Market news

-

22:27

Stocks. Daily history for Oct 17’2017:

(index / closing price / change items /% change)

Nikkei +80.56 21336.12 +0.38%

TOPIX +4.19 1723.37 +0.24%

Hang Seng +4.69 28697.49 +0.02%

CSI 300 -0.38 3913.07 -0.01%

Euro Stoxx 50 +1.50 3607.77 +0.04%

FTSE 100 -10.80 7516.17 -0.14%

DAX -8.64 12995.06 -0.07%

CAC 40 -1.51 5361.37 -0.03%

DJIA +40.48 22997.44 +0.18%

S&P 500 +1.72 2559.36 +0.07%

NASDAQ -0.35 6623.66 -0.01%

S&P/TSX +14.20 15816.90 +0.09%

-

20:08

The main US stock indexes completed trading with a slight change

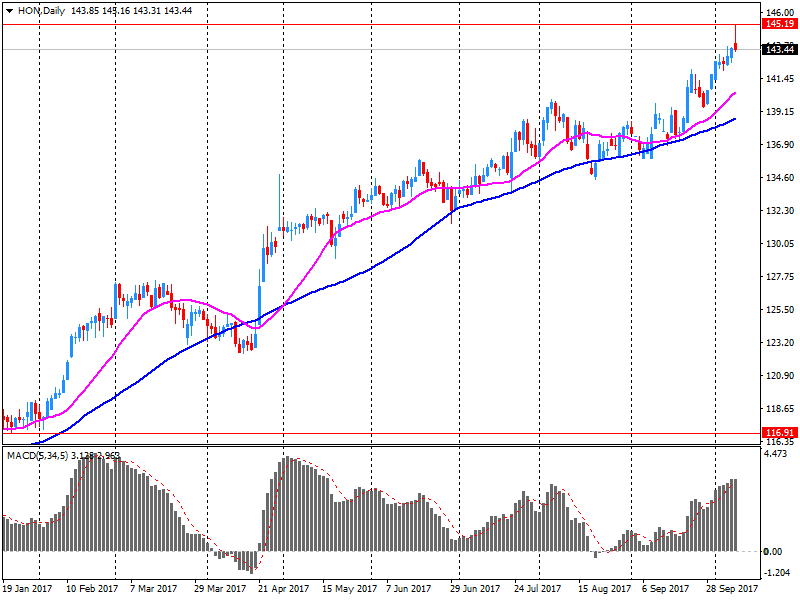

The major US stock indexes finished trading near zero, with the Dow Jones Industrial Average surpassing 23,000 for the first time, thanks to a more than 6 percent increase in UnitedHealth (UNH) shares and a more than 3 percent increase in Johnson & Johnson (JNJ ).

Certain support for the market was also provided by favorable data for the United States. The Bureau of Employment Accounting reported that in September, import prices in the US rose by 0.7 percent, which is the largest monthly increase since the increase of 0.7 percent in June 2016. Last time, import prices increased by more than 0.7 percent in May 2016 (then growth was 1.2 percent). Higher prices for imports of both fuel and non-fuel materials contributed to a general increase in import prices for September. Import prices in the US also increased on a 12-month basis, reaching 2.7 percent.

Meanwhile, the Fed said that industrial production in the US rose in September, as the effects of hurricanes Harvey and Irma began to disappear, and construction and utility production were restored. Industrial production increased by 0.3% after it decreased by 0.7% in August (revised from -0.9%.) Nevertheless, the July release was revised to -0.1% from +0.4 The economists predicted that in September industrial production will grow by 0.3%, while the total production growth increased by 0.2 percentage points to 76.0% from the revised 75.8% in August.

At the same time, the confidence of builders in the market of newly built houses for one family increased by four points to 68 in October, according to the housing market index (HMI) from the National Association of House Builders (NAHB) / Wells Fargo. This was the highest rate since May.

