Noticias del mercado

-

23:59

Schedule for today, Thursday, Jun 02’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance April -2.16 -2

01:30 Australia Retail Sales, M/M April 0.4% 0.3%

05:00 Japan Consumer Confidence May 40.8 40.4

08:30 United Kingdom PMI Construction May 52 52

09:00 OPEC OPEC Meetings

09:00 Eurozone Producer Price Index (YoY) April -4.2% -4.1%

09:00 Eurozone Producer Price Index, MoM April 0.3% 0.1%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0%

12:15 U.S. ADP Employment Report May 156 180

12:30 Eurozone ECB Press Conference

12:30 U.S. Continuing Jobless Claims May 2163 2150

12:30 U.S. Initial Jobless Claims May 268 270

12:35 U.S. FOMC Member Jerome Powell Speaks

13:00 United Kingdom BOE Gov Mark Carney Speaks

15:00 Canada BOC Deputy Governor Lawrence Schembri Speaks

15:00 U.S. Crude Oil Inventories May -4.226

23:30 Australia AIG Services Index May 49.7

-

22:00

U.S.: Total Vehicle Sales, mln, May 17.45 (forecast 17.2)

-

17:05

OECD keeps its global growth outlook unchanged

The Organization for Economic Cooperation and Development (OECD) released its growth forecast on Wednesday. The OECD kept its global growth outlook unchanged.

"Growth is flat in the advanced economies and has slowed in many of the emerging economies that have been the global locomotive since the crisis," the OECD Secretary-General Angel Gurria.

"Slower productivity growth and rising inequality pose further challenges," he added

The OECD expect the U.S. will grow 1.8% in 2016, down from the previous estimate of 2.0%, and 2.2% in 2017, unchanged from the previous estimate.

Japan's economy is expected to grow 0.7% in 2016 and 0.4% in 2017, down from the previous estimates of 0.8% and 0.6%, respectively.

Eurozone's forecast was upgraded to 1.6% in 2016 from the previous estimate of 1.4%, while 2017 forecast remained unchanged at 1.7% in 2017.

The OECD noted that Britain's leave from the European Union would weigh on the economic growth in the U.K., other European countries and the rest of the world.

China is expected to expand at 6.5% in 2016 and 6.2% in 2017, unchanged from the previous estimates.

Global GDP is estimated to grow 3.0% in 2016 and 3.3% in 2017, unchanged from the previous estimates.

-

16:40

Construction spending in the U.S. drops 1.8% in April

The U.S. Commerce Department released construction spending data on Wednesday. Construction spending in the U.S. dropped 1.8% in April, missing expectations for a 0.6% gain, after a 1.5% rise in March. It was the biggest drop January 2011.

March's figure was revised up from a 0.3% increase.

The decrease was mainly driven by a rise in total public and private spending. Total public construction spending slid 2.8% in April, while total spending on private construction projects decreased 1.5%.

-

16:22

ISM manufacturing purchasing managers’ index rises to 51.3 in May

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Wednesday. The index rose to 51.3 in May from 50.8 in April. Analysts had expected the index to decrease to 50.2.

A reading above 50 indicates expansion, below indicates contraction.

The increase was mainly driven by rises in prices and supplier deliveries. The price index jumped to 63.5 in May from 59.0 in April, while supplier deliveries climbed 54.1 from 49.1.

The production index dropped to 52.6 in May from 54.2 in April, while the new orders index fell to 55.7 from 55.8.

The employment index remained unchanged at 49.2 in May.

-

16:00

U.S.: ISM Manufacturing, May 51.3 (forecast 50.2)

-

16:00

U.S.: Construction Spending, m/m, April -1.8% (forecast 0.6%)

-

15:56

U.S. final manufacturing purchasing managers' index (PMI) decreases to 50.7 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. final manufacturing purchasing managers' index (PMI) decreased to 50.7 in May from 50.8 in April, up from the preliminary estimate of 50.5. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The index was driven by a slower pace of growth in new business, while output declined for the first time since September 2009.

"The survey data indicate that factory output fell in May at its fastest rate since 2009, suggesting that manufacturing is acting as a severe drag on the economy in the second quarter," Markit's Chief Economist Chris Williamson said.

"For those looking for a rebound in the economy after the lacklustre start to the year, the deteriorating trend in manufacturing is not going to provide any comfort," he added.

-

15:51

Canadian manufacturing PMI falls to 52.1 in May

Royal Bank of Canada (RBC), the Supply Chain Management Association (SCMA) and Markit Economics released their RBC Canadian manufacturing PMI on Wednesday. The index fell to 52.1 in May from 52.2 in April. It was the highest level since December 2014.

