Noticias del mercado

-

19:03

European Central Bank President Mario Draghi: Eurozone’s economy is expected to continue to recover

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Interest rates will remain low for an extended period of time;

- The economy in the Eurozone continued to recover;

- The ECB is ready to act if needed to boost inflation toward 2% target;

- There are downside risks, but the balance of risks improved due to the central bank's stimulus measures;

- Downside risks are the slowdown in the global economy, the upcoming British referendum and other geopolitical risks;

- Inflation in the Eurozone could be negative in the coming months before rising in the second half of 2016;

- Structural and fiscal policies were needed.

- Interest rates will remain low for an extended period of time;

-

18:40

European Central Bank upgrades its inflation and growth forecasts for this year

The ECB raised its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.2% in 2016, up from its March estimate of 0.1%, 1.3% in 2017, unchanged from its March estimate, and 1.6% in 2018, unchanged from its March estimate.

The central bank expects the economy in the Eurozone to expand 1.6% in 2016, up from its March estimate of 1.4%, 1.7% in 2017, unchanged from its March estimate, and 1.7% in 2018, down from its March estimate of 1.8%.

-

15:50

Option expiries for today's 10:00 ET NY cut

USDJPY 108.00-05 (611m) 108.60 (355m) 109.00 (1.32bln) 109.50 (689m) 110.00 (222m) 110.50 (820m) 111.00 (962m) 112.00 (575m)

EURUSD: 1.1035 (EUR 678m) 1.1050 (383m) 1.1100 (1.78bln) 1.1200 (620m) 1.1225 (356m) 1.1255-60 (861m) 1.1300 (413m) 1.1369 (640m) 1.1400 (442m)

GBPUSD 1.4355 (GBP 227m) 1.4380 (321m) 1.4400 (398m) 1.4450 (181m) 1.4500 (419m)

AUDUSD 0.7150 (AUD 455m) 0.7200 (486m) 0.7240 (1.6bln) 0.7260 (259m) 0.7285-90 (412m) 0.7300 (449m) 0.7350 (808m) 0.7440 (764m)

USDCAD 1.3000 (USD 920m) 1.3100 (1.06bln) 1.3250 (815m)

NZDUSD 0.6800 (NZD 209m)

EURJPY 123.50 (EUR 235m)

AUDJPY 80.00 (AUD 275m)

-

15:08

OECD: consumer price inflation in the OECD area remains unchanged at 0.8% year-on-year in April

OECD released its consumer price inflation (CPI) data on Thursday. Consumer price inflation in the OECD area remained unchanged at 0.8% year-on-year in April.

Energy prices slid at an annual rate of 7.8% in April, up from a 9.5% fall in March, while food prices decreased to 0.4% from 0.7%.

CPI excluding food and energy in the OECD area fell to 1.8% year-on-year in April from 1.9% in March.

February's CPI was -0.1% in Germany, -0.3% in Japan, -0.5% in Italy, 1.1% in the U.S, 1.7% in Canada, and 0.3% in the U.K.

The consumer price inflation in Eurozone was -0.2% in April, while the inflation in China was 2.3%.

-

14:46

European Central Bank keeps its interest rate unchanged at 0.00% in June

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.00%. This decision was widely expected by analysts.

The ECB will start to buy corporate bonds on June 08.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its meeting in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. The central bank decided to launch further four targeted longer-term refinancing operations (LTRO).

-

14:40

Initial jobless claims fall to 267,000 in the week ending May 28

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 28 in the U.S. decreased by 1,000 to 267,000 from 268,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 65th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 12,000 to 2,172,000 in the week ended May 21.

-

14:30

U.S.: Initial Jobless Claims, May 267 (forecast 270)

-

14:30

U.S.: Continuing Jobless Claims, May 2172 (forecast 2150)

-

14:25

U.S. ADP Employment Report: private sector adds 173,000 jobs in May

Private sector in the U.S. added 173,000 jobs in May, according the ADP report on Thursday. April's figure was revised up to 166,000 jobs from a previous reading of 156,000 jobs.

Analysts expected the private sector to add 175,000 jobs.

Services sector added 175,000 jobs in May, while goods-producing sector shed 1,000.

"Job growth has moderated this spring as energy companies and manufacturers shed jobs," the Chief Economist of Moody's Analytics Mark Zandi said.

