Market news

-

23:46

Australia: AiG Performance of Construction Index, March 51.2

-

22:29

Commodities. Daily history for Apr 06’02’2017:

(raw materials / closing price /% change)

Oil 51.74 +0.08%

Gold 1,253.60 +0.02%

-

22:28

Stocks. Daily history for Apr 06’2017:

(index / closing price / change items /% change)

Nikkei -264.21 18597.06 -1.40%

TOPIX -24.48 1480.18 -1.63%

Hang Seng -127.08 24273.72 -0.52%

CSI 300 +10.16 3514.05 +0.29%

Euro Stoxx 50 +16.99 3489.57 +0.49%

FTSE 100 -28.48 7303.20 -0.39%

DAX +13.35 12230.89 +0.11%

CAC 40 +29.59 5121.44 +0.58%

DJIA +14.80 20662.95 +0.07%

S&P 500 +4.54 2357.49 +0.19%

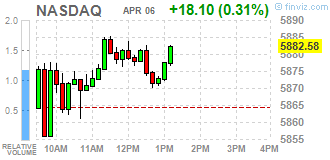

NASDAQ +14.47 5878.95 +0.25%

S&P/TSX +54.19 15697.18 +0.35%

-

22:27

Currencies. Daily history for Apr 06’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0641 -0,23%

GBP/USD $1,2467 -0,18%

USD/CHF Chf1,0051 +0,10%

USD/JPY Y110,83 +0,29%

EUR/JPY Y117,95 +0,07%

GBP/JPY Y138,17 +0,12%

AUD/USD $0,7541 -0,34%

NZD/USD $0,6968 0,00%

USD/CAD C$1,3414 -0,17%

-

22:02

Schedule for today,Friday, Apr 07’2017 (GMT0)

00:00 Japan Labor Cash Earnings, YoY February 0.5% 0.5%

05:00 Japan Leading Economic Index (Preliminary) February 104.9 104.7

05:00 Japan Coincident Index (Preliminary) February 115.1

05:45 Switzerland Unemployment Rate (non s.a.) March 3.6% 3.4%

06:00 Germany Current Account February 12.8

06:00 Germany Industrial Production s.a. (MoM) February 2.8% 0.1%

06:00 Germany Trade Balance (non s.a.), bln February 14.8

06:45 France Trade Balance, bln February -7.9 -4.9

06:45 France Industrial Production, m/m February -0.3% 0.5%

07:00 Switzerland Foreign Currency Reserves March 668.18

07:30 United Kingdom Halifax house price index March 0.1% 0.3%

07:30 United Kingdom Halifax house price index 3m Y/Y March 5.1% 3.9%

08:30 United Kingdom Total Trade Balance February -1.97

08:30 United Kingdom Industrial Production (YoY) February 3.2% 3.7%

08:30 United Kingdom Industrial Production (MoM) February -0.4% 0.2%

08:30 United Kingdom Manufacturing Production (YoY) February 2.7% 3.9%

08:30 United Kingdom Manufacturing Production (MoM) February -0.9% 0.3%

09:00 United Kingdom BOE Gov Mark Carney Speaks

12:30 Canada Employment March 15.3 5

12:30 Canada Unemployment rate March 6.6% 6.7%

12:30 U.S. Average workweek March 34.4 34.4

12:30 U.S. Government Payrolls March 8

12:30 U.S. Manufacturing Payrolls March 28 15

12:30 U.S. Average hourly earnings March 0.2% 0.3%

12:30 U.S. Labor Force Participation Rate March 63%

12:30 U.S. Private Nonfarm Payrolls March 227 175

12:30 U.S. Unemployment Rate March 4.7% 4.7%

12:30 U.S. Nonfarm Payrolls March 235 180

13:00 U.S. President Trump and President Xi Jinping Meeting

14:00 United Kingdom NIESR GDP Estimate March 0.6% 0.6%

14:00 Canada Ivey Purchasing Managers Index March 55.0 56.3

14:00 Canada BOC Gov Stephen Poloz Speaks

14:00 U.S. Wholesale Inventories February -0.2% 0.4%

16:15 U.S. FOMC Member Dudley Speak

19:00 U.S. Consumer Credit February 8.79 13.9

-

20:06

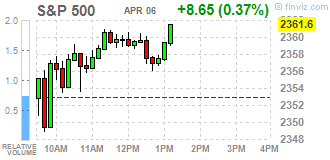

Major US stock indexes finished trading above the zero mark

Major US stock indices rose slightly on Thursday amid positive US data, as well as higher quotations in the core materials sector

The further increase was restrained by the cautiousness of investors on the eve of the meeting of the leaders of the United States and China and the uncertainty about the rapid financial pressure of the United States. President Trump and his Chinese counterpart Jinping are starting their two-day meeting later today, and at the top of the agenda is the possibility of using Trump trade links between the US and China to put pressure on Beijing to curb the military cooperation program with North Korea.

