Market news

-

19:00

DJIA 18268.84 0.34 0%, NASDAQ 5295.00 -11.85 -0.22%, S&P 500 2156.75 -4.02 -0.19%

-

16:01

European stocks closed: FTSE 7044.39 44.43 0.63%, DAX 10490.86 -77.94 -0.74%, CAC 4449.91 -30.19 -0.67%

-

15:39

WSE: Session Results

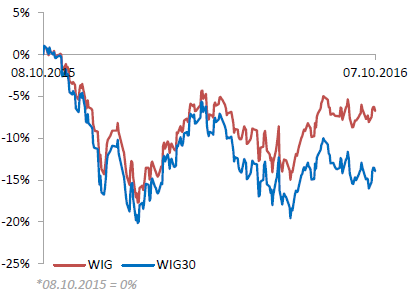

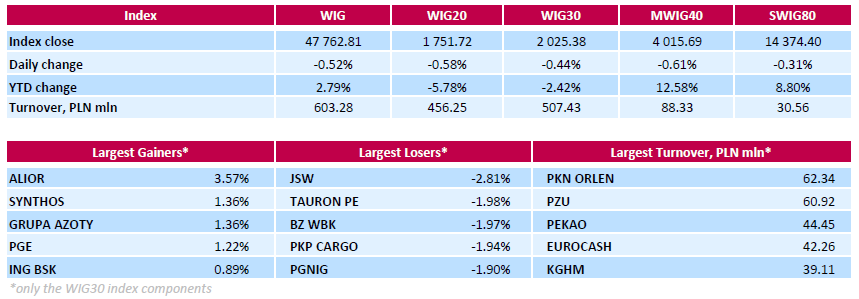

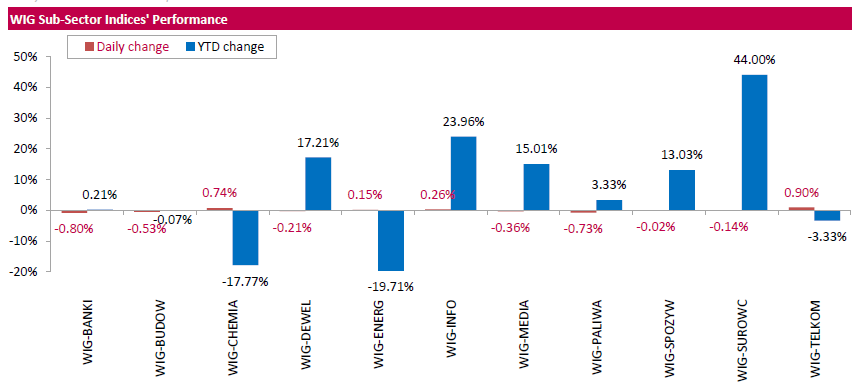

Polish equity market closed lower on Friday. The broad market measure, the WIG index, fell by 0.52%. Most sectors dropped, with financials (-0.80%) underperforming.

The large-cap stocks' benchmark, the WIG30 Index, plunged by 0.44%. In the index basket, coking coal producer JSW (WSE: JSW) topped the list of decliners with a 2.81% drop. Other major laggards were genco TAURON PE (WSE: TPE), bank BZ WBK (WSE: BZW), railway freight transport operator PKP CARGO (WSE: PKP) and oil and gas producer PGNIG (WSE: PGN), slipping by 1.9%-1.98%. On the other side of the ledger, bank ALIOR (WSE: ALR) led the gainers with a 3.57% advance, followed by two chemical producers GRUPA AZOTY (WSE: ATT) and SYNTHOS (WSE: SNS), each growing by 1.36%.

-

15:31

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes lower on Friday after a weaker-than-expected September jobs report indicated that the U.S. Federal Reserve would be cautious about raising interest rates. U.S. employment growth slowed for the third straight month in September, with employers adding 156,000 jobs, a report by the Labor Department showed. Economists polled by Reuters had expected 175,000. The rate of unemployment climbed to 5% from 4.9% in August, though the increase was driven by Americans rejoining the labor force.

Most of Dow stocks in negative area (21 of 30). Top gainer - The Travelers Companies, Inc. (TRV, +1.20%). Top loser - United Technologies Corporation (UTX, -1.80%).