"Retailers are also more circumspect in their hiring. Despite the recent slowdown, job growth remains strong enough to reduce underemployment," he added.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 4.9% in May from 5.0% in April. The U.S. economy is expected to add 162,000 jobs in May, after adding 160,000 jobs in April.

-

14:15

U.S.: ADP Employment Report, May 173 (forecast 175)

-

14:11

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the release of the European Central Bank’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Trade Balance April -1.97 Revised From -2.16 -2 -1.58

01:30 Australia Retail Sales, M/M April 0.4% 0.3% 0.2%

05:00 Japan Consumer Confidence May 40.8 40.4 40.9

08:30 United Kingdom PMI Construction May 52 52 51.2

09:00 OPEC OPEC Meetings

09:00 Eurozone Producer Price Index (YoY) April -4.1% Revised From -4.2% -4.1% -4.4%

09:00 Eurozone Producer Price Index, MoM April 0.3% 0.1% -0.3%

11:45 Eurozone ECB Interest Rate Decision 0.0% 0.0% 0.0%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. Private sector in the U.S. is expected to add 175,000 jobs in May, according the ADP report on Wednesday.

The number of initial jobless claims in the U.S. is expected to rise by 2,000 to 270,000 last week.

The euro traded mixed against the U.S. dollar after the release of the European Central Bank's (ECB) interest rate decision. The central bank kept its interest rate unchanged as widely expected by analysts. The ECB will start to buy corporate bonds on June 08.

A press conference is scheduled to be at 12:30 GMT.

Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index declined 0.3% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

On a yearly basis, Eurozone's producer price index dropped 4.4% in April, missing expectations for a 4.1% decline, after a 4.1% fall in March. March's figure was revised up from a 4.2% drop.

Eurozone's producer prices excluding energy fell 1.2% year-on-year in April, after a 1.1% decline in March. Energy prices dropped at an annual rate of 12.5% in April.

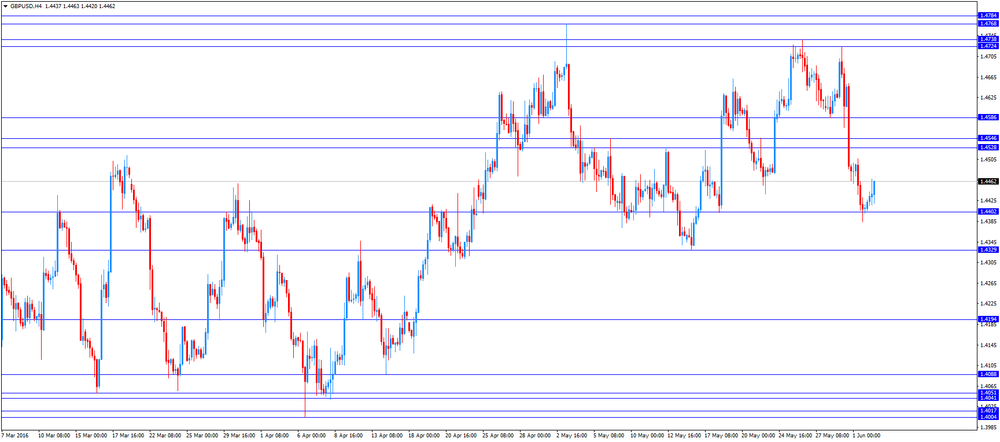

The British pound traded higher against the U.S. dollar after the release of the weaker-than-expected construction PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 51.2 in May from 52.0 in April. It was the lowest level since June 2013. Analysts had expected the index to remain unchanged at 52.0.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new orders.

