Market news

-

23:17

Stocks. Daily history for Jan 26’2017:

(index / closing price / change items /% change)

Nikkei +344.89 19402.39 +1.81%

TOPIX +23.43 1545.01 +1.54%

Hang Seng +325.05 23374.17 +1.41%

CSI 300 +12.06 3387.96 +0.36%

Euro Stoxx 50 -7.02 3319.13 -0.21%

FTSE 100 -2.94 7161.49 -0.04%

DAX +42.58 11848.63 +0.36%

CAC 40 -10.43 4867.24 -0.21%

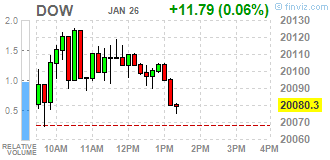

DJIA +32.40 20100.91 +0.16%

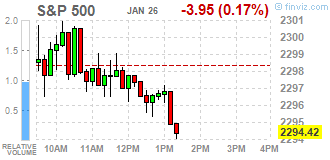

S&P 500 -1.69 2296.68 -0.07%

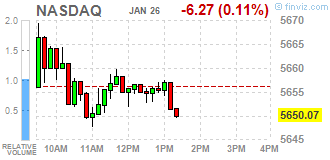

NASDAQ -1.16 5655.18 -0.02%

S&P/TSX -28.32 15615.52 -0.18%

-

20:01

DJIA 20106.94 38.43 0.19%, NASDAQ 5658.31 1.97 0.03%, S&P 500 2297.59 -0.78 -0.03%

-

18:25

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock indexes little changed on Thursday, after breaching the milestone a day earlier, while losses in tech stocks weighed on the S&P 500 and the Nasdaq Composite indexes. The post-election rally roared back to life this week following optimism over U.S. President Donald Trump's pro-growth initiatives and solid earnings, catapulting the Dow above the historic mark.

Dow stocks mixed (15 vs 15). Top loser - Verizon Communications Inc. (VZ, -1.35%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.31%).

Most of S&P sectors in negative area. Top gainer - Conglomerates (+1.5%). Top loser - Consumer goods (-0.7%).

At the moment:

Dow 20023.00 +20.00 +0.10%

S&P 500 2292.00 -2.00 -0.09%

Nasdaq 100 5154.50 +8.00 +0.16%

Oil 53.70 +0.95 +1.80%

Gold 1189.50 -8.30 -0.69%

U.S. 10yr 2.51 -0.01

-

17:05

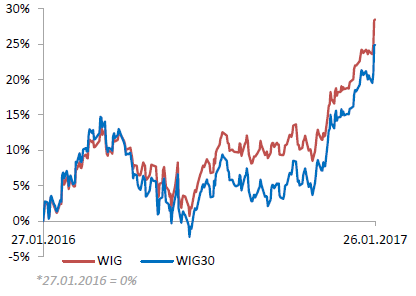

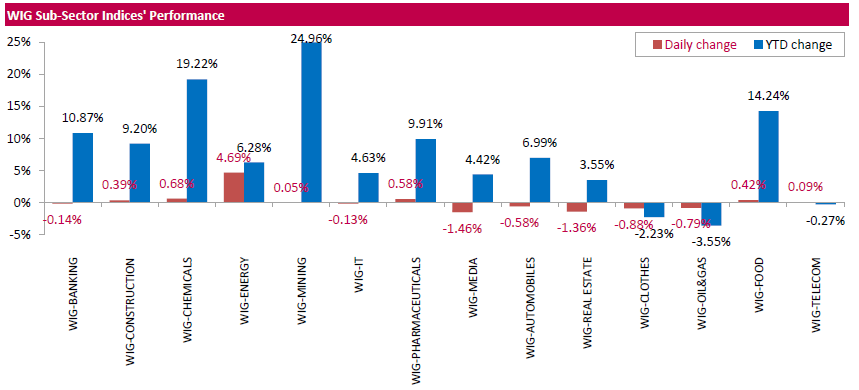

WSE: Session Results

Polish equity market closed slightly higher on Thursday. The broad market measure, the WIG index, added 0.14%. Sector performance within the WIG Index was mixed. Utilities stocks (+4.69%) were the strongest group, while media names (-1.46%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, edged up 0.07%. In the index basket, coking coal producer JSW (WSE: JSW) and four energy generating sector's names ENERGA (WSE: ENG), ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON (WSE: TPE) posted the largest gains, climbing by 2.41%-9.21%. At the same time, bank ING BSK (WSE: ING) was biggest loser, dropping by 3.43%. Other major laggards were footwear retailer CCC (WSE: CCC), bank MBANK (WSE: MBK) and oil refiner PKN ORLEN (WSE: PKN), falling by 1.87%, 1.12% and 1.1% respectively. It should be noted that PKN ORLEN reported that its net profit amounted to PLN 5.261 bln in 2016, up 85.4% y/y. Its total sales volume rose by 2 percent to a record 10 bln liters of fuel. But its revenues fell by 9.9% y/y to PLN 79.553 bln. As a result, its net margin stood at 12.1%, down 5.5 p.p. y/y. The company also said that it expected that its downstream margin might slightly decrease in 2017 compared to the 2016 average.

-

17:01

European stocks closed: FTSE 7161.49 -2.94 -0.04%, DAX 11848.63 42.58 0.36%, CAC 4867.24 -10.43 -0.21%

-

14:34

U.S. Stocks open: Dow +0.11%, Nasdaq +0.20%, S&P +0.06%

-

14:27

Before the bell: S&P futures 0%, NASDAQ futures +0.15%

U.S. stock-index futures were flat as investors demonstraded caution after the major indices closed at record highs yesterday.

Global Stocks:

Nikkei 19,402.39 +344.89 +1.81%

Hang Seng 23,374.17 +325.05 +1.41%

Shanghai 3,159.17 +9.61 +0.31%

FTSE 7,176.48 +12.05 +0.17%

CAC 4,878.65 +0.98 +0.02%

DAX 11,846.34 +40.29 +0.34%

Crude $53.11 (-0.13%)

Gold $1,188.00 (-0.82%)

-

13:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.26

-0.27(-0.7391%)

4154

ALTRIA GROUP INC.

MO

71.05

0.09(0.1268%)

817

AMERICAN INTERNATIONAL GROUP

AIG

60.83

-0.25(-0.4093%)

660

Apple Inc.

AAPL

121.8

-0.08(-0.0656%)

31310

AT&T Inc

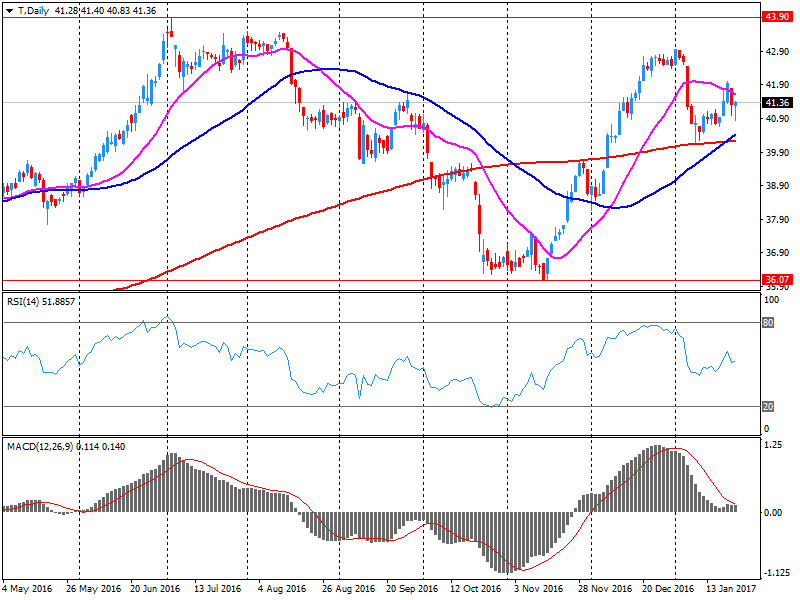

T

41.25

-0.14(-0.3382%)

79178

Barrick Gold Corporation, NYSE

ABX

87.15

-0.01(-0.0115%)

2714

Boeing Co

BA

167.52

0.16(0.0956%)

1896

Caterpillar Inc

CAT

97.2

-0.95(-0.9679%)

252781

Cisco Systems Inc

CSCO

30.73

0.03(0.0977%)

1942

Citigroup Inc., NYSE

C

57.77

0.08(0.1387%)

23388

E. I. du Pont de Nemours and Co

DD

76.85

0.18(0.2348%)

3890

Exxon Mobil Corp

XOM

85.62

0.28(0.3281%)

5710

Facebook, Inc.

