- “Most important NFP of the year” - BofA Merrill

Noticias del mercado

“Most important NFP of the year” - BofA Merrill

"In our view, Friday's US payrolls report will be watched even more keenly than usual as investors look for confirmation that the weak print last month was an outlier and not the start of a new, weaker trend.

Market expectations are for a significant bounce to 180k, matching our economists' estimates, but looking at historical data, we find some evidence of a tendency for consensus to over-estimate the size of the rebound following particularly disappointing payroll reports.

With Brexit spillovers keeping markets nervous, we believe the risks around Non-farm Payrolls (NFP) are asymmetric, especially following the broad risk rally we have seen up until Tuesday this week, with a miss in payrolls likely to see risk sentiment sharply affected. While a strong NFP report would moderate some negativity, we believe it would take a particularly strong print to meaningfully (and sustainably) move near-term Fed expectations forward, given post-Brexit global uncertainty.

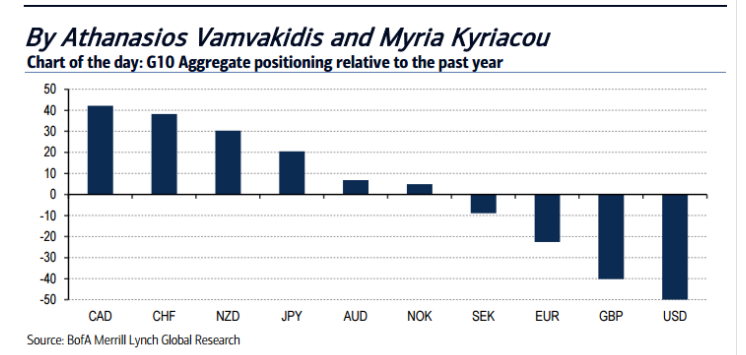

Positioning for delight… or disappointment in FX - sell CAD

Positioning suggests disappointment from a weak NFP would be negative for CAD/JPY and NZD/JPY, while a strong number could support USD/CAD and USD/CHF.

On balance, being short CAD going into the NFP has the best risk-reward potential, in our view".