As for the data, the initial claims for unemployment benefits in the US recorded their biggest drop in almost two years last week, indicating further tightening in the labor market. Initial applications for unemployment benefits fell by 25,000 units and, taking into account seasonal fluctuations, reached 234,000 for the week to April 1, the Ministry of Labor said on Thursday. The fall was the largest in the week ending April 25, 2015.

In addition, market participants expect a report on employment in the non-agricultural sector of the US, which will be released on Friday. Current forecasts indicate that in March the number of employed increased by 180 thousand after an increase of 235 thousand in February, while the unemployment rate remained at around 4.7%. Experts note that strong data may force the markets to take into account the possibility of four rate hikes in 2017.

Components of the DOW index finished the session in different directions (17 in positive territory, 13 in negative). Most fell shares Verizon Communications Inc. (VZ, -1.11%). Caterpillar Inc. was the growth leader. (CAT, + 1.66%).

Most sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 0.6%). The utilities sector fell most of all (-0.3%).

At closing:

DJIA + 0.08% 20.664.79 +16.64

Nasdaq + 0.25% 5,878.95 +14.47

S & P + 0.20% 2.357.58 +4.63

-

19:00

DJIA +0.10% 20,668.73 +20.58 Nasdaq +0.00% 5,864.62 +0.14 S&P +0.01% 2,353.15 +0.20

-

17:21

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes rose on Thursday, led by energy companies and a rebound in financials, but gains were kept in check by cautious trading ahead of the Trump-Xi meeting and on uncertainty about quick U.S. fiscal stimulus. President Donald Trump and his Chinese counterpart, Xi Jinping, start their two-day meeting later in the day, and top of the agenda is the possibility of Trump using U.S.-China trade ties to pressure Beijing to do more to rein in North Korea's arms program.

Most of Dow stocks in positive area (27 of 30). Top loser - Verizon Communications Inc. (VZ, -1.15%). Top gainer - Caterpillar Inc. (CAT, +1.97%).

Most of S&P sectors in positive area. Top loser - Utilities (-0.3%). Top gainer - Basic Materials (+0.7%).

At the moment:

Dow 20649.00 +72.00 +0.35%

S&P 500 2356.50 +10.00 +0.43%

Nasdaq 100 5424.75 +8.50 +0.16%

Oil 51.71 +0.56 +1.09%

Gold 1254.00 +5.50 +0.44%

U.S. 10yr 2.35 +0.00

-

16:00

European stocks closed: FTSE 100 -28.48 7303.20 -0.39% DAX +13.35 12230.89 +0.11% CAC 40 +29.59 5121.44 +0.58%

-

14:22

Top house intelligence committee democrat Schiff says investigation of Russian involvement in U.S Election needs to get fully back on track

-

14:05

House intelligence Chairman Nunes says he will temporarily step down from panel's Russia investigation @Lee_Saks

-

13:51

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0585-1.0600 (EUR 780m) 1.0625-1.0635 (676m) 1.0650 ( 650m) 1.0700 (1.37bln) 1.0710-1.0720 (473m) 1.0750 (958m) 1.0775-1.0785 (604m)

USDJPY: 110.00 (USD 715m) 110.20-110.35 (626m) 110.75 (422m) 111.00-10 (485m) 111.85-112.00 (1.2bln) 112.25 (532m) 112.50 (680m)

EURGBP 0.8470 (EUR 240m)

USDCHF: 0.9850 (USD 550m) 1.00 (200m) 1.0040-50 (835m)

AUDUSD: 0.7550-60 (AUD 447m) 0.7570 (352m) 0.7585-0.7600 (1.72bln)

NZDUSD 0.6950 (NZD 212m) 0.7975-80 (353m) 0.7000 (207m)

-

13:35

U.S. Stocks open: Dow -0.02%, Nasdaq +0.06%, S&P -0.07%

-

13:28

Before the bell: S&P futures +0.13%, NASDAQ futures +0.12%

U.S. stock-index rose slightly, a day after Wall Street saw its biggest reversal in 14 months following signals that the Federal Reserve could start unwinding its balance sheet this year. Optimism was provided by lower-than-expected initial claims.