FB

131.54

0.06(0.0456%)

88657

FedEx Corporation, NYSE

FDX

60.83

-0.25(-0.4093%)

660

Ford Motor Co.

F

87.15

-0.01(-0.0115%)

2714

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.37

-0.13(-0.7879%)

253996

General Motors Company, NYSE

GM

38.41

0.13(0.3396%)

9039

Google Inc.

GOOG

838.03

2.36(0.2824%)

8491

Home Depot Inc

HD

139.1

1.62(1.1784%)

610

HONEYWELL INTERNATIONAL INC.

HON

87.15

-0.01(-0.0115%)

2714

Intel Corp

INTC

37.93

0.13(0.3439%)

73641

International Business Machines Co...

IBM

178.44

0.15(0.0841%)

1706

Johnson & Johnson

JNJ

112.25

-0.55(-0.4876%)

252223

JPMorgan Chase and Co

JPM

86.15

0.12(0.1395%)

17237

McDonald's Corp

MCD

121.51

-0.28(-0.2299%)

603

Merck & Co Inc

MRK

60.83

-0.25(-0.4093%)

660

Microsoft Corp

MSFT

60.83

-0.25(-0.4093%)

660

Nike

NKE

53.89

0.03(0.0557%)

211

Pfizer Inc

PFE

31.4

0.11(0.3515%)

16978

Procter & Gamble Co

PG

87.15

-0.01(-0.0115%)

2714

Tesla Motors, Inc., NASDAQ

TSLA

254.3

-0.17(-0.0668%)

5939

The Coca-Cola Co

KO

60.83

-0.25(-0.4093%)

660

Travelers Companies Inc

TRV

60.83

-0.25(-0.4093%)

660

Twitter, Inc., NYSE

TWTR

87.15

-0.01(-0.0115%)

2714

United Technologies Corp

UTX

109.68

-1.28(-1.1536%)

296

Visa

V

84.05

0.15(0.1788%)

221

Yahoo! Inc., NASDAQ

YHOO

45.06

0.12(0.267%)

2451

Yandex N.V., NASDAQ

YNDX

23.45

-0.25(-1.0548%)

850

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Intl Paper (IP) upgraded to Buy from Neutral at Citigroup

Downgrades:

United Tech (UTX) downgraded to a Hold from Buy at Argus

Johnson & Johnson (JNJ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

AT&T (T) target raised to $42 from $39 at RBC Capital Mkts; Sector Perform

AT&T (T) target raised to $44 from $42 at FBR & Co.; Market Perform

-

13:14

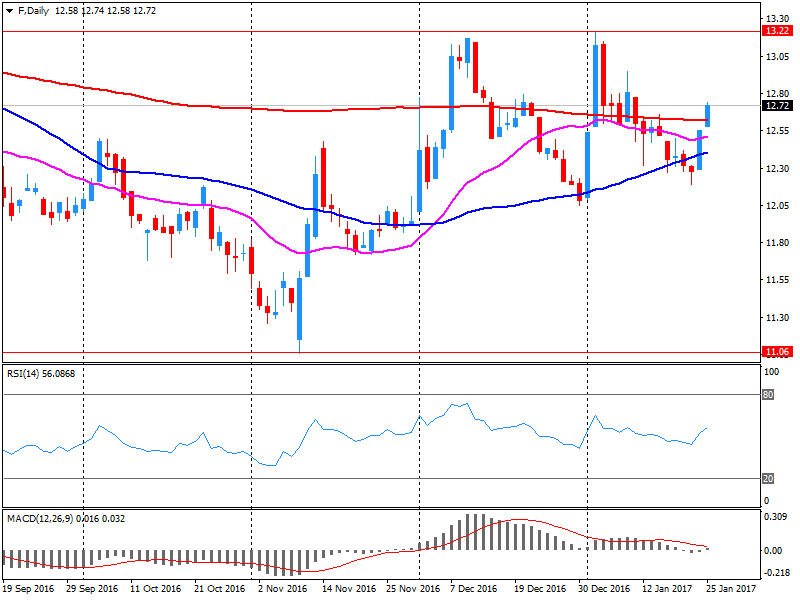

Company News: Ford Motor (F) posts mixed Q4 results

Ford Motor reported Q4 FY 2016 earnings of $0.30 per share (versus $0.58 in Q4 FY 2015), slightly missing analysts' consensus estimate of $0.32.