The decline was mainly driven by falls in new business and employment, while output rose to the highest level since June 2015.

"While production and new orders are up, the fall in export sales raises questions about Canada's transition to a more export-led expansion," RBC senior vice-president and chief economist, Craig Wright, said.

-

15:45

U.S.: Manufacturing PMI, May 50.7 (forecast 50.5)

-

15:43

Greece’s manufacturing PMI drops to 48.4 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Wednesday. Greece's manufacturing purchasing managers' index (PMI) dropped to 48.4 in May from 49.7 in April.

The drop was driven by declines in output, new orders and employment.

"The fall in demand for Greek goods, from both domestic and international markets, continued to take its toll on goods producers and remains a key roadblock for a future economic recovery," Markit economist Samuel Agass said.

-

15:38

Italy’s manufacturing PMI decreases to 52.4 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for Italy on Wednesday. Italy's Markit/ADACI manufacturing PMI decreased to 52.4 in May from 53.9 in April.

The decrease was driven by a slower growth in output, new orders and job creation.

"The index sank to its second-lowest level in the past 15 months, as the rates of expansion in output, new orders and employment eased. The latest export figure was likewise disappointing, showing the smallest rise in sales to clients from abroad since October 2014," Markit economist Phil Smith said.

-

15:37

Option expiries for today's 10:00 ET NY cut

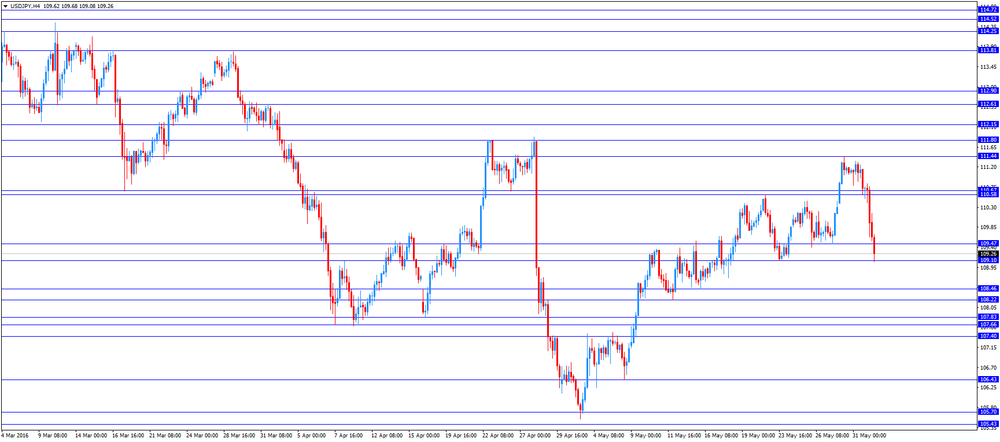

USDJPY 109.00 (240m) 109.50 (363m) 110.40-50 (630m) 111.25 (300m)

EURUSD: 1.1085 (EUR 862m) 1.1130 (980m) 1.1145-50 (307m) 1.1200 (1.18bln)1.1245-50 (457m) 1.1270 (248m) 1.1295-1.1300 (463m) 1.1365 (1.12bln)

GBPUSD 1.4525 (GBP 201m) 1.4600 (279m)

EURGBP 0.7725 (EUR 240m)

USDCHF 0.9700 (USD 240m) 0.9900 (240m)

AUDUSD 0.7200 (AUD 331m) 0.7275 (225m) 0.7375 (275m) 0.7440 (312m)

USDCAD 1.3015 (USD 360m) 1.3100 (1.17bln)

EURJPY 123.00 (EUR 263m)

-

15:31

Spain’s manufacturing PMI slides to 51.8 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for Spain on Wednesday. Spain's manufacturing purchasing managers' index (PMI) slid to 51.8 in May from 53.5 in April. It was the lowest level since October 2015.

The decrease was mainly driven by a slower growth in output, new orders and employment.

"The Spanish manufacturing sector moved closer to stagnation in May, according to the latest PMI release, suggesting that the current period of expansion could be coming to an end," a senior economist at Markit Andrew Harker said.

-

15:01

Nationwide: UK house prices rise 0.2% in May

The Nationwide Building Society released its house prices data for the U.K. on Wednesday. UK house prices were up 0.2% in May, after a 0.2% increase in April.