Stocks:

Nikkei 18,597.06 -264.21 -1.40%

Hang Seng 24,273.72 -127.08 -0.52%

Shanghai 3,281.60 +11.29 +0.35%

FTSE 7,301.56 -30.12 -0.41%

CAC 5,106.41 +14.56 +0.29%

DAX 12,195.13 -22.41 -0.18%

Crude $51.43 (+0.55%)

Gold $1,253.80 (+0.42%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

33.86

0.01(0.03%)

1571

Amazon.com Inc., NASDAQ

AMZN

913

3.72(0.41%)

43108

AMERICAN INTERNATIONAL GROUP

AIG

61.5

-0.12(-0.19%)

1000

AT&T Inc

T

41.1

0.08(0.20%)

26661

Barrick Gold Corporation, NYSE

ABX

19.33

-0.03(-0.16%)

50181

Caterpillar Inc

CAT

94.32

0.08(0.08%)

967

Chevron Corp

CVX

109

0.36(0.33%)

1365

Cisco Systems Inc

CSCO

32.89

-0.11(-0.33%)

1555

Citigroup Inc., NYSE

C

59.69

0.10(0.17%)

25001

Exxon Mobil Corp

XOM

82.75

0.22(0.27%)

540

Facebook, Inc.

FB

142.09

0.24(0.17%)

32471

Ford Motor Co.

F

11.32

0.06(0.53%)

22366

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.55

0.11(0.82%)

22824

General Motors Company, NYSE

GM

34.2

0.20(0.59%)

9996

Goldman Sachs

GS

227.35

-0.31(-0.14%)

3090

Google Inc.

GOOG

830.25

-1.16(-0.14%)

927

Intel Corp

INTC

36.37

0.15(0.41%)

1218

International Business Machines Co...

IBM

173.13

0.25(0.14%)

1732

JPMorgan Chase and Co

JPM

86

-0.19(-0.22%)

36335

Merck & Co Inc

MRK

63.74

0.17(0.27%)

358

Microsoft Corp

MSFT

65.59

0.03(0.05%)

7345

Nike

NKE

54.99

0.01(0.02%)

1772

Pfizer Inc

PFE

34.47

0.28(0.82%)

15201

Starbucks Corporation, NASDAQ

SBUX

58.23

0.01(0.02%)

1363

Tesla Motors, Inc., NASDAQ

TSLA

296.85

1.85(0.63%)

77958

Twitter, Inc., NYSE

TWTR

14.58

0.05(0.34%)

28744

Verizon Communications Inc

VZ

48.52

0.08(0.16%)

15843

Yandex N.V., NASDAQ

YNDX

22.8

0.19(0.84%)

300

-

12:49

Canadian municipalities issued $7.5 billion worth of building permits in February, down 2.5% from January

Ontario and Alberta led the five provinces that reported declines in February. The national decrease was mainly the result of lower construction intentions for single-family dwellings and institutional structures.

The value of residential building permits issued by Canadian municipalities fell 1.5% from January to $5.0 billion in February, but remained just above the $5.0 billion mark for a second consecutive month. The decline in single-family construction intentions was moderated by an increase in the multi-family component. Four provinces posted decreases in the residential sector in February, led by Ontario.

Construction intentions for single-family dwellings declined 5.4% to $2.6 billion in February. Ontario registered the greatest decrease in this component, more than offsetting the six provinces that reported gains.

-

12:48

US unemployment claims continue to decline

In the week ending April 1, the advance figure for seasonally adjusted initial claims was 234,000, a decrease of 25,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 258,000 to 259,000. The 4-week moving average was 250,000, a decrease of 4,500 from the previous week's revised average. The previous week's average was revised up by 250 from 254,250 to 254,500.

