Market news

-

22:26

Stocks. Daily history for Oct 18’2017:

(index / closing price / change items /% change)

Nikkei +26.93 21363.05 +0.13%

TOPIX +1.27 1724.64 +0.07%

Hang Seng +14.27 28711.76 +0.05%

CSI 300 +31.09 3944.16 +0.79%

Euro Stoxx 50 +11.88 3619.65 +0.33%

FTSE 100 +26.70 7542.87 +0.36%

DAX +47.97 13043.03 +0.37%

CAC 40 +22.44 5383.81 +0.42%

DJIA +160.16 23157.60 +0.70%

S&P 500 +1.90 2561.26 +0.07%

NASDAQ +0.56 6624.22 +0.01%

S&P/TSX -34.74 15782.16 -0.22%

-

20:11

The main US stock indexes rose on the basis of today's trading

The major US stock indexes finished higher, with the Dow Jones industrial index rising most, updating its record high with support from IBM, which reported strong earnings.

In addition, as it became known, in September, the pace of housing construction in the US fell to a one-year low, as Hurricanes Harvey and Irma violated the construction of single-family houses in the South, which indicates that the housing market is likely to remain a brake on economic growth in the third quarter. The laying of new homes fell 4.7% to a seasonally adjusted annual figure of 1.127 million units, the Commerce Department said on Wednesday. This was the lowest level since September 2016, which followed the August revised rate of 1.183 million units.

Meanwhile, the review of the Fed "Beige Book" indicated that economic activity in September and October continued to grow at a moderate pace, despite the hurricanes that hit the south-east of the country. In the area of responsibility of the Fed-Richmond, the Fed-Atlanta and the Fed-Dallas, heavy consequences of natural disasters were noted. The impact of Hurricane Irma on the tourist sphere of Florida was especially noticeable. The survey also showed that employment growth "was generally modest," while labor markets across the country were marked by high labor demand. The rate of inflation has also remained modest since the release of the latest Beige Book, which corresponded to other indicators of price dynamics. The increase in prices was noted in the transport and energy sectors, and in construction.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was the shares of International Business Machines Corporation (IBM, + 9.23%). Outsider were shares of Chevron Corporation (CVX, -1.77%).

Most sectors of the S & P index finished trading in positive territory. The financial sector grew most (+ 0.5%). The largest decrease was in the base resources sector (-0.6%).

At closing:

DJIA + 0.70% 23,157.60 +160.16

Nasdaq + 0.01% 6,624.22 +0.56

S & P + 0.07% 2.561.26 +1.90

-

19:00

DJIA +0.67% 23,152.48 +155.04 Nasdaq +0.11% 6,631.09 +7.43 S&P +0.12% 2,562.34 +2.98

-

16:00

European stocks closed: FTSE 100 +26.70 7542.87 +0.36% DAX +47.97 13043.03 +0.37% CAC 40 +22.44 5383.81 +0.42%

-

13:32

U.S. Stocks open: Dow +0.44%, Nasdaq +0.13%, S&P +0.16%

-

13:17

Before the bell: S&P futures +0.16%, NASDAQ futures +0.08%

U.S. stock-index futures were slightly higher on Wednesday as positive sentiment continued to linger amid upbeat earnings reports from the U.S. companies.

Global Stocks:

Nikkei 21,363.05 +26.93 +0.13%

Hang Seng 28,711.76 +14.27 +0.05%

Shanghai 3,381.37 +9.33 +0.28%

S&P/ASX5,890.48 +0.865 +0.01%

FTSE 7,548.57 +32.40 +0.43%

CAC 5,392.48 +31.11 +0.58%

DAX 13,060.81 +65.75 +0.51%

Crude $52.09 (+0.40%)

Gold $1,280.10 (-0.47%)

-

12:46

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

47.65

-0.12(-0.25%)

2300

ALTRIA GROUP INC.

MO

65

0.13(0.20%)

188

Amazon.com Inc., NASDAQ

AMZN

1,009.93

0.80(0.08%)

13400

American Express Co

AXP

91.91

0.22(0.24%)

1642

Apple Inc.

AAPL

160.8

0.33(0.21%)

139742

AT&T Inc

T

36.29

0.06(0.17%)

13824

Barrick Gold Corporation, NYSE

ABX

16.11

-0.11(-0.68%)

11400

Caterpillar Inc

CAT

131

0.46(0.35%)

77744

Chevron Corp

CVX

119.61

-0.61(-0.51%)

153448

Cisco Systems Inc

CSCO

33.61

0.01(0.03%)

1047

Citigroup Inc., NYSE

C

72.48

0.29(0.40%)

31857

Exxon Mobil Corp

XOM

82.56

-0.40(-0.48%)

160643

Facebook, Inc.

FB

176.7

0.59(0.34%)

82153

Ford Motor Co.

F

12.3

0.03(0.24%)

45598

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.92

-0.01(-0.07%)

37380

General Electric Co

GE

23.27

0.08(0.35%)

30656

General Motors Company, NYSE

GM

45.1

0.08(0.18%)

11525

Goldman Sachs

GS

236.63

0.54(0.23%)

30985

Google Inc.

GOOG

992

-0.18(-0.02%)

831

Hewlett-Packard Co.

HPQ

21.7

0.15(0.70%)

304304

Intel Corp

INTC

39.9

0.11(0.28%)

152070

International Business Machines Co...