On a yearly basis, house prices fell to 4.7% in May from 4.9% in April.

"In the near term, it's going to be difficult to gauge the underlying strength of activity in the housing market due to the volatility generated by the stamp duty changes which took effect from 1 April.," Nationwide's Chief Economist, Robert Gardner, said.

"House purchase activity is likely to fall in the months ahead given the number of purchasers that brought forward transactions," he added.

-

14:38

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on the manufacturing PMI data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Manufacturing PMI May 50.1 50 50.1

01:00 China Non-Manufacturing PMI May 53.5 53.1

01:30 Australia Gross Domestic Product (QoQ) Quarter I 0.7% Revised From 0.6% 0.8% 1.1%

01:30 Australia Gross Domestic Product (YoY) Quarter I 2.9% Revised From 3% 2.8% 3.1%

01:45 China Markit/Caixin Manufacturing PMI May 49.4 49.2

02:00 Japan Manufacturing PMI (Finally) May 47.6 Revised From 48.2 47.6 47.7

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I 0.4% 0.2% 0.1%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I 0.3% Revised From 0.4% 0.8% 0.7%

07:15 Switzerland Retail Sales (MoM) April -0.3%

07:15 Switzerland Retail Sales Y/Y April -1.3%

07:30 Switzerland Manufacturing PMI May 54.7 54 55.8

07:50 France Manufacturing PMI (Finally) May 48 48.3 48.4

07:55 Germany Manufacturing PMI (Finally) May 51.8 52.4 52.1

08:00 Eurozone Manufacturing PMI (Finally) May 51.7 51.5 51.5

08:30 United Kingdom Net Lending to Individuals, bln April 9.2 Revised From 9.3 5.3 1.6

08:30 United Kingdom Purchasing Manager Index Manufacturing May 49.4 Revised From 49.2 49.6 50.1

08:30 United Kingdom Consumer credit, mln April 1822 Revised From 1883 1600 1287

08:30 United Kingdom Mortgage Approvals April 70.31 Revised From 71.36 67.9 66.25

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The final manufacturing purchasing managers' index is expected to decline to 50.5 in May from 50.8 in April.

The ISM manufacturing purchasing managers' index is expected to decrease to 50.2 in May from 50.8 in April.

The Fed will release its Beige Book at 18:00 GMT.

The euro traded higher against the U.S. dollar on the manufacturing PMI data from the Eurozone. Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final manufacturing purchasing managers' index (PMI) declined to 51.5 in May from 51.7 in April, in line with the preliminary reading.

The decline was driven by a slower growth in new business from both domestic and export markets.

"Manufacturing in the euro area remained stuck in a state of near-stagnation in May, failing to break out of the slow growth phase that has plagued producers since February," Chris Williamson, Chief Economist at Markit said.

"The disappointing performance of manufacturing adds to suspicions that the pace of Eurozone economic growth in the second quarter has cooled after a surprisingly brisk start to the year based on the latest estimate of GDP," he added.

Germany's final Markit/BME manufacturing PMI rose to 52.1 in May from 51.8 in April, down from the preliminary reading of 52.4.

France's final manufacturing PMI increased to 48.4 in May from 48.0 in April, up from the preliminary reading of 48.3.

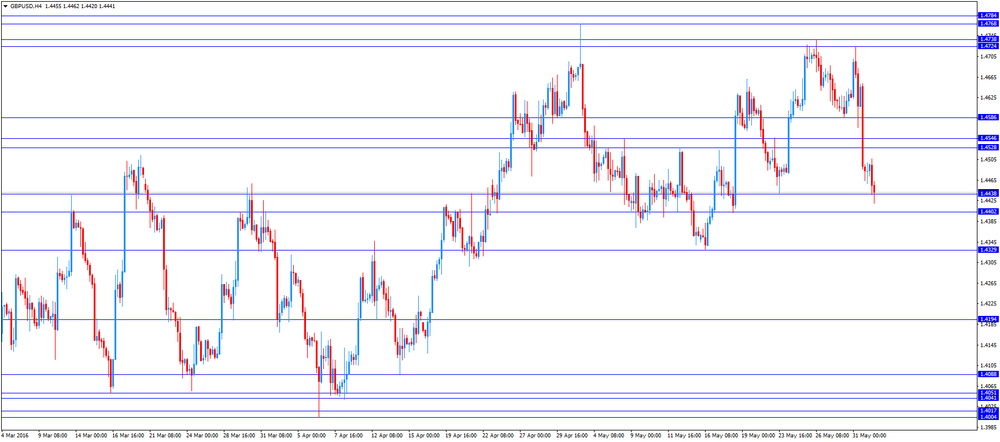

The British pound traded lower against the U.S. dollar on the mixed economic data from the U.K. Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. rose to 50.1 in May from 49.4 in April, exceeding expectations for a rise to 49.6. April's figure was revised up from 49.2. The increase was driven by rises in new orders, input costs and average selling prices.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Wednesday. The number of mortgages approvals in the U.K. was down to 66,250 in April from 70,305 in March, missing expectations for a decrease to 67,900. March's figure was revised down from 71,357.