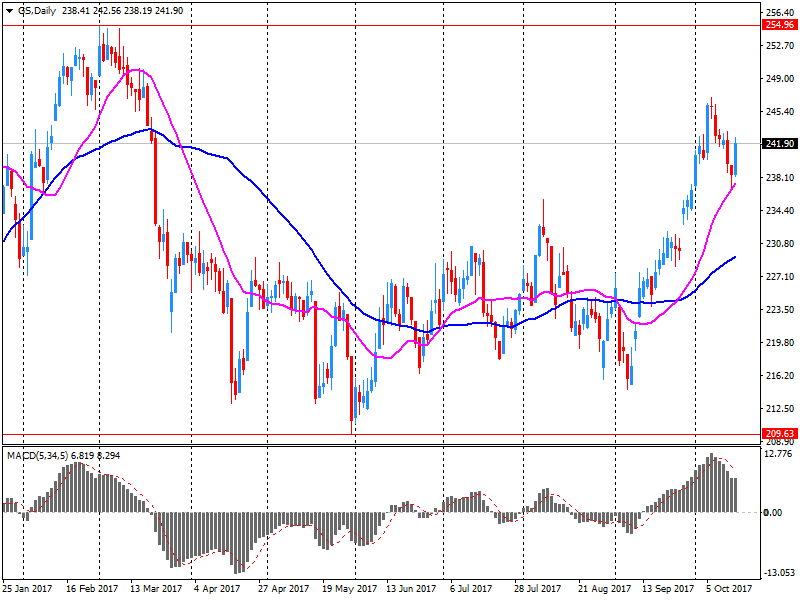

Most components of the DOW index finished trading in the red (17 of 30). Outsider were the shares of The Goldman Sachs Group, Inc. (GS, -2.69%). The leader of growth was UnitedHealth Group Incorporated (UNH, + 6.06%).

Most sectors of the S & P index recorded a decline. The largest decrease was shown in the financial sector (-0.4%). The healthcare sector grew most (+ 0.9%).

At closing:

DJIA + 0.17% 22,996.69 +39.73

Nasdaq -0.01% 6,623.66 -0.35

S & P + 0.07% 2.559.35 +1.71

-

19:00

DJIA +0.10% 22,980.42 +23.46 Nasdaq -0.05% 6,620.68 -3.33 S&P -0.01% 2,557.37 -0.27

-

16:00

European stocks closed: FTSE 100 -10.80 7516.17 -0.14% DAX -8.64 12995.06 -0.07% CAC 40 -1.51 5361.37 -0.03%

-

13:33

U.S. Stocks open: Dow +0.12%, Nasdaq -0.02%, S&P +0.01%

-

13:28

Before the bell: S&P futures -0.02%, NASDAQ futures -0.06%

U.S. stock-index futures were flat on Tuesday as investors assessed earnings reports from big corporates, including UnitedHealth (UNH), Morgan Stanley (MS), Goldman Sachs (GS) and Johnson & Johnson (JNJ).

Global Stocks:

Nikkei 21,336.12 +80.56 +0.38%

Hang Seng 28,697.49 +4.69 +0.02%

Shanghai 3,373.44 -5.03 -0.15%

S&P/ASX 5,889.61 +42.85 +0.73%

FTSE 7,548.27 +21.30 +0.28%

CAC 5,366.84 +3.96 +0.07%

DAX 13,021.56 +17.86 +0.14%

Crude $52.13 (+0.50%)

Gold $1,289.80 (-1.01%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

219.65

0.93(0.43%)

264

ALCOA INC.

AA

48.6

0.36(0.75%)

5338

Amazon.com Inc., NASDAQ

AMZN

1,005.00

-1.34(-0.13%)

5322

Apple Inc.