-

12:30

Canada: Building Permits (MoM) , February -2.5%

-

12:30

U.S.: Initial Jobless Claims, 234 (forecast 251)

-

12:30

U.S.: Continuing Jobless Claims, 2028 (forecast 2040)

-

11:59

Orders

EUR/USD

Offers: 1.0650 1.0670 1.0685 1.0700 1.0730 1.0750

Bids: 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers: 1.2500 1.2520 1.2550-55 1.2585 1.2600

Bids: 1.2470 1.2450 1.2420 1.2400 1.2375-80 1.2350

EUR/JPY

Offers: 117.85 118.00 118.20 118.50 118.65 118.80 119.00

Bids: 117.50 117.30 117.00 116.85 116.50 116.00

EUR/GBP

Offers: 0.8535 0.8555-60 0.8580 0.8600 0.8630 0.8650

Bids: 0.8500 0.8485 0.8465 0.8450 0.8430 0.8400

USD/JPY

Offers: 110.60 110.80-85 111.00 111.20 111.50

Bids: 110.25-30 110.00 109.85 109.65 109.50

AUD/USD

Offers: 0.7565 0.7580 0.7600 0.7620 0.7650

Bids: 0.7525-30 0.7500 0.7485 0.7450

-

10:07

British Prime Minister May says where consumer markets are not working in the best interests of bill payers, we will act to make everyday costs more affordable

-

09:47

ECB's Weidmann says I could have imagined a less expansive monetary policy as many economic indicators develop positively

-

Discussion is legitmate on when ECB should consider monetary policy normalisation and how it could adjust its communication accordingly

-

-

09:05

Eu's Dombrovskis, commenting on possible U.S reregulation, says our financial markets are interconnected, we should preserve global financial architecture

-

08:22

Eurozone retailers registered a decline in like-for-like sales during March

Eurozone retailers registered a decline in like-for-like sales during March, following a broad stagnation in the previous month. The overall decline was driven by a further sharp reduction in Italy, while month-onmonth sales in France fell for the first time since November. On the contrary, retail sales in Germany increased for the fourth consecutive month.

The headline Markit Eurozone Retail PMI - which tracks the month-on-month changes in like-for-like retail sales in the bloc‟s biggest three economies combined - dipped to 49.5 in March, from 49.9 in February, signalled a slight decline in sales.

-

08:21

Major stock exchanges in Europe trading in the red zone: FTSE 7267.45 -64.23 -0.88%, DAX 12132.37 -85.17 -0.70%, CAC 5055.12 -36.73 -0.72%

-

07:20

Swiss CPI rose 0.2% in March, as expected

The consumer price index (IPC) increased by 0.2% in March 2017 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.6% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO).

-

07:15

Ecb's Draghi says a reassessment of the current monetary policy stance is not warranted. EUR/USD moves sharply lower

-

Monetary policy stance is still appropriate

-

Before making any alterations to the components of our stance - interest rates, asset purchases and forward guidance - we still need to build sufficient confidence

-

Don't have enough evidence yet to significantly change our inflation forecasts

-

-

07:15

Switzerland: Consumer Price Index (YoY), March 0.6% (forecast 0.5%)

-

07:15

Switzerland: Consumer Price Index (MoM) , March 0.2% (forecast 0.2%)

-

06:45

Negative start of trading expected on the main European stock markets: DAX -0.6%, CAC40 -0.6%, FTSE -0.7%

-

06:35

Options levels on thursday, April 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0838 (555)

$1.0807 (1071)

$1.0764 (462)

Price at time of writing this review: $1.0673

Support levels (open interest**, contracts):

$1.0619 (502)

$1.0578 (738)

$1.0526 (1668)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 48397 contracts, with the maximum number of contracts with strike price $1,1450 (3936);

- Overall open interest on the PUT options with the expiration date June, 9 is 53796 contracts, with the maximum number of contracts with strike price $1,0400 (4701);

- The ratio of PUT/CALL was 1.11 versus 1.14 from the previous trading day according to data from April, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.2710 (783)

$1.2614 (370)

$1.2519 (894)

Price at time of writing this review: $1.2482

Support levels (open interest**, contracts):

$1.2386 (579)

$1.2290 (425)

$1.2192 (542)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 15259 contracts, with the maximum number of contracts with strike price $1,3000 (1364);

- Overall open interest on the PUT options with the expiration date June, 9 is 16949 contracts, with the maximum number of contracts with strike price $1,1500 (3056);

- The ratio of PUT/CALL was 1.11 versus 1.10 from the previous trading day according to data from April, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:12

Quantitative tightening by the Fed expected in Q1 2018, says Danske Bank

"In terms of the economic development, there was not much new in the FOMC minutes revealed yesterday, as the FOMC members have already been quite outspoken since the meeting.

