Noticias del mercado

-

21:01

DJIA 17814.63 24.96 0.14%, NASDAQ 4963.29 11.04 0.22%, S&P 500 2101.90 2.57 0.12%

-

19:03

European Central Bank President Mario Draghi: Eurozone’s economy is expected to continue to recover

The European Central Bank (ECB) President Mario Draghi said at a press conference on Thursday:

- Interest rates will remain low for an extended period of time;

- The economy in the Eurozone continued to recover;

- The ECB is ready to act if needed to boost inflation toward 2% target;

- There are downside risks, but the balance of risks improved due to the central bank's stimulus measures;

- Downside risks are the slowdown in the global economy, the upcoming British referendum and other geopolitical risks;

- Inflation in the Eurozone could be negative in the coming months before rising in the second half of 2016;

- Structural and fiscal policies were needed.

- Interest rates will remain low for an extended period of time;

-

18:40

European Central Bank upgrades its inflation and growth forecasts for this year

The ECB raised its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.2% in 2016, up from its March estimate of 0.1%, 1.3% in 2017, unchanged from its March estimate, and 1.6% in 2018, unchanged from its March estimate.

The central bank expects the economy in the Eurozone to expand 1.6% in 2016, up from its March estimate of 1.4%, 1.7% in 2017, unchanged from its March estimate, and 1.7% in 2018, down from its March estimate of 1.8%.

-

18:13

European stocks close: stocks closed mixed on the ECB’s interest rate decision

Stock closed slightly mixed after the release of the European Central Bank's (ECB) interest rate decision. The central bank kept its interest rate unchanged as widely expected by analysts. The ECB will start to buy corporate bonds on June 08.

The ECB raised its inflation and growth forecasts. Inflation in the Eurozone is expected to be 0.2% in 2016, up from its March estimate of 0.1%, 1.3% in 2017, unchanged from its March estimate, and 1.6% in 2018, unchanged from its March estimate. The central bank expects the economy in the Eurozone to expand 1.6% in 2016, up from its March estimate of 1.4%, 1.7% in 2017, unchanged from its March estimate, and 1.7% in 2018, down from its March estimate of 1.8%.

Market participants also eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index declined 0.3% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

On a yearly basis, Eurozone's producer price index dropped 4.4% in April, missing expectations for a 4.1% decline, after a 4.1% fall in March. March's figure was revised up from a 4.2% drop.

Eurozone's producer prices excluding energy fell 1.2% year-on-year in April, after a 1.1% decline in March. Energy prices dropped at an annual rate of 12.5% in April.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 51.2 in May from 52.0 in April. It was the lowest level since June 2013. Analysts had expected the index to remain unchanged at 52.0.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new orders.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,185.61 -6.32 -0.10 %

DAX 10,208 +3.56 +0.03 %

CAC 40 4,466 -9.39 -0.21 %

-

18:00

European stocks closed: FTSE 6185.61 -6.32 -0.10%, DAX 10208.00 3.56 0.03%, CAC 4466.00 -9.39 -0.21%

-

17:50

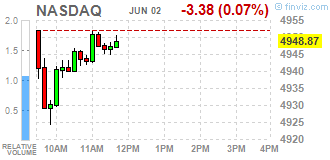

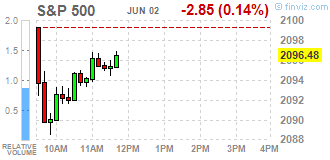

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stocks slightly fell on Thursday morning, weighed down by a fall in Apple as well as a morning drop in energy companies after OPEC failed to agree on output policy. Apple (AAPL) was down about one percent after Goldman Sachs cut its price target on the stock, citing lower growth expectations for the smartphone industry. Oil price came bake after Crude inventories data, which showed decreasing oil reserves in USA on previous week.

Most of Dow stocks in negative area (17 of 30). Top looser - Exxon Mobil Corporation (XOM, -1,67%). Top gainer - Johnson & Johnson (JNJ, +1,11%).

Most of S&P sectors also in negative area. Top looser - Utilities (-0,8%). Top gainer - Healthcare (+0,8%).