The company's quarterly revenues amounted to $38.700 bln (+2.10% y/y), beating analysts' consensus estimate of $34.893 bln.

F fell to $12.75 (-0.31%) in pre-market trading.

-

13:05

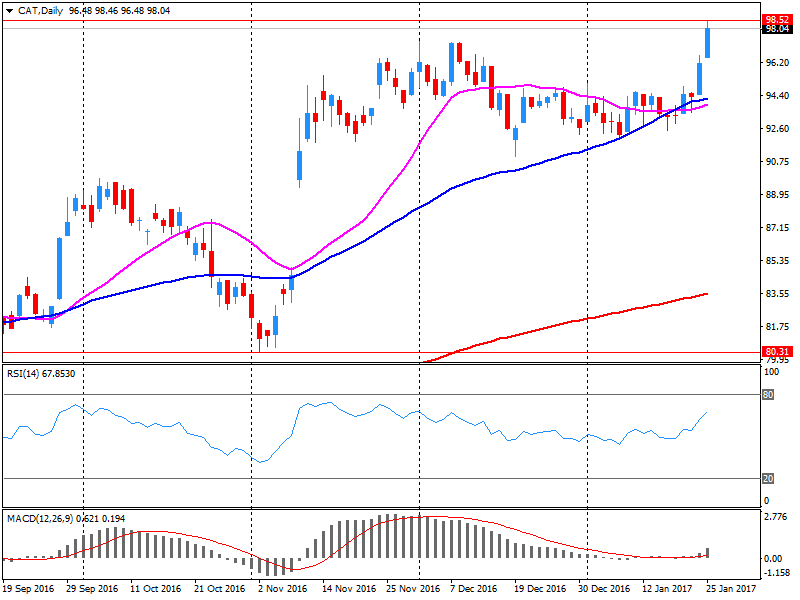

Company News: Caterpillar (CAT) posts mixed Q4 financials

Caterpillar reported Q4 FY 2016 earnings of $0.83 per share (versus $0.74 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $9.574 bln (-13.2% y/y), missing analysts' consensus estimate of $9.812 bln.

The company also said it slightly lowered its guidance for FY 2017. It now projects EPS of $2.90 (versus analysts' consensus estimate of $3.07) and revenues in a range of $36-39 bln (versus analysts' consensus estimate of $38.3 bln).

CAT fell to $97.19 (-0.98%) in pre-market trading.

-

12:47

Company News: AT&T (T) posts Q4 financials in line with analysts' estimates

AT&T reported Q4 FY 2016 earnings of $0.66 per share (versus $0.63 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $41.841 bln (-0.7% y/y), generally in-line with analysts' consensus estimate of $42.011 bln.

T rose to $41.40 (+0.02%) in pre-market trading.

-

09:16

Major stock markets in Europe trading in the green zone: DAX + 0.6%, FTSE + 0.3%, CAC40 + 0.3%, FTMIB + 0.7%, IBEX + 0.5%

-

07:55

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.2%, FTSE + 0.2%

-

06:26

Global Stocks

European stocks leapt Wednesday, pushed to their highest in more than a year by optimism over fresh records in the U.S. markets and a rally in bank shares. The Stoxx Europe 600 index SXXP, +1.29% climbed 1.3% to end at 366.59, its highest close since December 2015. The jump also marked the strongest one-day percentage gain since Nov. 9 last year.

The Dow Jones Industrial Average on Wednesday both crossed and closed above the 20,000 level for the first time, while the S&P 500 and Nasdaq Composite also cruised to records after upbeat earnings releases from heavyweights such as Boeing Co. and optimism over the economy.

Asian stock markets were broadly higher early Thursday, tracking overnight gains on Wall Street, with the Dow Jones Industrial Average closing above 20,000 points for the first time ever. The post-election equities rally in the U.S. has been spurred by hopes of fiscal spending, tax cuts and regulation rollback under the administration of President Donald Trump.

-