Most of S&P sectors also in negative area. Top gainer - Conglomerates (+0.1%). Top loser - Industrial Goods (-1.3%).

At the moment:

Dow 18153.00 -46.00 -0.25%

S&P 500 2149.00 -7.50 -0.35%

Nasdaq 100 4861.00 -11.00 -0.23%

Oil 50.33 -0.11 -0.22%

Gold 1255.70 +2.70 +0.22%

U.S. 10yr 1.75 +0.01

-

13:50

WSE: After start on Wall Street

This week key data turned out to be very similar to the previous ones. The number of jobs passed the forecast. Wage increase was in line with expectations, but worse presented the unemployment rate. The report was worse than expected, and some players will be treated it as reducing the likelihood of interest rate hikes by the Fed. Looking at today's data is worth to remember that the market consensus says that the Fed may raise the price of the loan on December, so before the December FOMC meeting, there will be two more reports from the labor market, which can make a difference. For the stocks market data are neutral - neither too good nor too weak.

After weaker than expected data from the US labor market Wall Street started trading from small growths that are already at the beginning of the session led the S&P500 index to the highs of ending week. The scale of the increase, however, is so small that it is difficult to prejudge, not only the fate of the session, but even its first passage. One hour before the end today's trading the WIG20 index was at the level of 1,752 points (-0,54%).

-

13:33

U.S. Stocks open: Dow +0.07%, Nasdaq +0.03%, S&P +0.11%

-

13:27

Before the bell: S&P futures -0.26%, NASDAQ futures -0.22%

U.S. stock-index futures slipped as investors assessed jobs data.

Global Stocks:

Nikkei 16,860.09 -39.01 -0.23%

Hang Seng 23,851.82 -100.68 -0.42%

Shanghai Closed

FTSE 7,076.54 +76.58 +1.09%

CAC 4,475.49 -4.61 -0.10%

DAX 10,546.49 -22.31 -0.21%

Crude $50.41 (-0.06%)

Gold $1262.10 (+0.73%)

-

13:07

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

171.76

0.12(0.0699%)

428

ALCOA INC.

AA

31.94

0.16(0.5035%)

866

Amazon.com Inc., NASDAQ

AMZN

844.05

2.39(0.284%)

16398

American Express Co

AXP

62

0.06(0.0969%)

250

Apple Inc.

AAPL

114.11

0.22(0.1932%)

130869

AT&T Inc

T

39.19

0.08(0.2045%)

9314

Barrick Gold Corporation, NYSE

ABX

15.91

0.27(1.7263%)

226874

Chevron Corp

CVX

102

-0.18(-0.1762%)

4785

Cisco Systems Inc

CSCO

31.5

0.02(0.0635%)

721

Citigroup Inc., NYSE

C

48.92

-0.15(-0.3057%)

23896

Exxon Mobil Corp

XOM

86.99

-0.05(-0.0574%)

4486

Facebook, Inc.

FB

128.89

0.15(0.1165%)

44314

Ford Motor Co.

F

12.4

0.01(0.0807%)

2700

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.42

0.12(1.165%)

51127

General Electric Co

GE

29.12

-0.15(-0.5125%)

38802

General Motors Company, NYSE

GM

32.5

-0.03(-0.0922%)

1000

Goldman Sachs

GS

167

-0.15(-0.0897%)

560

Google Inc.

GOOG

779.85

2.99(0.3849%)

2464

Hewlett-Packard Co.

HPQ

15.52

-0.08(-0.5128%)

576

Home Depot Inc

HD

129.71

-0.48(-0.3687%)

26844

HONEYWELL INTERNATIONAL INC.

HON

108.9

-6.71(-5.804%)

81962

Intel Corp

INTC

38.05

-0.02(-0.0525%)

1813

International Business Machines Co...

