Market news

-

22:18

Stocks. Daily history for Sep 20’2017:

(index / closing price / change items /% change)

Nikkei +11.08 20310.46 +0.05%

TOPIX +0.04 1667.92 +0.00%

Hang Seng +76.39 28127.80 +0.27%

CSI 300 +10.32 3842.44 +0.27%

Euro Stoxx 50 -5.63 3525.55 -0.16%

FTSE 100 -3.30 7271.95 -0.05%

DAX +7.38 12569.17 +0.06%

CAC 40 +4.22 5241.66 +0.08%

DJIA +41.79 22412.59 +0.19%

S&P 500 +1.59 2508.24 +0.06%

NASDAQ -5.28 6456.04 -0.08%

S&P/TSX +96.63 15389.60 +0.63%

-

20:08

The main US stock indexes mostly rose as a result of today's trading

US stock indices fell strongly in response to the results of the Fed meeting, but then regained lost ground and ended the session mostly in positive territory.

The Fed left the interest rate range for federal funds unchanged, between 1.00% and 1.25%, but hinted at the possibility of another rate hike in 2017, despite the fact that low inflation caused some managers to doubt the feasibility of such a move .

According to the Fed's average forecast, the interest rate will be 1.4% this year and 2.1% in 2018, as the recent CBR forecast. In the long term, the Fed expects that the rate will be 2.8%, and not 3%, and the current cycle of rate increases will be completed by 2020. Meanwhile, according to the forecast of the Fed, the target inflation rate will be reached in 2019, and not in 2018. This year inflation is expected to grow to 1.6%. Also, the Fed said it expects GDP growth of 2.4% in 2017 (in June the forecast was + 2.2%). In 2018, GDP is expected to grow by 2.1%, in 2019 - by 2%. As for employment, managers expect a drop in the unemployment rate from the current 4.4% to 4.3% this year.

Negligible impact on the course of trading also provided data on the United States. The National Association of Realtors reported that home sales in the secondary market fell for the fourth time in five months, as restrained supply levels continue to reduce overall activity. Sales growth in the Northeast and Midwest has outpaced the decline in the South and West. Total secondary home sales, which are completed transactions including single-family homes, urban homes, condominiums and cooperatives, fell 1.7%, seasonally adjusted to an annual rate of 5.35 million in August from 5.44 million in July. The sales level last month was 0.2% higher than last August, and is the lowest since then.

Most components of the DOW index finished trading in positive territory (20 out of 30). The leader of growth was the shares of McDonald's Corporation (MCD, + 1.47%). Outsider were the shares of Apple Inc. (AAPL, -1.85%).

The S & P sector showed mixed dynamics. The raw materials sector grew most (+ 0.4%). The largest decrease was shown by the consumer goods sector (-0.8%).

At closing:

DJIA + 0.18% 22.411.25 +40.45

Nasdaq -0.08% 6,456.04 -5.28

S & P + 0.06% 2.508.17 +1.52

-

19:00

DJIA +0.07% 22,386.96 +16.16 Nasdaq -0.32% 6,440.43 -20.89 S&P -0.09% 2,504.51 -2.14

-

16:00

European stocks closed: FTSE 100 -3.30 7271.95 -0.05% DAX +7.38 12569.17 +0.06% CAC 40 +4.22 5241.66 +0.08%

-

13:32

U.S. Stocks open: Dow +0.04%, Nasdaq +0.01%, S&P +0.06%

-

13:01

Before the bell: S&P futures +0.02%, NASDAQ futures -0.02%

U.S. stock-index futures were flat on were little changed on Wednesday, as investors awaited the Federal Reserve's rate decision and press conference of its Chair Janet Yellen.

Global Stocks:

Nikkei 20,310.46 +11.08 +0.05%

Hang Seng 28,127.80 +76.39 +0.27%

Shanghai 3,366.37 +9.52 +0.28%

S&P/ASX 5,709.09 -4.49 -0.08%

FTSE 7,274.56 -0.69 -0.01%

CAC 5,242.67 +5.23 +0.10%

DAX 12,553.06 -8.73 -0.07%

Crude $50.46 (+1.12%)

Gold $1,316.80 (+0.47%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

210.5

-3.06(-1.43%)

595

ALCOA INC.

AA

47.15

0.95(2.06%)

5916

Amazon.com Inc., NASDAQ

AMZN

970

0.14(0.01%)

3758

Apple Inc.

AAPL

158.08

-0.65(-0.41%)

93463

AT&T Inc

T

38.22

0.01(0.03%)

18790

Barrick Gold Corporation, NYSE

ABX

16.97

0.07(0.41%)

22089

Boeing Co

BA

252.86

0.40(0.16%)

2800

Caterpillar Inc

CAT

124.94

0.20(0.16%)

1235

Cisco Systems Inc

CSCO

32.55

0.06(0.18%)

2093

Citigroup Inc., NYSE

C

71.13

-0.02(-0.03%)

2260

Facebook, Inc.

