Noticias del mercado

-

23:46

Schedule for today, Wednesday, Jan 03’2018 (GMT0)

00:01 Japan Bank holiday

08:15 Switzerland Retail Sales (MoM) November -1.5%

08:15 Switzerland Retail Sales Y/Y November -3.0%

08:30 Switzerland Manufacturing PMI December 65.1 64.6

08:55 Germany Unemployment Rate s.a. December 5.6% 5.5%

08:55 Germany Unemployment Change December -18 -14

09:30 United Kingdom PMI Construction December 53.1 53.2

15:00 U.S. Construction Spending, m/m November 1.4% 0.8%

15:00 U.S. ISM Manufacturing December 58.2 58.2

19:00 U.S. FOMC meeting minutes

20:00 U.S. Total Vehicle Sales, mln December 17.48 17.4

22:30 Australia AIG Services Index December 51.7

-

15:45

U.S.: Manufacturing PMI, December 55.1 (forecast 55)

-

15:25

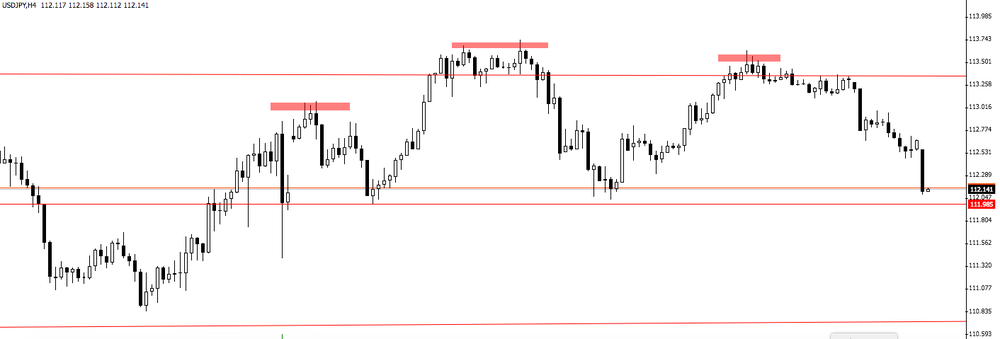

USD/JPY 4 hour time frame chart

USD/JPY has been following a bearish movement on the last few days.

However, as we can see on 4-hour time frame chart, the price is forming a chart pattern (head and shoulder) which can bring a more downside movements in this pair.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , December 56.3 (forecast 58)

-

10:28

EUR/USD Daily time frame chart

On daily time frame chart, we can see that there is a chart pattern (Head and shoulders) which the price has already broken the neckline.

However, it may be interesting to trade when the price starts to correct its movement.

Therefore, our suggestion is to wait for the retest of that neckline in order to enter long in this pair.

-

10:00

Eurozone: Manufacturing PMI, December 60.6 (forecast 60.6)

-

09:55

Germany: Manufacturing PMI, December 63.3 (forecast 63.3)

-

09:50

France: Manufacturing PMI, December 58.8 (forecast 59.3)

-

06:47

Options levels on tuesday, January 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.2130 (4380)

$1.2105 (3711)

$1.2076 (4165)

Price at time of writing this review: $1.1998

Support levels (open interest**, contracts):

$1.1944 (2317)

$1.1897 (4792)

$1.1849 (4677)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date January, 5 is 98603 contracts (according to data from December, 29) with the maximum number of contracts with strike price $1,2200 (6158);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3597 (2965)

$1.3578 (4730)

$1.3562 (2514)

Price at time of writing this review: $1.3499

Support levels (open interest**, contracts):

$1.3440 (1987)

$1.3395 (2416)

$1.3348 (2087)

Comments:

- Overall open interest on the CALL options with the expiration date January, 5 is 33479 contracts, with the maximum number of contracts with strike price $1,3500 (4730);

- Overall open interest on the PUT options with the expiration date January, 5 is 34511 contracts, with the maximum number of contracts with strike price $1,3250 (2803);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from December, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: Markit/Caixin Manufacturing PMI, December 51.5 (forecast 50.6)

-

00:25

Currencies. Daily history for Dec 29’2017:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1998 +0,47%

GBP/USD $1,3500 +0,44%

USD/CHF Chf0,97418 -0,44%

USD/JPY Y112,66 -0,17%

EUR/JPY Y135,19 +0,30%

GBP/JPY Y152,107 +0,26%

AUD/USD $0,7802 +0,44%

NZD/USD $0,7086 -0,02%

USD/CAD C$1,25668 0,00%

-