IBM

156

9.46(6.46%)

512394

Johnson & Johnson

JNJ

140.63

-0.16(-0.11%)

9250

JPMorgan Chase and Co

JPM

98.1

0.48(0.49%)

10831

Merck & Co Inc

MRK

64.25

1.03(1.63%)

92512

Microsoft Corp

MSFT

77.81

0.22(0.28%)

163272

Nike

NKE

51.83

-0.17(-0.33%)

1258

Pfizer Inc

PFE

36.28

0.08(0.22%)

171062

Tesla Motors, Inc., NASDAQ

TSLA

355.51

-0.24(-0.07%)

5471

Twitter, Inc., NYSE

TWTR

18.25

-0.03(-0.16%)

1553

UnitedHealth Group Inc

UNH

204.78

0.89(0.44%)

33414

Verizon Communications Inc

VZ

48.5

0.10(0.21%)

874

Visa

V

107.6

0.06(0.06%)

758

Wal-Mart Stores Inc

WMT

86.1

0.12(0.14%)

104491

Walt Disney Co

DIS

98.7

0.34(0.35%)

1649

-

12:43

Target price changes before the market open

Apple (AAPL) target raised to $160 from $150 at Mizuho

Johnson & Johnson (JNJ) target raised to $165 from $150 at Leerink Partners

Johnson & Johnson (JNJ) target raised to $142 at Stifel

Johnson & Johnson (JNJ) target raised to $147 from $144 at RBC Capital Mkts

HP Inc. (HPQ) target raised to $26 from $22 at RBC Capital Mkts

Goldman Sachs (GS) target raised to $250 from $243 at Buckingham Research

-

12:42

Downgrades before the market open

Chevron (CVX) downgraded to Hold from Buy at Societe Generale

Chevron (CVX) downgraded to Market Perform from Outperform at BMO Capital Markets

-

12:41

Upgrades before the market open

Merck (MRK) upgraded to Buy from Neutral at Citigroup

-

12:13

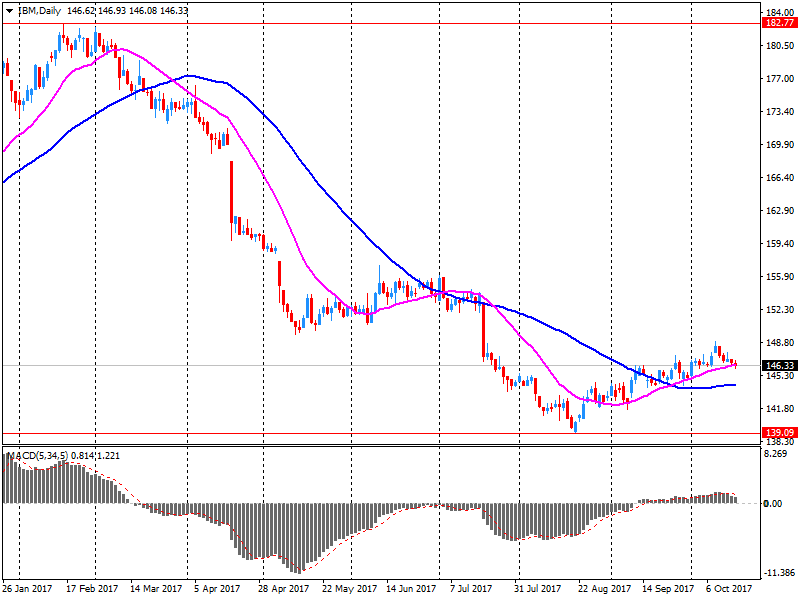

Company News: IBM (IBM) quarterly results beat analysts’ expectations

IBM (IBM) reported Q3 FY 2017 earnings of $3.30 per share (versus $3.29 in Q3 FY 2016), beating analysts' consensus estimate of $3.28.

The company's quarterly revenues amounted to $19.153 bln (-0.4% y/y), beating analysts' consensus estimate of $18.632 bln.

The company also reaffirmed guidance for FY2017, projecting EPS of at least $13.80 versus analysts' consensus estimate of $13.75.

IBM rose to $155.24 (+5.94%) in pre-market trading.

-

08:21

Major European stock exchanges trading mostly in the green zone: FTSE 7533.76 +17.59 + 0.23%, DAX 13010.14 +15.08 + 0.12%, CAC 5360.97 -0.40 -0.01%

-

05:32

Global Stocks

U.K. stocks finished lower on Tuesday after investors received inflation data that could harden the case for the Bank of England to raise British borrowing costs. The FTSE 100 index UKX, -0.14% fell 0.1% to close at 7,516.17, after darting between small gains and losses through the day. Among big movers Tuesday, shares of Merlin Entertainments PLC MERL, -15.94% tumbled 16%.

U.S. stocks ended mostly higher on Tuesday, with both the Dow and the S&P 500 finishing at records as a round of positive earnings reports from major companies boosted positive sentiment and extended the recent uptrend. The Dow Jones Industrial Average DJIA, +0.18% closed up 40.48 points, or 0.2%, at 22,997.44. The blue-chip average hit a record of 23,002.20 in midday trading, the first time in history it broke above that psychologically important level.

Equity markets in the Asia-Pacific region were slightly higher on Wednesday, building on Wall Street's bullish performance overnight, though gains were being capped as a key meeting of China's political elite kicked off. Regional investors were trading cautiously as the latest Communist Party congress got under way, where China's President Xi Jinping is expected to secure a second five-year term.

-