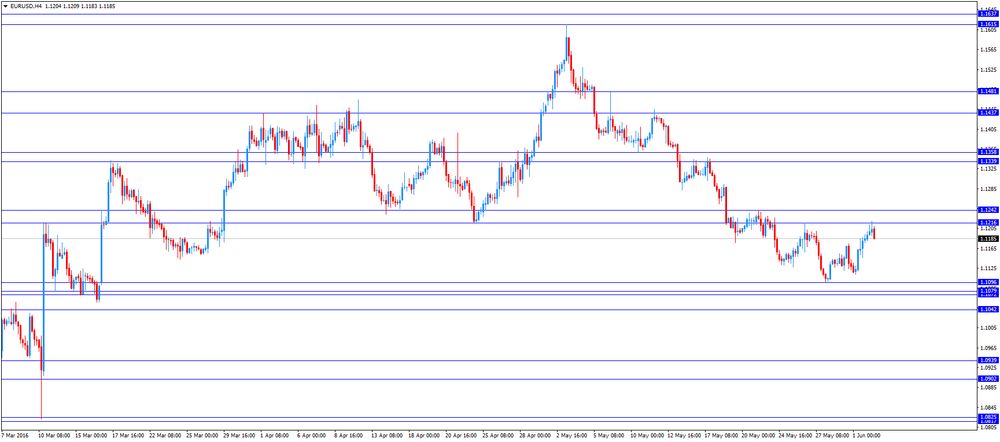

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.4467

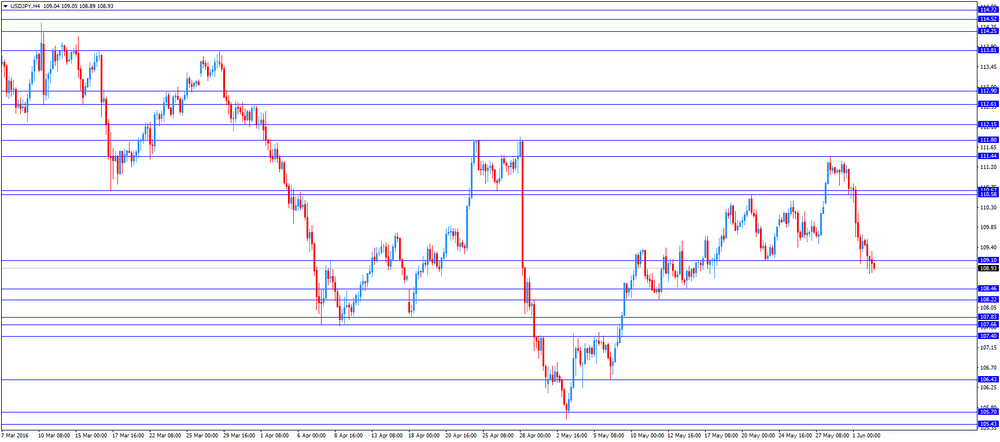

USD/JPY: the currency pair was down to Y108.83

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report May 156 175

12:30 Eurozone ECB Press Conference

12:30 U.S. Initial Jobless Claims May 268 270

12:35 U.S. FOMC Member Jerome Powell Speaks

13:00 United Kingdom BOE Gov Mark Carney Speaks

14:00 Eurozone ECB President Mario Draghi Speaks

15:00 Canada BOC Deputy Governor Lawrence Schembri Speaks

15:00 U.S. Crude Oil Inventories May -4.226 -2.72

-

13:50

Orders

EUR/USD

Offers 1.1220-25 1.1250 1.1280-85 1.1300 1.1325-30 1.1350 1.1380 1.1400

Bids 1.1200 1.1185 1.1165 1.1150 1.1130 1. 1.1100-10 1.1080 1.1065 1.1050 1.1030 1.1000

GBP/USD

Offers 1.4500 1.4530 1.4550 1.4580 1.4600 1.4625-30 1.4650 1.4670 1.4685 1.4700

Bids 1.4400 1.4385 1.4365 1.4350 14330 1.4300-10

EUR/GBP

Offers 0.7785 0.7800-10 0.7830 0.7850 0.7885 0.7900

Bids 0.7750 0.7730 0.7700 0.7670 0.7650 0.7630 0.7600

EUR/JPY

Offers 122.60 122.80 123.00 123.30 123.50 123.80 124.00 124.30 124.50

Bids 122.00 121.70 121.50 121.20 121.00

USD/JPY

Offers 109.50-60 109.80 110.00 110.20 110.50 110.80 111.00 111.20 111.35 1.1150

Bids 109.00 108.75-80 108.50 108.00 107.50

AUD/USD

Offers 0.7270 0.7285 0.7300 0.7320-25 0.7350 0.7375-800.7400

Bids 0.7225 0.7200 0.7180-85 0.7150 0.7135 0.7100

-

13:45

Eurozone: ECB Interest Rate Decision, 0.0% (forecast 0.0%)

-

11:53

Number of registered unemployed people in Spain decrease by 119,768 in May

Spain's labour ministry release its labour market figures on Thursday. The number of registered unemployed people decreased by 119,768 in May, after a 83,599 drop in April.