At the moment:

Dow 17750.00 -29.00 -0.16%

S&P 500 2093.50 -4.50 -0.21%

Nasdaq 100 4510.50 -11.00 -0.24%

Oil 48.94 -0.07 -0.14%

Gold 1213.90 -0.80 -0.07%

U.S. 10yr 1.80 -0.04

-

17:39

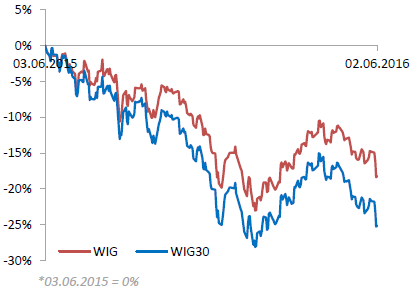

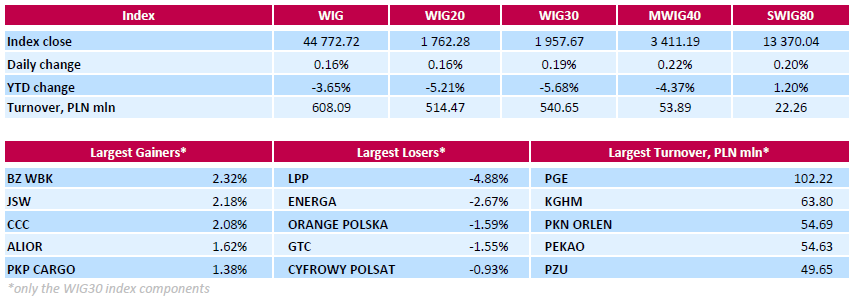

WSE: Session Results

Polish equity market closed higher on Thursday. The broad market benchmark, the WIG Index, added 0.16%. Sector-wise, construction sector (+0.68%) was the best-performing group, while telecoms (-1.35%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, grew by 0.19%. In the index basket, bank BZ WBK (WSE: BZW), coking coal miner JSW (WSE: JSW) and footwear retailer CCC (WSE: CCC) topped the list of the session's best performers, gaining 2.32%, 2.18% and 2.08% respectively. On the other side of the ledger, clothing retailer LPP (WSE: LPP) recorded the biggest drop of 4.88%, as the company announced that pace of its sales growth in May was 5% y/y, which, however, was not enough to impress the investors. Other major decliners were genco ENERGA (WSE: ENG), telecommunication services provider ORANGE POLSKA (WSE: OPL) and property developer GTC (WSE: GTC), which plunged by 2.67%, 1.59% and 1.55% respectively.

-

15:33

U.S. Stocks open: Dow -0.23%, Nasdaq -0.19%, S&P -0.21%

-

15:25

Before the bell: S&P futures -0.20%, NASDAQ futures -0.15%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 16,562.55 -393.18 -2.32%

Hang Seng 20,859.22 +98.24 +0.47%

Shanghai Composite 2,925.07 +11.56 +0.40%

FTSE 6,195.54 +3.61 +0.06%

CAC 4,464.16 -11.23 -0.25%

DAX 10,197.48 -6.96 -0.07%

Crude $48.79 (-0.45%)

Gold $1216.60 (+0.16%)

-

15:08

OECD: consumer price inflation in the OECD area remains unchanged at 0.8% year-on-year in April

OECD released its consumer price inflation (CPI) data on Thursday. Consumer price inflation in the OECD area remained unchanged at 0.8% year-on-year in April.

Energy prices slid at an annual rate of 7.8% in April, up from a 9.5% fall in March, while food prices decreased to 0.4% from 0.7%.

CPI excluding food and energy in the OECD area fell to 1.8% year-on-year in April from 1.9% in March.

February's CPI was -0.1% in Germany, -0.3% in Japan, -0.5% in Italy, 1.1% in the U.S, 1.7% in Canada, and 0.3% in the U.K.

The consumer price inflation in Eurozone was -0.2% in April, while the inflation in China was 2.3%.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169

0.31(0.1838%)

200

ALCOA INC.