Consumer credit in the U.K. rose by £1.287 billion in April, missing expectations for an £1.600 billion increase, after a £1.822 billion gain in March. March's figure was revised down from £1.833 billion.

Net lending to individuals in the U.K. increased by £1.6 billion in April, missing expectations for an £5.3 billion rise, after a £9.2 billion gain in March. March's figure was revised down from a £9.3 billion rise.

The Swiss franc traded higher against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.1% in the first quarter, missing expectations for a 0.2% gain, after a 0.4% increase in the fourth quarter. GDP was driven by a positive contribution from consumption expenditure from private households, investments in construction and equipment.

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Wednesday. The manufacturing purchasing managers' index in Switzerland climbed to 55.8 in May from 54.7 in April, beating expectations for a decline to 54.0. It was the highest level since February 2014. The increase was mainly driven by a rise in backlog of orders sub-indexes.

The Federal Statistical Office released its retail sales data for Switzerland on Wednesday. Retail sales in Switzerland were down at an annual rate of 1.9% in April, after a 1.6% decrease in March. March's figure was revised down from a 1.3% decline. Sales of food, beverages and tobacco fell at an annual rate of 0.8% in April, while non-food sales dropped 3.4%.

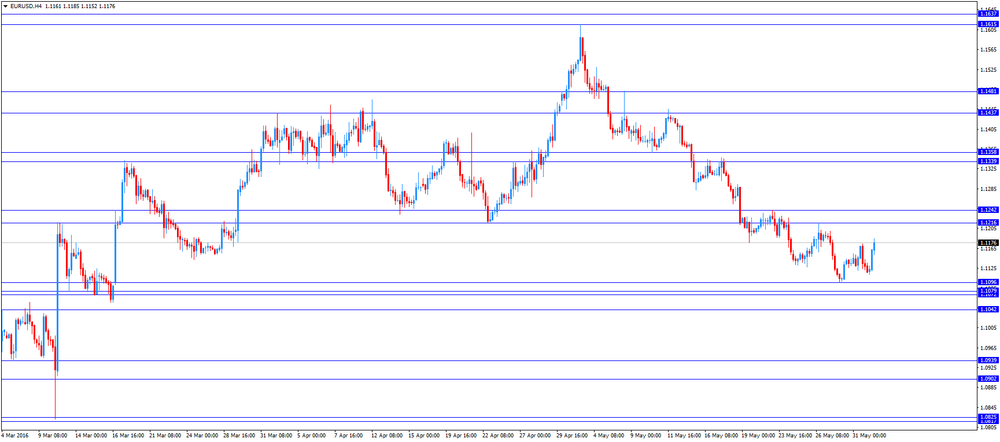

EUR/USD: the currency pair rose to $1.1185

GBP/USD: the currency pair fell to $1.4420

USD/JPY: the currency pair was down to Y109.08

The most important news that are expected (GMT0):

13:45 U.S. Manufacturing PMI (Finally) May 50.8 50.5

14:00 U.S. Construction Spending, m/m April 0.3% 0.6%

14:00 U.S. ISM Manufacturing May 50.8 50.2

18:00 U.S. Fed's Beige Book

-

14:19

Swiss manufacturing PMI climbs to 55.8 in May, the highest level since February 2014

Credit Suisse and procure.ch released their manufacturing purchasing managers' index (PMI) for Switzerland on Wednesday. The manufacturing purchasing managers' index in Switzerland climbed to 55.8 in May from 54.7 in April, beating expectations for a decline to 54.0. It was the highest level since February 2014.

A reading above 50 indicates expansion.

The increase was mainly driven by a rise in backlog of orders sub-indexes.

The production decreased to 52.7 in May from 59.4 in April, while the backlog of orders sub-index jumped to 60.2 from 57.6.

Purchase prices were up to 51.9 in May from 47.3 in April.

Employment rose to 50.0 in May from 49.1 in April.