AAPL

159.68

-0.20(-0.13%)

50758

AT&T Inc

T

36.29

0.12(0.33%)

6704

Barrick Gold Corporation, NYSE

ABX

16.11

-0.13(-0.80%)

22216

Boeing Co

BA

255.75

-4.00(-1.54%)

15754

Chevron Corp

CVX

120.85

0.72(0.60%)

634

Cisco Systems Inc

CSCO

33.68

0.14(0.42%)

280

Citigroup Inc., NYSE

C

72.21

0.44(0.61%)

63307

Exxon Mobil Corp

XOM

82.7

-0.11(-0.13%)

520

Facebook, Inc.

FB

174.82

0.30(0.17%)

46809

Ford Motor Co.

F

12.1

-0.02(-0.17%)

17730

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.06

-0.21(-1.38%)

304301

General Electric Co

GE

23.29

-0.07(-0.30%)

55469

General Motors Company, NYSE

GM

45.95

0.19(0.42%)

25916

Goldman Sachs

GS

245.85

3.44(1.42%)

75281

Intel Corp

INTC

39.51

-0.25(-0.63%)

3235

International Business Machines Co...

IBM

146.7

-0.13(-0.09%)

638

Johnson & Johnson

JNJ

135.8

-0.32(-0.24%)

144527

JPMorgan Chase and Co

JPM

98.35

0.51(0.52%)

29423

McDonald's Corp

MCD

165.03

0.02(0.01%)

178

Microsoft Corp

MSFT

77.5

-0.15(-0.19%)

4865

Procter & Gamble Co

PG

93.2

0.06(0.06%)

332

Starbucks Corporation, NASDAQ

SBUX

54.81

-0.10(-0.18%)

614

Tesla Motors, Inc., NASDAQ

TSLA

351.22

0.62(0.18%)

10146

The Coca-Cola Co

KO

46.55

-0.07(-0.15%)

5225

UnitedHealth Group Inc

UNH

196.1

2.90(1.50%)

17659

Verizon Communications Inc

VZ

48

-0.09(-0.19%)

340

Visa

V

108.4

0.10(0.09%)

1358

Wal-Mart Stores Inc

WMT

85.89

0.15(0.17%)

5555

Walt Disney Co

DIS

98.1

-0.03(-0.03%)

505

-

12:50

Target price changes before the market open

General Electric (GE) target lowered to $23 from $27 at Goldman

-

12:49

Downgrades before the market open

Freeport-McMoRan (FCX) downgraded to Sell from Hold at Deutsche Bank

-

12:48

Upgrades before the market open

Chevron (CVX) upgraded to Outperform from Neutral at Macquarie

-

12:31

Company News: UnitedHealth (UNH) Q3 earnings beat analysts’ estimate

UnitedHealth (UNH) reported Q3 FY 2017 earnings of $2.66 per share (versus $2.17 in Q3 FY 2016), beating analysts' consensus estimate of $2.57.

The company's quarterly revenues amounted to $50.322 bln (+8.7% y/y), generally in-line with analysts' consensus estimate of $50.383 bln.

The company also raised guidance for FY2017, projecting EPS approaching $10.00 (prior $9.75-9.90) versus analysts' consensus estimate of $9.86.

UNH rose to $196.00 (+1.45%) in pre-market trading.

-

12:21

Company News: Morgan Stanley (MS) quarterly results beat analysts’ forecasts

Morgan Stanley (MS) reported Q3 FY 2017 earnings of $0.93 per share (versus $0.81 in Q3 FY 2016), beating analysts' consensus estimate of $0.81.

The company's quarterly revenues amounted to $9.197 bln (+3.2% y/y), beating analysts' consensus estimate of $9.048 bln.

MS rose to $ 49.55 (+1.25%) in pre-market trading.