The decline was driven by a fall in unemployment in the farm sector.

The number of registered youth unemployed people fell by 45,853 in May from the last year.

The total number of jobless in Spain was 3.89 million in May, below 4 million level for the first time since August 2010.

-

11:37

Japan’s consumer confidence index increases to 40.9 in May

Japan's Cabinet Office released its consumer confidence index on Thursday. The consumer confidence index increased to 40.9 in May from 40.8 in April.

The increase was driven by rises in 3 of 4 sub-indexes. The overall livelihood sub-index increased to 39.7 in May from 39.6 in April, the income growth sub-index remained unchanged at 40.8, the employment sub-index rose to 42.9 from 42.8, while the willingness to buy durable goods sub-index was up to 40.2 from 39.8.

-

11:33

UK construction PMI slides to 51.2 in May

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 51.2 in May from 52.0 in April. It was the lowest level since June 2013.

Analysts had expected the index to remain unchanged at 52.0.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new orders.

"Construction companies are facing a challenging second quarter of 2016, with growth headwinds apparent across all three key areas of activity," Senior Economist at Markit, Tim Moore, said.

"May data signalled the worst month for commercial building since June 2013, while residential work and civil engineering activity both saw a renewed loss of momentum," he added.

-

11:11

Eurozone's producer price index declines 0.3% in April

Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index declined 0.3% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

Intermediate goods prices rose 0.2% in April, capital goods prices were up 0.1%, non-durable consumer goods prices were down 0.1% and durable consumer goods prices increased 0.1%, while energy prices decreased 1.1%.

On a yearly basis, Eurozone's producer price index dropped 4.4% in April, missing expectations for a 4.1% decline, after a 4.1% fall in March. March's figure was revised up from a 4.2% drop.

Eurozone's producer prices excluding energy fell 1.2% year-on-year in April, after a 1.1% decline in March. Energy prices dropped at an annual rate of 12.5% in April.

-

11:03

Retail sales in Australia rise 0.2% in April

The Australian Bureau of Statistics released its retail sales data on Thursday. Retail sales in Australia rose 0.2% in April, missing expectations for a 0.3% rise, after a 0.4% increase in March.

Sales in cafes, restaurants and takeaway food services climbed 1.0% in April, sales in household goods retailing were up 0.3%, and clothing, footwear and personal accessory retailing sales rose 0.5%, while department stores sales increased 0.4%.

On a yearly basis, retail sales climbed 3.6% in April, after a 3.6% rise in March.

-

11:00

Eurozone: Producer Price Index (YoY), April -4.4% (forecast -4.1%)

-

11:00

Eurozone: Producer Price Index, MoM , April -0.3% (forecast 0.1%)

-

10:46

Australia's trade deficit narrows to A$1.58 billion in April

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$1.58 billion in April from A$1.97 billion in March, beating expectations for a rise to a deficit of A$2.0 billion. March's figure was revised down from a deficit of A$2.16 billion.

Exports increased by 1.0% in April, while imports declined by 1.0%.

-

10:30

United Kingdom: PMI Construction, May 51.2 (forecast 52)

-

10:21

Option expiries for today's 10:00 ET NY cut

USD/JPY 108.00-05 (611m) 108.60 (355m) 109.00 (1.32bln) 109.50 (689m) 110.00 (222m) 110.50 (820m) 111.00 (962m) 112.00 (575m)

EUR/USD: 1.1035 (EUR 678m) 1.1050 (383m) 1.1100 (1.78bln) 1.1200 (620m) 1.1225 (356m) 1.1255-60 (861m) 1.1300 (413m) 1.1369 (640m) 1.1400 (442m)

GBP/USD 1.4355 (GBP 227m) 1.4380 (321m) 1.4400 (398m) 1.4450 (181m) 1.4500 (419m)

AUD/USD 0.7150 (AUD 455m) 0.7200 (486m) 0.7240 (1.6bln) 0.7260 (259m) 0.7285-90 (412m) 0.7300 (449m) 0.7350 (808m) 0.7440 (764m)

USD/CAD 1.3000 (USD 920m) 1.3100 (1.06bln) 1.3250 (815m)

NZD/USD 0.6800 (NZD 209m)

EUR/JPY 123.50 (EUR 235m)

AUD/JPY 80.00 (AUD 275m)

-

10:17

Beige Book: the U.S. economic activity expands modestly in most districts

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economy expanded modestly in most districts since the last Beige Book report.