-

14:00

Orders

EUR/USD

Offers 1.1150-60 1.1185 1.1200 1.1230 1.1250 1.1280-85 1.1300

Bids 1.1100-10 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4500 1.4530 1.4550 1.4580 1.4600 1.4625-30 1.4650 1.4670 1.4685 1.4700

Bids 1.4465 1.4450 1.4430 1.4400 1.4385 1.4365 1.4350 14330 1.4300-10

EUR/GBP

Offers 0.7700-05 0.7730 0.7755-60 0.7785 0.7800

Bids 0.7670 0.7650 0.7630 0.7600 0.7580-85 0.7565 0.7550

EUR/JPY

Offers 122.80 123.00 123.30 123.50 123.80 124.00 124.30 124.50

Bids 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers 110.20 110.50 110.80 111.00 111.20 111.35 1.1150 111.80 111.95-112.00

Bids 109.80 109.65 109.40-50 109.20 109.00 108.75-80 108.50 108.00

AUD/USD

Offers 0.7285 0.7300 0.7320-25 0.7350 0.7375-80 0.7400

Bids 0.7250 0.7225 0.7200 0.7180-85 0.7150 0.7135 0.7100

-

12:33

Number of mortgages approvals in the U.K. declines to 66,250 in April

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Wednesday. The number of mortgages approvals in the U.K. was down to 66,250 in April from 70,305 in March, missing expectations for a decrease to 67,900. March's figure was revised down from 71,357.

Consumer credit in the U.K. rose by £1.287 billion in April, missing expectations for an £1.600 billion increase, after a £1.822 billion gain in March. March's figure was revised down from £1.833 billion.

Net lending to individuals in the U.K. increased by £1.6 billion in April, missing expectations for an £5.3 billion rise, after a £9.2 billion gain in March. March's figure was revised down from a £9.3 billion rise.

-

12:13

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. rises to 50.1 in May

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Wednesday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. rose to 50.1 in May from 49.4 in April, exceeding expectations for a rise to 49.6. April's figure was revised up from 49.2.

A reading above 50 indicates expansion, below indicates contraction.

The increase was driven by rises in new orders, input costs and average selling prices.

"The manufacturing sector continued its lacklustre start to 2016. Although key indicators for output, new orders and the headline PMI all ticked higher in May, the latest survey is still consistent with around a 0.8% quarterly decline in the official ONS Manufacturing Production Index," Markit's Senior Economist Rob Dobson said.

"There are signs that increased client uncertainty resulting from slower growth and the forthcoming EU referendum is weighing on investment spending," he added.

-

12:07

France’s final manufacturing PMI increases to 48.4 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Wednesday. France's final manufacturing purchasing managers' index (PMI) increased to 48.4 in May from 48.0 in April, up from the preliminary reading of 48.3.

Output slid a fastest pace since April 2015, while employment dropped at the sharpest since August 2014.

"French manufacturers continued to face a difficult operating environment in May, with output and employment falling at sharper rates. Soft demand conditions continue to hold back new order intakes, leading manufacturers to cut their output prices further in a bid to stimulate sales," Markit Senior Economist Jack Kennedy said.

-

11:52

Germany’s final manufacturing PMI rises to 52.1 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Wednesday. Germany's final Markit/BME manufacturing purchasing managers' index (PMI) rose to 52.1 in May from 51.8 in April, down from the preliminary reading of 52.4.

The index was mainly driven by rises in output.

"It is encouraging that Germany's manufacturing PMI appears to be on an upward journey, with the latest index reading the highest since January and fuelled by an acceleration in output growth and sustained job creation," Markit economist Oliver Kolodseike said.

-

11:48

Eurozone’s final manufacturing PMI declines to 51.5 in May

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final manufacturing purchasing managers' index (PMI) declined to 51.5 in May from 51.7 in April, in line with the preliminary reading.

The decline was driven by a slower growth in new business from both domestic and export markets.

"Manufacturing in the euro area remained stuck in a state of near-stagnation in May, failing to break out of the slow growth phase that has plagued producers since February," Chris Williamson, Chief Economist at Markit said.

"The disappointing performance of manufacturing adds to suspicions that the pace of Eurozone economic growth in the second quarter has cooled after a surprisingly brisk start to the year based on the latest estimate of GDP," he added.

-

11:43

Swiss retail sales decline 1.9% year-on-year in April

The Federal Statistical Office released its retail sales data for Switzerland on Wednesday. Retail sales in Switzerland were down at an annual rate of 1.9% in April, after a 1.6% decrease in March. March's figure was revised down from a 1.3% decline.