AA

9.2

-0.10(-1.0753%)

6065

Amazon.com Inc., NASDAQ

AMZN

719.68

0.24(0.0334%)

7270

American Express Co

AXP

66

0.09(0.1365%)

415

Apple Inc.

AAPL

97.82

-0.64(-0.65%)

180432

Barrick Gold Corporation, NYSE

ABX

17.04

0.14(0.8284%)

32932

Caterpillar Inc

CAT

72.5

0.23(0.3183%)

6572

Chevron Corp

CVX

100.4

-0.73(-0.7218%)

1440

Citigroup Inc., NYSE

C

46.8

-0.14(-0.2983%)

3733

Deere & Company, NYSE

DE

82.99

0.16(0.1932%)

508

Exxon Mobil Corp

XOM

88.36

-0.88(-0.9861%)

21925

Facebook, Inc.

FB

118.65

-0.13(-0.1094%)

26210

Ford Motor Co.

F

13.07

-0.04(-0.3051%)

22275

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.47

-0.13(-1.2264%)

85914

General Electric Co

GE

30.01

-0.10(-0.3321%)

846

General Motors Company, NYSE

GM

30.19

-0.03(-0.0993%)

3186

Goldman Sachs

GS

160

0.03(0.0188%)

2710

Google Inc.

GOOG

734.58

0.43(0.0586%)

371

Hewlett-Packard Co.

HPQ

13.39

-0.05(-0.372%)

6510

International Business Machines Co...

IBM

151.19

-1.32(-0.8655%)

257

JPMorgan Chase and Co

JPM

65.69

0.00(0.00%)

543

McDonald's Corp

MCD

120.7

-0.38(-0.3138%)

5525

Microsoft Corp

MSFT

52.85

-0.00(-0.00%)

16369

Nike

NKE

54.55

-0.22(-0.4017%)

4661

Pfizer Inc

PFE

34.62

-0.13(-0.3741%)

1035

Procter & Gamble Co

PG

81.88

0.09(0.11%)

850

Starbucks Corporation, NASDAQ

SBUX

54.8

-0.02(-0.0365%)

488

Tesla Motors, Inc., NASDAQ

TSLA

219.5

-0.06(-0.0273%)

2983

Twitter, Inc., NYSE

TWTR

14.98

-0.04(-0.2663%)

30407

Verizon Communications Inc

VZ

50.43

0.00(0.00%)

4072

Wal-Mart Stores Inc

WMT

70.35

-0.15(-0.2128%)

1922

Yahoo! Inc., NASDAQ

YHOO

36.55

-0.10(-0.2729%)

54410

Yandex N.V., NASDAQ

YNDX

20.35

-0.21(-1.0214%)

725

-

14:46

European Central Bank keeps its interest rate unchanged at 0.00% in June

The European Central Bank (ECB) kept its monetary unchanged on Thursday. The interest rate remained unchanged at 0.00%. This decision was widely expected by analysts.

The ECB will start to buy corporate bonds on June 08.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its meeting in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. The central bank decided to launch further four targeted longer-term refinancing operations (LTRO).

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded to Neutral from Buy at BofA/Merrill

Other:

Home Depot (HD) initiated with a Buy at BTIG Research

FedEx (FDX) target raised to $178 from $174 at Stifel

Amazon (AMZN) target raised to $820 from $770 at Evercore ISI

-

14:40

Initial jobless claims fall to 267,000 in the week ending May 28

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending May 28 in the U.S. decreased by 1,000 to 267,000 from 268,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 65th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 12,000 to 2,172,000 in the week ended May 21.

-

14:25

U.S. ADP Employment Report: private sector adds 173,000 jobs in May

Private sector in the U.S. added 173,000 jobs in May, according the ADP report on Thursday. April's figure was revised up to 166,000 jobs from a previous reading of 156,000 jobs.

Analysts expected the private sector to add 175,000 jobs.

Services sector added 175,000 jobs in May, while goods-producing sector shed 1,000.

"Job growth has moderated this spring as energy companies and manufacturers shed jobs," the Chief Economist of Moody's Analytics Mark Zandi said.