The Districts of Philadelphia, Cleveland, Atlanta, Chicago, St. Louis and Minneapolis activity grew modestly, San Francisco's economy expanded moderately, Chicago's and Kansas City's activity economy rose slowly, Dallas' economy expanded marginally, while the New York District's growth was steady.

The Fed noted that consumer rose modestly in many district, the labour market expanded modestly, while prices increased slightly in most districts.

Manufacturing activity was mixed across districts, while construction activity rose April through mid-May.

-

08:36

Asian session: The Australian dollar dipped

The Australian dollar dipped 0.1 percent to $0.7250 , losing a some steam after rising sharply to a two-week high of $0.7300 the previous day on stronger-than-expected local first quarter GDP data.Asian stocks eased on Thursday after surveys showed global manufacturing activity and demand remain weak, while a jump in the yen sent Japan's Nikkei reeling more than 2 percent.

June 2 The yen sat on top of large gains against its peers early on Thursday after surging on risk aversion and disappointment over lack of clear policy guidance by Japan following a decision to delay a consumption tax hike.

The dollar was steady at 109.480 yen, having slid from a high of 110.830 overnight as a big drop in Tokyo stocks fuelled bids for the safe-haven currency.

The greenback, which had soared to a one-month high of 111.455 yen on Monday on expectations for an early U.S. rate hike, also took a big knock after Japanese Prime Minister Shinzo Abe announced on Wednesday that he was delaying a sales tax hike by two and a half years.

The euro lost 0.6 percent versus the yen on Wednesday and last traded at 122.50, while the Australian dollar retreated 0.7 percent against the yen overnight.

Worries about whether Britain will vote to stay in the European Union or not later this month also buoyed the yen, although the Japanese currency did give back some its big gains against the dollar late Wednesday on the stronger-than-expected Institute for Supply Management (ISM) U.S. factory activity numbers.

The dollar will await the U.S. May ADP private employment report due later in the day for potential relief, with the report often seen providing clues to the all-important non-farm payrolls data scheduled for release on Friday.

EUR / USD: during the Asian session, the pair is trading in the range of $ 1.1190-1.1210

GBP / USD: during the Asian session, the pair was trading in the $ 1.4415-40

USD / JPY: during the Asian session, the pair is trading in the range of $ 108.80-109.50

Based on Reuters materials

-

08:33

Options levels on thursday, June 2, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1312 (3838)

$1.1273 (3979)

$1.1242 (4397)

Price at time of writing this review: $1.1194

Support levels (open interest**, contracts):

$1.1144 (7402)

$1.1117 (4302)

$1.1082 (5139)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 73675 contracts, with the maximum number of contracts with strike price $1,1400 (5180);

- Overall open interest on the PUT options with the expiration date June, 3 is 85812 contracts, with the maximum number of contracts with strike price $1,1200 (7402);

- The ratio of PUT/CALL was 1.16 versus 1.18 from the previous trading day according to data from June, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.4700 (2061)

$1.4601 (2611)

$1.4503 (2664)

Price at time of writing this review: $1.4429

Support levels (open interest**, contracts):

$1.4394 (1532)

$1.4297 (2756)

$1.4199 (3005)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 32991 contracts, with the maximum number of contracts with strike price $1,4500 (2664);

- Overall open interest on the PUT options with the expiration date June, 3 is 35458 contracts, with the maximum number of contracts with strike price $1,4200 (3005);

- The ratio of PUT/CALL was 1.07 versus 1.08 from the previous trading day according to data from June, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:05

Japan: Consumer Confidence, May 40.9 (forecast 40.4)

-

03:30

Australia: Retail Sales, M/M, April 0.2% (forecast 0.3%)

-

03:30

Australia: Trade Balance , April -1.58 (forecast -2)

-

00:30

Currencies. Daily history for Jun 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1185 +0,49%

GBP/USD $1,4411 -0,50%

USD/CHF Chf0,9882 -0,55%

USD/JPY Y109,45 -1,15%

EUR/JPY Y122,42 -0,66%

GBP/JPY Y157,74 -1,65%

AUD/USD $0,7251 +0,29%

NZD/USD $0,6814 +0,76%

USD/CAD C$1,3077 -0,11%

-