Sales of food, beverages and tobacco fell at an annual rate of 0.8% in April, while non-food sales dropped 3.4%.

On a monthly basis, retail sales rose by 0.1% in April, after a 0.4% drop in March. March's figure was revised down from a 0.3% fall.

Sales of food, beverages and tobacco declined 0.3% in April, while non-food sales climbed 1.2%.

-

11:33

Switzerland's GDP rises 0.1% in the first quarter

The State Secretariat for Economic Affairs (SECO) released its gross domestic product (GDP) data for Switzerland on Wednesday. Switzerland's GDP rose 0.1% in the first quarter, missing expectations for a 0.2% gain, after a 0.4% increase in the fourth quarter.

GDP was driven by a positive contribution from consumption expenditure from private households, investments in construction and equipment.

Exports of goods climbed 2.1% in the first quarter, while exports of services increased 2.0%.

Imports of goods climbed 0.4% in the first quarter, while imports of services were up 2.8%.

Household spending rose by 0.7% in the first quarter, government spending was down 0.8%, equipment spending slid 2.1%, while construction spending increased 1.1%.

On a yearly basis, Switzerland's economy grew at 0.7% in the first quarter, missing expectations for a 0.8% rise, after a 0.3% increase in the fourth quarter. The fourth quarter's figure was revised down from a 0.4% growth.

-

11:21

Final Markit/Nikkei manufacturing purchasing managers' index for Japan rises to 47.7 in May

The final Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan rose to 47.7 in May from 47.6 in April, up from the preliminary reading of 47.6. April's figure was revised down from 48.2.

A reading above 50 indicates expansion, a reading below 50 indicates contraction of activity.

Output, new orders and new exports orders declined at a faster pace in May

"The aftermaths of the earthquakes in one of Japan's key manufacturing regions continued to weigh heavily on the manufacturing sector," economist at Markit, Amy Brownbill, said.

-

11:17

Chinese Markit/Caixin manufacturing PMI decreases to 49.2 in May

The Chinese Markit/Caixin manufacturing PMI fell to 49.2 in May from 49.4 in April. The decrease was driven by declines in output and new orders. Employment continued to decline.

"Overall, China's economy has not been able to sustain the recovery it had in the first quarter and is in the process of bottoming out," Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group, said.

"The government still needs to make full use of proactive fiscal policy measures accompanied by a prudent monetary policy to prevent the economy from slowing further," he added.

-

11:11

Capital spending in Japan jumps 4.2% in the first quarter

Japan's Ministry of Finance released its capital spending data on late Tuesday evening. Capital spending in Japan jumped 4.2% in the first quarter, exceeding expectations for a 1.9% rise, after a 8.5% gain in the fourth quarter.

Capital spending excluding software soared 4.3% in the first quarter, after a 8.9% rise in the fourth quarter.

Company profits in Japan declined 9.3% in the first quarter, while company sales were down 3.3%.

-

11:06

Australian Industry Group’s manufacturing purchasing managers’ index for Australia drops to 51.0 in May

The Australian Industry Group (AiG) released its manufacturing purchasing managers' index (PMI) for Australia on the late Tuesday evening. The index dropped to 51.0 in May from 53.4 in April.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

A stronger Australian dollar in early 2016 weighed on the activity in the manufacturing sector. The renewed depreciation of the Aussie after the interest rate cut in May could support the manufacturing sector.

-

11:02

Option expiries for today's 10:00 ET NY cut

USD/JPY 109.00 (240m) 109.50 (363m) 110.40-50 (630m) 111.25 (300m)

EUR/USD: 1.1085 (EUR 862m) 1.1130 (980m) 1.1145-50 (307m) 1.1200 (1.18bln) 1.1245-50 (457m) 1.1270 (248m) 1.1295-1.1300 (463m) 1.1365 (1.12bln)

GBP/USD 1.4525 (GBP 201m) 1.4600 (279m)

EUR/GBP 0.7725 (EUR 240m)

USD/CHF 0.9700 (USD 240m) 0.9900 (240m)

AUD/USD 0.7200 (AUD 331m) 0.7275 (225m) 0.7375 (275m) 0.7440 (312m)

USD/CAD 1.3015 (USD 360m) 1.3100 (1.17bln)

EUR/JPY 123.00 (EUR 263m)

-

11:00

BRC: U.K. shop prices are down 1.8% year-on-year in May

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.8% year-on-year in May, after a 1.7% decline in April.