"Retailers are also more circumspect in their hiring. Despite the recent slowdown, job growth remains strong enough to reduce underemployment," he added.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to decline to 4.9% in May from 5.0% in April. The U.S. economy is expected to add 162,000 jobs in May, after adding 160,000 jobs in April.

-

12:00

European stock markets mid session: stocks traded higher ahead the ECB’s interest rate decision

Stock indices traded higher ahead of the release of the European Central Bank's (ECB) interest rate decision. Analysts expect the central bank to keep its interest rate unchanged.

Market participants also eyed the economic data from the Eurozone. Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index declined 0.3% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

On a yearly basis, Eurozone's producer price index dropped 4.4% in April, missing expectations for a 4.1% decline, after a 4.1% fall in March. March's figure was revised up from a 4.2% drop.

Eurozone's producer prices excluding energy fell 1.2% year-on-year in April, after a 1.1% decline in March. Energy prices dropped at an annual rate of 12.5% in April.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 51.2 in May from 52.0 in April. It was the lowest level since June 2013. Analysts had expected the index to remain unchanged at 52.0.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new orders.

Current figures:

Name Price Change Change %

FTSE 100 6,213.07 +21.14 +0.34 %

DAX 10,220.54 +16.10 +0.16 %

CAC 40 4,481.94 +6.55 +0.15 %

-

11:53

Number of registered unemployed people in Spain decrease by 119,768 in May

Spain's labour ministry release its labour market figures on Thursday. The number of registered unemployed people decreased by 119,768 in May, after a 83,599 drop in April.

The decline was driven by a fall in unemployment in the farm sector.

The number of registered youth unemployed people fell by 45,853 in May from the last year.

The total number of jobless in Spain was 3.89 million in May, below 4 million level for the first time since August 2010.

-

11:37

Japan’s consumer confidence index increases to 40.9 in May

Japan's Cabinet Office released its consumer confidence index on Thursday. The consumer confidence index increased to 40.9 in May from 40.8 in April.

The increase was driven by rises in 3 of 4 sub-indexes. The overall livelihood sub-index increased to 39.7 in May from 39.6 in April, the income growth sub-index remained unchanged at 40.8, the employment sub-index rose to 42.9 from 42.8, while the willingness to buy durable goods sub-index was up to 40.2 from 39.8.

-

11:33

UK construction PMI slides to 51.2 in May

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. dropped to 51.2 in May from 52.0 in April. It was the lowest level since June 2013.

Analysts had expected the index to remain unchanged at 52.0.

A reading above 50 indicates expansion in the construction sector.

The decline was mainly driven by a drop in new orders.

"Construction companies are facing a challenging second quarter of 2016, with growth headwinds apparent across all three key areas of activity," Senior Economist at Markit, Tim Moore, said.

"May data signalled the worst month for commercial building since June 2013, while residential work and civil engineering activity both saw a renewed loss of momentum," he added.

-

11:11

Eurozone's producer price index declines 0.3% in April

Eurostat released its producer price index for the Eurozone on Thursday. Eurozone's producer price index declined 0.3% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

Intermediate goods prices rose 0.2% in April, capital goods prices were up 0.1%, non-durable consumer goods prices were down 0.1% and durable consumer goods prices increased 0.1%, while energy prices decreased 1.1%.

On a yearly basis, Eurozone's producer price index dropped 4.4% in April, missing expectations for a 4.1% decline, after a 4.1% fall in March. March's figure was revised up from a 4.2% drop.

Eurozone's producer prices excluding energy fell 1.2% year-on-year in April, after a 1.1% decline in March. Energy prices dropped at an annual rate of 12.5% in April.

-

11:03

Retail sales in Australia rise 0.2% in April

The Australian Bureau of Statistics released its retail sales data on Thursday. Retail sales in Australia rose 0.2% in April, missing expectations for a 0.3% rise, after a 0.4% increase in March.

Sales in cafes, restaurants and takeaway food services climbed 1.0% in April, sales in household goods retailing were up 0.3%, and clothing, footwear and personal accessory retailing sales rose 0.5%, while department stores sales increased 0.4%.

On a yearly basis, retail sales climbed 3.6% in April, after a 3.6% rise in March.

