Twitter, Inc., NYSE

TWTR

14.58

0.05(0.34%)

28744

Verizon Communications Inc

VZ

48.52

0.08(0.16%)

15843

Yandex N.V., NASDAQ

YNDX

22.8

0.19(0.84%)

300

-

08:21

Major stock exchanges in Europe trading in the red zone: FTSE 7267.45 -64.23 -0.88%, DAX 12132.37 -85.17 -0.70%, CAC 5055.12 -36.73 -0.72%

-

05:34

Global Stocks

European oil stocks showed strength Wednesday, but the moves, along with a reading of eurozone services activity at a near six-year high, didn't translate to gains for regional indexes.

U.S. stocks ended lower Wednesday, suffering a late selloff after minutes of the Federal Reserve's March meeting showed policy makers plan to begin unwinding the central bank's gigantic balance sheet before the end of the year.

Stocks in Japan hit lows for the year following a down day on Wall Street, as global investors fretted over the direction of U.S. policy and its effects on asset prices. Traders were also positioning themselves ahead of the summit meeting between President Donald Trump and China's top leader, Xi Jinping.

-