The decline was mainly driven by a drop in non-food prices, which plunged 2.7% year-on-year in May.

Food prices fell at an annual rate of 0.3% in May.

"Looking slightly longer term we know that the recent commodity price increases will start to put pressure on retailers to raise their own prices. We would normally expect these input costs to filter through to prices eventually, but the big question is how far fierce competition in the industry will insulate consumers from price increases," BRC Chief Executive, Helen Dickinson, said.

-

10:54

OECD: G20 total international merchandise trade declines in the first quarter

OECD released its G20 total international merchandise trade data on Tuesday. G20 total international merchandise trade, seasonally adjusted and expressed in current US dollars, declined in the first quarter of 2016 due to further drop in oil prices. Exports slid by 3.8% in the first quarter, while imports plunged by 4.1%.

-

10:48

European Central Bank Governing Council member Ignazio Visco: the ECB is ready to add further stimulus measures if needed

The European Central Bank (ECB) Governing Council member Ignazio Visco said on Tuesday that the central bank was ready to add further stimulus measures if needed to boost inflation in the Eurozone.

"We will continue if necessary to deploy all the instruments made available to us in our mandate," he said.

-

10:37

Japanese Prime Minister Shinzo Abe announces the government will delay the sales tax rise until October 2019

Japanese Prime Minister Shinzo Abe announced on Wednesday that the government would delay the sales tax rise until October 2019. The Japanese government planned to increase the sales tax to 10% in April 2017 from the 8%.

Abe said that the delay should help the economy to improve.

-

10:32

United Kingdom: Net Lending to Individuals, bln, April 1.6 (forecast 5.3)

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , May 50.1 (forecast 49.6)

-

10:30

United Kingdom: Mortgage Approvals, April 66.25 (forecast 67.9)

-

10:30

United Kingdom: Consumer credit, mln, April 1287 (forecast 1600)

-

10:21

Official data: Chinese manufacturing PMI remains unchanged at 50.1 in May

The Chinese manufacturing PMI remained unchanged at 50.1 in May, according to the Chinese government. Analysts had expected the index to decrease to 50.0.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The production sub-index increased to 52.3 in May from 52.2 in April, the new orders sub-index was down to 50.7 from 51, and the new exports sub-index fell to 50 from 50.1, while the employment sub-index increased to 48.2 from 47.8.

The services PMI decreased to 53.1 in May from 53.5 in April.

-

10:10

Australia's GDP climbs 1.1% in the first quarter

The Australian Bureau of Statistics released its GDP data on Wednesday. Australia's GDP climbed 1.1% in the first quarter, exceeding expectations for a 0.8% gain, after a 0.7% rise in the fourth quarter. The fourth quarter's figure was revised up from a 0.6% increase.

Final consumption spending was up 0.7% in the first quarter.

Terms of trade dropped 1.9% in the first quarter, while real net national disposable income increased 0.2%.

Private gross fixed capital formation dropped 2.2% in the first quarter.

On a yearly basis, Australia's GDP rose 3.1% in the first quarter, beating expectations for a 2.8% increase, after a 2.9% gain in the fourth quarter. The fourth quarter's figure was revised down from a 3.0% rise.

-

10:00

Eurozone: Manufacturing PMI, May 51.5 (forecast 51.5)

-

09:55

Germany: Manufacturing PMI, May 52.1 (forecast 52.4)

-

09:50

France: Manufacturing PMI, May 48.4 (forecast 48.3)

-

09:30

Switzerland: Manufacturing PMI, May 55.8 (forecast 54)

-

08:33

Asian session: The Australian dollar jumped

The Australian dollar was up 0.6 percent to $0.7277 helped by stronger-than-expected first quarter economic growth, which pushed it further away from last week's three-month low of $0.7145.

There was little market reaction to the official and private surveys on China's manufacturing activity, whCrude pulled back from eight-month highs reached last week amid expectations that a global glut was easing, falling overnight to profit taking. U.S. crude was last down 0.7 percent at $48.76 a barrel and Brent fell 0.8 percent to $49.51.

ich were roughly in line with expectations, suggesting the world's second-largest economy is still struggling to regain traction.