-

12:16

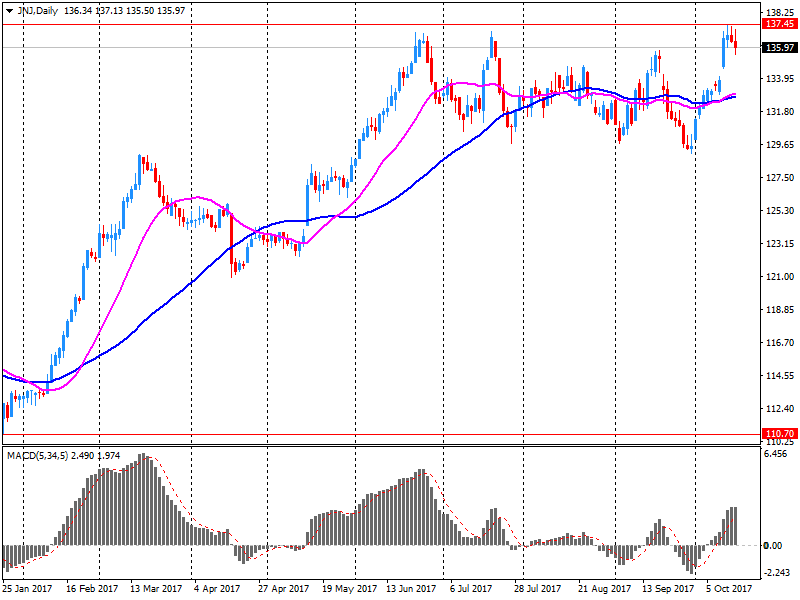

Company News: Johnson & Johnson (JNJ) quarterly results beat analysts’ estimates

Johnson & Johnson (JNJ) reported Q3 FY 2017 earnings of $1.90 per share (versus $1.68 in Q3 FY 2016), beating analysts' consensus estimate of $1.80.

The company's quarterly revenues amounted to $19.650 bln (+10.3% y/y), beating analysts' consensus estimate of $19.291 bln.

The company also raised FY2017 EPS guidance to $7.25-7.30 from $7.12-7.22 (versus analysts' consensus estimate of $7.18) and FY2017 revenues forecast to $76.1-76.5 bln from $75.8-76.1 bln (versus analysts' consensus estimate of $75.84 bln).

JNJ rose to $137.57 (+1.07%) in pre-market trading.

-

12:03

Company News: Goldman Sachs (GS) quarterly results beat analysts’ expectations

Goldman Sachs (GS) reported Q3 FY 2017 earnings of $5.02 per share (versus $4.88 in Q3 FY 2016), beating analysts' consensus estimate of $4.16.

The company's quarterly revenues amounted to $8.330 bln (+2.0% y/y), beating analysts' consensus estimate of $7.595 bln.

GS rose to $245.25 (+1.17%) in pre-market trading.

-

07:33

Major stock markets in Europe trading mixed: FTSE 7520.67 -6.30 -0.08%, DAX 12996.24 -7.46 -0.06%, CAC 5370.36 +7.48 + 0.14%

-

06:45

Eurostoxx 50 futures up 0.11 pct , DAX futures down 0.03 pct , FTSE futures down 0.02 pct, CAC 40 futures up 0.15 pct

-

05:30

Global Stocks

Stocks listed in Spain dropped Monday, weighing on the pan-European benchmark, after the central government in Madrid gave Catalonia's separatist leaders until Thursday to drop their push for independence. In Madrid, the IBEX 35 IBEX, -0.75% fell 0.8% to close at 10,181.40, falling for a third straight session. As the index extended its loss from the open, the broader Stoxx Europe 600 SXXP, +0.00% erased its gain to end flat at 391.41.

The global stock rally showed signs of slowing Tuesday, with many Asia-Pacific indexes little changed ahead of the start of the Chinese Communist Party's congress. One exception was Australia, where stocks rebounded thanks to stronger commodity prices. The S&P/ASX 200 XJO, +0.80% was recently up 0.7% as it got a lift from Rio Tinto RIO, +1.84% and BHP Billiton BHP, +1.45% . Their shares rose more than 1%, with Rio hitting another 3½-year high.

U.S. stocks closed higher Monday, with all three major indexes logging another round of records, as investors looked ahead to key corporate earnings reports that could set the tone for trading and determine whether the lofty levels of the equity market are justified.

-