FB

172.48

-0.04(-0.02%)

15166

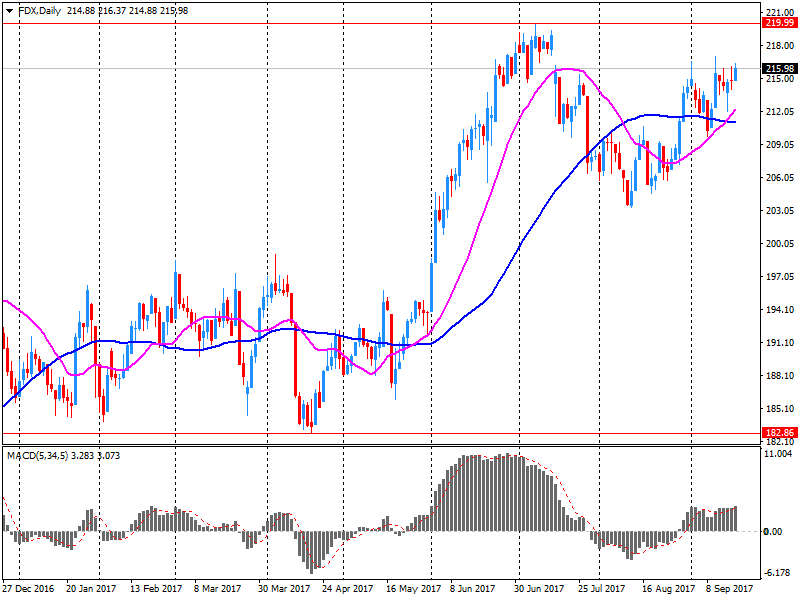

FedEx Corporation, NYSE

FDX

214

-2.00(-0.93%)

23694

Ford Motor Co.

F

11.63

-0.09(-0.77%)

63930

General Motors Company, NYSE

GM

38.85

0.15(0.39%)

14787

Google Inc.

GOOG

922

0.19(0.02%)

653

Home Depot Inc

HD

157.76

0.10(0.06%)

1109

Intel Corp

INTC

37.32

0.09(0.24%)

1003

Johnson & Johnson

JNJ

133.06

-2.16(-1.60%)

17837

JPMorgan Chase and Co

JPM

93.8

-0.14(-0.15%)

2128

McDonald's Corp

MCD

157.9

0.47(0.30%)

8378

Microsoft Corp

MSFT

75.35

-0.09(-0.12%)

12786

Pfizer Inc

PFE

35.75

0.30(0.85%)

16084

Procter & Gamble Co

PG

94.08

-0.09(-0.10%)

250

Starbucks Corporation, NASDAQ

SBUX

54.5

-0.12(-0.22%)

888

Tesla Motors, Inc., NASDAQ

TSLA

373.2

-1.90(-0.51%)

35707

The Coca-Cola Co

KO

45.81

-0.17(-0.37%)

3200

Twitter, Inc., NYSE

TWTR

17.85

0.09(0.51%)

30188

United Technologies Corp

UTX

113.5

-0.15(-0.13%)

100

Verizon Communications Inc

VZ

49

-0.34(-0.69%)

986

Visa

V

106

0.59(0.56%)

13129

Wal-Mart Stores Inc

WMT

79.95

-0.10(-0.12%)

1003

-

12:44

Downgrades before the market open

3M (MMM) downgraded to Underweight from Neutral at JP Morgan

Johnson & Johnson (JNJ) downgraded to Sell from Neutral at Goldman; target raised to $130 from $125

-

12:43

Upgrades before the market open

Pfizer (PFE) upgraded to Overweight from Equal-Weight at Morgan Stanley

-

11:44

Company News: FedEx (FDX) Q1 EPS miss analysts’ estimate

FedEx (FDX) reported Q1 FY 2018 earnings of $2.65 per share (versus $2.90 in Q1 FY 2017), missing analysts' consensus estimate of $3.09.

The company's quarterly revenues amounted to $15.300 bln (+4.1% y/y), generally in-line with analysts' consensus estimate of $15.354 bln.

The company also issued downside guidance for FY2018, projecting EPS of $12.00-12.80 versus analysts' consensus estimate of $13.38.

FDX fell to $213.00 (-1.39%) in pre-market trading.

-

07:45

Major stock exchanges in Europe trading mostly in the red zone: FTSE 7275.83 +0.58 + 0.01%, DAX 12551.82 -9.97 -0.08%, CAC 5235.18 -2.26 -0.04%

-

05:29

Global Stocks

European stocks swung between small gains and losses on Tuesday, with investors staying cautious ahead of this week's Federal Reserve meeting that will be scrutinized for hints on future U.S. monetary policy. The Stoxx Europe 600 index SXXP, +0.04% ended marginally higher at 382.12, after trading in a relatively tight range during the session.

U.S. stocks extended gains Tuesday with all three main benchmarks closing at records as the Federal Reserve began its two-day policy meeting where they are expected to finalize the details on the unwinding of its $4.5 trillion balance sheet. The Dow Jones Industrial Average DJIA, +0.18% rose 42 points, or 0.2%, to end at 22,373, its sixth straight record finish, while the S&P 500 SPX, +0.11% added 2 points, or 0.1%, to 2,506, logging its fourth record close in a row.

Equity trading across Asia was muted early Wednesday on caution before the U.S. Federal Reserve's policy announcement. After a solid start to the week, markets were treading water as investors awaited monetary policy guidance from the Federal Open Market Committee. Most investors aren't expecting interest rates to rise.

-