The Caixin/Markit Manufacturing Purchasing Managers' index (PMI) showed activity at China's factories shrank for a 15th straight month in May. The official manufacturing May PMI painted a slightly more optimistic picture and stood unchanged from the previous month at 50.1

Sterling was on the defensive, last trading little changed at $1.4490 after dropping more than one percent on Tuesday, after polls showing those who support Brexit may be increasing.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1125-35

GBP / USD: during the Asian session, the pair was trading in the $ 1.4465-90

USD / JPY: it fell to Y109.65 in the Asian session, the pair

Based on Reuters materials

-

08:31

Options levels on wednesday, June 1, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1264 (3732)

$1.1225 (4306)

$1.1193 (1586)

Price at time of writing this review: $1.1121

Support levels (open interest**, contracts):

$1.1087 (4731)

$1.1061 (5041)

$1.1027 (3524)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 73888 contracts, with the maximum number of contracts with strike price $1,1400 (5255);

- Overall open interest on the PUT options with the expiration date June, 3 is 87171 contracts, with the maximum number of contracts with strike price $1,1200 (8005);

- The ratio of PUT/CALL was 1.18 versus 1.21 from the previous trading day according to data from May, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.4800 (1643)

$1.4701 (2095)

$1.4603 (2605)

Price at time of writing this review: $1.4493

Support levels (open interest**, contracts):

$1.4395 (1744)

$1.4298 (2692)

$1.4199 (2997)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 32679 contracts, with the maximum number of contracts with strike price $1,4500 (2678);

- Overall open interest on the PUT options with the expiration date June, 3 is 35401 contracts, with the maximum number of contracts with strike price $1,4200 (2997);

- The ratio of PUT/CALL was 1.08 versus 1.07 from the previous trading day according to data from May, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Switzerland: Gross Domestic Product (QoQ) , Quarter I 0.1% (forecast 0.2%)

-

07:45

Switzerland: Gross Domestic Product (YoY), Quarter I 0.7% (forecast 0.8%)

-

04:00

Japan: Manufacturing PMI, May 47.7 (forecast 47.6)

-

03:30

Australia: Gross Domestic Product (QoQ), Quarter I 1.1% (forecast 0.8%)

-

03:30

Australia: Gross Domestic Product (YoY), Quarter I 3.1% (forecast 2.8%)

-

03:01

China: Manufacturing PMI , May 50.1 (forecast 50)

-

03:00

China: Non-Manufacturing PMI, May 53.1

-

01:50

Japan: Capital Spending, March 4.2% (forecast 1.9%)

-

01:32

Australia: AIG Manufacturing Index, May 51.0

-

00:33

Currencies. Daily history for May 31’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1130 -0,04%

GBP/USD $1,4483 -0,98%

USD/CHF Chf0,9936 +0,15%

USD/JPY Y110,71 -0,38%

EUR/JPY Y123,23 -0,41%

GBP/JPY Y160,34 -1,36%

AUD/USD $0,7230 +0,68%

NZD/USD $0,6762 +1,08%

USD/CAD C$1,3092 +0,34%

-

00:01

Schedule for today, Wednesday, Jun 01’2016:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI May 50.1 50

01:00 China Non-Manufacturing PMI May 53.5

01:30 Australia Gross Domestic Product (QoQ) Quarter I 0.6% 0.6%

01:30 Australia Gross Domestic Product (YoY) Quarter I 3% 2.7%

01:45 China Markit/Caixin Manufacturing PMI May 49.4

02:00 Japan Manufacturing PMI (Finally) May 48.2 47.6

05:45 Switzerland Gross Domestic Product (QoQ) Quarter I 0.4% 0.2%

05:45 Switzerland Gross Domestic Product (YoY) Quarter I 0.4% 0.8%

07:15 Switzerland Retail Sales (MoM) April -0.3%

07:15 Switzerland Retail Sales Y/Y April -1.3%

07:30 Switzerland Manufacturing PMI May 54.7 54

07:50 France Manufacturing PMI (Finally) May 48 48.3

07:55 Germany Manufacturing PMI (Finally) May 51.8 52.4

08:00 Eurozone Manufacturing PMI (Finally) May 51.7 51.5

08:30 United Kingdom Net Lending to Individuals, bln April 9.3 5.3

08:30 United Kingdom Purchasing Manager Index Manufacturing May 49.2 49.6

08:30 United Kingdom Consumer credit, mln April 1883 1600

08:30 United Kingdom Mortgage Approvals April 71.36 67.9

13:45 U.S. Manufacturing PMI (Finally) May 50.8 50.5

14:00 U.S. Construction Spending, m/m April 0.3% 0.6%

14:00 U.S. ISM Manufacturing May 50.8 50.2

18:00 U.S. Fed's Beige Book

20:00 U.S. Total Vehicle Sales, mln May 17.42 17.2

-