-

10:46

Australia's trade deficit narrows to A$1.58 billion in April

The Australian Bureau of Statistics released its trade data on Thursday. Australia's trade deficit narrowed to A$1.58 billion in April from A$1.97 billion in March, beating expectations for a rise to a deficit of A$2.0 billion. March's figure was revised down from a deficit of A$2.16 billion.

Exports increased by 1.0% in April, while imports declined by 1.0%.

-

10:17

Beige Book: the U.S. economic activity expands modestly in most districts

The Fed released its Beige Book on Wednesday. The central bank said that the U.S. economy expanded modestly in most districts since the last Beige Book report.

The Districts of Philadelphia, Cleveland, Atlanta, Chicago, St. Louis and Minneapolis activity grew modestly, San Francisco's economy expanded moderately, Chicago's and Kansas City's activity economy rose slowly, Dallas' economy expanded marginally, while the New York District's growth was steady.

The Fed noted that consumer rose modestly in many district, the labour market expanded modestly, while prices increased slightly in most districts.

Manufacturing activity was mixed across districts, while construction activity rose April through mid-May.

-

08:20

WSE: Before opening

The Warsaw market once again showed the worse side, and breaking of the 1,800 points level by the WIG20 index asks to look at the January lows. The last two sessions on The WSE were very unsuccessful. An important reason seems to be unofficial information about the following changes in the functioning of open pension funds and there is still no solution to the problem of foreign currency loans. This is clearly seen in the weakness of the banking sector.

The global risk appetite has also decreased, but at a disproportionately smaller scale. Yesterday's session on Wall Street despite the start of declines, ended with a slight increase. If the world sentiment would have seriously deteriorated, it should translate into further declines on the Warsaw Stock Exchange.

For this day the important point will be the ECB press conference with the presentation of new economic forecasts although we should not expect major changes or bold announcements.

-

07:03

Global Stocks

European stocks finished lower Wednesday, with mining shares among the biggest laggards after lackluster Chinese manufacturing data underscored worries about the health of the world's second-largest economy.

The Stoxx Europe 600 SXXP, -0.96% fell 1% to end at 344.12.

U.S. stocks eked out a gain Wednesday as investors focused on the positive aspects of the latest batch of data that showed the U.S. economy plodding along.

The Federal Reserve's Beige Book, a collection of anecdotes about the economy, indicated that most districts were seeing only moderate performance and that consumer spending and employment posted mostly modest growth.

The S&P 500 SPX, +0.11% edged up 2.37 points, or 0.1%, to close at 2,099.33, as seven of its 10 main sectors were trading in the green. Consumer-staples stocks, up 0.7%, topped gainers for the large-cap index, while a 1% decline in telecommunications shares weighed.

The Dow Jones Industrial Average DJIA, +0.01% recovered from a more than 120-point drop to end 2.47 points higher, or less than 0.1%, at 17,789.67.

Asian stocks eased on Thursday after surveys showed global manufacturing activity and demand remain weak, while a jump in the yen sent Japan's Nikkei reeling more than 2 percent.

MSCI's broadest index of Asia-Pacific shares outside Japan struggled to keep its head above water after rising more than 3 percent over the last seven days.

-

04:07

Nikkei 225 16,661.42 -294.31 -1.74 %, Hang Seng 20,816.28 +55.30 +0.27 %, Shanghai Composite 2,916.56 +3.06 +0.10 %

-

00:31

Stocks. Daily history for Jun 01’2016:

(index / closing price / change items /% change)

Nikkei 225 16,955.73 -279.25 -1.6 %

Hang Seng 20,760.98 -54.11 -0.3 %

S&P/ASX 200 5,323.17 -55.39 -1.0 %

Shanghai Composite 2,914.21 -2.41 -0.1 %

FTSE 100 6,191.93 -38.86 -0.6 %

CAC 40 4,475.39 -30.23 -0.7 %

Xetra DAX 10,204.44 -58.30 -0.6 %

S&P 500 2,099.33 +2.37 +0.1 %

NASDAQ Composite 4,952.25 +4.20 +0.1 %

Dow Jones 17,789.67 +2.47 0.0%

-