IBM

157.45

0.57(0.3633%)

200

JPMorgan Chase and Co

JPM

67.71

-0.16(-0.2357%)

2275

Nike

NKE

52.26

0.23(0.442%)

2821

Starbucks Corporation, NASDAQ

SBUX

53.3

0.16(0.3011%)

632

The Coca-Cola Co

KO

41.77

0.06(0.1439%)

905

Twitter, Inc., NYSE

TWTR

19.8501

-0.0199(-0.1002%)

353036

United Technologies Corp

UTX

101.8

-0.28(-0.2743%)

2984

Wal-Mart Stores Inc

WMT

69.15

-0.21(-0.3028%)

1029

Walt Disney Co

DIS

93.05

0.22(0.237%)

2949

Yahoo! Inc., NASDAQ

YHOO

43.17

-0.51(-1.1676%)

39949

Yandex N.V., NASDAQ

YNDX

22.18

0.05(0.2259%)

100

-

12:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Alcoa (AA) target raised to $39 from $13 at Stifel

Wal-Mart (WMT) target lowered to $75 from $76 at RBC Capital Mkts

Wal-Mart (WMT) target lowered to $76 from $78 at Telsey Advisory Group

-

11:03

WSE: Mid session comment

After the morning market activity and the subsequent stabilization, everything pointed to the fact that for trade with a more dynamic we will have to wait until the publication of data in the US. This did not happen and two hours prior to the publication of mentioned data atmosphere in the markets deteriorated, in theory in a quietest phase of the trade and the Warsaw market in the wake of the DAX went down below the minimum of the morning. It is difficult to find a direct cause of such weakness. Looking for a bit of force to explain the observed weakness should be mentioned concerns before too strong data which will have impact for further increase the likelihood of the December interest rate hikes in the US.

At the halfway point of the session the WIG20 index was at the level of 1,751 points (-0,60%).

-

07:49

Major stock exchanges began trading mixed: FTSE + 0.6%, DAX -0.2%, CAC40 flat, FTMIB + 0.1%, IBEX flat

-

07:17

WSE: After opening

WIG20 index opened at 1762.35 points (+0.03%)*

WIG 48046.12 0.07%

WIG30 2034.51 0.01%

mWIG40 4047.59 0.18%

*/ - change to previous close

Unexpectedly, the beginning of the session brings departure down both in our market as well as on the main floors of Euroland. Yesterday's session in Europe and in the United States clearly indicated that investors are waiting for today's publication of data from the US labor market. So it should be now and we may assume that the initial fall will soon be stopped, and move on to a more peaceful trade. After fifteen minutes of the session WIG20 index was at the level of 1,756 points (-028%).

-

06:28

WSE: Before opening

Thursday's session on Wall Street ended with a modest changes in the major indexes but much more interesting things happened in Asia, where was a displacement of sales of the British pound. The entire action lasted 3 minutes not giving anyone a chance to maintain a position on the Forex platforms either through killing SL orders or overload of margin. Unfortunately comes to mind a suspicion of price manipulation and the translations will be linked to alleged technical problems, which takes place in the first articles on the subject. The first comment from the Bloomberg Service as an excuse given the tile Asian market where the set algorithms joined to a sharp drop deepening it further. This event has more in common with the well-known phenomenon of the equity markets (ie. flash crash) than really serious sell-off but it could have an impact on equity markets in Europe.

Today's macro calendar contains a lot of data, but the key info for the markets will be "payrolls data", announced at 14:30 (Warsaw time). It will be the September data on employment change in the US and on the unemployment rate even the dynamics of the hourly rate. Investors bet the strong data on the currency market and it reinforce the dollar. Better than expected data will restore speculations about the December increase in the price of credit in the United States.

-

05:21

Global Stocks

European stocks closed in negative territory Thursday, as airline shares were punished after a profit warning from EasyJet PLC, but bank shares rebounded.

U.S. stocks flatlined on Thursday as investors abstained from making big bets ahead of Friday's much-anticipated September jobs report. Stocks sold off in early trade, but the market recouped much of its losses after a high-ranking European Central Bank official repudiated reports that the central bank had discussed tapering its bond-buying program.

Market worries sent Asian equities broadly lower early Friday, as increasingly heated discussions over the U.K.'s exit from the European Union saw the pound plunging against the U.S. dollar. The selloff began after French President François Hollande called for tough negotiations with the U.K. as it leaves the EU. Britain wanted to leave the bloc "but doesn't want to pay," which was "not possible," Mr. Hollande said in comments cited by Sky News.

-