However, as Fed Chair Janet Yellen said at the press conference following the meeting, the FOMC participants discussed when to change the current reinvestment strategy (which states that the Fed will continue to reinvest principal payments until the normalization of the Fed funds rate is well under way).

Further, the minutes say that a change to the Committee s reinvestment policy would likely be appropriate later this year. The minutes also suggested that quantitative tightening would likely depend on the Fed funds target range or the level of an economic variable (possibly the PCE inflation rate or the unemployment rate, as it was the case with the Evans rule).

Meanwhile, the Fed staff still expects the Trump administration to ease fiscal policy but has pushed back the timing of when those policy changes were anticipated to take effect".

-

06:08

German factory orders rose less than expected in February

Based on provisional data, the Federal Statistical Office (Destatis) reports that price-adjusted new orders in manufacturing had increased in February 2017 a seasonally and working-day adjusted 3.4% on January 2017. For January 2017, revision of the preliminary outcome resulted in a decrease of 6.8% compared with December 2016 (primary -7.4%). Price-adjusted new orders without major orders in manufacturing had increased in February 2017 a seasonally and working-day adjusted 2.2% on January 2017.

In February 2017, domestic orders increased by 8.1% and foreign orders remaind unchanged on the previous month. New orders from the euro area were down 2.4% on the previous month, new orders from other countries increased 1.6% compared to January 2017.

-

06:00

Germany: Factory Orders s.a. (MoM), February 3.4% (forecast 4%)

-

05:50

Trump says he will make an announcement in two weeks on Davis-Bacon act that regulates wages on federally funded projects - New York Times

-

Wants to see how healthcare proceeds in congress before settling on details of tax reform bill

-

Infrastructure plan, which had been expected later this year, may be accelerated

-

Infrastructure plan "nay go public/private on some deals"

-

-

05:47

There was detailed discussion of ending the reinvestment policy - FOMC meeting minutes

The Federal Reserve is ready to start to shrink their bloated $4.5 trillion balance sheet this year, the minutes of the March monetary policy meeting revealed, cited by rttnews.

At the March 14-15 meeting, FOMC members voted at the meeting to raise interest rates a quarter-point while projecting two further rate hikes this year.

There was detailed discussion of ending the reinvestment policy, with policy makers unsure whether to phase out reinvestment of principal payments or cutting them off at once by year's end.

This is seen as a nod to the improving economy and prospect of strong medium-term economic growth.

Provided that the economy continued to perform about as expected, "most participants anticipated that gradual increases in the federal funds rate would continue and judged that a change to the Committee's reinvestment policy would likely be appropriate later this year," the minutes said.

-

05:45

The Caixin China Composite PMI pointed to a weaker increase in total Chinese output at the end of the first quarter

The Caixin China Composite PMI data (which covers both manufacturing and services) pointed to a weaker increase in total Chinese output at the end of the first quarter. At 52.1 in March, the Composite Output Index fell from 52.6 in February to signal the slowest increase in Chinese business activity for six months.

Similar trends were seen at the sector level, with both manufacturers and service providers noting slower expansions in output. Furthermore, the rate of services activity growth weakened to a six-month low in March. This was highlighted by the seasonally adjusted Caixin China General Services Business Activity Index posting at 52.2, down from 52.6 in February, which was consistent with only a modest rate of increase. Chinese manufacturing production also rose modestly in March.

March data pointed to weaker growth in composite new orders, with the rate of expansion edging down to a four-month low. This reflected weaker increases in new work across both monitored sectors. As was the case with activity, service providers registered the slowest increase in new business since last September. A number of services companies mentioned that new product developments and greater client numbers had lifted sales. At the same time, goods producers signalled a softer, albeit still solid, rise in new orders

-

05:34

Global Stocks

European oil stocks showed strength Wednesday, but the moves, along with a reading of eurozone services activity at a near six-year high, didn't translate to gains for regional indexes.

U.S. stocks ended lower Wednesday, suffering a late selloff after minutes of the Federal Reserve's March meeting showed policy makers plan to begin unwinding the central bank's gigantic balance sheet before the end of the year.

Stocks in Japan hit lows for the year following a down day on Wall Street, as global investors fretted over the direction of U.S. policy and its effects on asset prices. Traders were also positioning themselves ahead of the summit meeting between President Donald Trump and China's top leader, Xi Jinping.

-

05:16

Japan: Consumer Confidence, March 43.9 (forecast 43.5)

-

01:45

China: Markit/Caixin Services PMI, March 52.2 (forecast 53.2)

-